This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form W-12

for the current year.

Instructions for IRS Form W-12 IRS Paid Preparer Tax Identification Number (Ptin) Application and Renewal

This document contains official instructions for IRS Form W-12 , IRS Paid Preparer Tax Identification Number (Ptin) Application and Renewal - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form W-12 is available for download through this link.

FAQ

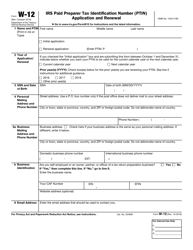

Q: What is Form W-12?

A: Form W-12 is the application and renewal form for IRS Paid Preparer Tax Identification Number (PTIN).

Q: Who needs to file Form W-12?

A: Paid tax preparers who are required to have a PTIN need to file Form W-12.

Q: What is a PTIN?

A: PTIN stands for Paid Preparer Tax Identification Number. It is a unique identifier that tax preparers must have.

Q: How do I apply for a PTIN?

A: You can apply for a PTIN by completing and submitting Form W-12 to the IRS.

Q: Do I need to renew my PTIN?

A: Yes, PTINs need to be renewed annually.

Q: What information is required on Form W-12?

A: Form W-12 requires information such as name, address, Social Security number, and professional credentials.

Q: Are there any fees for filing Form W-12?

A: Yes, there is a fee associated with applying for and renewing a PTIN.

Q: Can I e-file Form W-12?

A: No, Form W-12 cannot be e-filed and must be mailed to the IRS.

Q: What is the deadline for filing Form W-12?

A: There is no specific deadline for filing Form W-12, but it should be submitted before you begin preparing tax returns.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.