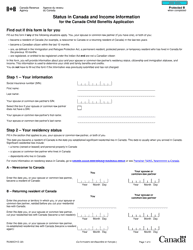

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC66

for the current year.

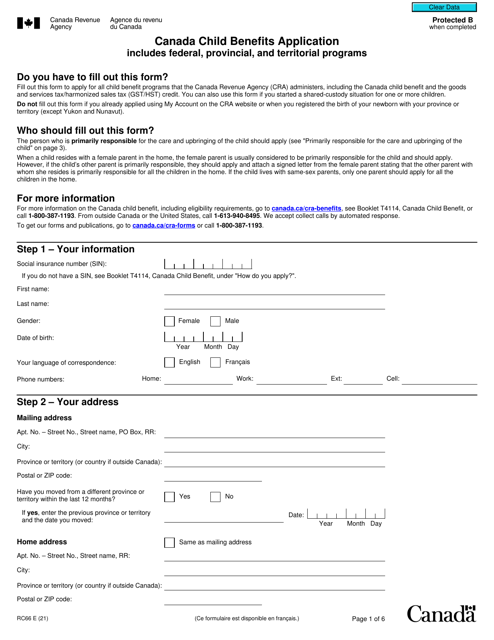

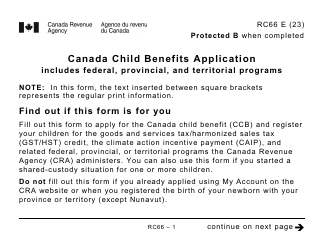

Form RC66 Canada Child Benefits Application - Canada

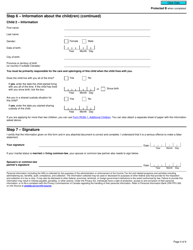

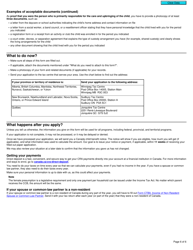

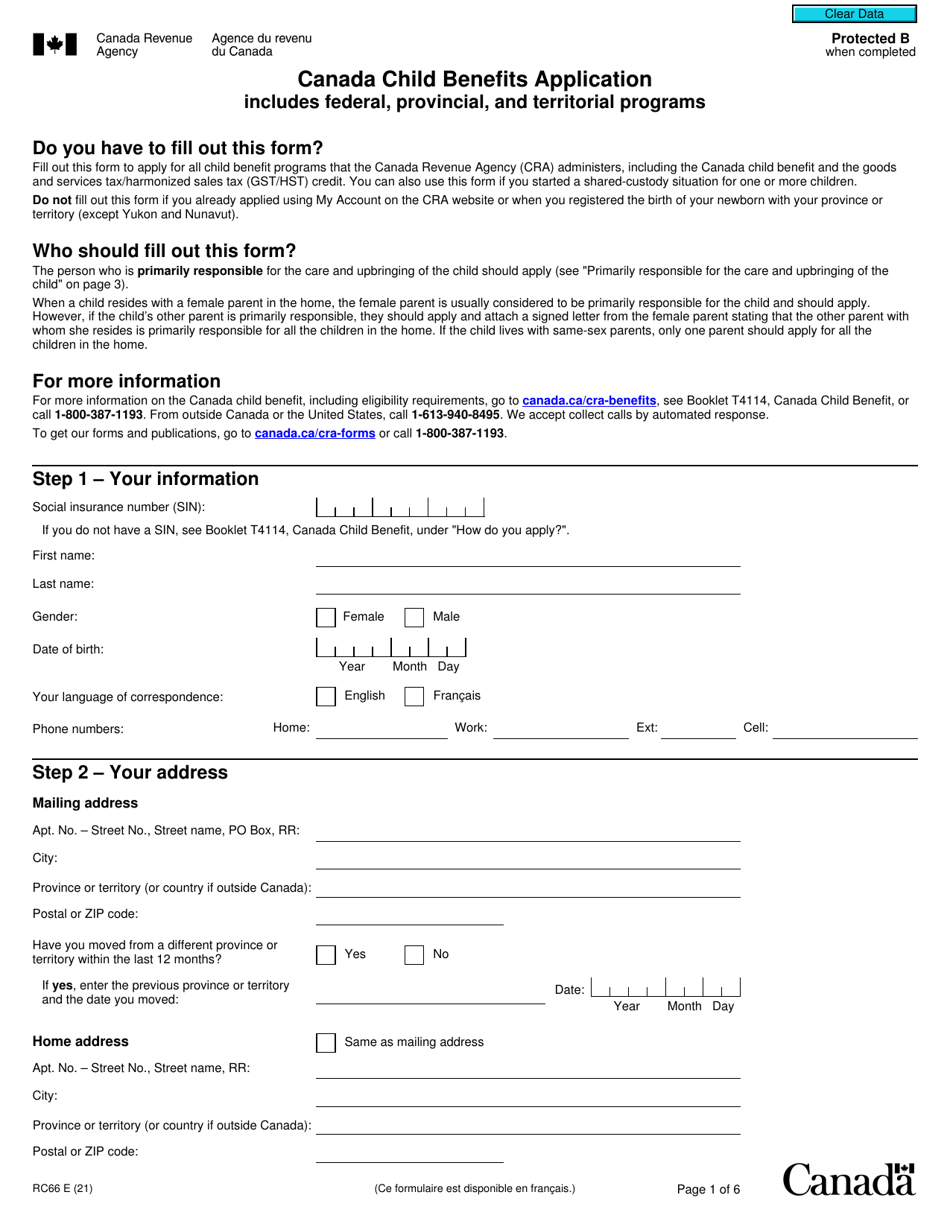

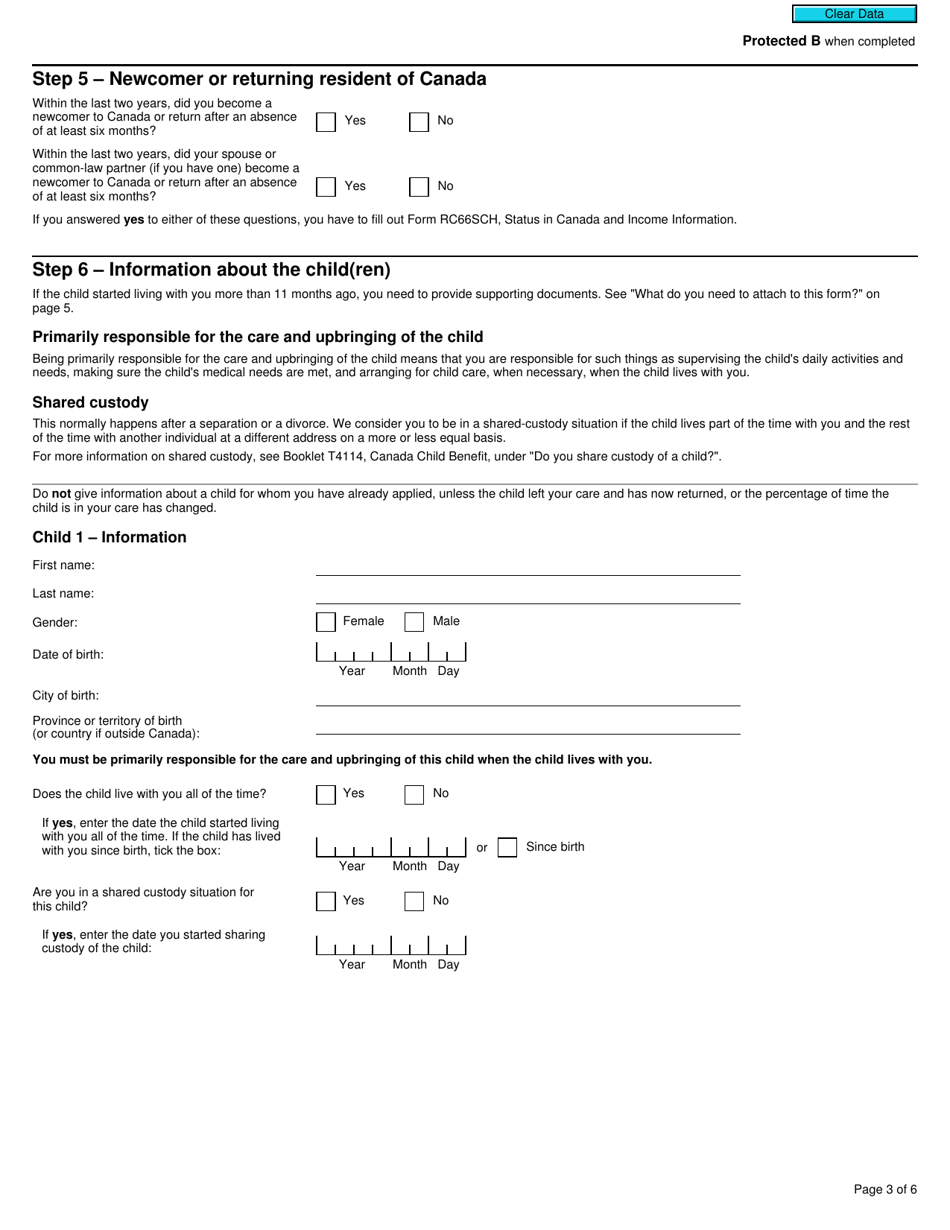

