This version of the form is not currently in use and is provided for reference only. Download this version of

Form ARB-COTA5

for the current year.

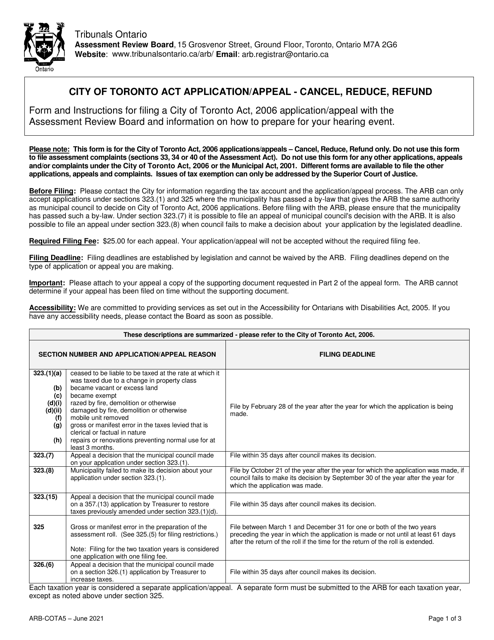

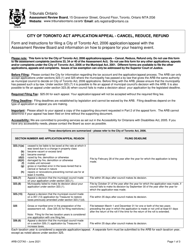

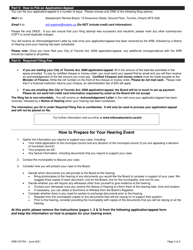

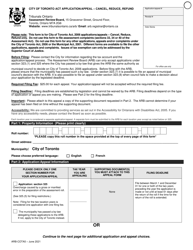

