This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form W-12

for the current year.

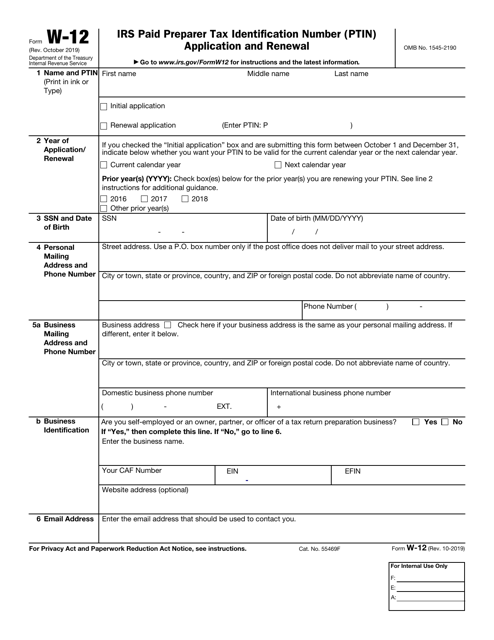

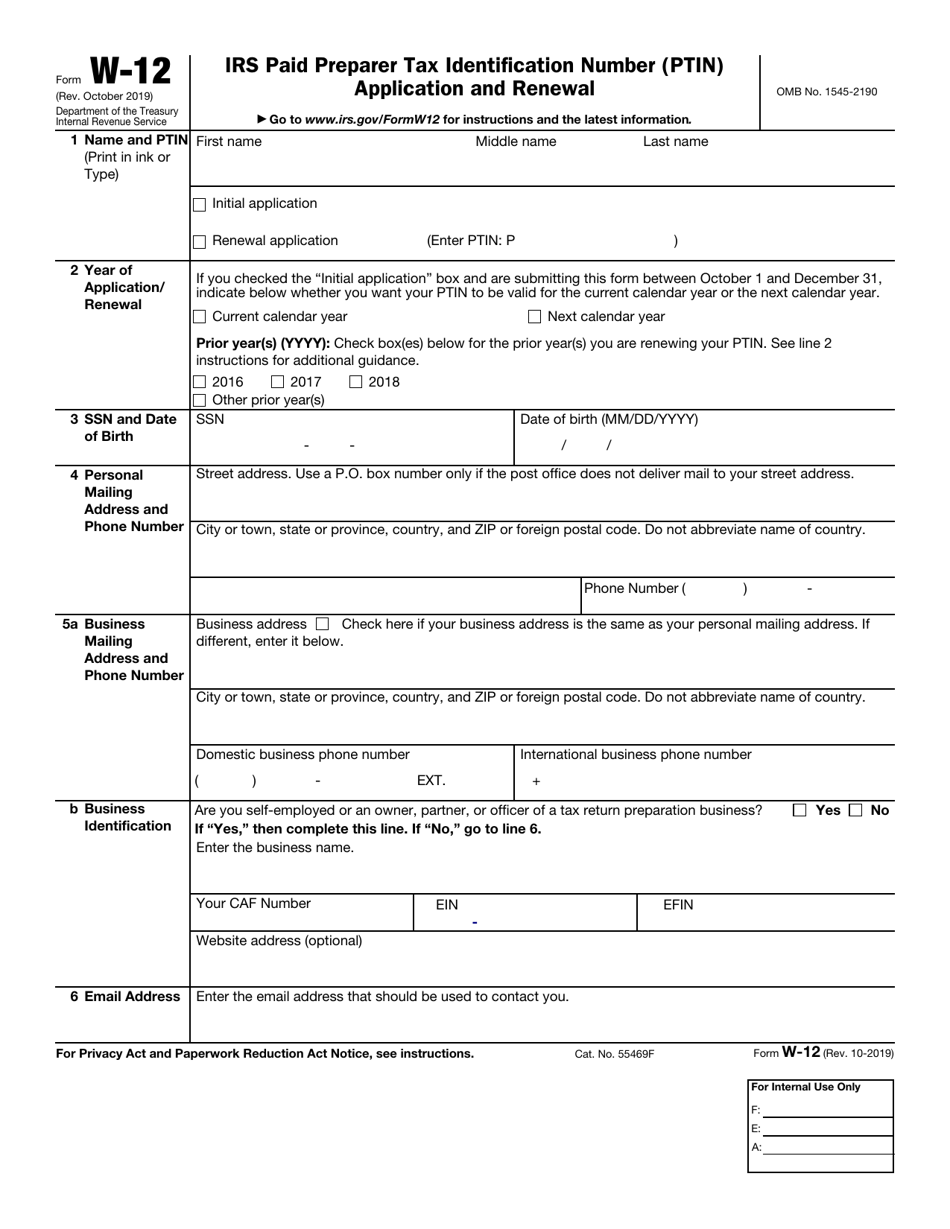

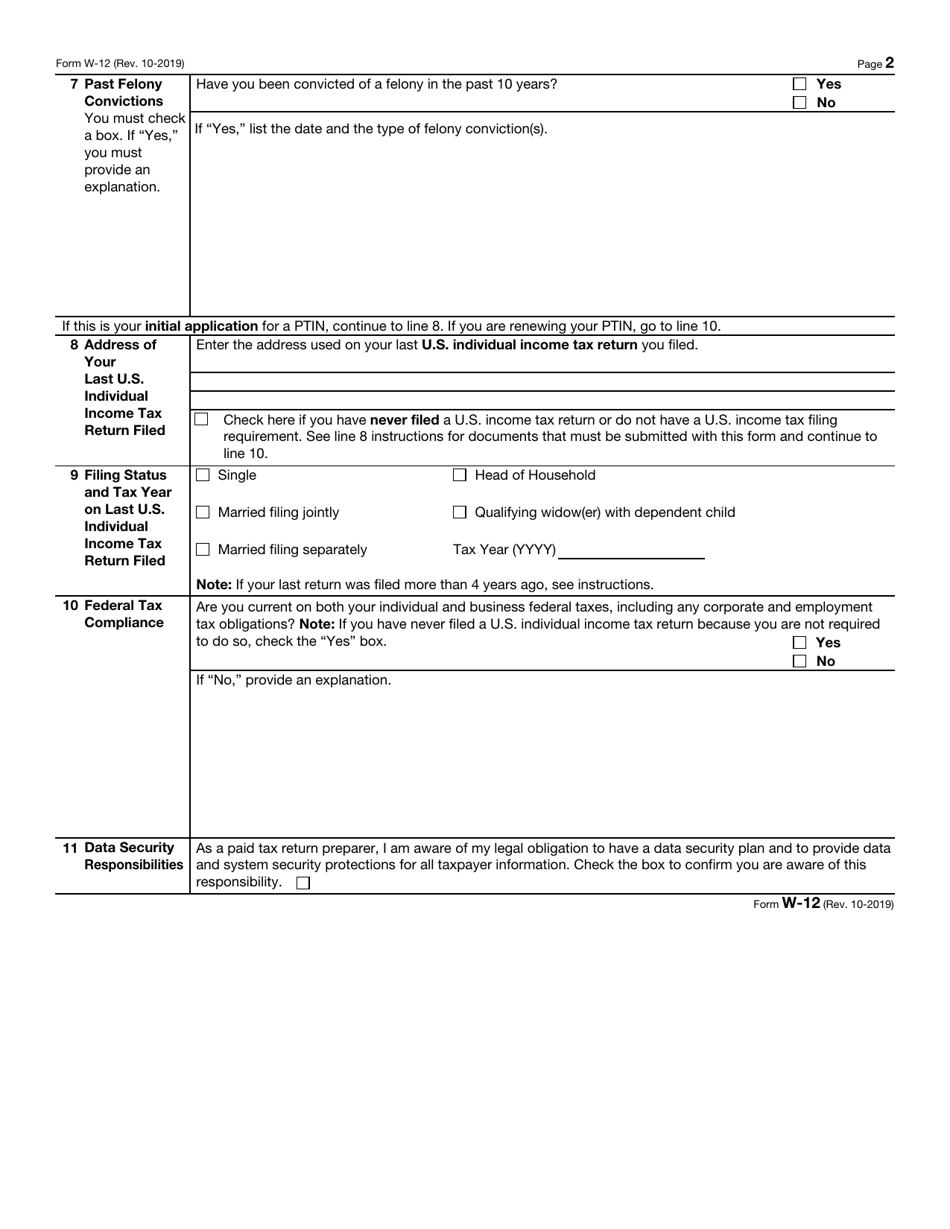

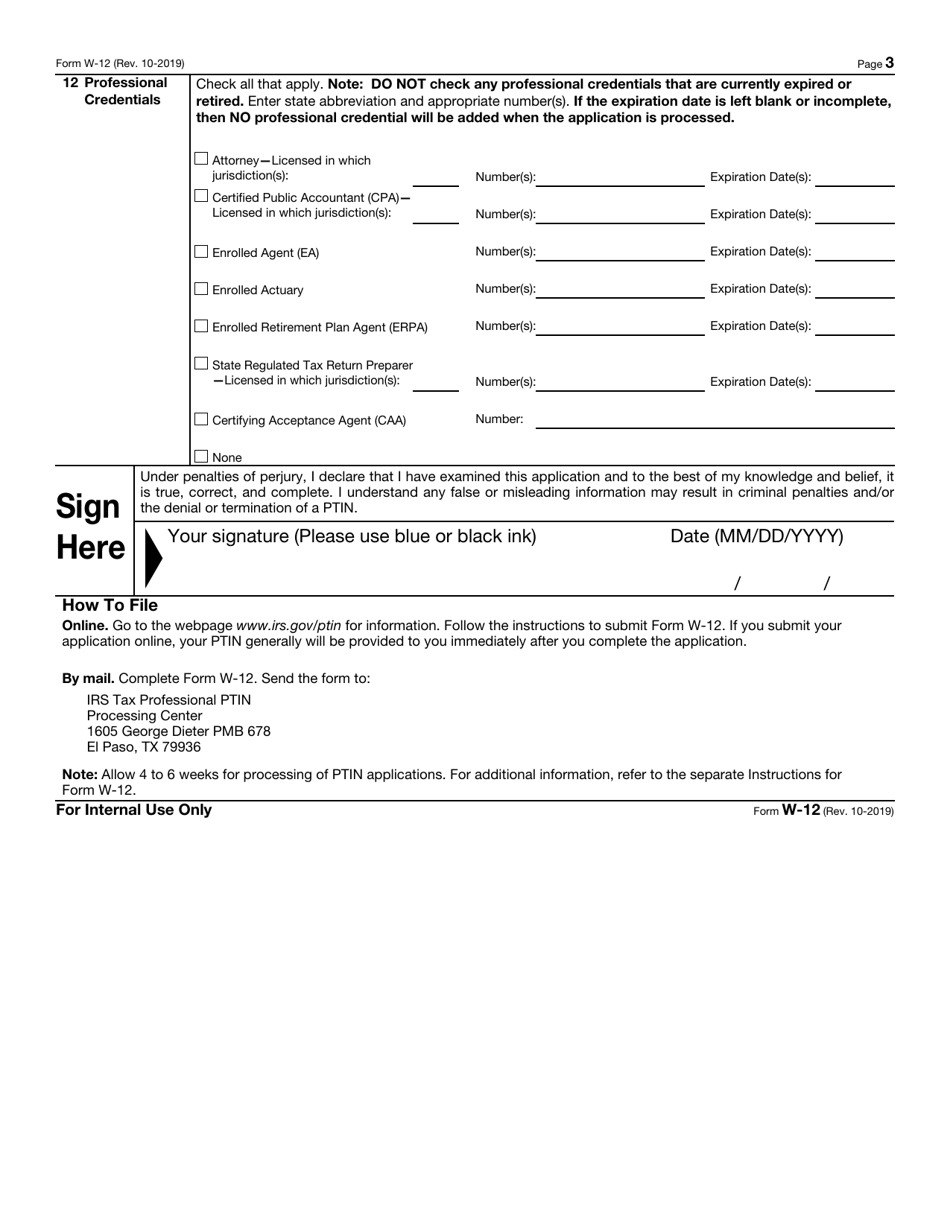

IRS Form W-12 IRS Paid Preparer Tax Identification Number (Ptin) Application and Renewal

What Is IRS Form W-12?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2019. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form W-12?

A: IRS Form W-12 is the form used by paid tax preparers to apply for or renew their Preparer Tax Identification Number (PTIN).

Q: What is a PTIN?