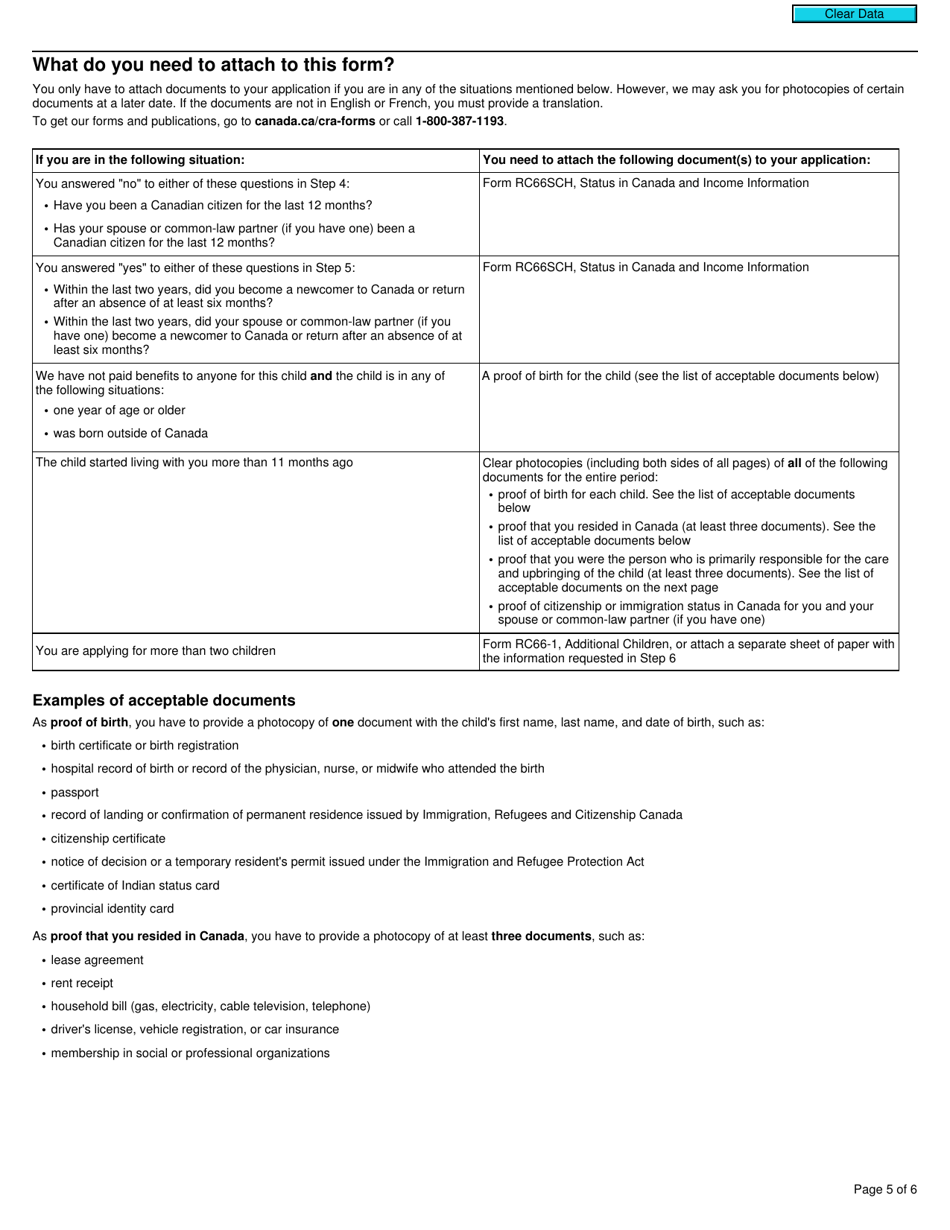

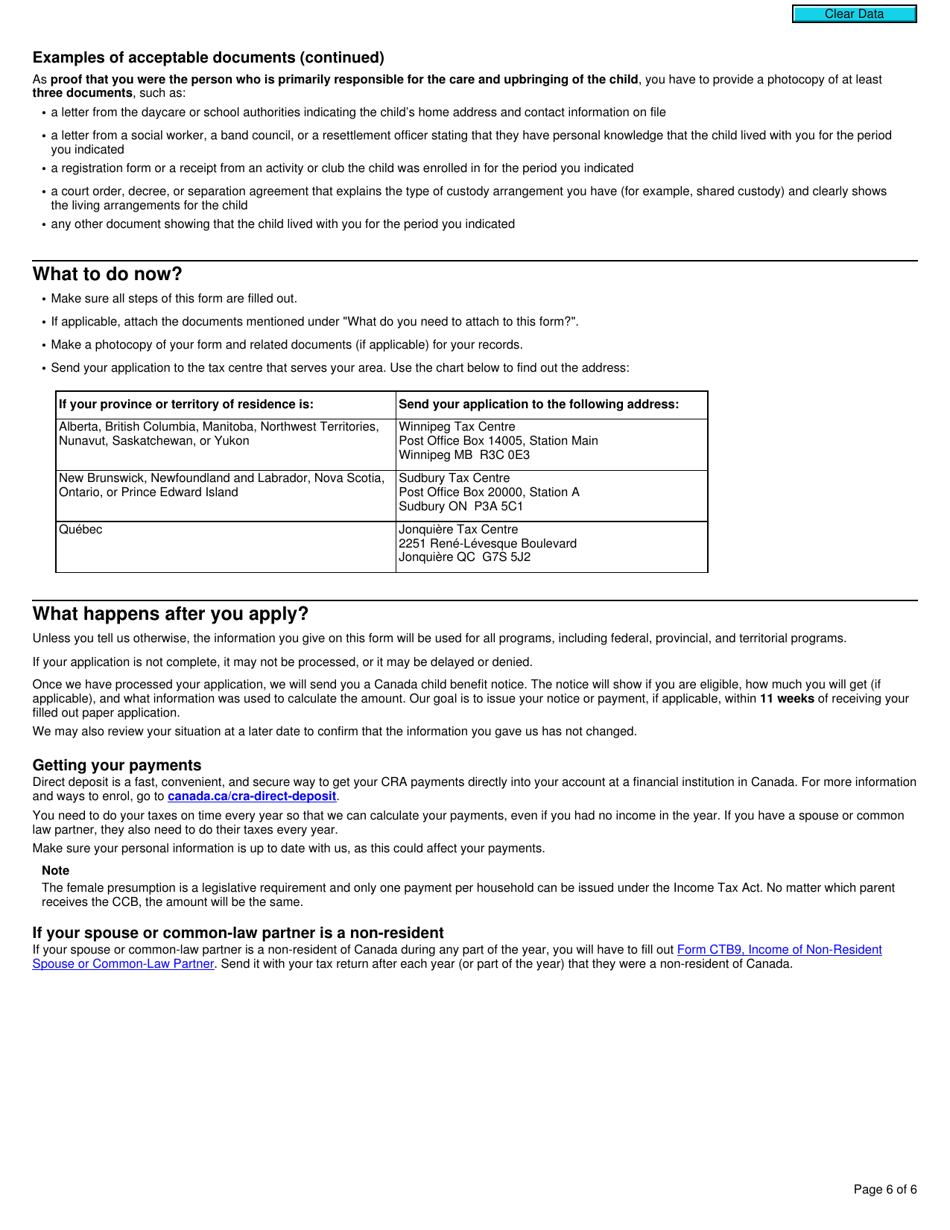

Form RC66, Canada Child Benefits Application, is used to apply for child benefits in Canada. The form is used to determine eligibility and calculate the amount of benefits that an individual may be entitled to receive to help with the costs of raising a child.

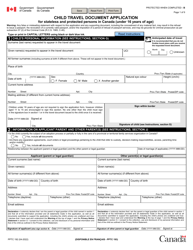

