This version of the form is not currently in use and is provided for reference only. Download this version of

Form 6025

for the current year.

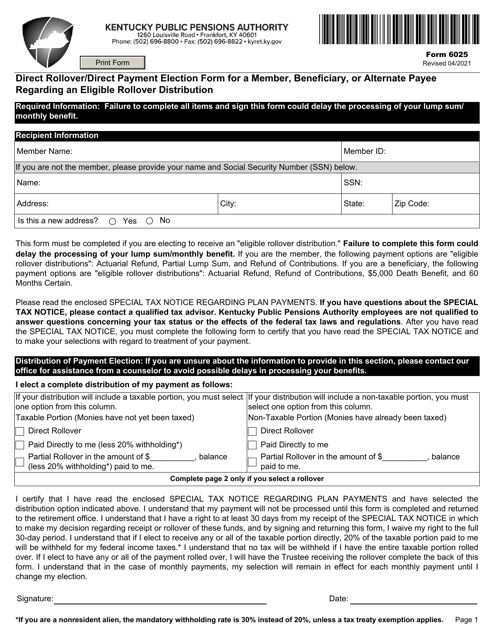

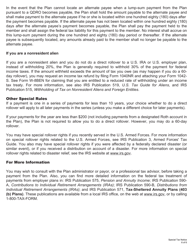

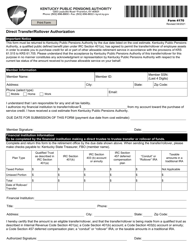

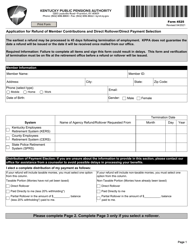

Form 6025 Direct Rollover / Direct Payment Election Form for a Member, Beneficiary, or Alternate Payee Regarding an Eligible Rollover Distribution - Kentucky

What Is Form 6025?

This is a legal form that was released by the Kentucky Public Pensions Authority - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 6025?

A: Form 6025 is the Direct Rollover/Direct Payment Election Form for a Member, Beneficiary, or Alternate Payee Regarding an Eligible Rollover Distribution in Kentucky.

Q: Who can use Form 6025?

A: Members, beneficiaries, or alternate payees who want to make a direct rollover or direct payment election for an eligible rollover distribution can use Form 6025.