A: A PTIN is a unique identifier that the IRS requires all paid tax return preparers to have.

Q: Who needs to file Form W-12?

A: Paid tax return preparers who do not already have a PTIN or whose PTIN has expired need to file Form W-12.

Q: How often do I need to renew my PTIN?

A: PTINs must be renewed each year by December 31st.

Q: What information do I need to provide on Form W-12?

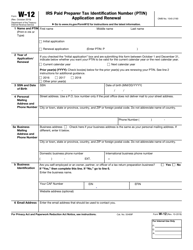

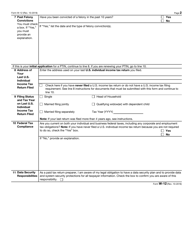

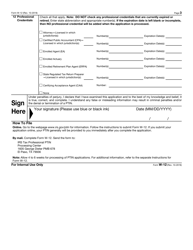

A: Form W-12 requires personal identification information, contact information, and information about previous PTINs, if applicable.

Q: What happens if I don't file Form W-12?

A: If you are a paid tax preparer and do not have a valid PTIN, you may be ineligible to prepare tax returns for compensation.

Q: How long does it take to receive a PTIN after filing Form W-12?

A: After filing Form W-12, it typically takes 4-6 weeks to receive your PTIN from the IRS.

Q: Do I need to include any supporting documents with Form W-12?

A: In most cases, you do not need to include any supporting documents with Form W-12. However, you may be asked to provide additional documentation if the IRS needs to verify the information you provided.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form W-12 through the link below or browse more documents in our library of IRS Forms.