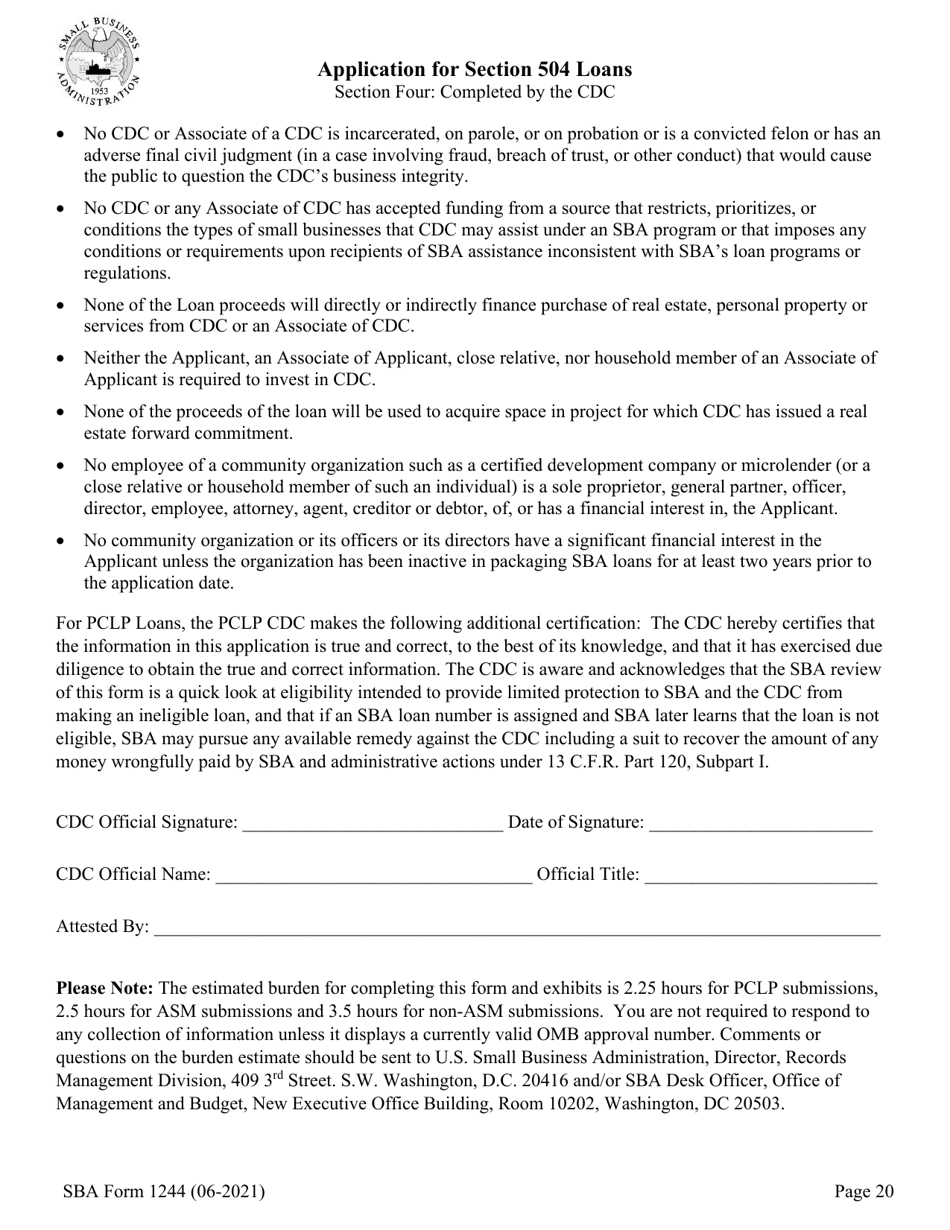

This version of the form is not currently in use and is provided for reference only. Download this version of

SBA Form 1244

for the current year.

