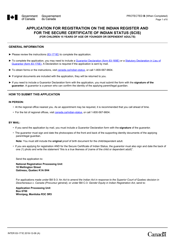

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2214

for the current year.

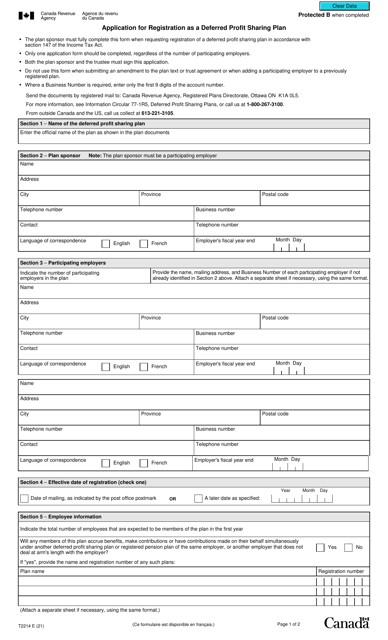

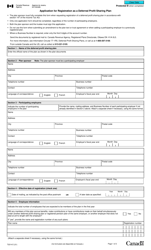

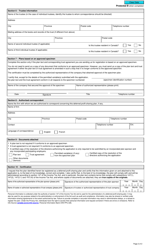

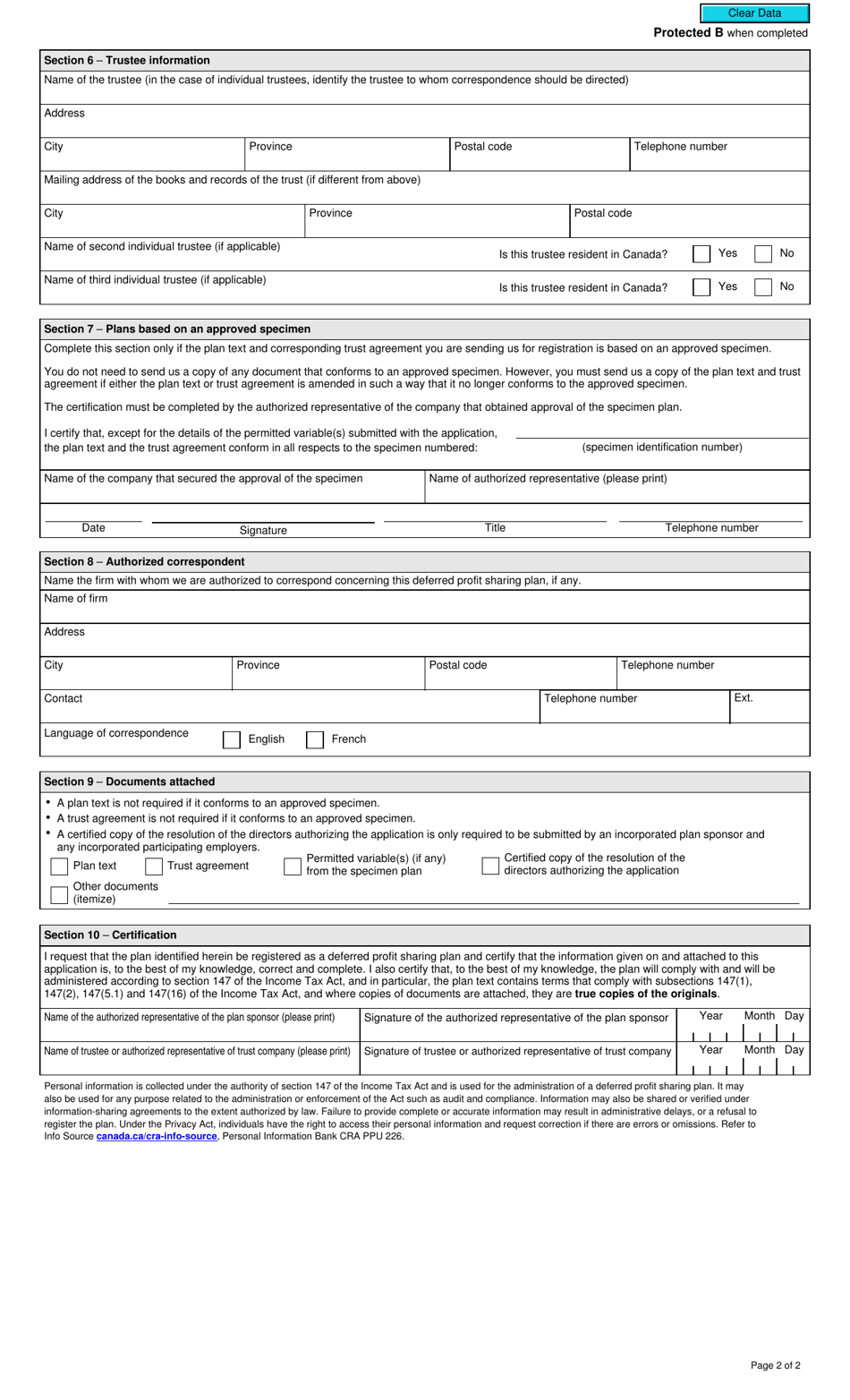

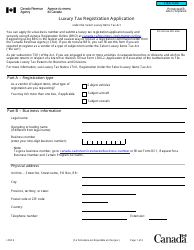

Form T2214 Application for Registration as a Deferred Profit Sharing Plan - Canada

Form T2214 Application for Registration as a Deferred Profit Sharing Plan - Canada is used for registering a deferred profit sharing plan with the Canada Revenue Agency (CRA). It allows employers to establish a retirement savings plan for their employees and receive tax benefits.

The employer or plan administrator files the Form T2214 Application for Registration as a Deferred Profit Sharing Plan in Canada.

FAQ

Q: What is Form T2214?

A: Form T2214 is an Application for Registration as a Deferred Profit Sharing Plan in Canada.

Q: Who needs to complete Form T2214?

A: Plan administrators who want to register a deferred profit sharing plan in Canada need to complete Form T2214.

