This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC376

for the current year.

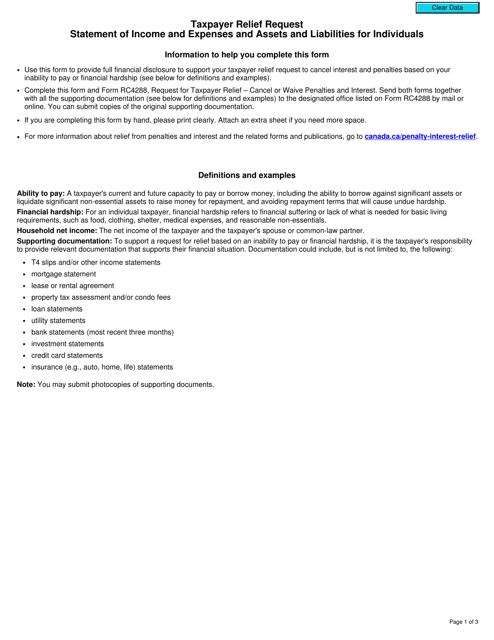

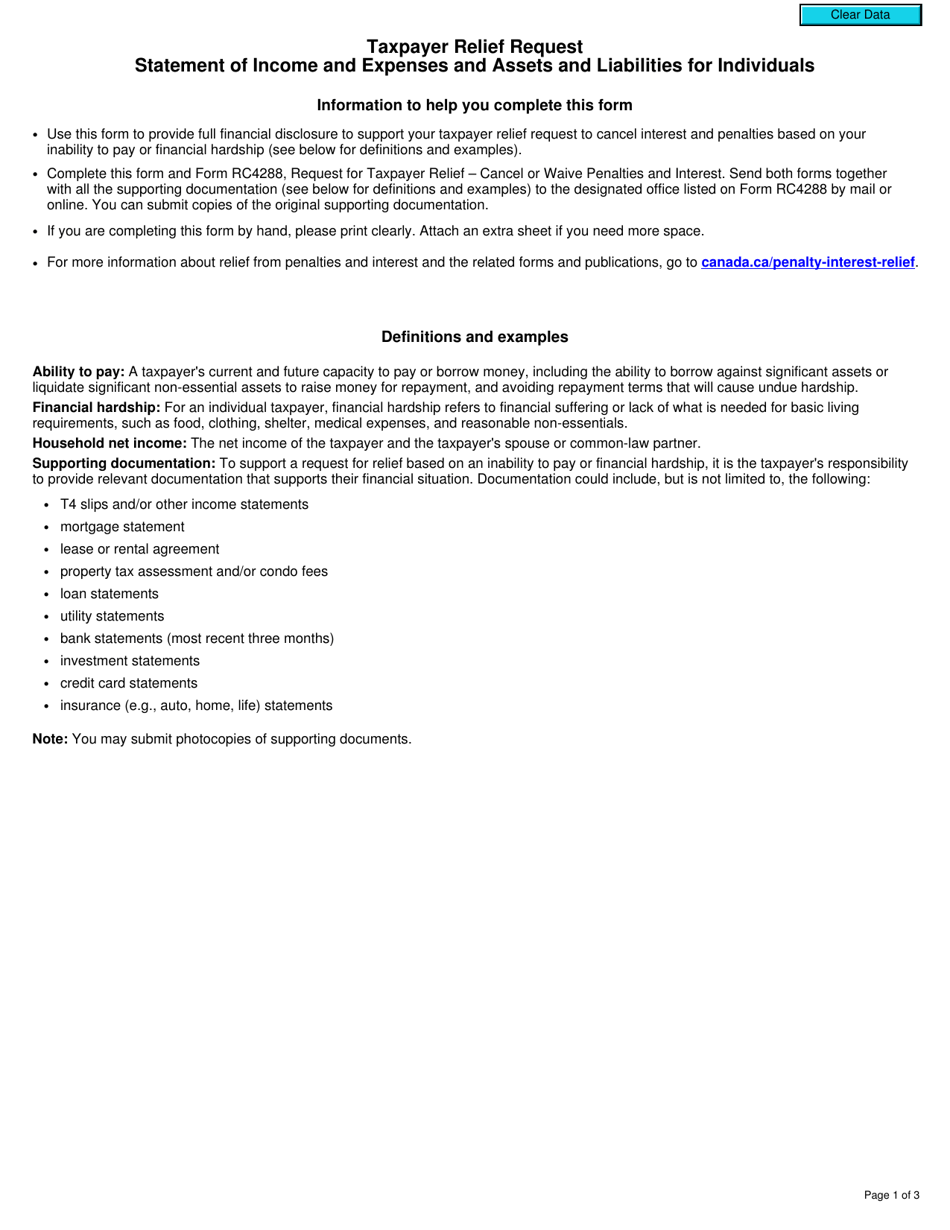

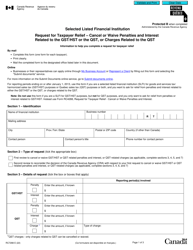

Form RC376 Taxpayer Relief Request Statement of Income and Expenses and Assets and Liabilities for Individuals - Canada

Form RC376 Taxpayer Relief Request Statement of Income and Expenses and Assets and Liabilities for Individuals in Canada is used to request relief from certain tax-related penalties or interest charges. It allows individuals to provide details about their income, expenses, assets, and liabilities to support their request for relief.

