This version of the form is not currently in use and is provided for reference only. Download this version of

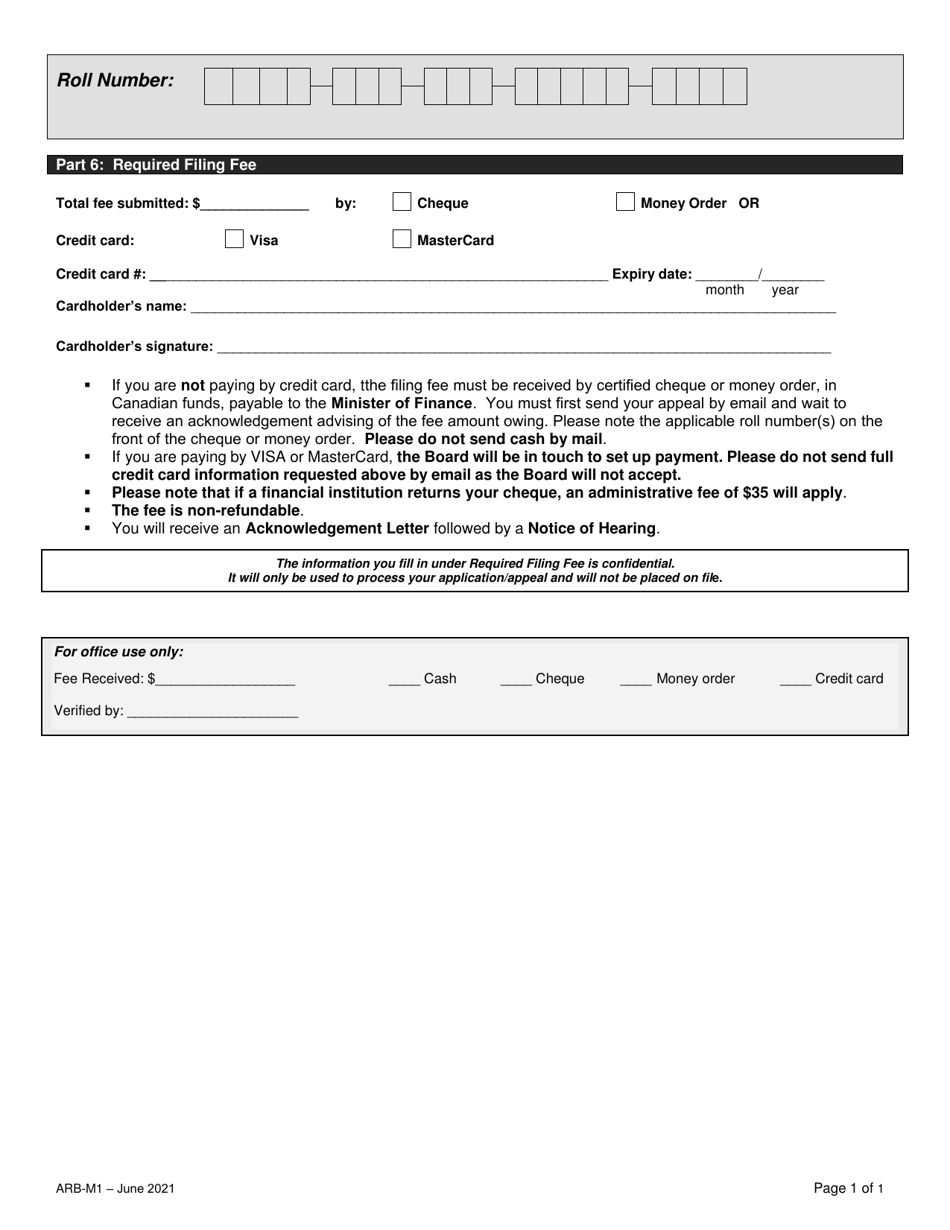

Form ARB-M1

for the current year.