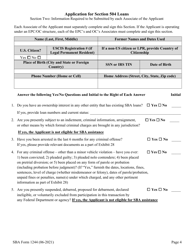

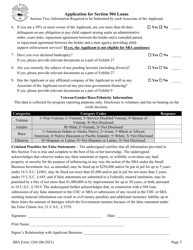

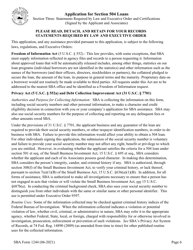

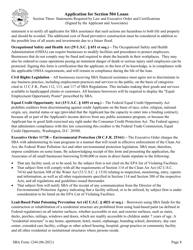

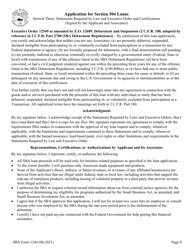

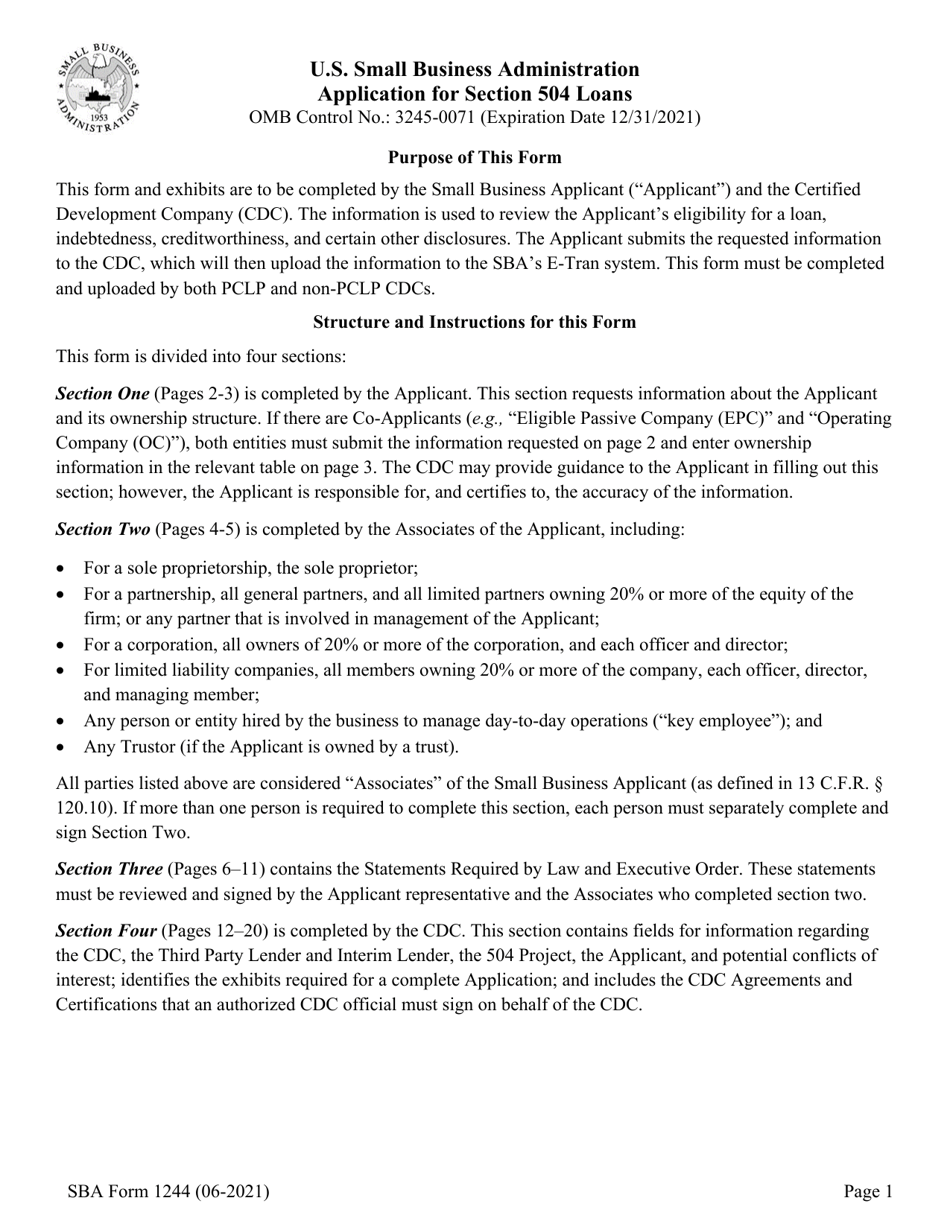

