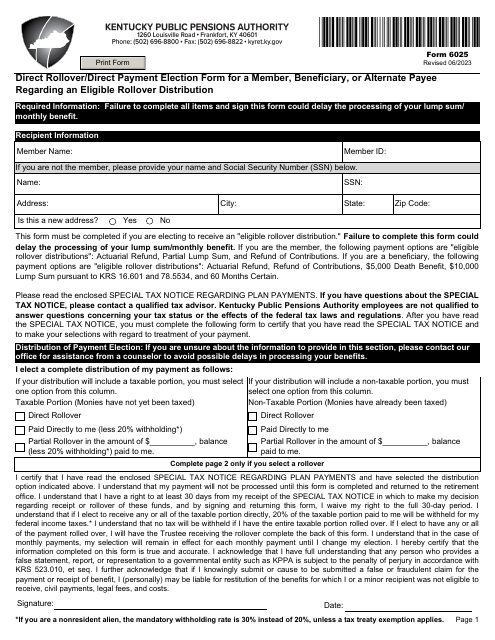

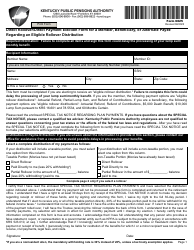

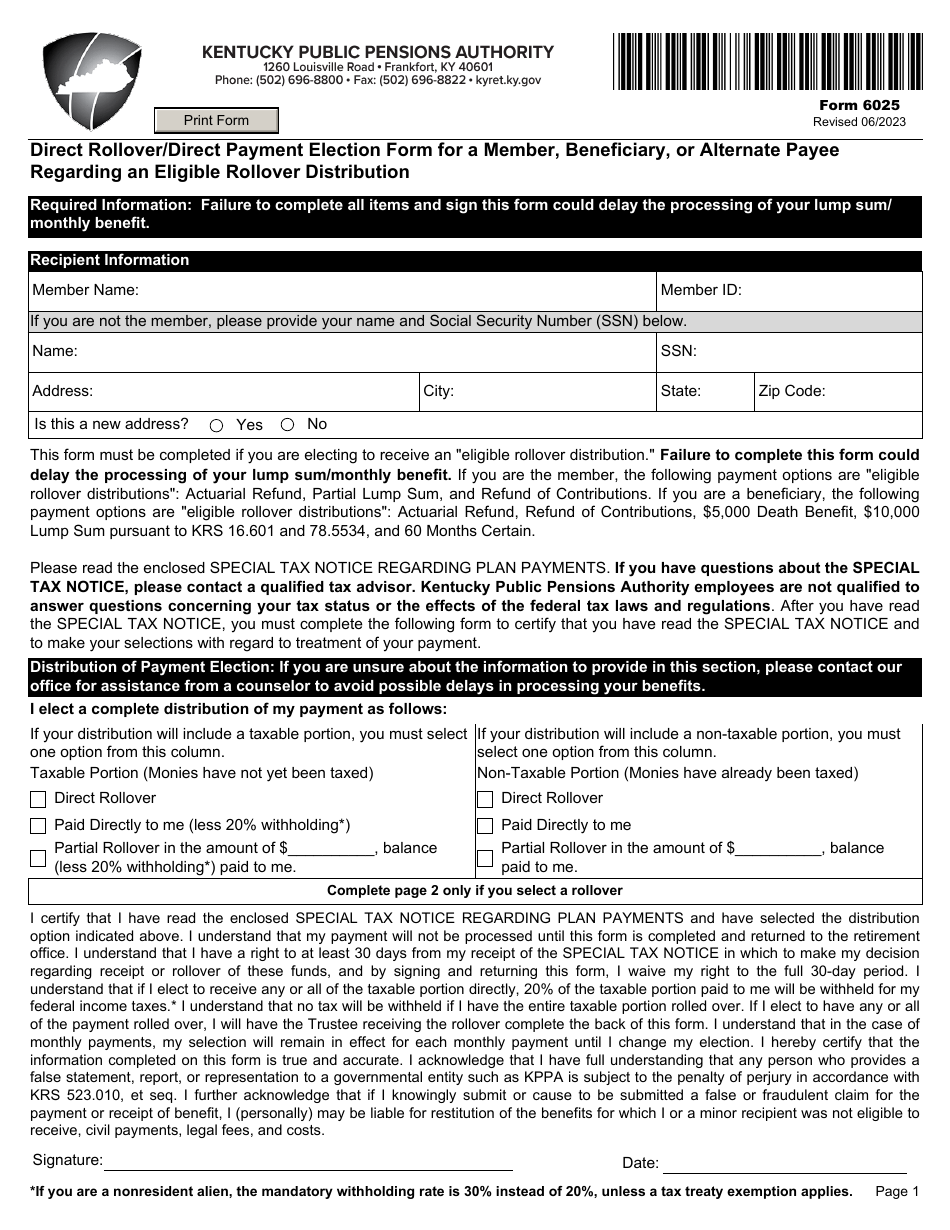

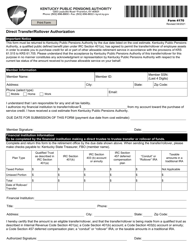

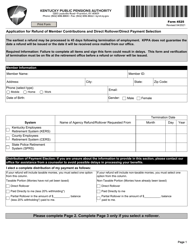

Form 6025 Direct Rollover / Direct Payment Election Form for a Member, Beneficiary, or Alternate Payee Regarding an Eligible Rollover Distribution - Kentucky

What Is Form 6025?