The Form RC376 Taxpayer Relief Request Statement of Income and Expenses and Assets and Liabilities for Individuals in Canada is typically filed by individuals who are seeking relief from penalties or interest charged by the Canada Revenue Agency (CRA).

FAQ

Q: What is Form RC376?

A: Form RC376 is the Taxpayer Relief Request Statement of Income and Expenses and Assets and Liabilities for Individuals in Canada.

Q: Who should use Form RC376?

A: Form RC376 should be used by individuals in Canada who are seeking taxpayer relief.

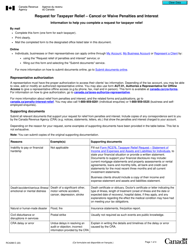

Q: What is taxpayer relief?

A: Taxpayer relief is a program that allows individuals to apply for relief from penalties, interest, or certain fees that they may owe to the Canada Revenue Agency.

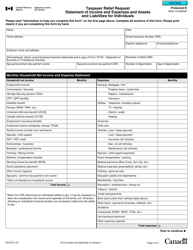

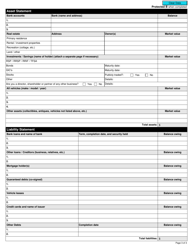

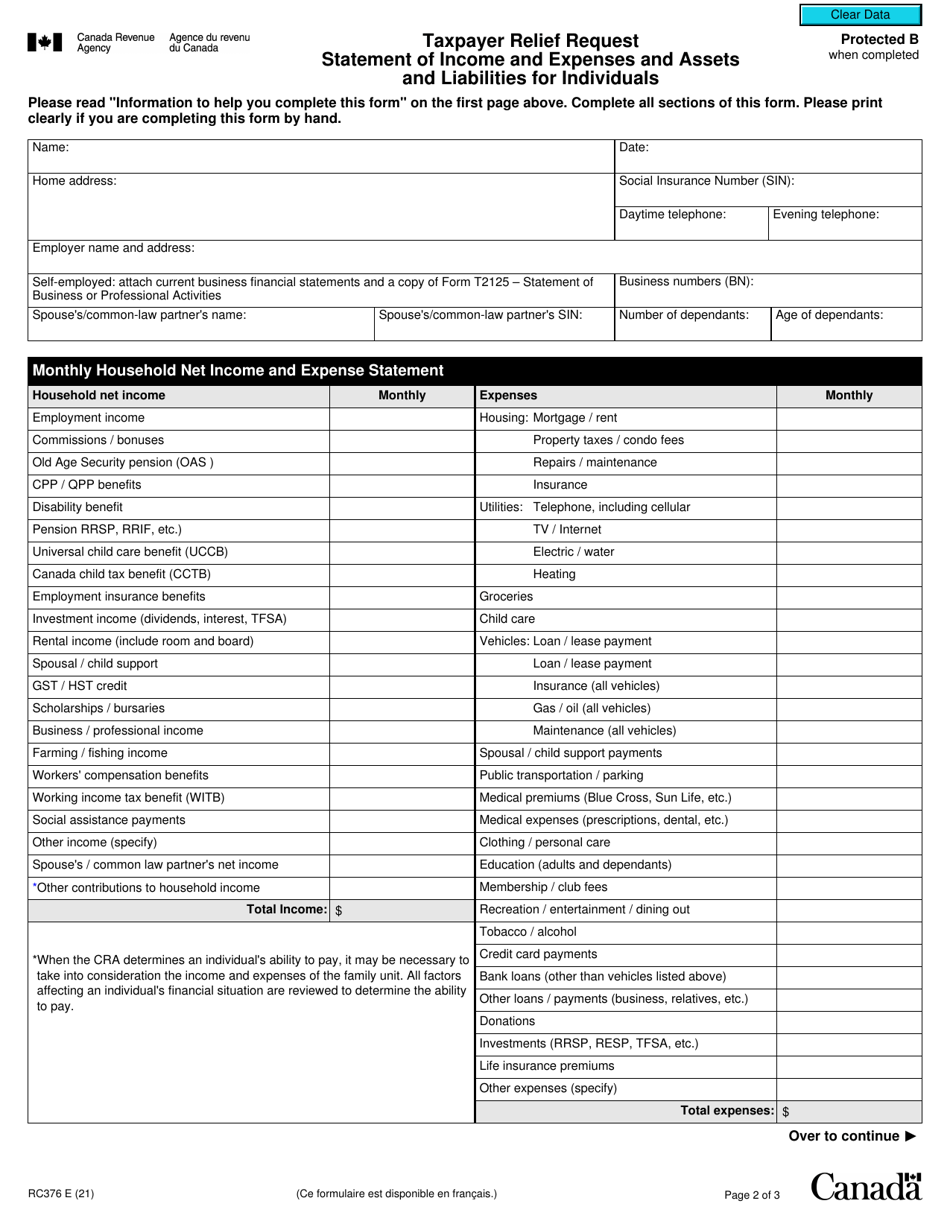