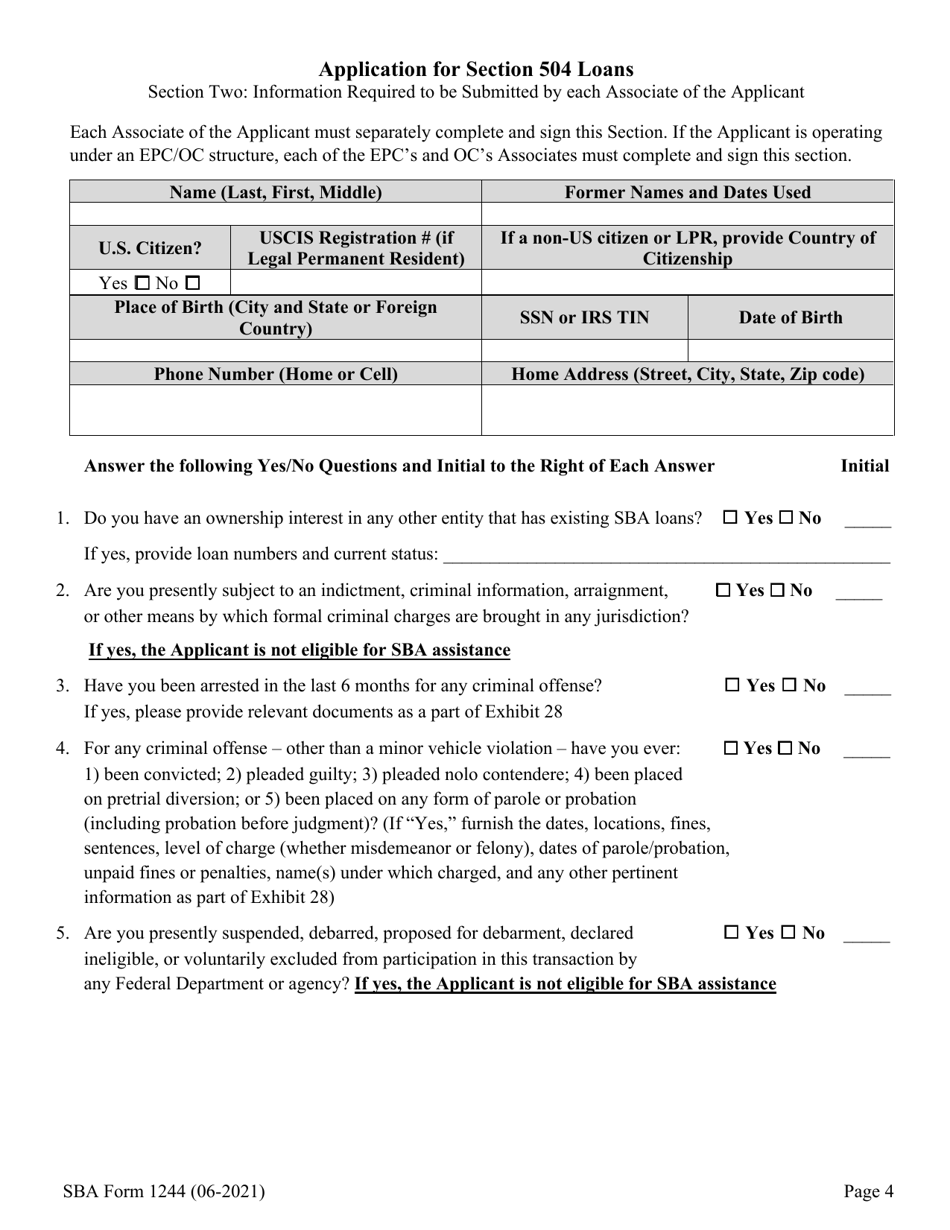

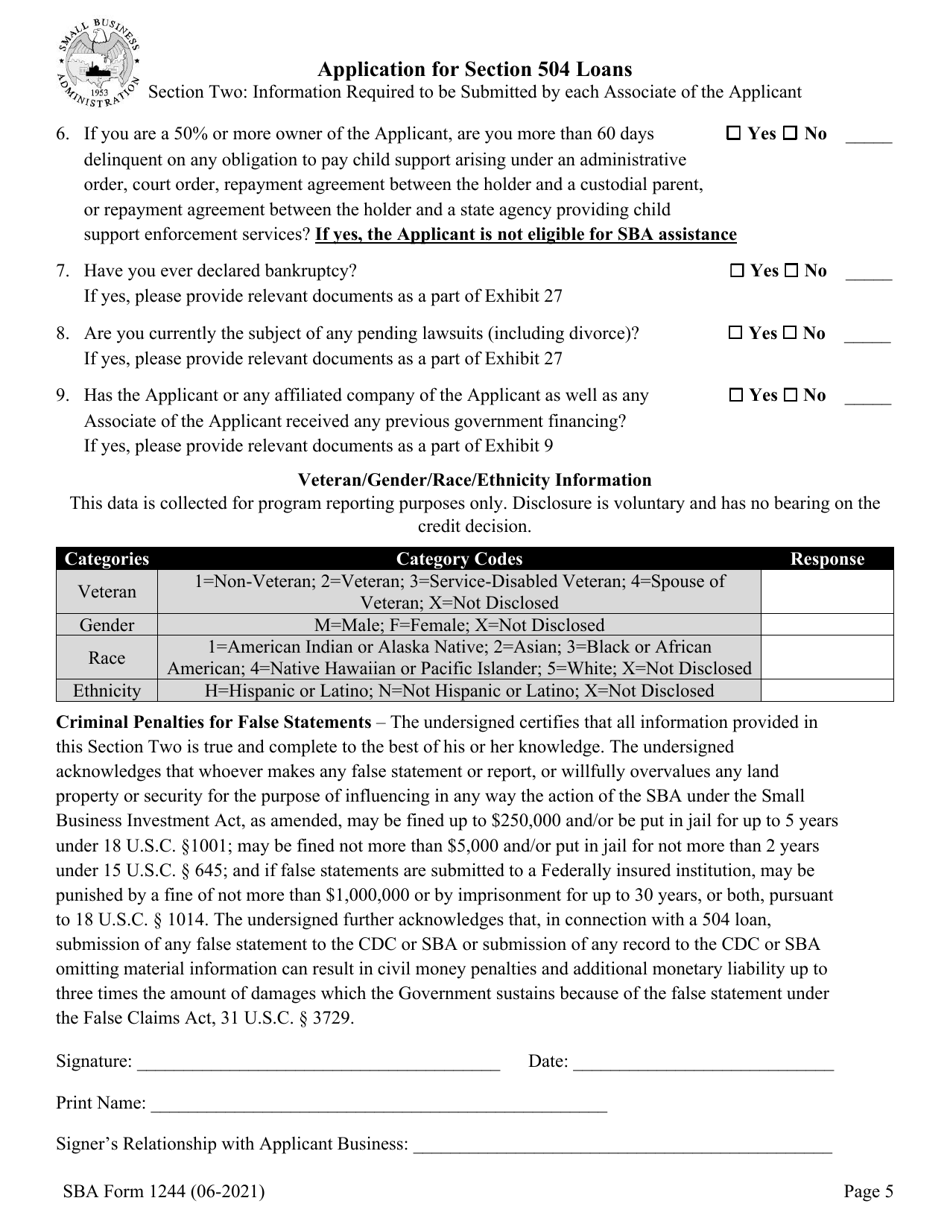

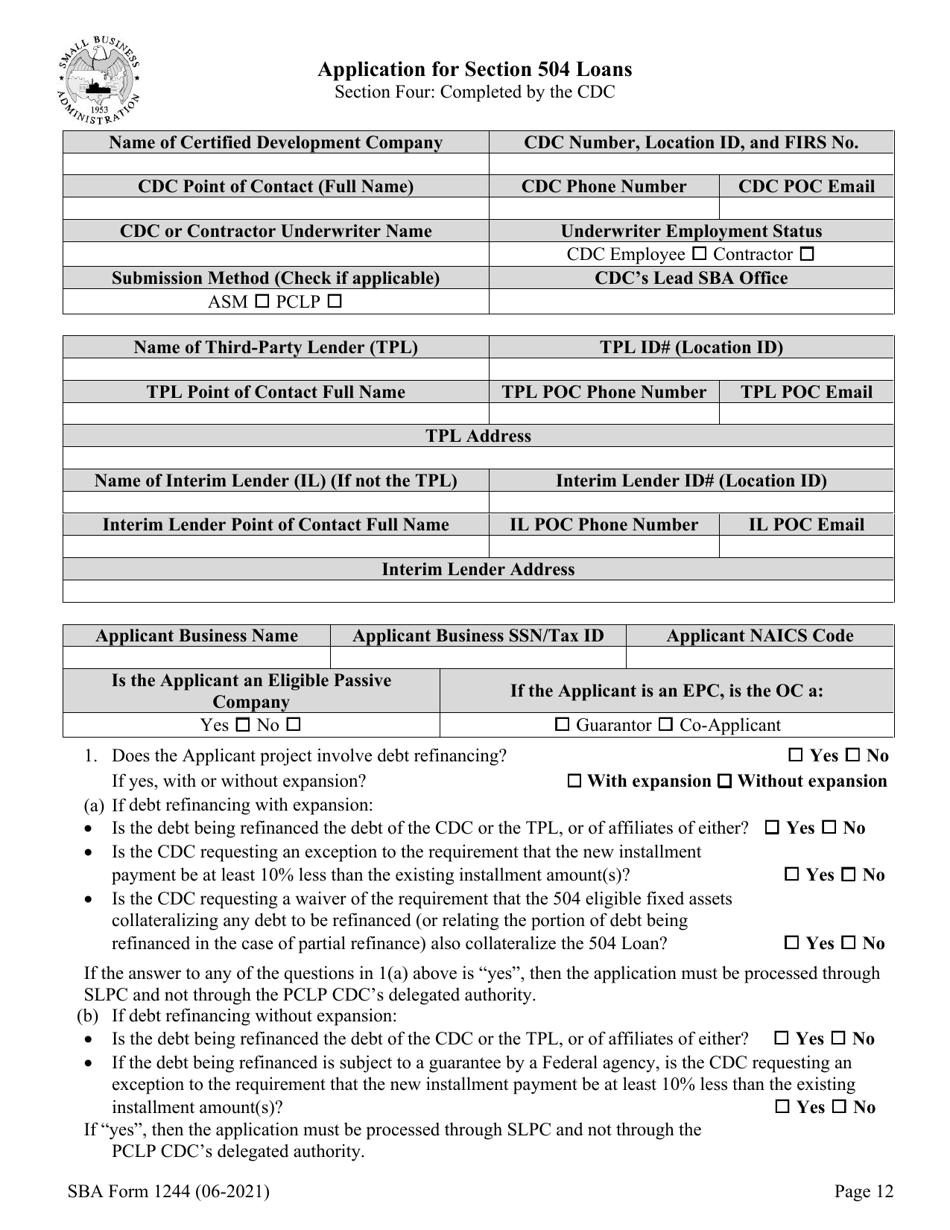

