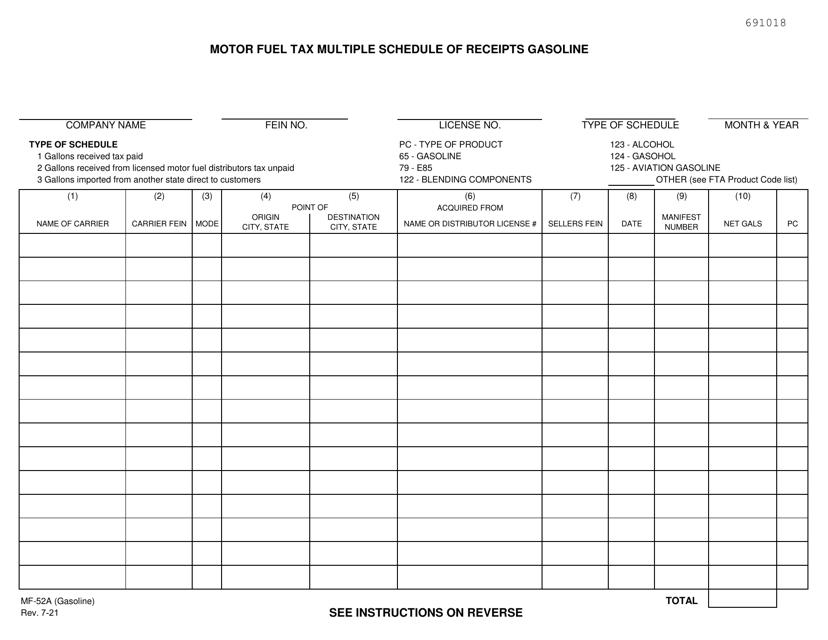

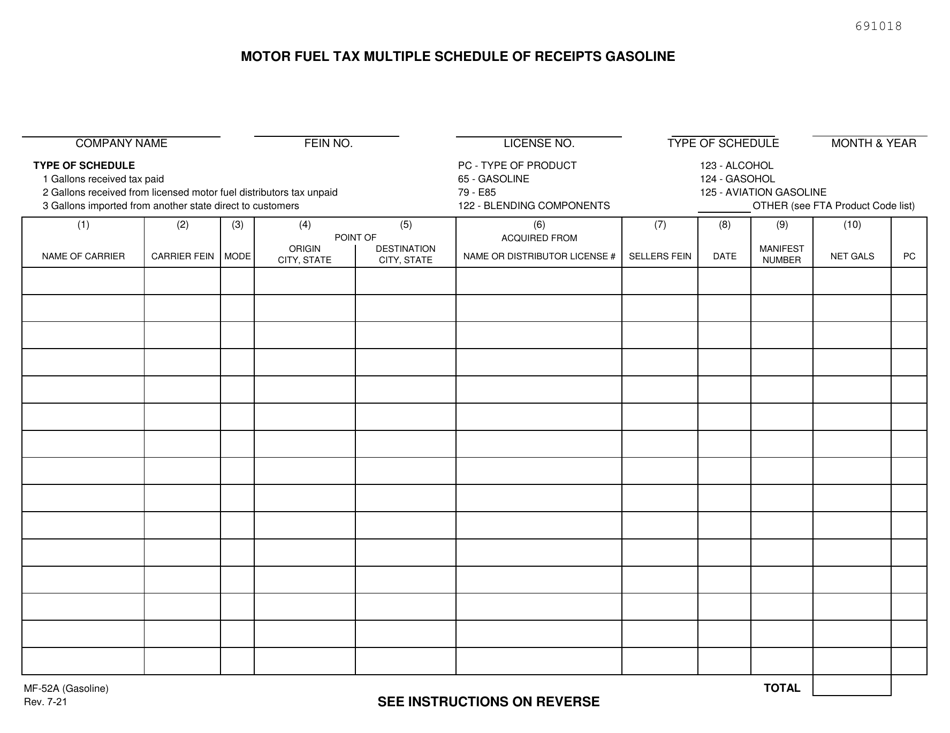

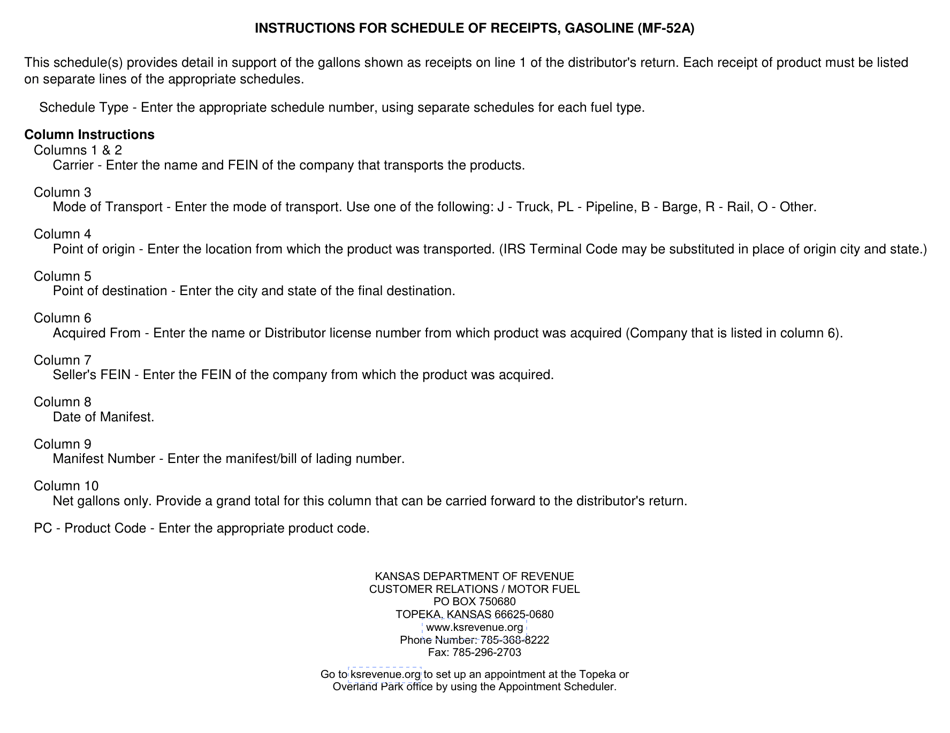

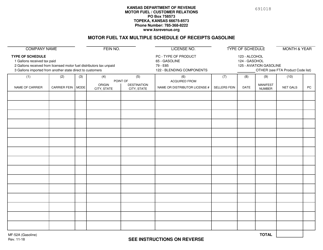

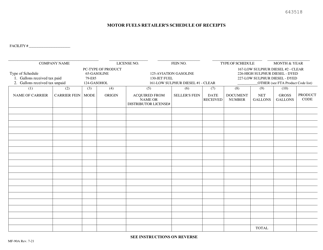

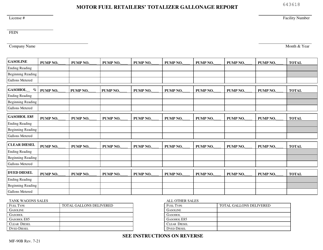

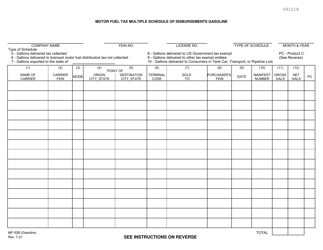

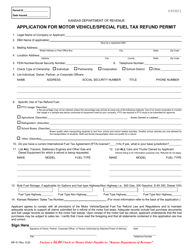

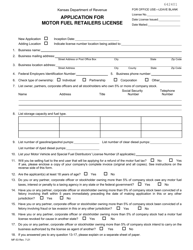

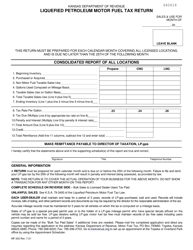

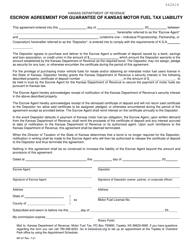

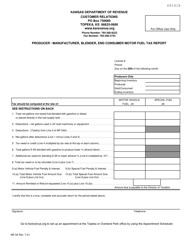

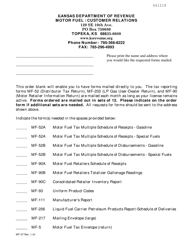

Form MF-52A GASOLINE Motor Fuel Tax Multiple Schedule of Receipts Gasoline - Kansas

What Is Form MF-52A GASOLINE?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MF-52A?

A: Form MF-52A is Gasoline Motor Fuel Tax Multiple Schedule of Receipts specifically used for reporting gasoline taxes in Kansas.

Q: Who needs to file Form MF-52A?

A: Any person or entity that sells gasoline in Kansas and is liable for gasoline tax needs to file Form MF-52A.

Q: What is the purpose of Form MF-52A?