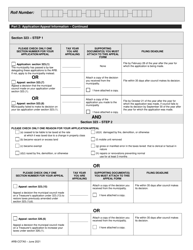

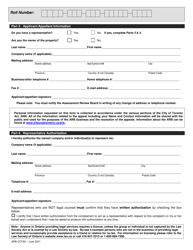

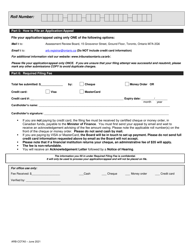

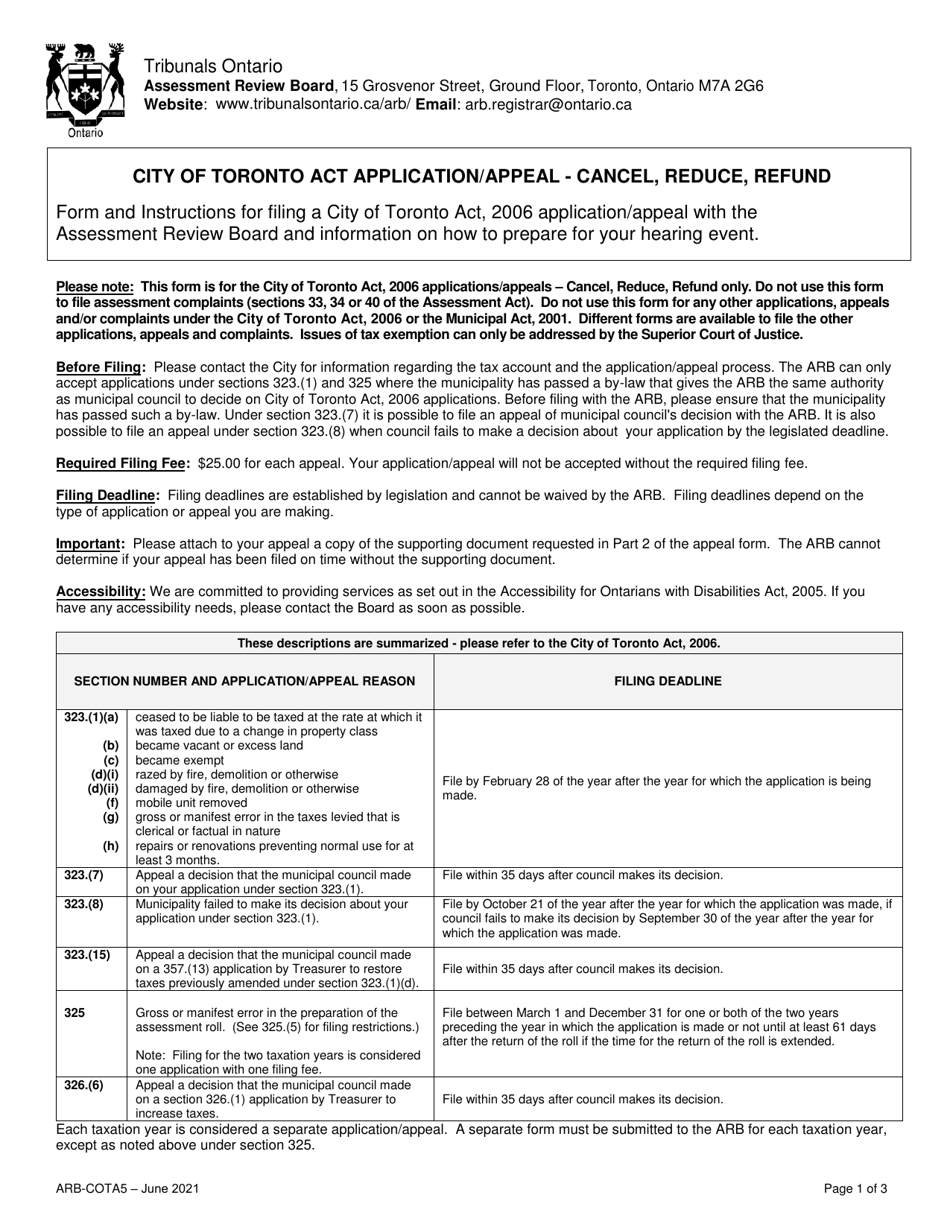

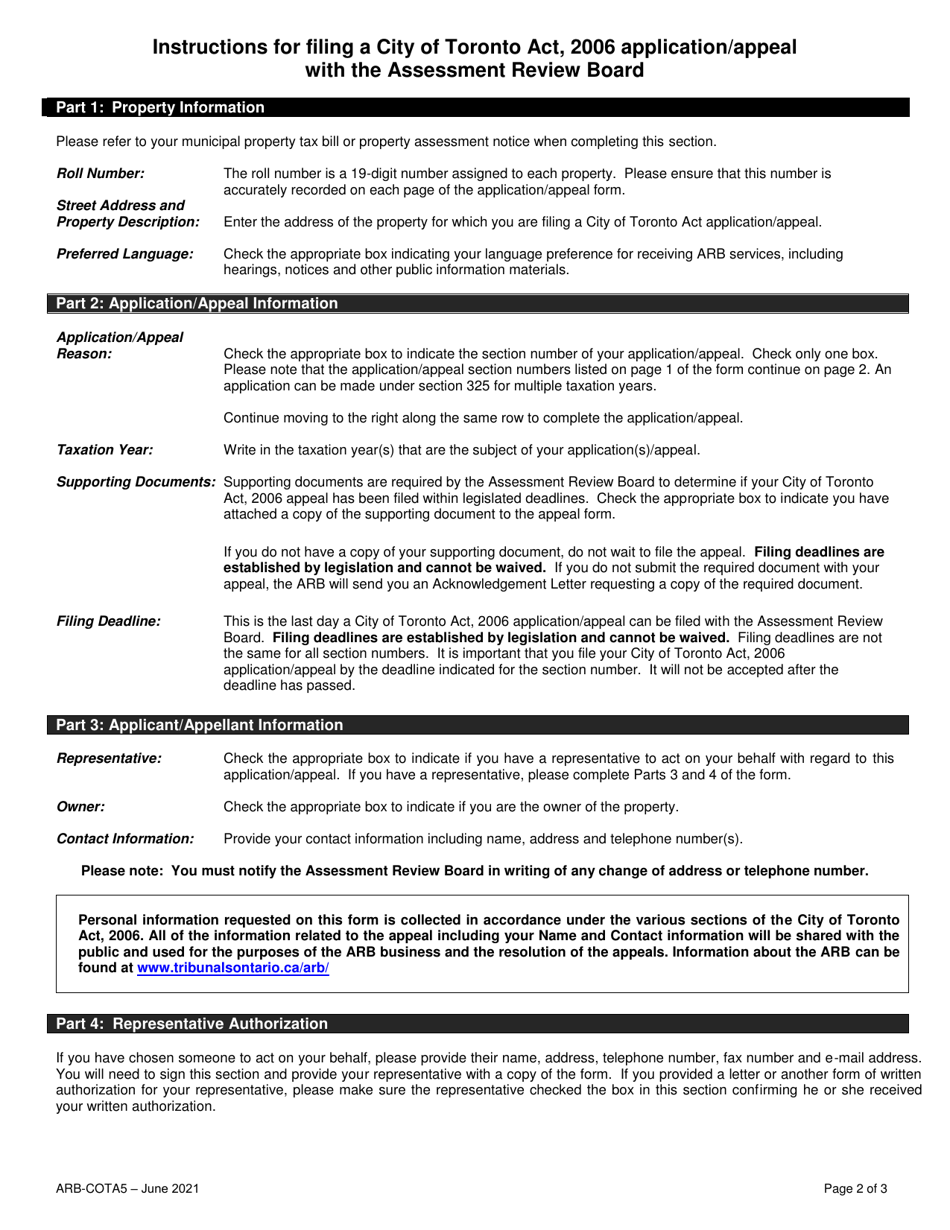

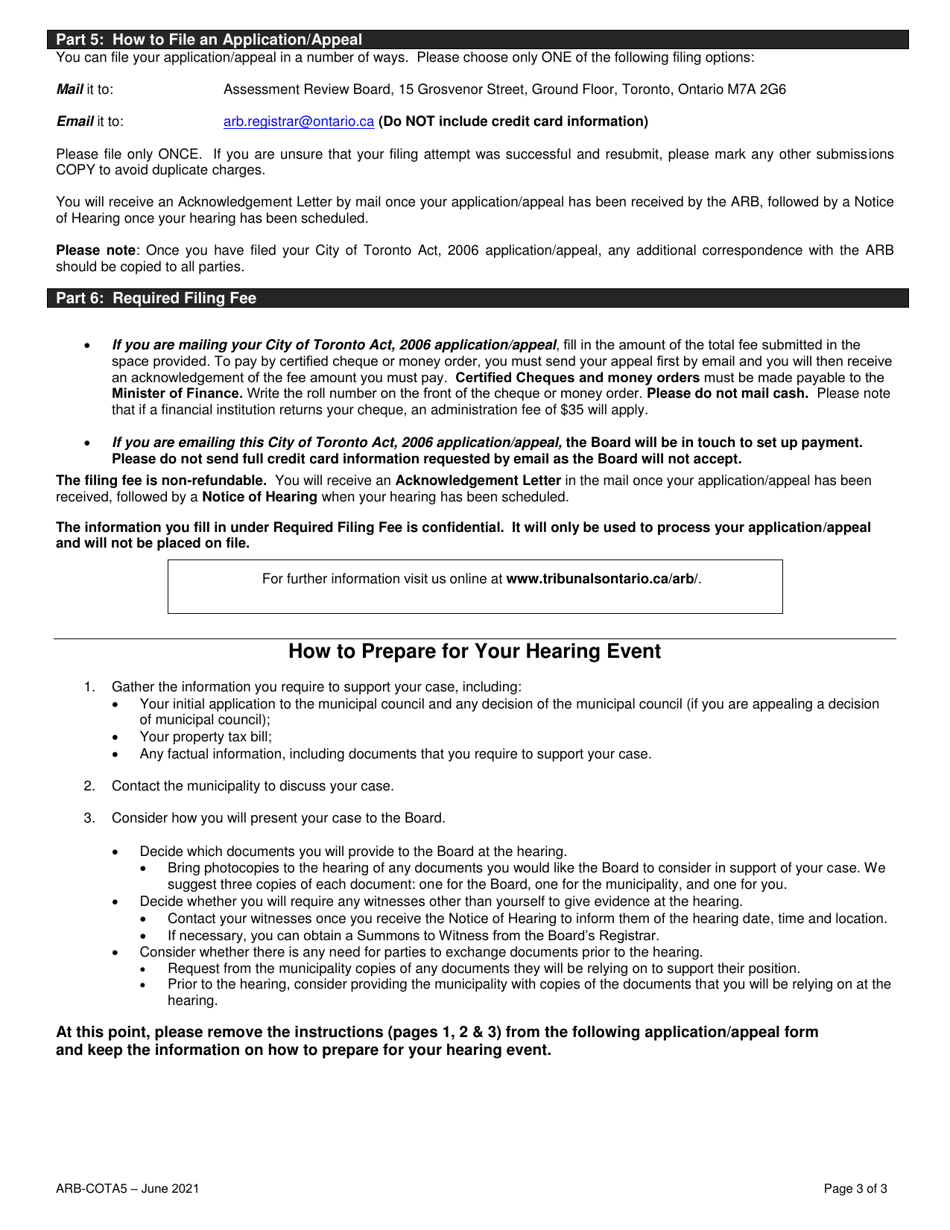

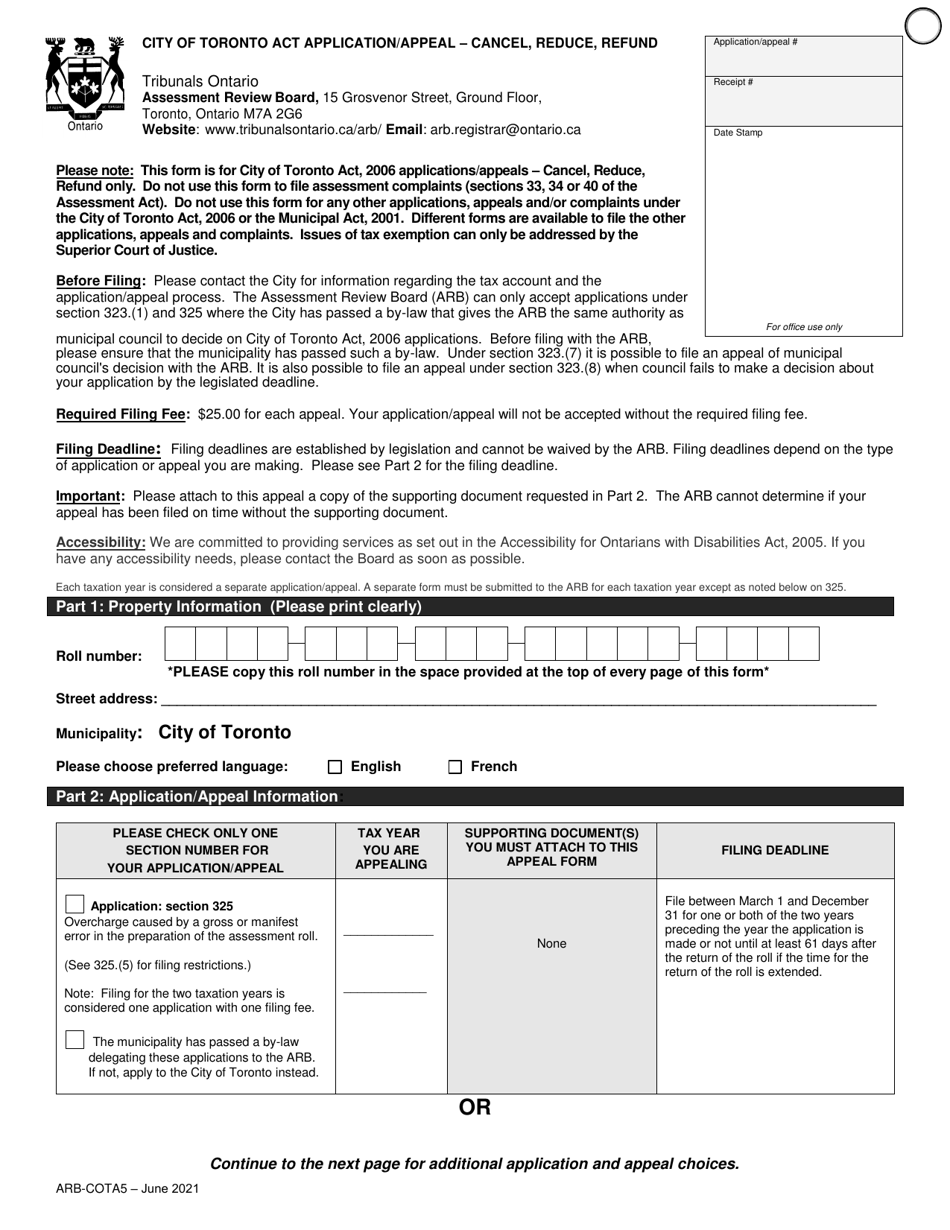

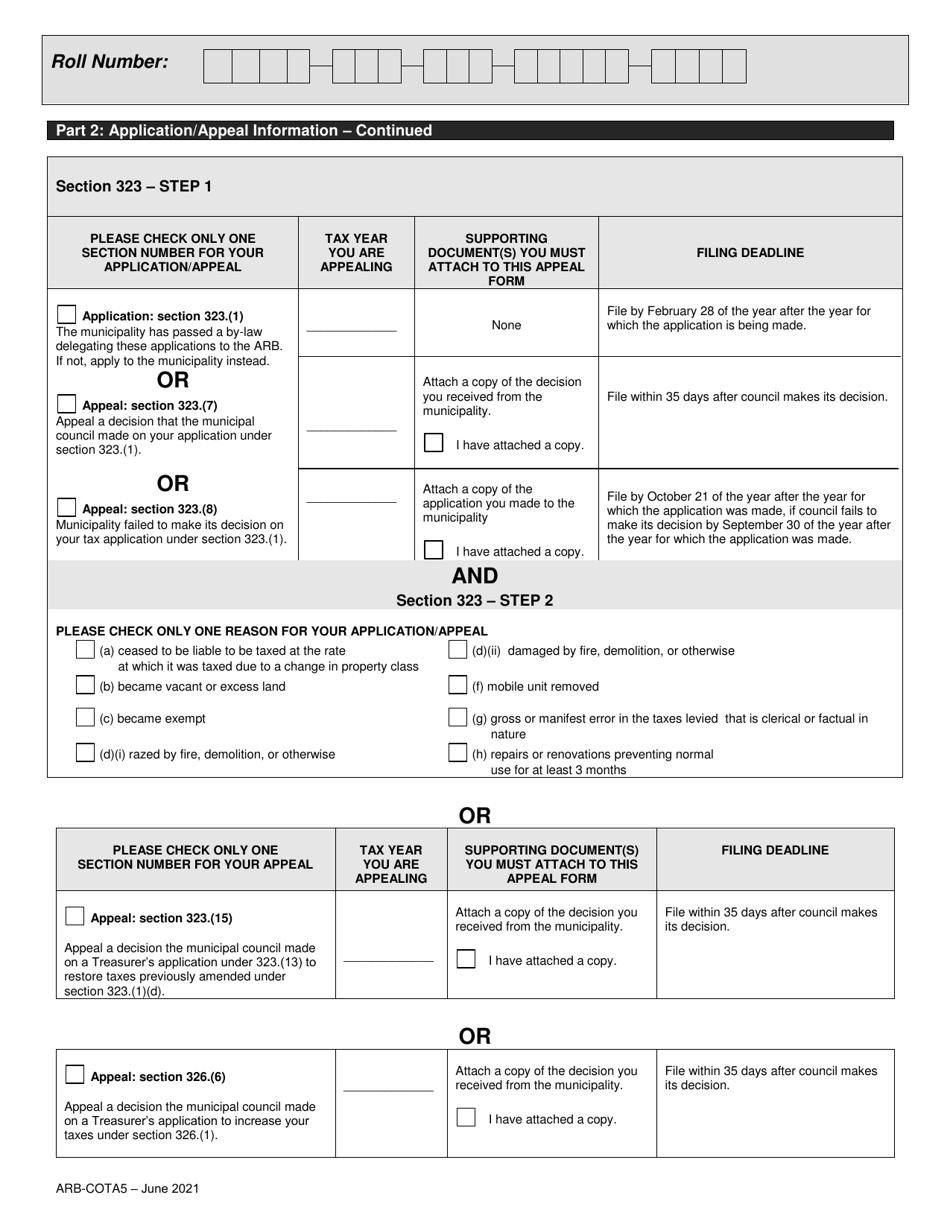