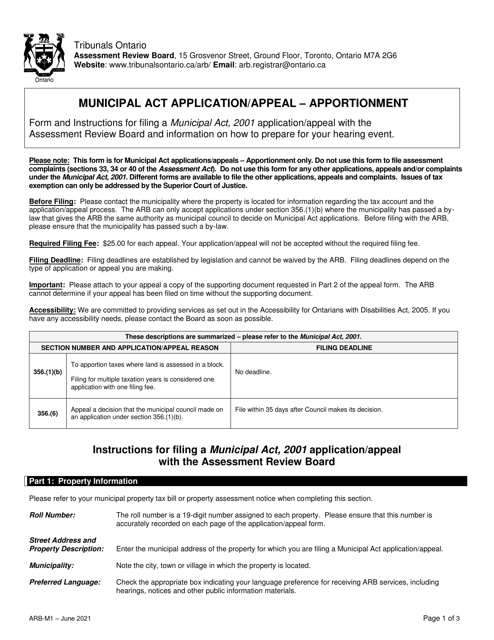

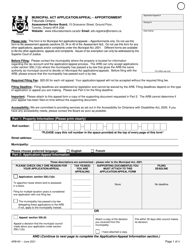

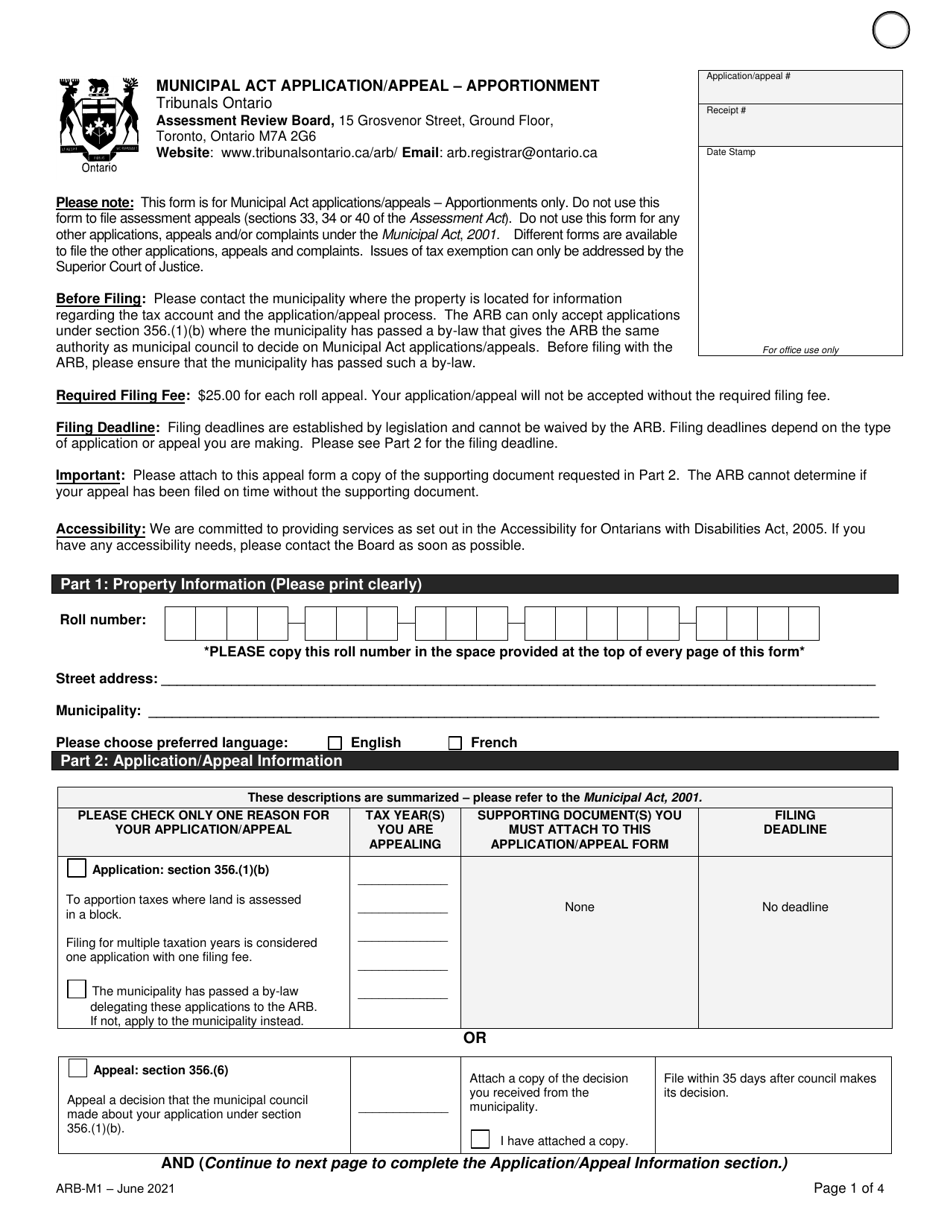

Form ARB-M1 Municipal Act Application / Appeal - Apportionment - Ontario, Canada

Form ARB-M1 Municipal Act Application/Appeal is used in Ontario, Canada for applying or appealing the apportionment of property taxes. It is a form that property owners can use to request a re-evaluation or adjustment of how their property taxes are apportioned.