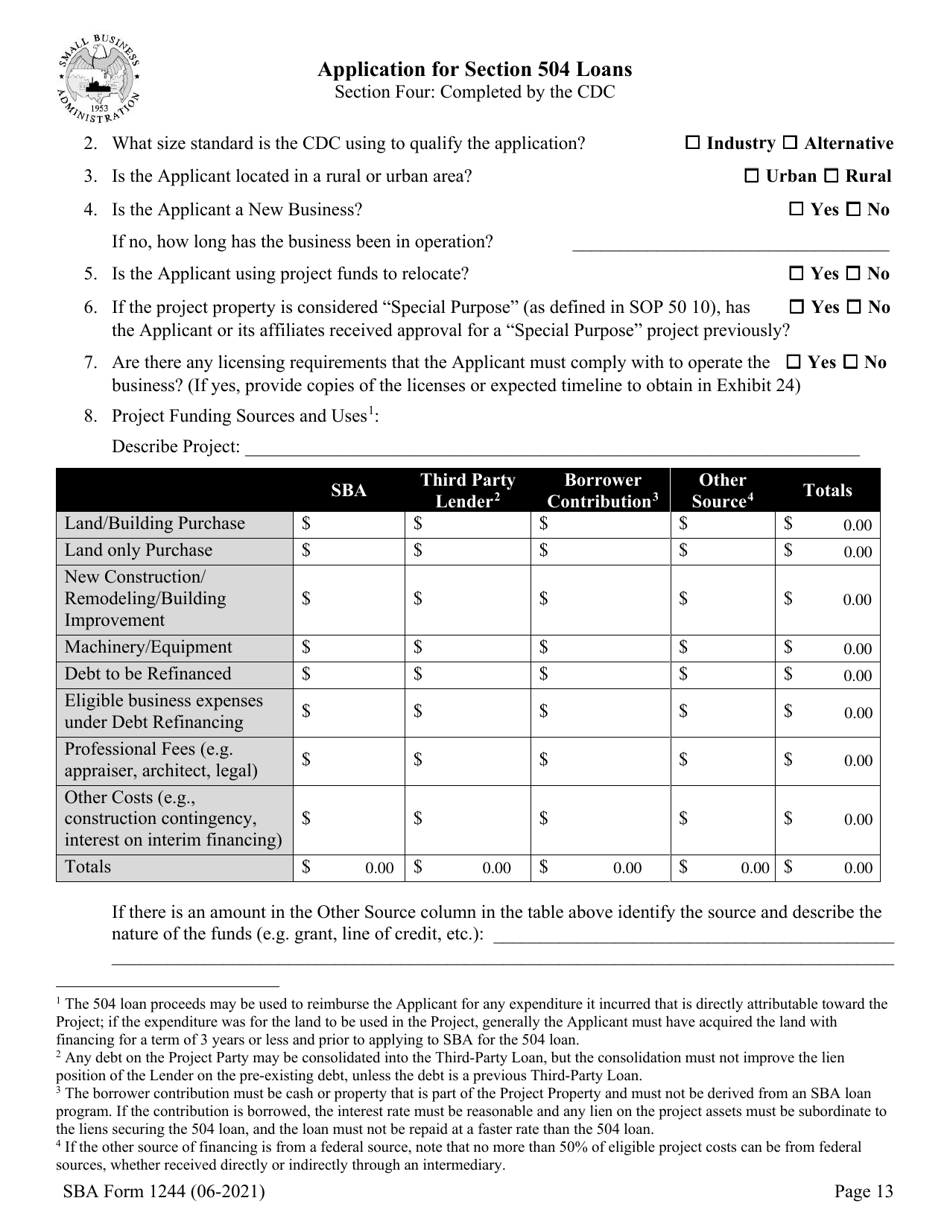

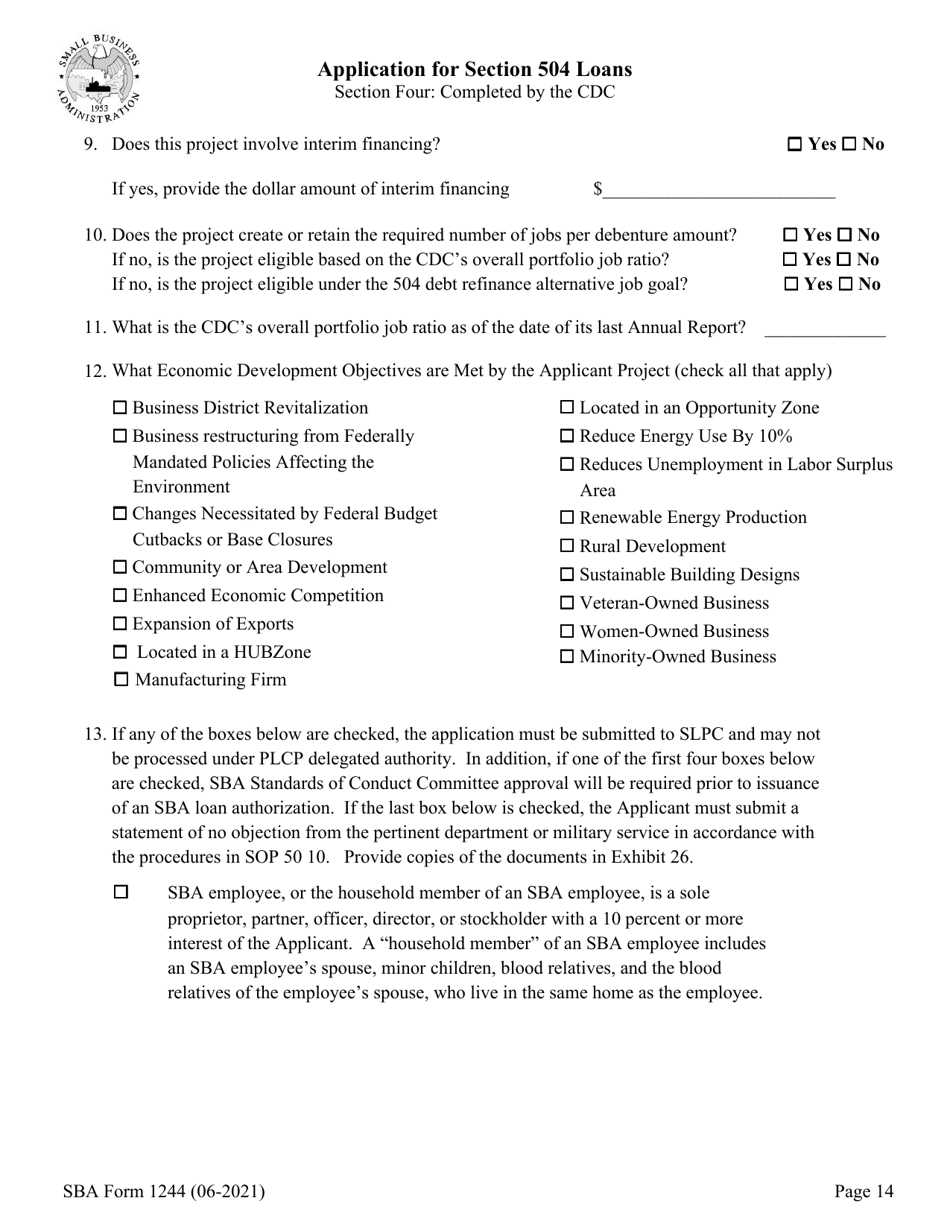

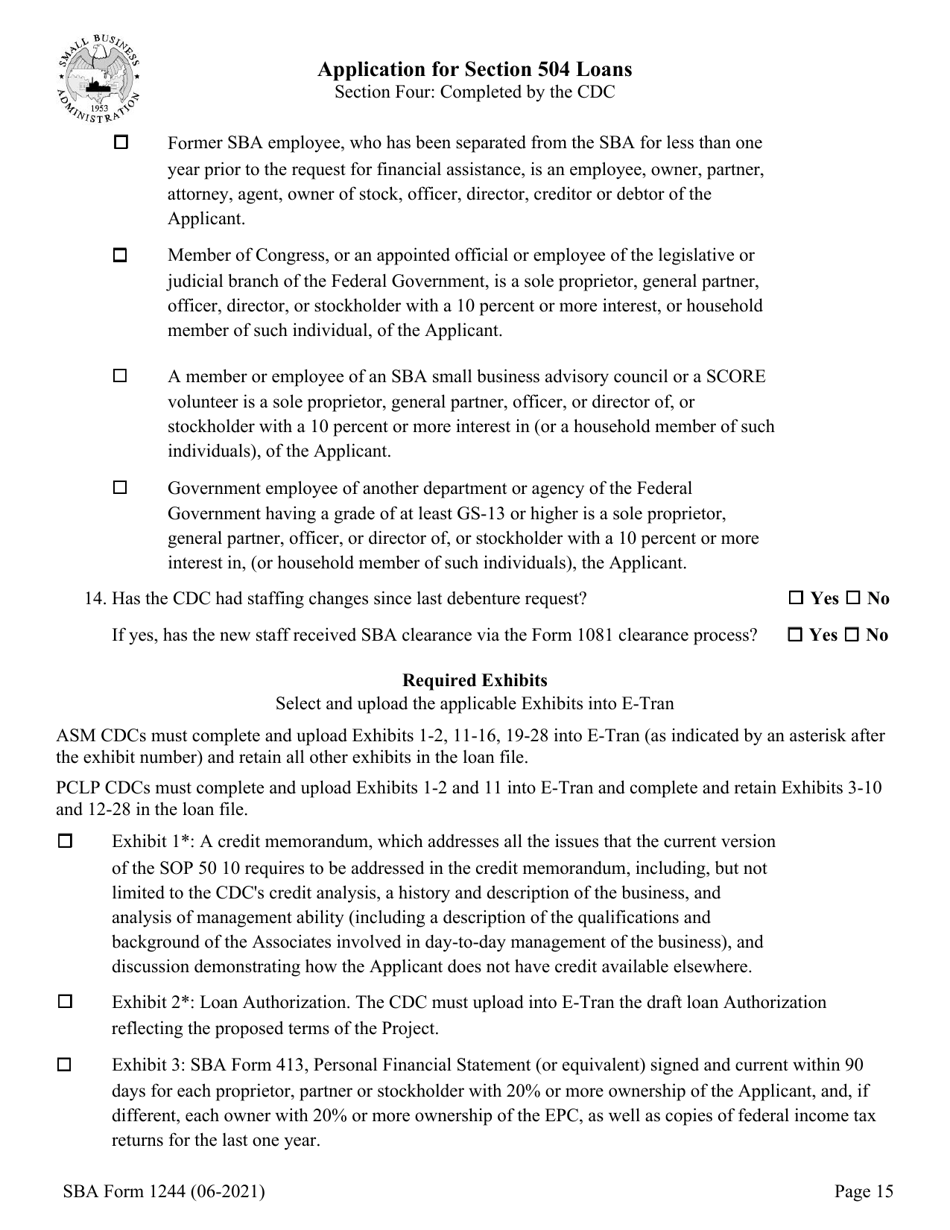

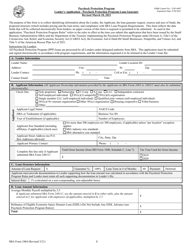

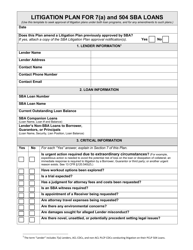

SBA Form 1244 Application for Section 504 Loans

What Is SBA Form 1244?