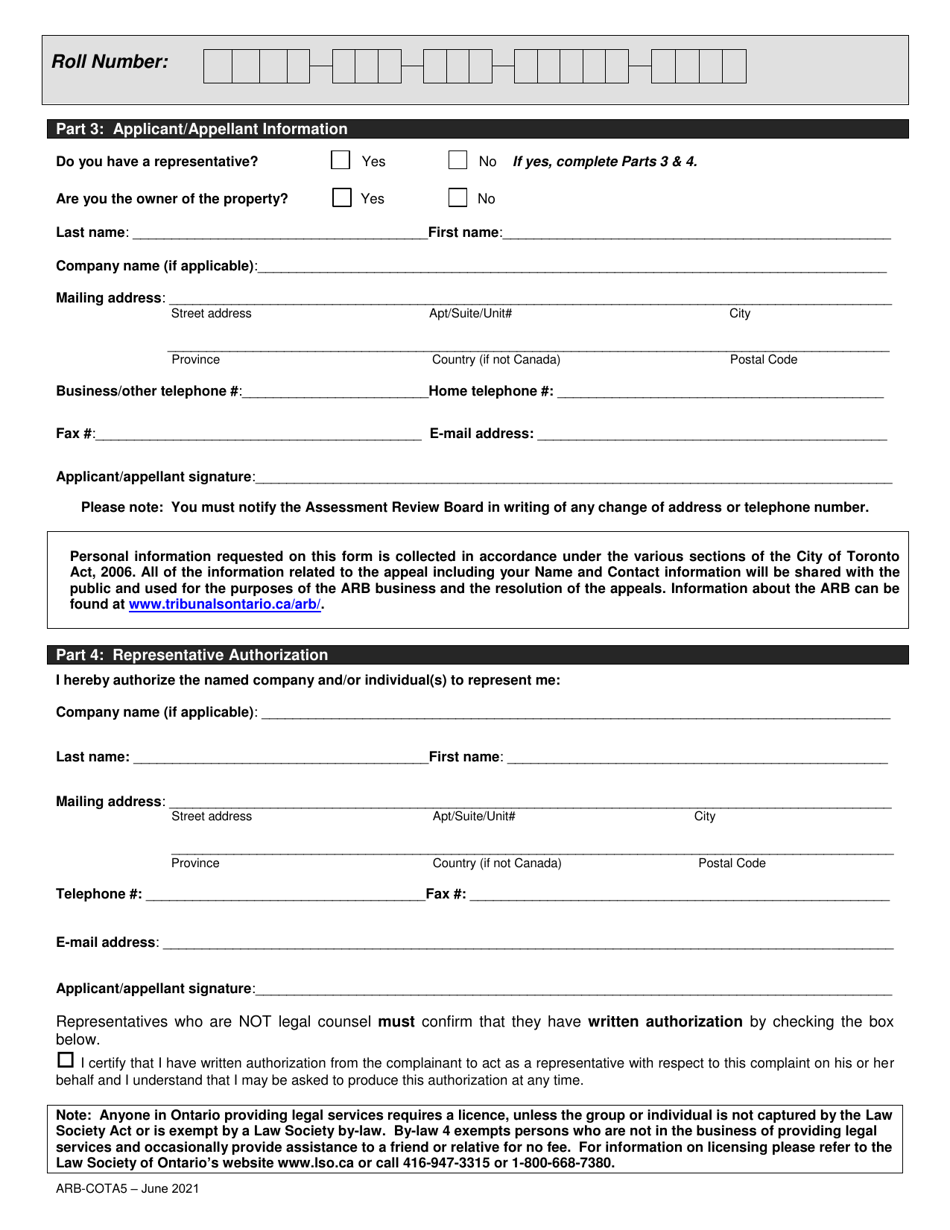

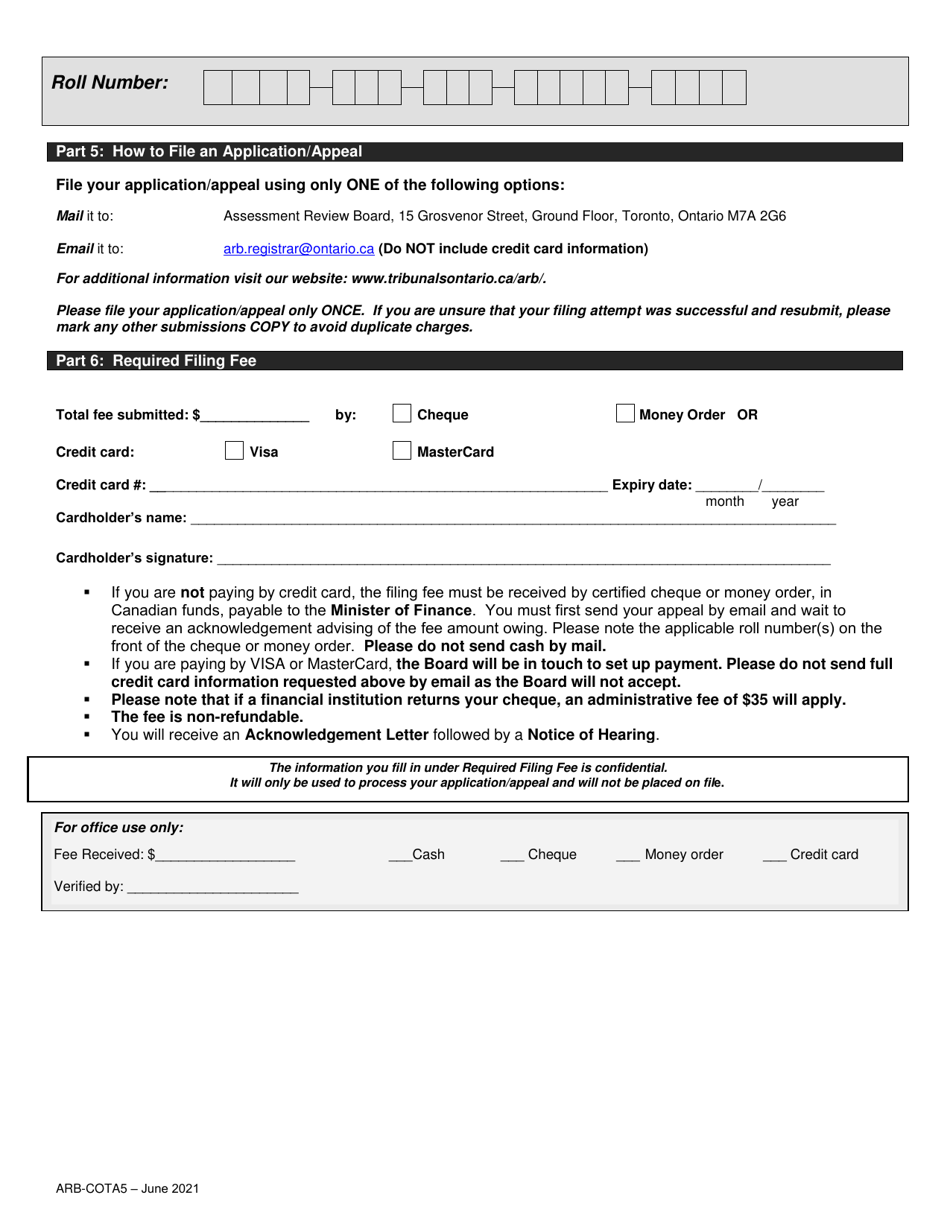

Form ARB-COTA5 City of Toronto Act Application / Appeal - Cancel, Reduce, Refund - Ontario, Canada

Form ARB-COTA5 is a City of Toronto Act Application/Appeal form used in Ontario, Canada. It is used for requesting a cancellation, reduction, or refund for