This is a legal form that was released by the Kentucky Public Pensions Authority - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 6025?A: Form 6025 is a Direct Rollover/Direct Payment Election Form.

Q: Who can use Form 6025?A: Members, beneficiaries, or alternate payees can use Form 6025.

Q: What is the purpose of Form 6025?A: Form 6025 is used to make an election regarding an eligible rollover distribution.

Q: What is an eligible rollover distribution?A: An eligible rollover distribution is a distribution of funds from a retirement account that is eligible to be rolled over into another qualified retirement plan or individual retirement account (IRA).

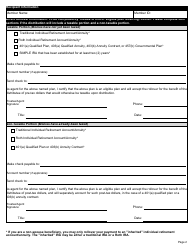

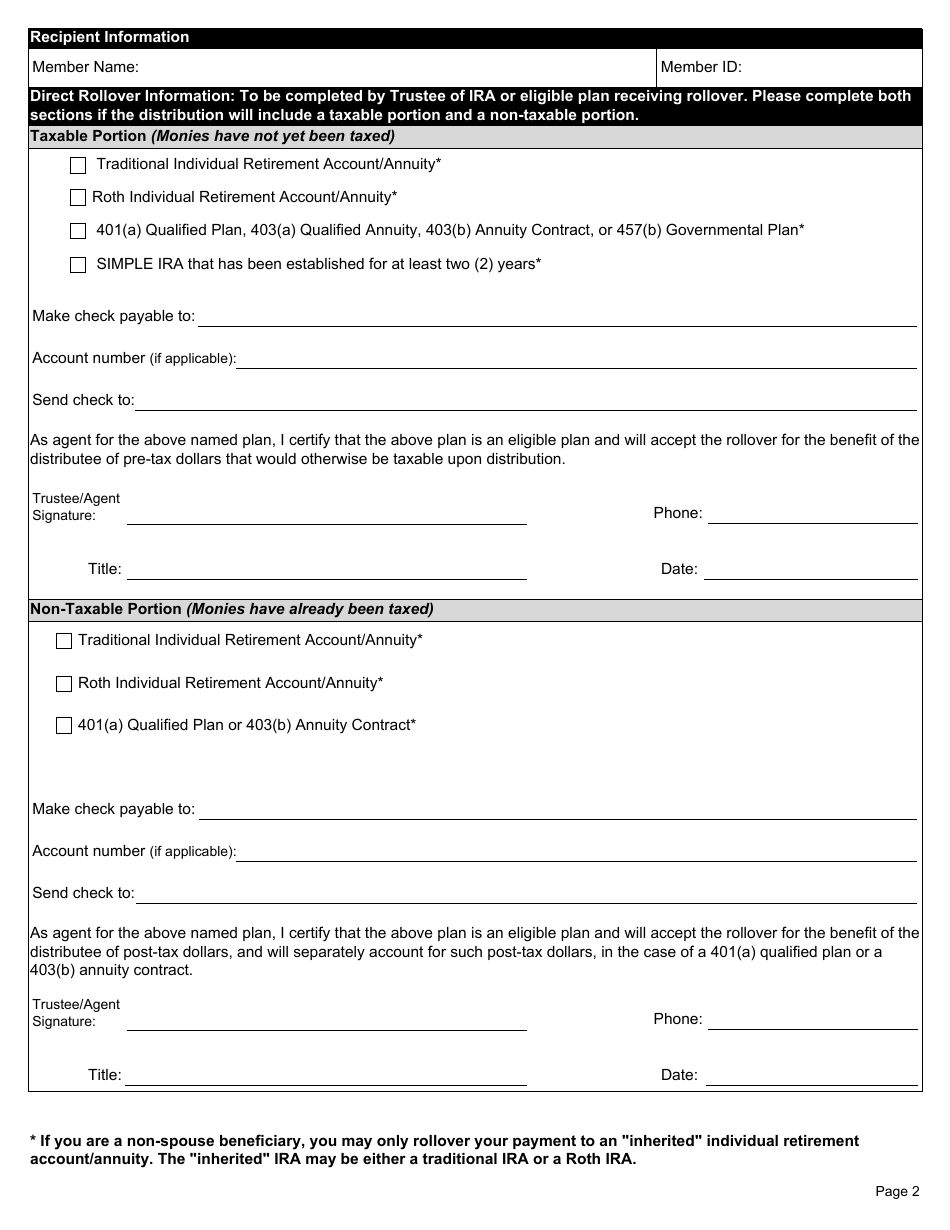

Q: What options are available on Form 6025?A: Form 6025 allows individuals to elect a direct rollover or direct payment of an eligible rollover distribution.

Q: What is a direct rollover?A: A direct rollover is when the funds from an eligible rollover distribution are directly transferred to another qualified retirement plan or IRA.

Q: What is a direct payment?A: A direct payment is when the funds from an eligible rollover distribution are paid to the individual instead of being rolled over.

Q: Why would someone choose a direct rollover?A: Some individuals may choose a direct rollover to avoid immediate taxation and preserve the tax-deferred status of their retirement funds.

Q: Why would someone choose a direct payment?A: Some individuals may choose a direct payment if they need immediate access to the funds or if they have other plans for using the distribution.