The Form ARB-M1 Municipal Act Application/Appeal for Apportionment in Ontario, Canada is filed by property owners.

FAQ

Q: What is the Form ARB-M1?

A: Form ARB-M1 is the application/appeal form used for matters related to apportionment under the Municipal Act in Ontario, Canada.

Q: What is the Municipal Act?

A: The Municipal Act is legislation in Ontario, Canada, which governs municipal governments and their activities.

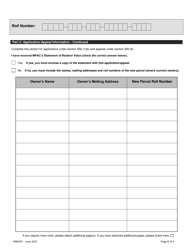

Q: What is apportionment under the Municipal Act?

A: Apportionment under the Municipal Act refers to the allocation of costs or expenses among property owners.

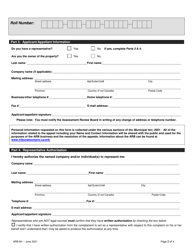

Q: Who can use Form ARB-M1?

A: Form ARB-M1 can be used by individuals or entities who wish to apply for or appeal matters related to apportionment under the Municipal Act.

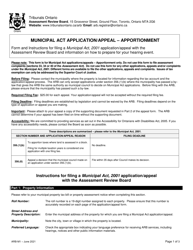

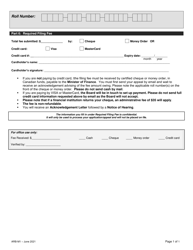

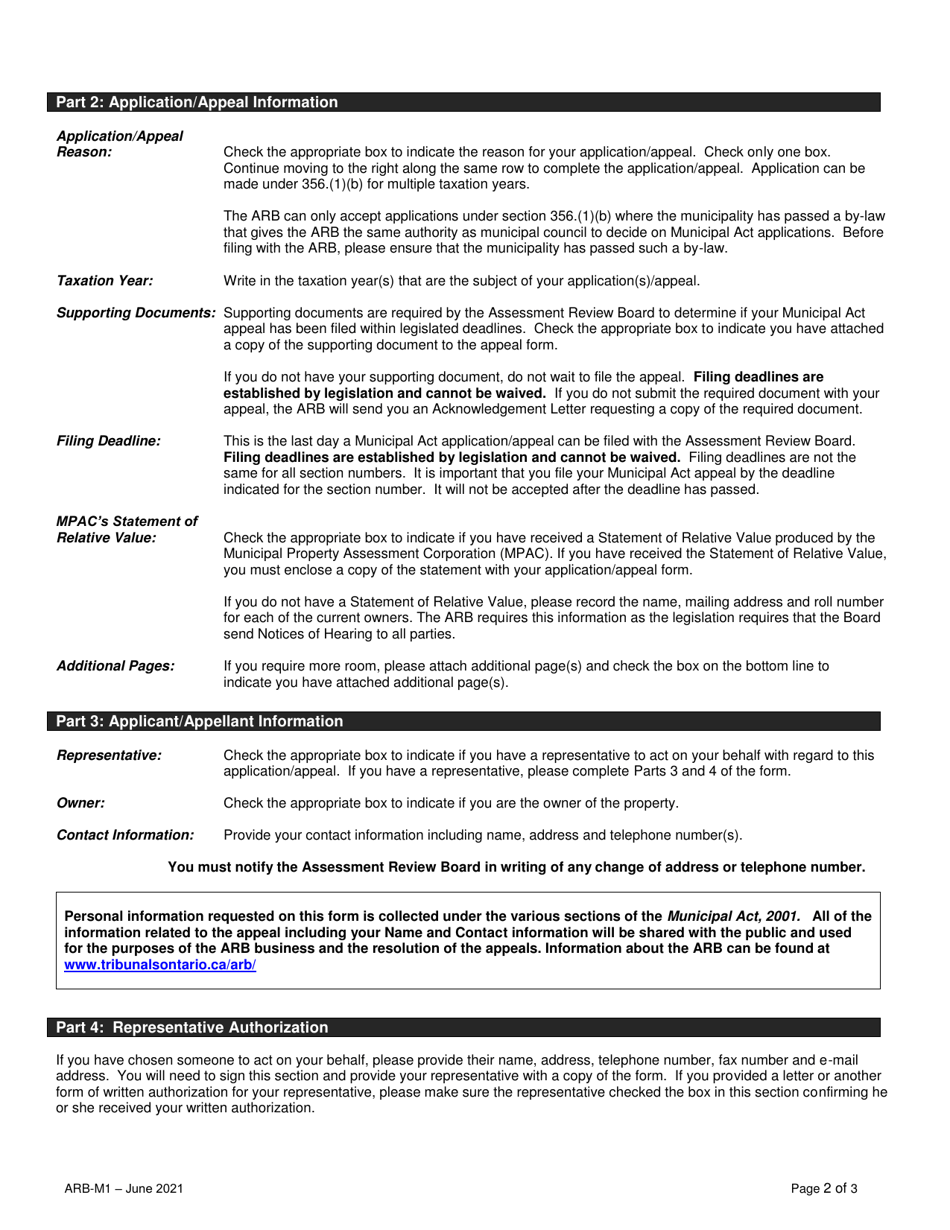

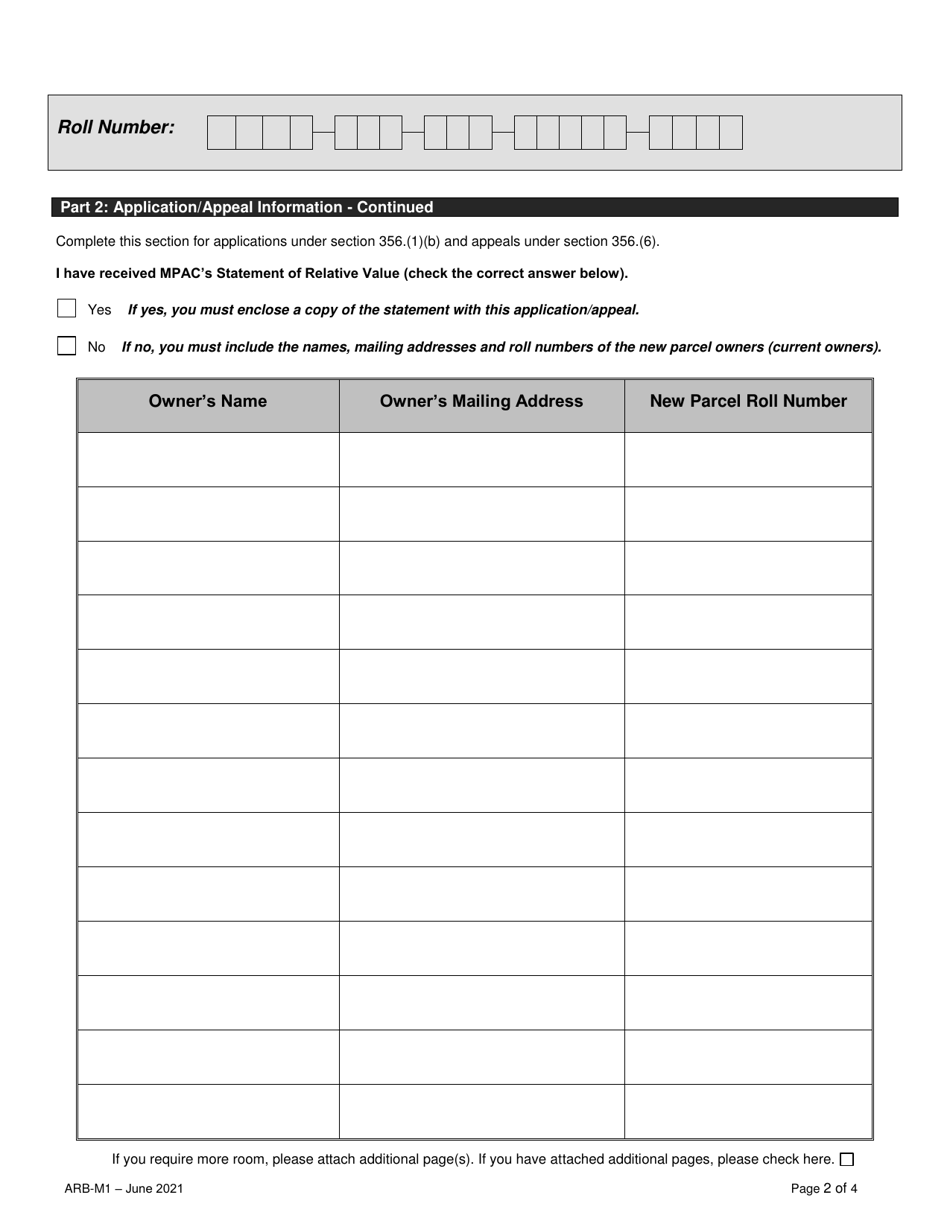

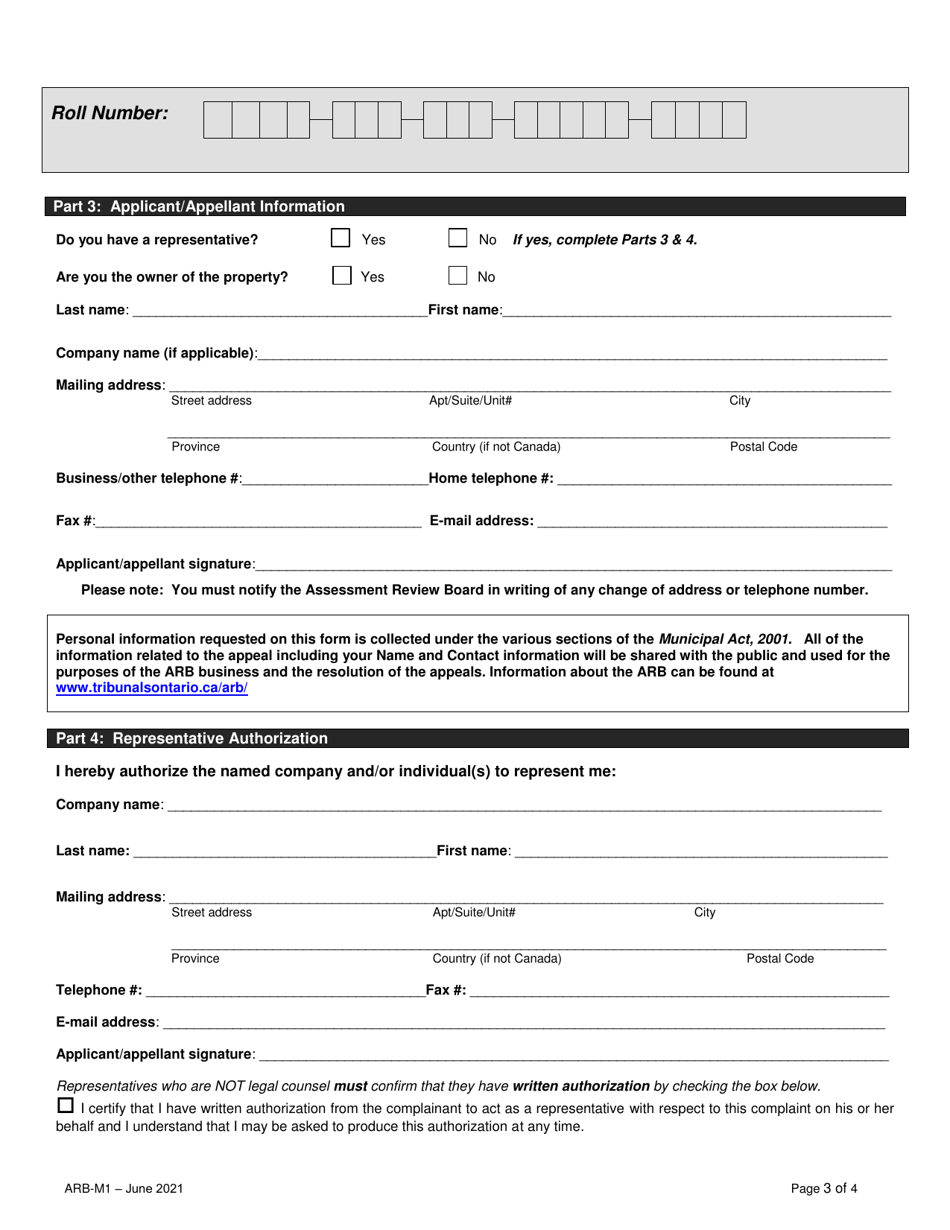

Q: What information is required in Form ARB-M1?