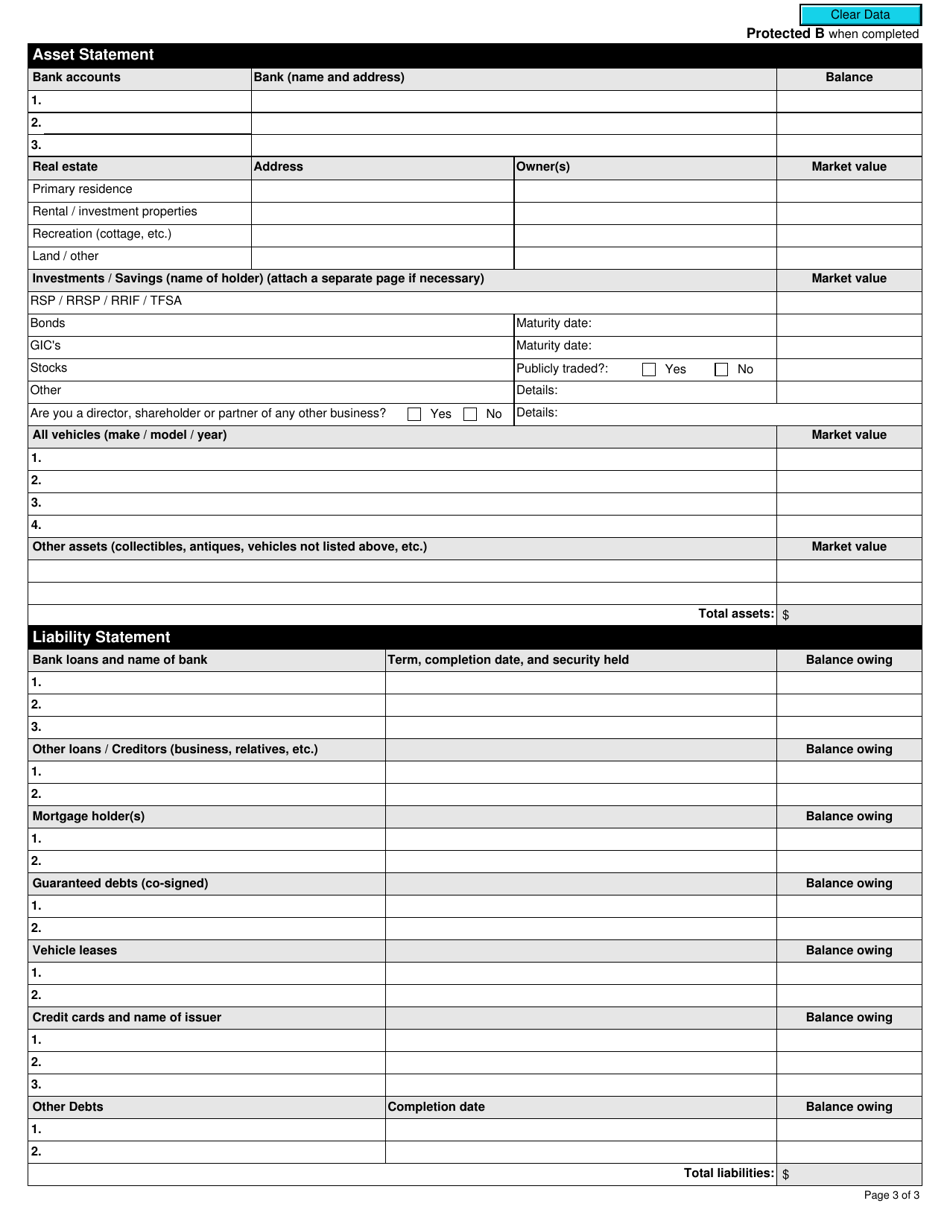

Q: What information is required on Form RC376?

A: Form RC376 requires individuals to provide detailed information about their income, expenses, assets, and liabilities.

Q: Is there a deadline for submitting Form RC376?

A: There is no specific deadline for submitting Form RC376, but it is recommended to submit the form as soon as possible.

Q: What happens after I submit Form RC376?

A: After submitting Form RC376, the Canada Revenue Agency will review your request for taxpayer relief and notify you of their decision.

Q: Can I appeal a decision made on Form RC376?

A: Yes, if you disagree with the Canada Revenue Agency's decision on your taxpayer relief request, you can file an appeal.

Q: Are there any fees associated with Form RC376?

A: There are no fees associated with submitting Form RC376, but you may still be responsible for any outstanding taxes, penalties, or interest owed.