A: The purpose of Form MF-52A is to report and pay the taxes owed on the sale of gasoline in Kansas.

Q: When is Form MF-52A due?

A: Form MF-52A is due on or before the 25th day of the month following the reporting period.

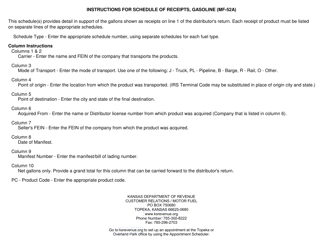

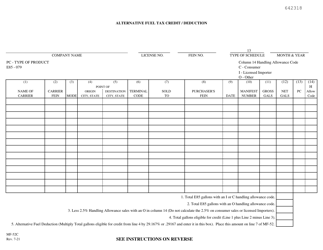

Q: What information do I need to complete Form MF-52A?

A: To complete Form MF-52A, you will need to provide details about the gasoline sales, including the number of gallons sold and the amount of tax due.

Q: Are there any penalties for not filing Form MF-52A?

A: Yes, failure to file Form MF-52A or pay the taxes owed on time may result in penalties and interest.

Q: Do I need to keep a copy of Form MF-52A for my records?

A: Yes, it is recommended to keep a copy of Form MF-52A and any supporting documents for your records in case of future audits or inquiries.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MF-52A GASOLINE by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.