This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1198

for the current year.

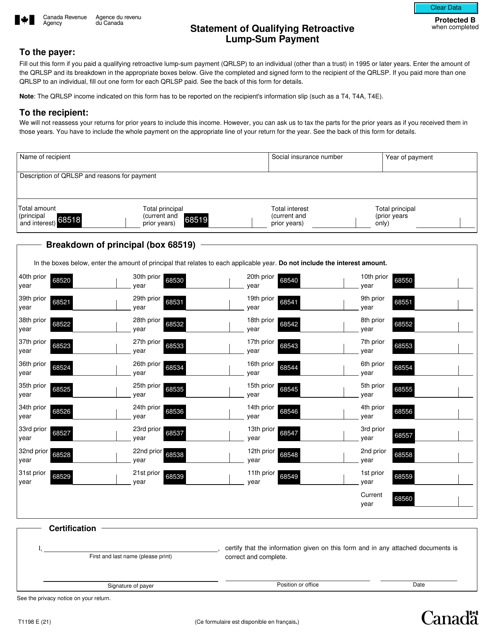

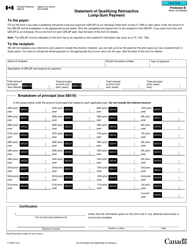

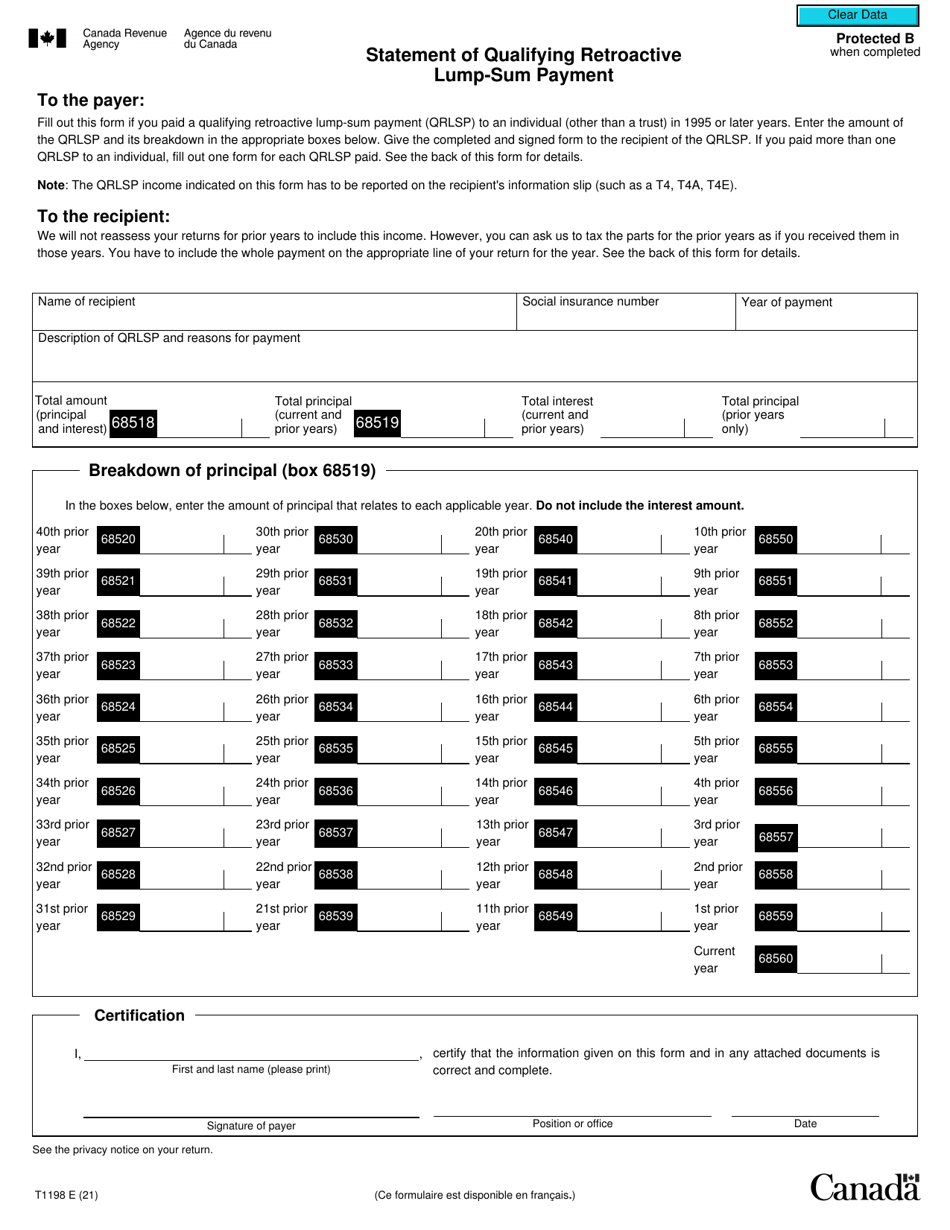

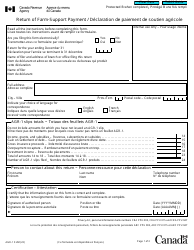

Form T1198 Statement of Qualifying Retroactive Lump-Sum Payment - Canada

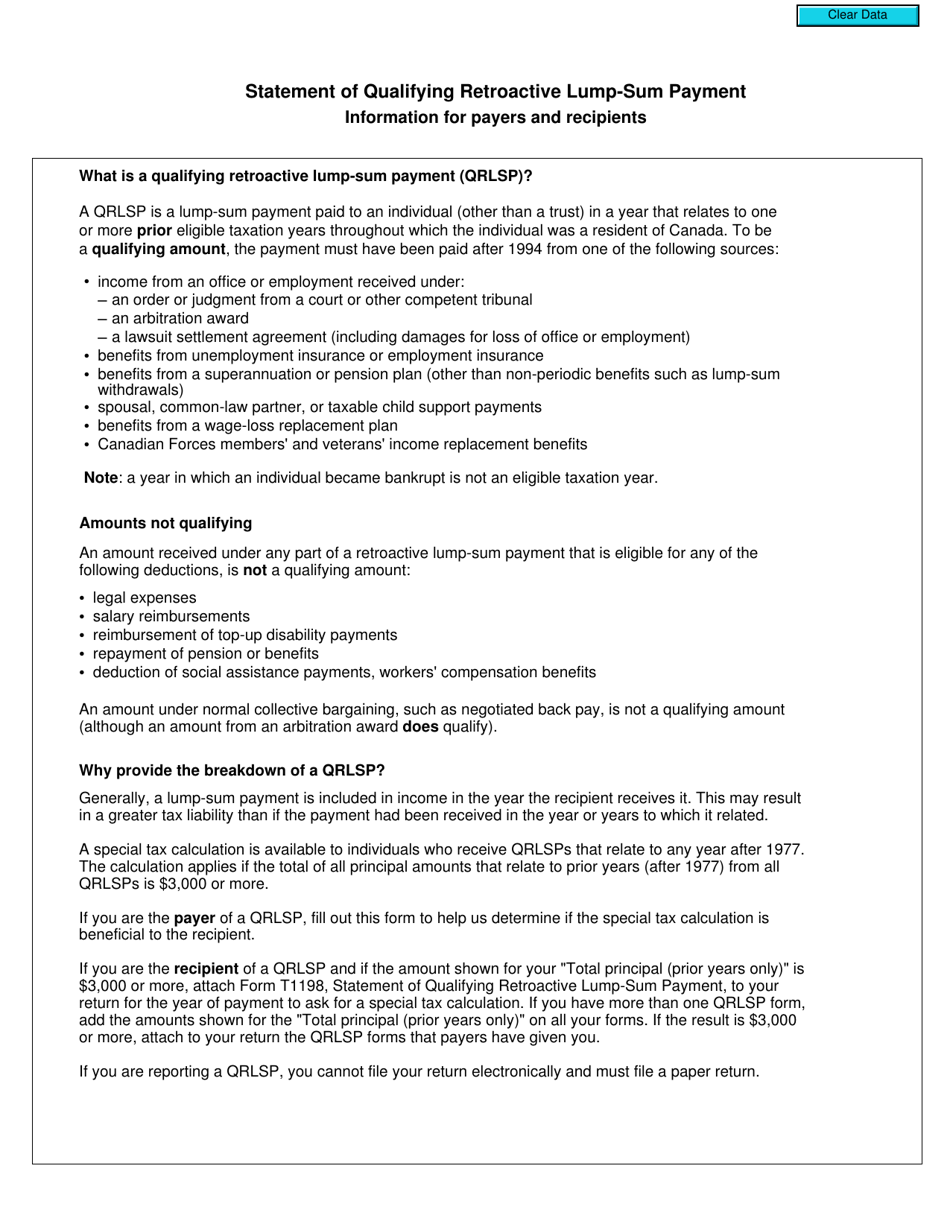

Form T1198 Statement of Qualifying Retroactive Lump-Sum Payment in Canada is used to report the tax treatment of a qualifying retroactive lump-sum payment. It is used to determine how much of the payment will be subject to income tax, and how much can be transferred to a Registered Retirement Savings Plan (RRSP).

The taxpayer who received the retroactive lump-sum payment is responsible for filing the Form T1198 Statement of Qualifying Retroactive Lump-Sum Payment in Canada.

FAQ

Q: What is Form T1198?

A: Form T1198 is a statement used in Canada to report qualifying retroactive lump-sum payments.

Q: What is a qualifying retroactive lump-sum payment?

A: A qualifying retroactive lump-sum payment is a payment received in a lump sum that represents an amount that should have been included in a previous tax year.

Q: When is Form T1198 used?

A: Form T1198 is used when you receive a qualifying retroactive lump-sum payment and need to report it for tax purposes.

Q: How do I fill out Form T1198?

A: You will need to provide information about the payment, such as the type, the amount, and the tax year it relates to.