Form RC376 Taxpayer Relief Request - Statement of Income and Expenses and Assets and Liabilities for Individuals - Canada

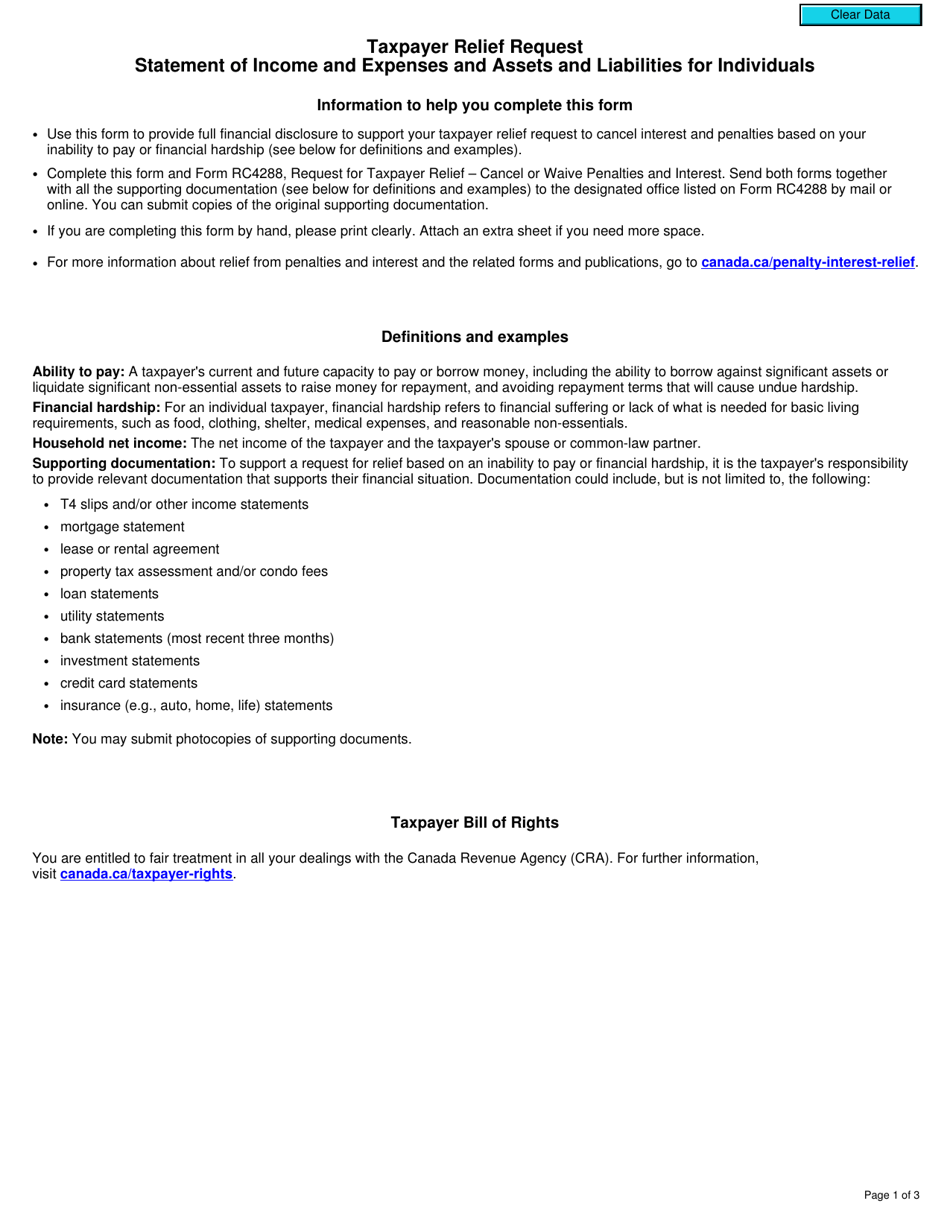

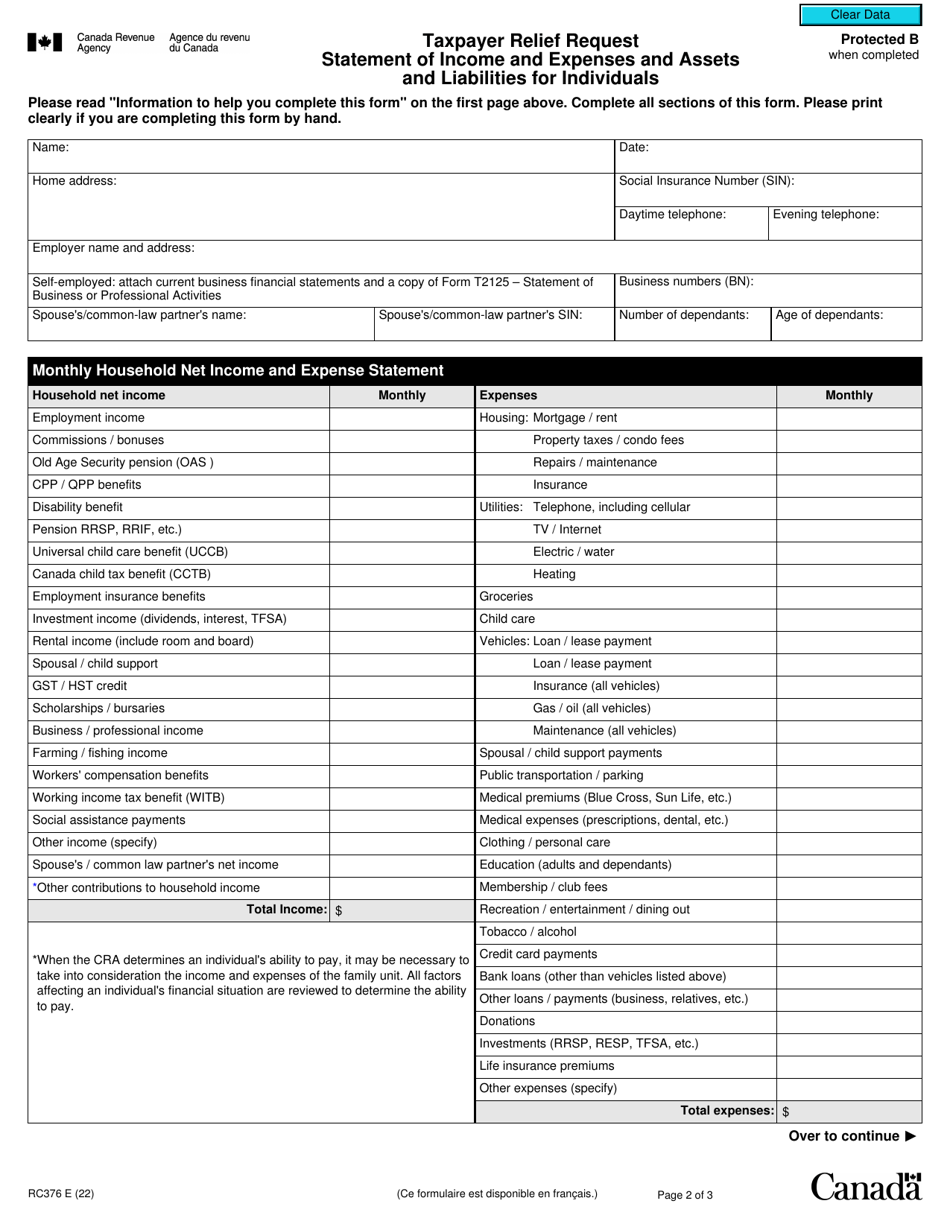

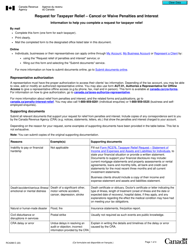

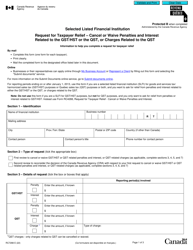

Form RC376 Taxpayer Relief Request - Statement of Income and Expenses and Assets and Liabilities for Individuals in Canada is used to request relief from penalties or interest charges imposed by the Canada Revenue Agency (CRA). The form allows individuals to provide detailed information about their income, expenses, assets, and liabilities to support their request for relief.

The Form RC376 Taxpayer Relief Request - Statement of Income and Expenses and Assets and Liabilities for Individuals in Canada is filed by individuals who are seeking relief from certain tax penalties or interest charges.

Form RC376 Taxpayer Relief Request - Statement of Income and Expenses and Assets and Liabilities for Individuals - Canada - Frequently Asked Questions (FAQ)

Q: What is Form RC376?

A: Form RC376 is the Taxpayer Relief Request - Statement of Income and Expenses and Assets and Liabilities for Individuals in Canada.

Q: Why would I need to fill out Form RC376?

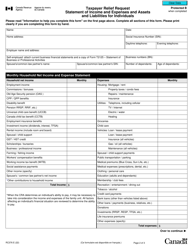

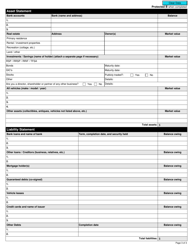

A: You would need to fill out Form RC376 if you are requesting tax relief from the Canada Revenue Agency (CRA) and need to provide details about your income, expenses, assets, and liabilities.

Q: What is the purpose of Form RC376?

A: The purpose of Form RC376 is to provide the CRA with a clear picture of your financial situation in order to assess your eligibility for tax relief.

Q: Is Form RC376 only for individuals?

A: Yes, Form RC376 is specifically for individuals seeking tax relief in Canada.

Q: What information do I need to include in Form RC376?

A: You will need to include details about your income, expenses, assets, and liabilities for the tax period you are requesting relief for.

Q: Are there any specific guidelines or instructions for filling out Form RC376?

A: Yes, the CRA provides detailed instructions on how to complete Form RC376. It's important to follow these instructions carefully to ensure accurate and complete information.

Q: Is there a deadline for submitting Form RC376?

A: There is no specific deadline for submitting Form RC376, but it is recommended to submit it as soon as possible to expedite the assessment of your tax relief request.

Q: Can I submit Form RC376 electronically?

A: No, currently the CRA only accepts Form RC376 by mail or fax.

Q: What happens after I submit Form RC376?

A: Once you submit Form RC376, the CRA will review your request and assess your eligibility for tax relief based on the information provided. They may contact you for additional information or clarification if needed.