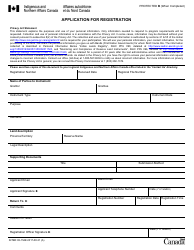

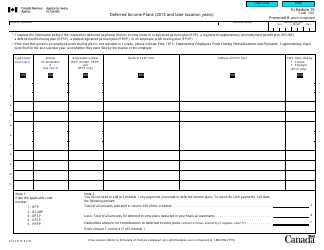

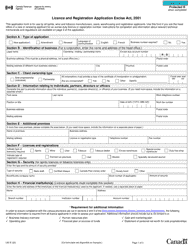

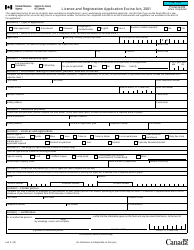

Q: What information do I need to provide on Form T2214?

A: You will need to provide information about the plan administrator, employer, and plan details, as well as any previous plan amendments or terminations.

Q: Are there any fees associated with submitting Form T2214?

A: There are no fees associated with submitting Form T2214.

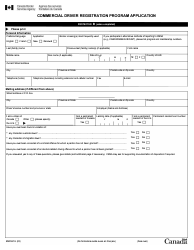

Q: What is the deadline for submitting Form T2214?

A: Form T2214 must be submitted within 60 days of the effective date of the plan or plan amendment.

Q: What happens after I submit Form T2214?

A: The CRA will review your application and notify you of their decision to approve or deny the registration of your deferred profit sharing plan.

Q: Can I make changes to my deferred profit sharing plan after it is registered?

A: Yes, you can make changes to your deferred profit sharing plan after it is registered. You will need to notify the CRA of any plan amendments or terminations.