The Form RC66 Canada Child Benefits Application in Canada is typically filed by the parents or legal guardians of the child.

FAQ

Q: What is Form RC66?

A: Form RC66 is the Canada Child Benefits Application.

Q: What is the purpose of Form RC66?

A: The purpose of Form RC66 is to apply for the Canada Child Benefits program.

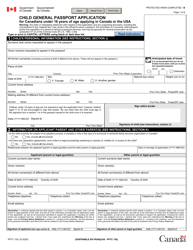

Q: Who can apply using Form RC66?

A: Any individual or family who is a resident of Canada can apply using Form RC66.

Q: What are the Canada Child Benefits?

A: Canada Child Benefits are tax-free monthly payments provided by the Canadian government to eligible families to help with the cost of raising children.

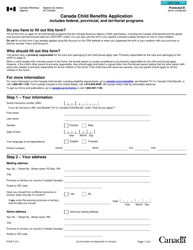

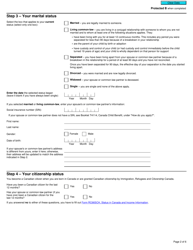

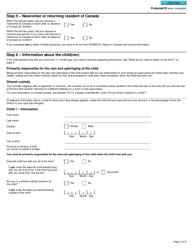

Q: What information is required in Form RC66?