A: Form ARB-M1 requires information such as the property details, description of the apportionment matter, and grounds for the appeal.

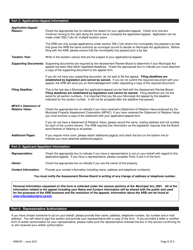

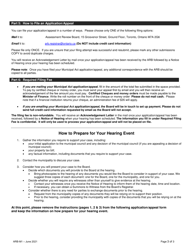

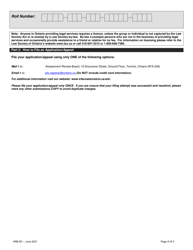

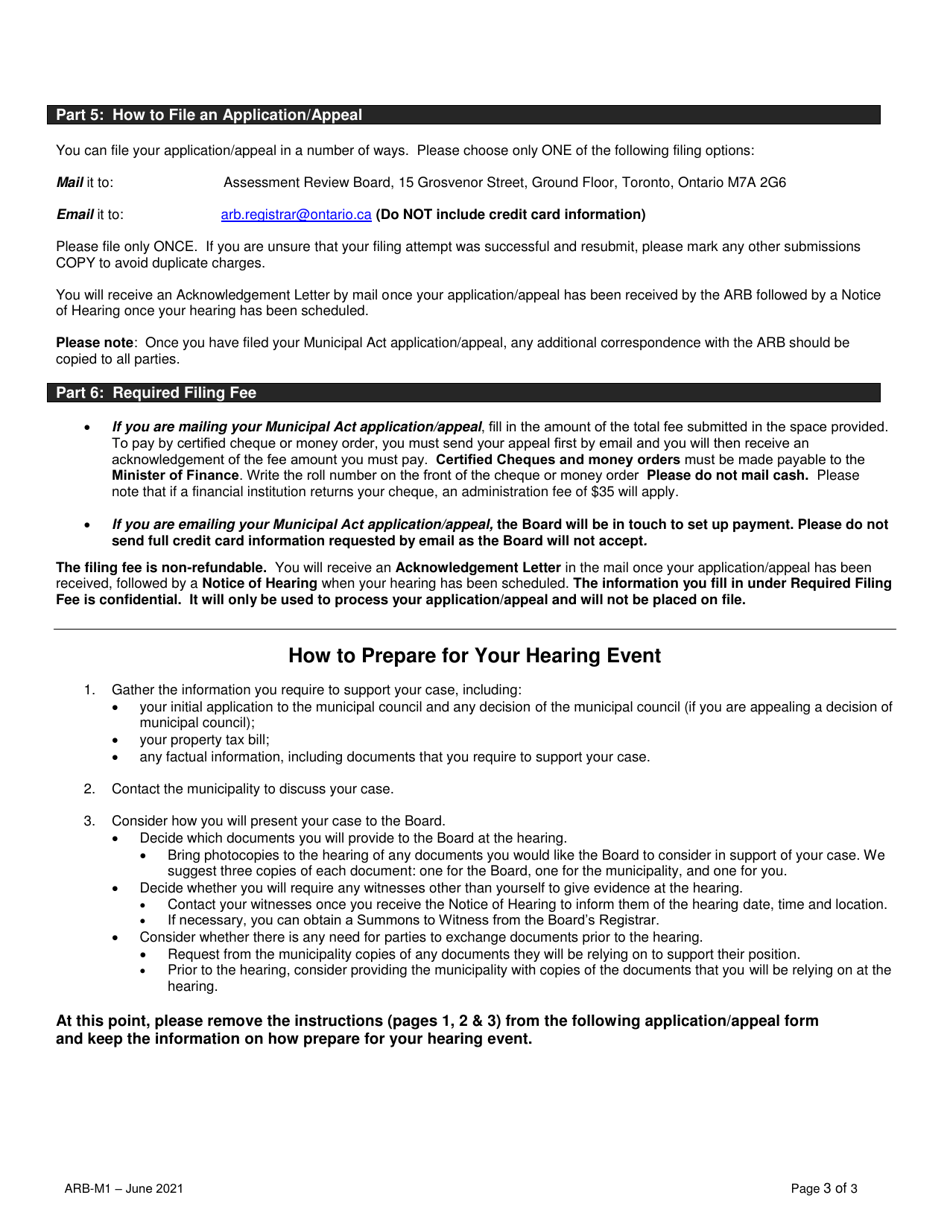

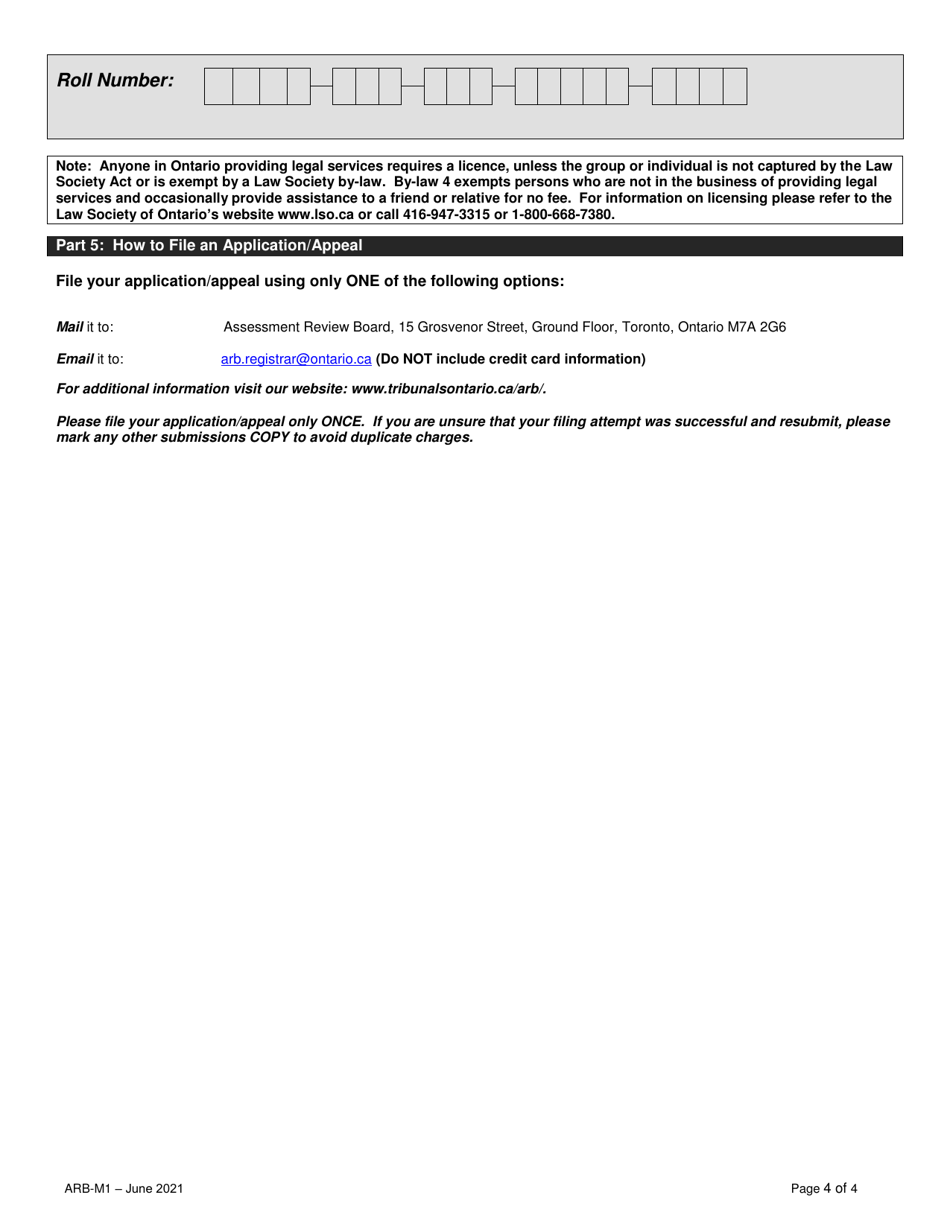

Q: What is the process after submitting Form ARB-M1?

A: After submitting Form ARB-M1, the Assessment Review Board will review the application/appeal and schedule a hearing if necessary.

Q: Can I get assistance in filling out Form ARB-M1?

A: Yes, you can seek assistance from legal professionals or contact the Assessment Review Board for guidance in filling out Form ARB-M1.

Q: How long does the process take after submitting Form ARB-M1?

A: The timeframe for the process after submitting Form ARB-M1 may vary depending on the complexity of the matter and the workload of the Assessment Review Board.