This is a legal form that was released by the U.S. Small Business Administration on June 1, 2021 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SBA Form 1244?

A: SBA Form 1244 is an application form for Section 504 loans.

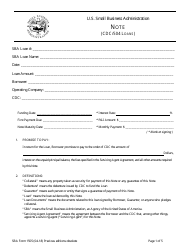

Q: What are Section 504 loans?

A: Section 504 loans are long-term, fixed-rate loans provided by the Small Business Administration (SBA) to assist small businesses in acquiring fixed assets for expansion or modernization.

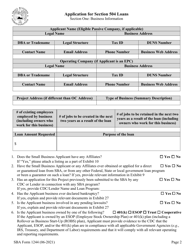

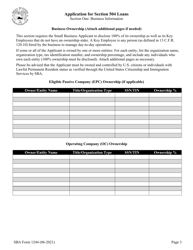

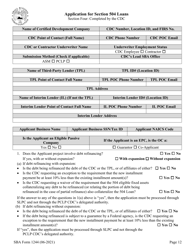

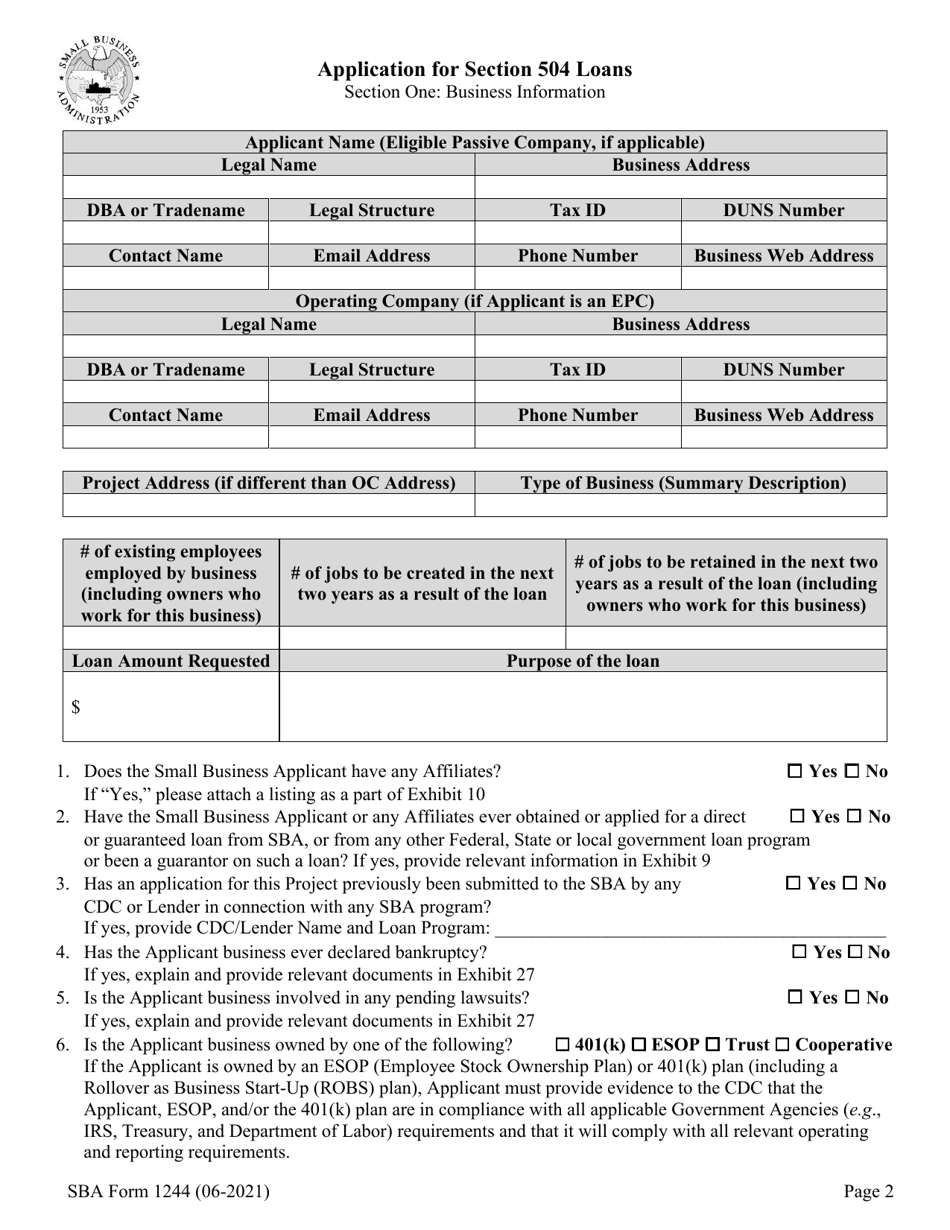

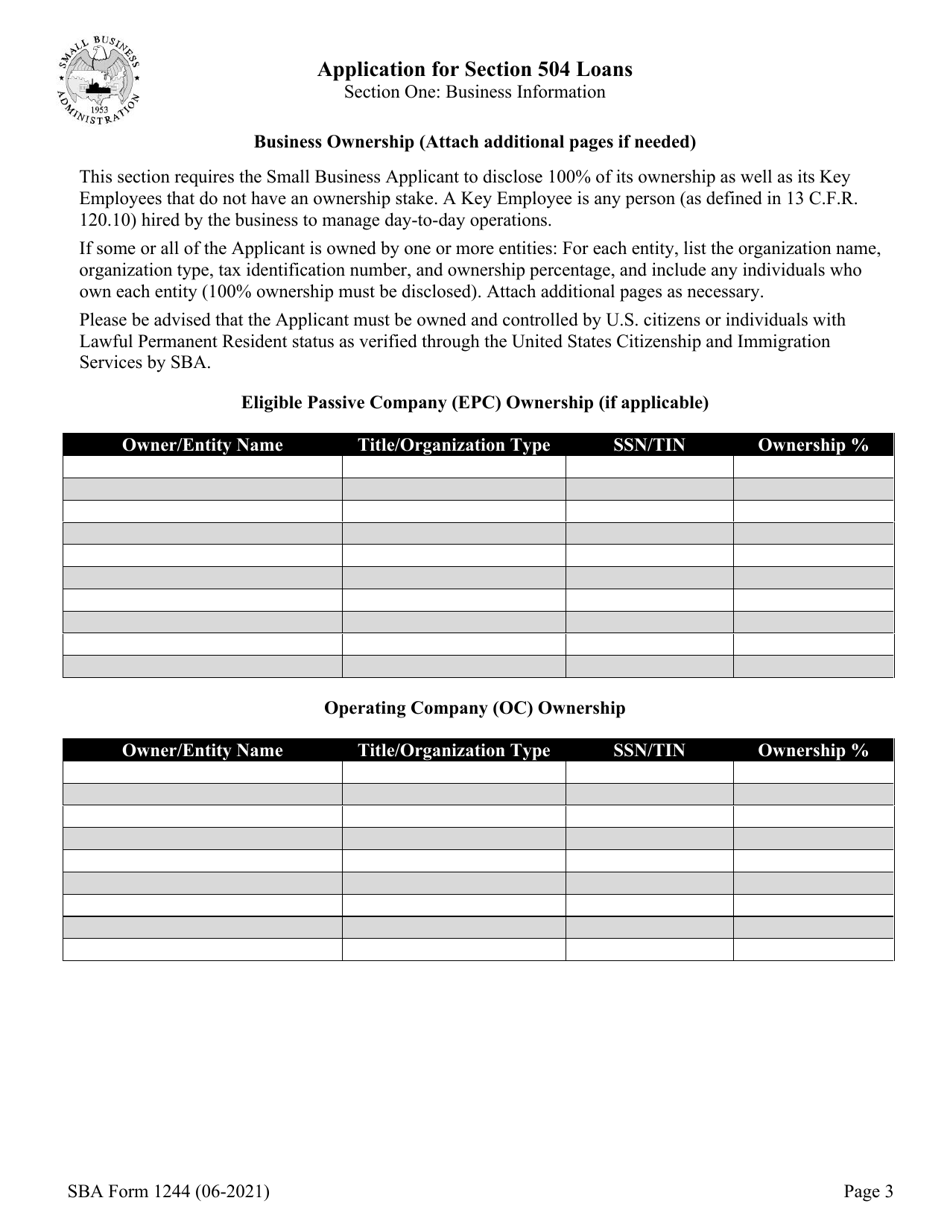

Q: Who can apply for a Section 504 loan?

A: Small businesses, including sole proprietorships, partnerships, and corporations, can apply for Section 504 loans.

Q: What can Section 504 loans be used for?

A: Section 504 loans can be used to acquire fixed assets, such as real estate, buildings, machinery, or equipment.

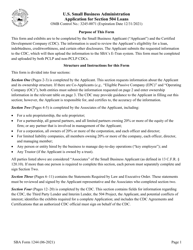