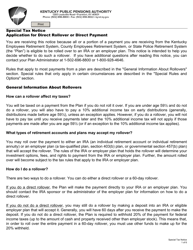

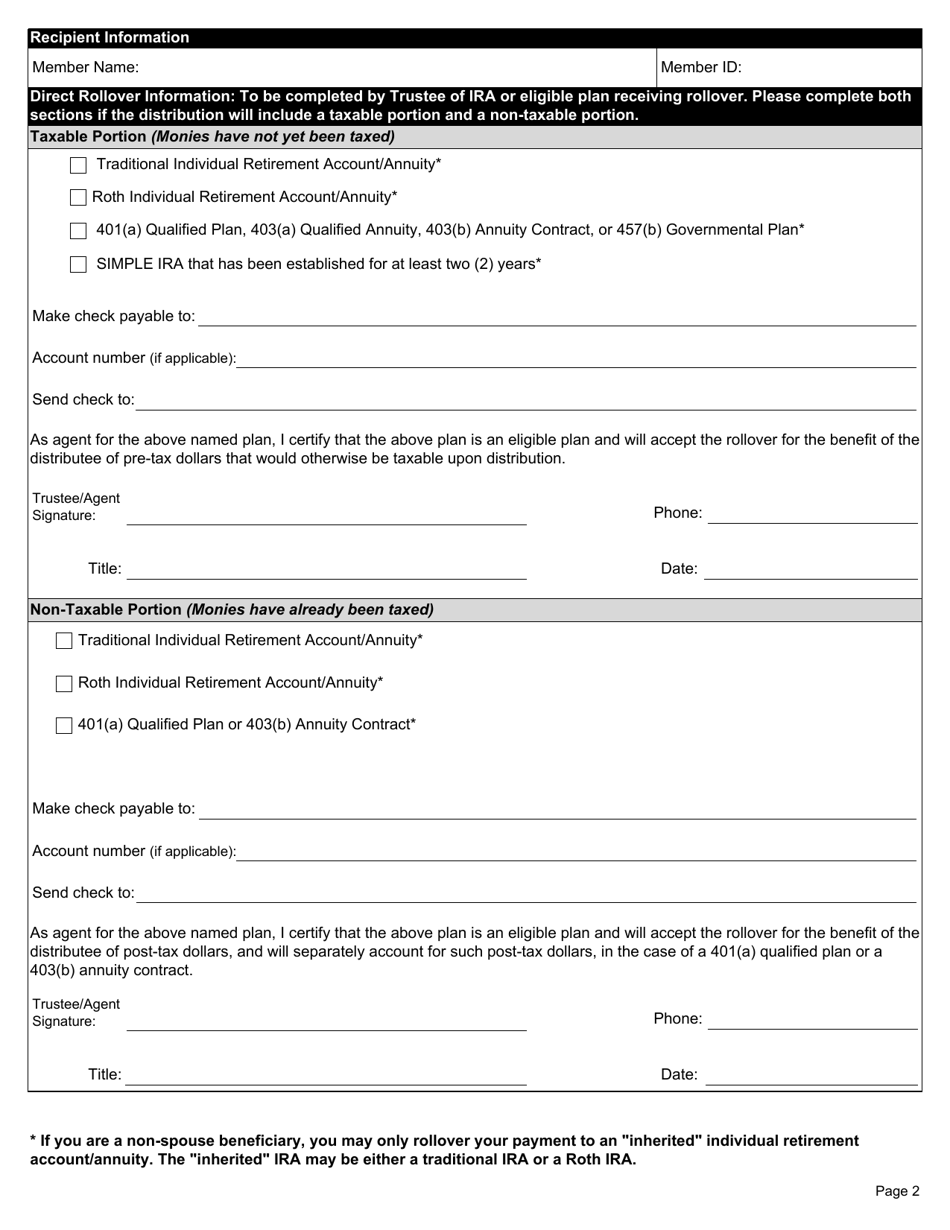

Q: What is an eligible rollover distribution?

A: An eligible rollover distribution refers to a distribution from a qualified retirement plan that can be rolled over into another eligible retirement plan or individual retirement account (IRA).

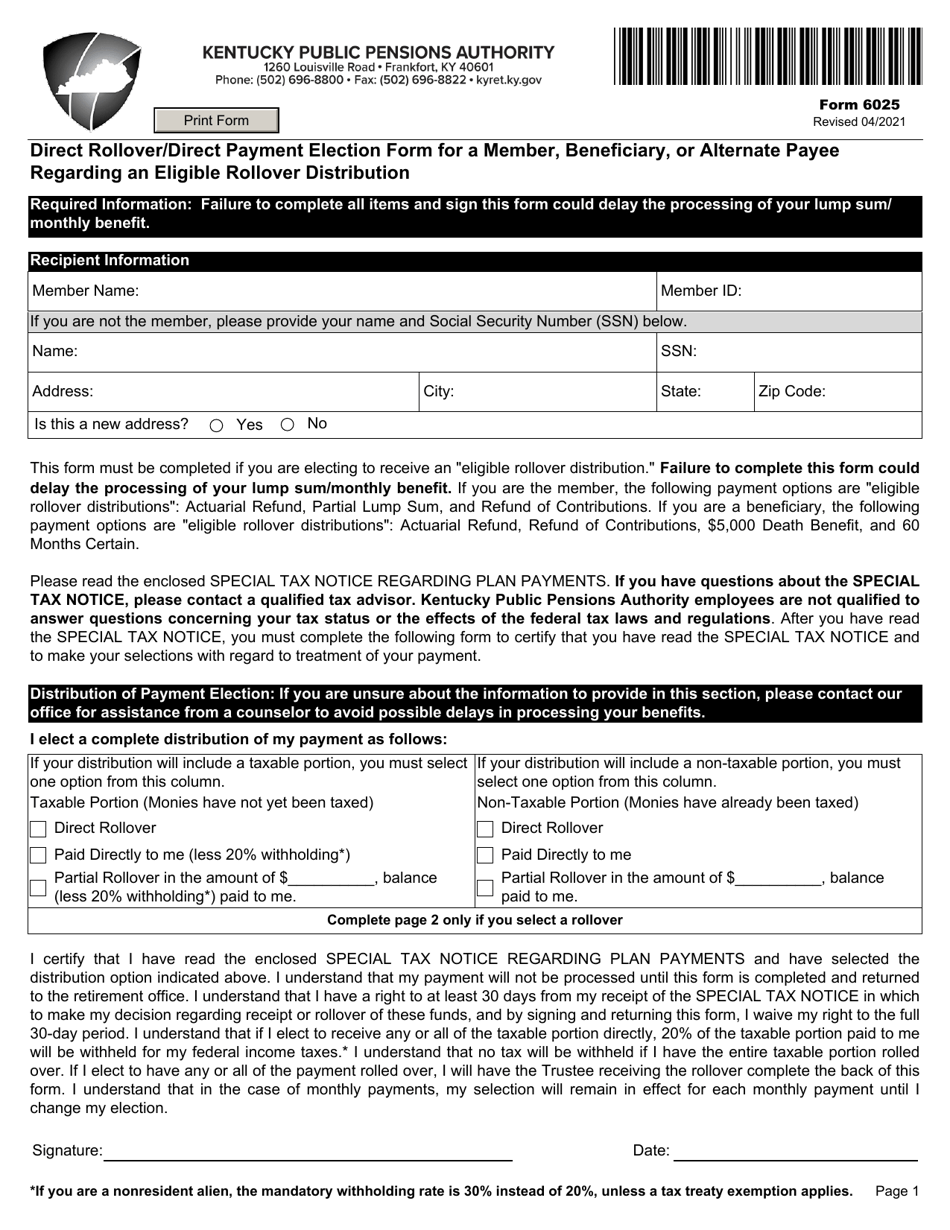

Q: What is a direct rollover?

A: A direct rollover is a tax-free movement of funds from one retirement plan into another, without the funds being paid to the individual first.

Q: What is a direct payment?

A: A direct payment is the transfer of funds from a qualified retirement plan directly to the individual, without rolling over the funds into another eligible retirement plan or IRA.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Kentucky Public Pensions Authority;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 6025 by clicking the link below or browse more documents and templates provided by the Kentucky Public Pensions Authority.