A: Form RC66 requires information such as the applicant's personal details, marital status, income, and details about each child for whom the benefits are being claimed.

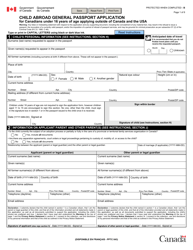

Q: Is there a deadline for submitting Form RC66?

A: There is no specific deadline for submitting Form RC66. However, it is recommended to apply as soon as possible after the birth or adoption of a child to ensure timely benefits.

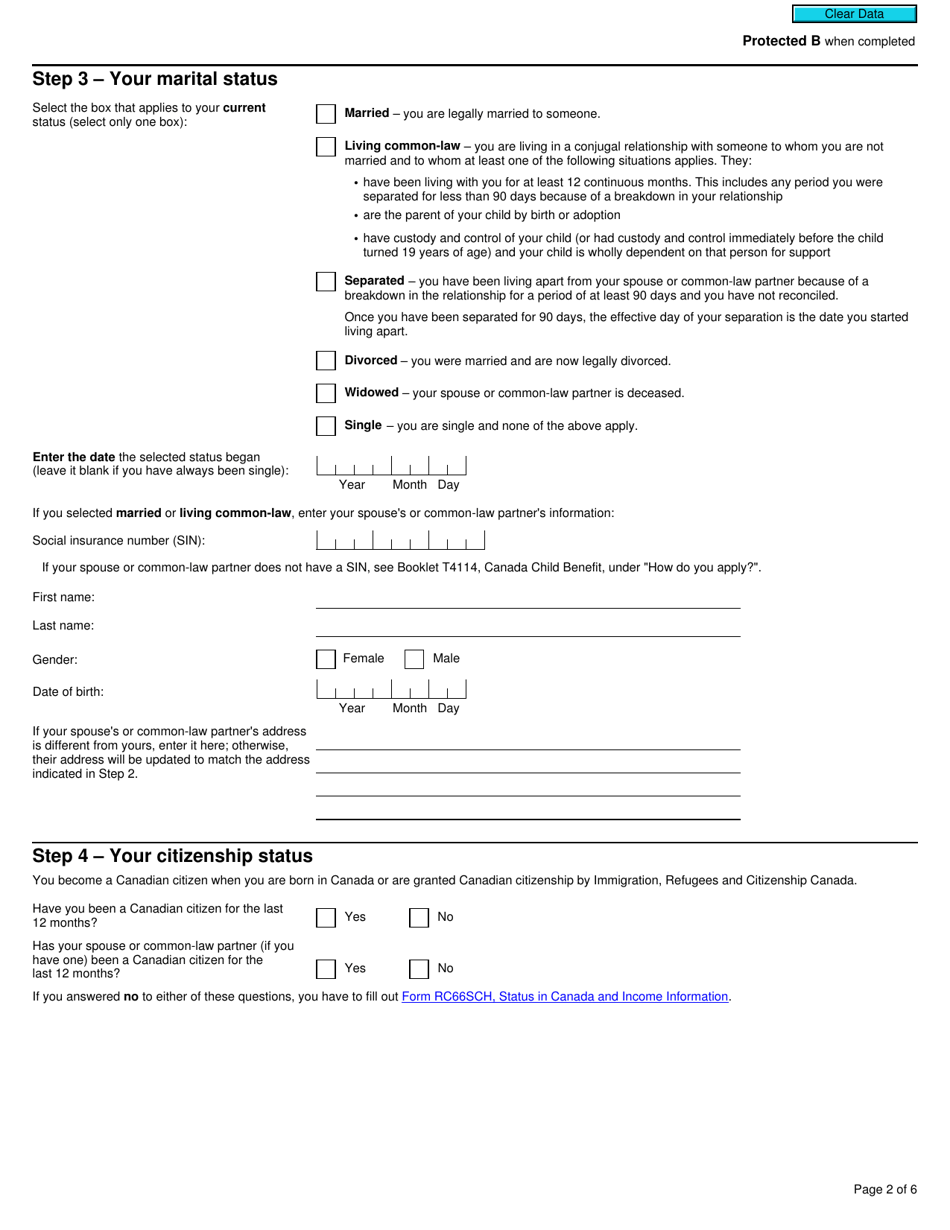

Q: How long does it take to process Form RC66?

A: The processing time for Form RC66 may vary, but it typically takes about 8 weeks for the CRA to process and assess the application.