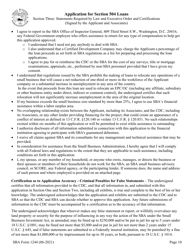

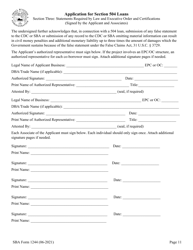

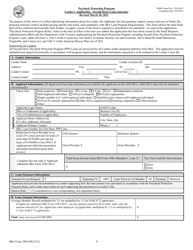

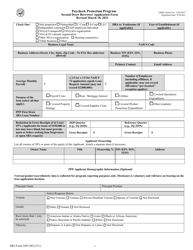

Q: How to complete SBA Form 1244?

A: You need to provide information about your business, assets, and financial statements. The form must be signed and submitted to the SBA.

Q: Is there a deadline for submitting SBA Form 1244?

A: There is no specific deadline for submitting SBA Form 1244, but it is recommended to apply as soon as possible.

Q: What happens after submitting SBA Form 1244?

A: After submitting the form, the SBA will review your application and make a decision on your loan request.

Q: Are there any fees for applying for SBA Form 1244?

A: There may be fees associated with the loan application process, including appraisal costs, environmental reports, and other third-party services.

Form Details:

- Released on June 1, 2021;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form 1244 by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.