certain matters related to property taxes or assessments in the City of Toronto.

The form ARB-COTA5 City of Toronto Act Application/Appeal is filed by individuals or businesses who would like to cancel, reduce, or seek a refund for a specific matter related to the City of Toronto in the province of Ontario, Canada.

FAQ

Q: What is the ARB-COTA5 City of Toronto Act?

A: The ARB-COTA5 City of Toronto Act is an application or appeal process for property owners in the City of Toronto, Ontario, Canada.

Q: What is the purpose of the ARB-COTA5 City of Toronto Act?

A: The purpose of the ARB-COTA5 City of Toronto Act is to address property assessment issues and potential tax adjustments.

Q: Who can apply or appeal through the ARB-COTA5 City of Toronto Act?

A: Property owners in the City of Toronto, Ontario, Canada can apply or appeal through the ARB-COTA5 City of Toronto Act.

Q: What can be canceled, reduced, or refunded through the ARB-COTA5 City of Toronto Act?

A: Through the ARB-COTA5 City of Toronto Act, property owners can seek to cancel, reduce, or obtain a refund for their property assessment or tax.

Q: Is the ARB-COTA5 City of Toronto Act only applicable in Toronto?

A: Yes, the ARB-COTA5 City of Toronto Act is specifically applicable to properties within the City of Toronto in Ontario, Canada.