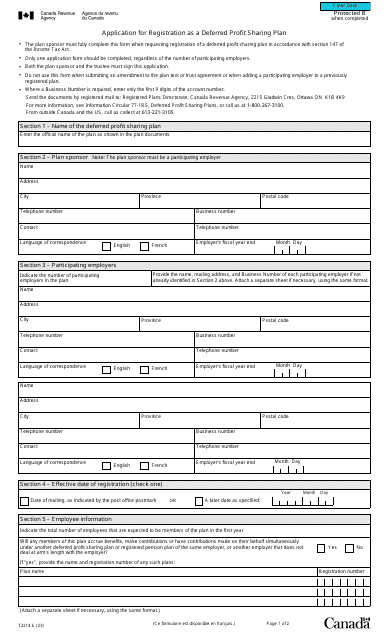

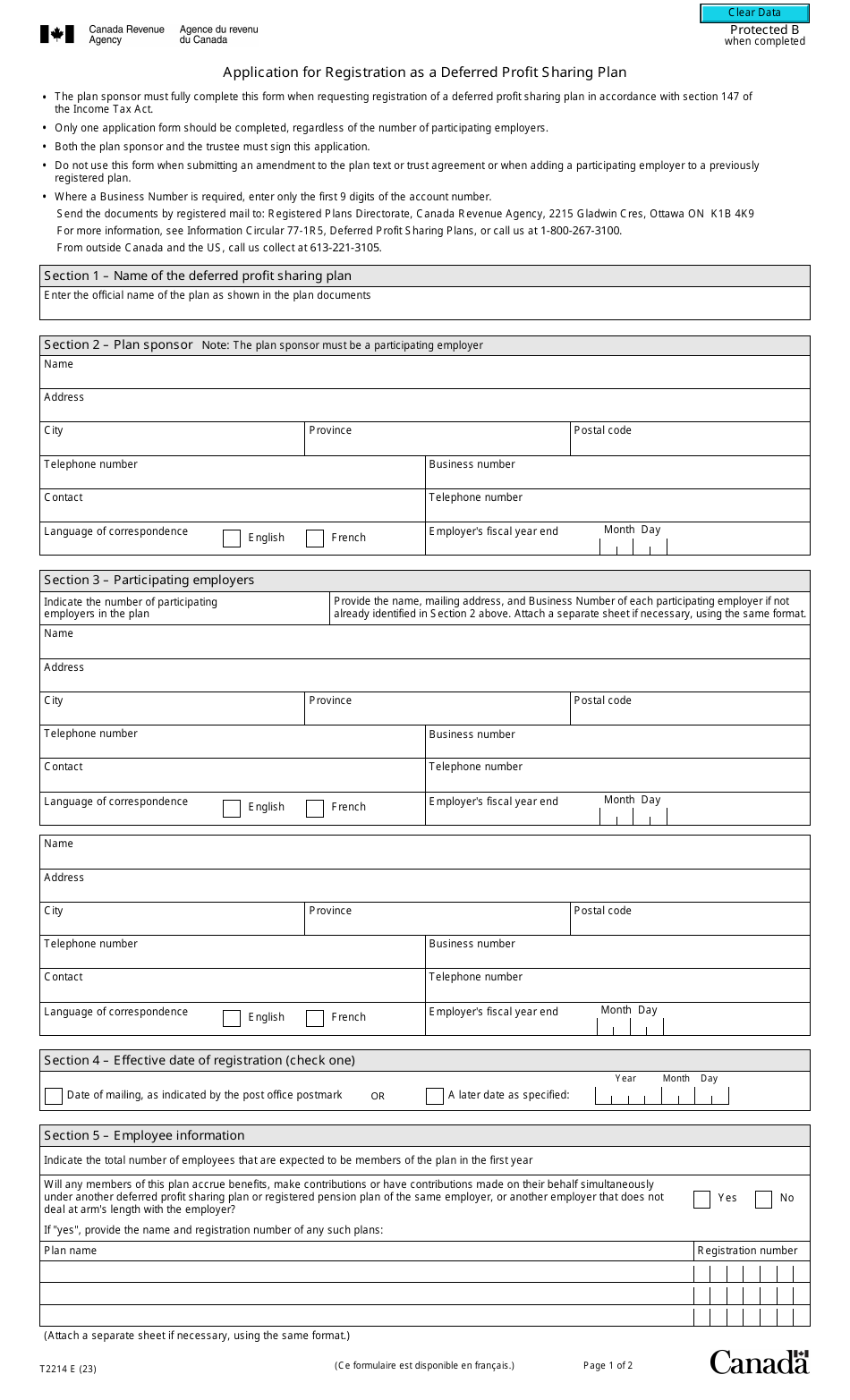

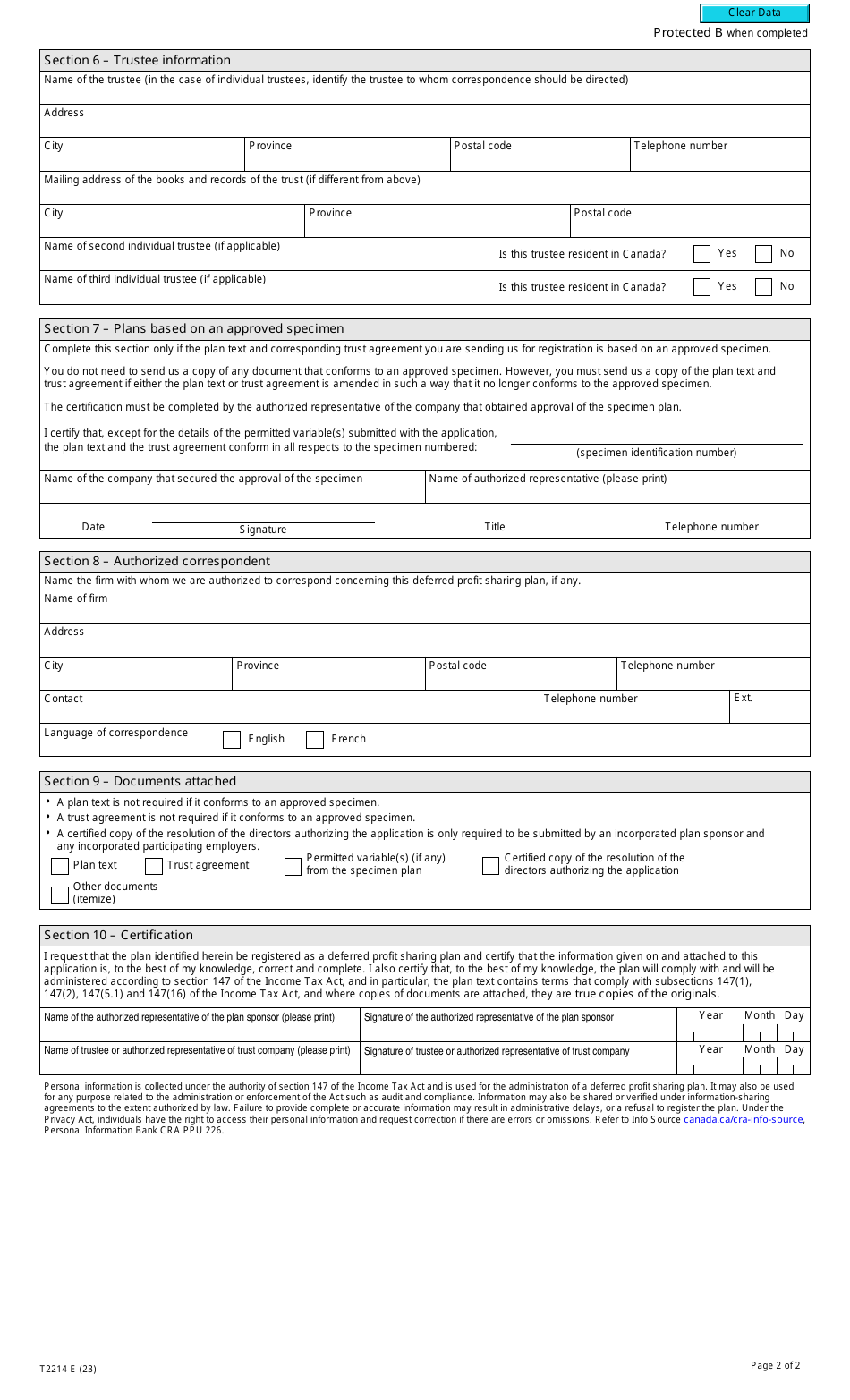

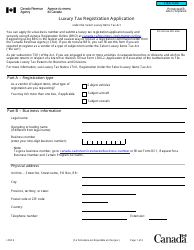

Form T2214 Application for Registration as a Deferred Profit Sharing Plan - Canada

Form T2214 Application for Registration as a Deferred Profit Sharing Plan - Canada is used for registering a deferred profit sharing plan with the Canada Revenue Agency (CRA). It allows employers to establish a retirement savings plan for their employees and receive tax benefits.

The employer or plan administrator files the Form T2214 Application for Registration as a Deferred Profit Sharing Plan in Canada.

Form T2214 Application for Registration as a Deferred Profit Sharing Plan - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2214?

A: Form T2214 is an Application for Registration as a Deferred Profit Sharing Plan in Canada.

Q: Who needs to complete Form T2214?

A: Plan administrators who want to register a deferred profit sharing plan in Canada need to complete Form T2214.

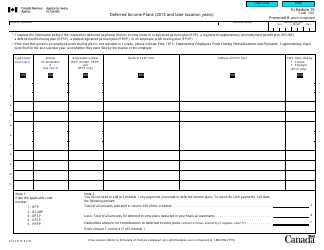

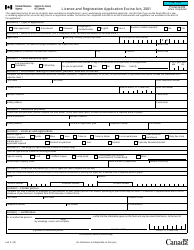

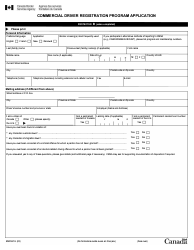

Q: What information do I need to provide on Form T2214?

A: You will need to provide information about the plan administrator, employer, and plan details, as well as any previous plan amendments or terminations.

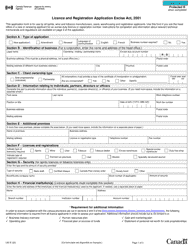

Q: Are there any fees associated with submitting Form T2214?

A: There are no fees associated with submitting Form T2214.

Q: What is the deadline for submitting Form T2214?

A: Form T2214 must be submitted within 60 days of the effective date of the plan or plan amendment.

Q: What happens after I submit Form T2214?

A: The CRA will review your application and notify you of their decision to approve or deny the registration of your deferred profit sharing plan.

Q: Can I make changes to my deferred profit sharing plan after it is registered?

A: Yes, you can make changes to your deferred profit sharing plan after it is registered. You will need to notify the CRA of any plan amendments or terminations.