This version of the form is not currently in use and is provided for reference only. Download this version of

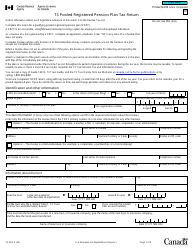

Form RC368

for the current year.

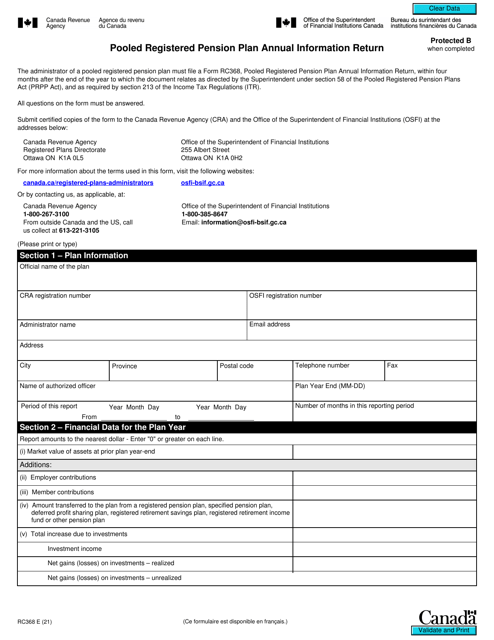

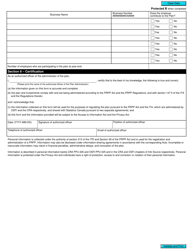

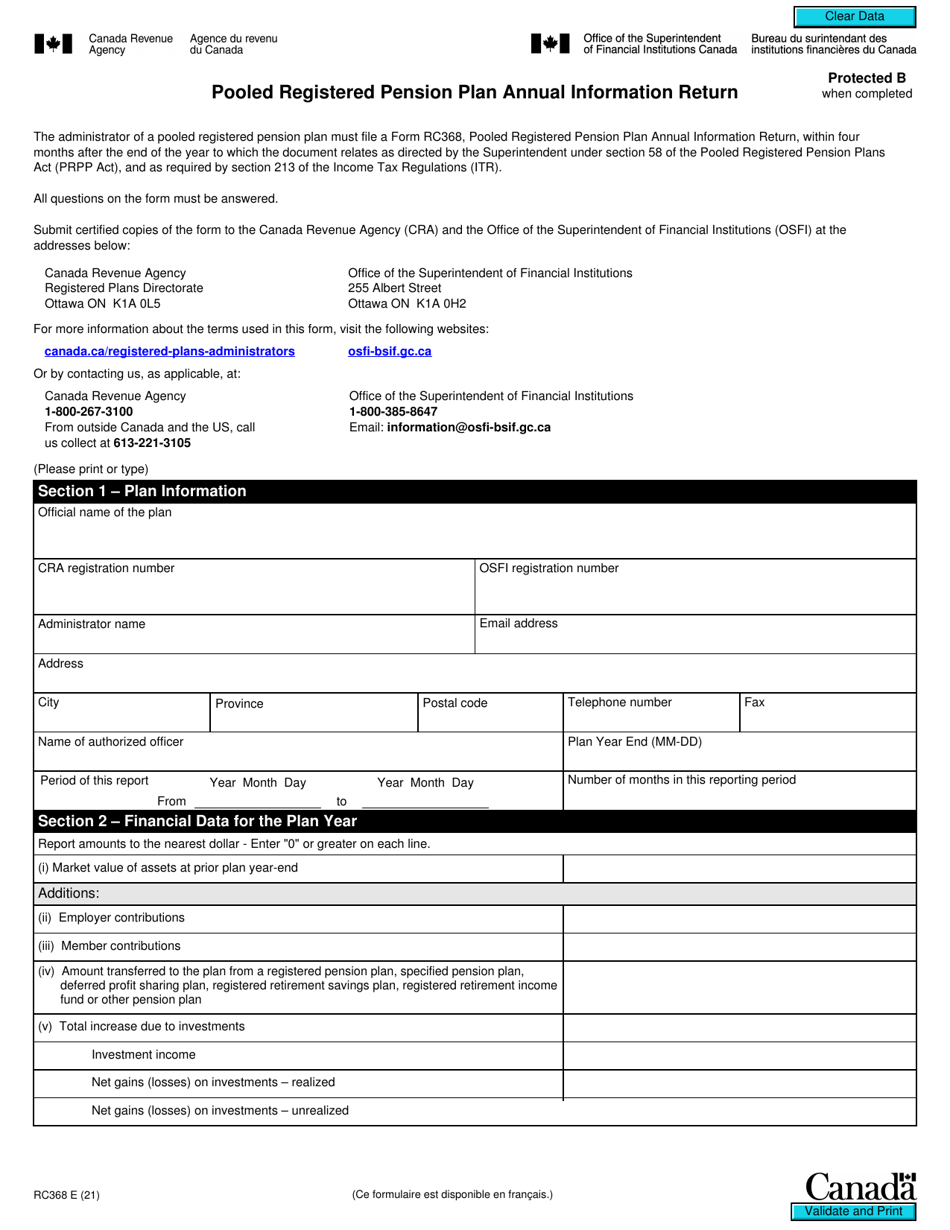

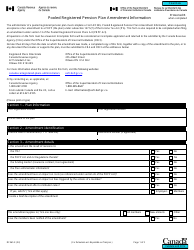

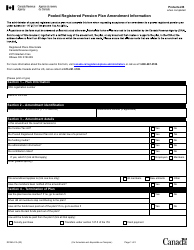

Form RC368 Pooled Registered Pension Plan Annual Information Return - Canada

Form RC368 Pooled Registered Pension Plan Annual Information Return is used in Canada for reporting information on a Pooled Registered Pension Plan's operations and activities during the year. It provides important data to the Canada Revenue Agency for tax and regulatory purposes.

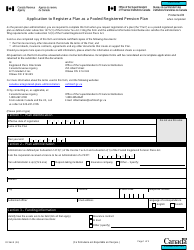

The administrator of the Pooled Registered Pension Plan (PRPP) is responsible for filing the Form RC368 Pooled Registered Pension Plan Annual Information Return in Canada.

FAQ

Q: What is Form RC368?

A: Form RC368 is the Pooled Registered Pension Plan Annual Information Return.

Q: Who needs to file Form RC368?

A: Plan administrators of Pooled Registered Pension Plans (PRPPs) in Canada need to file Form RC368.

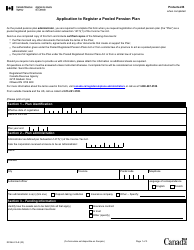

Q: What is the purpose of Form RC368?

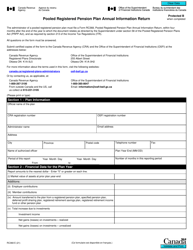

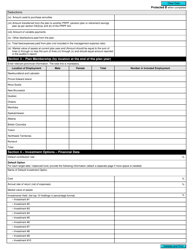

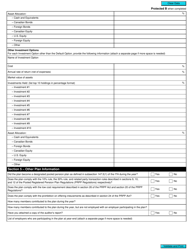

A: The purpose of Form RC368 is to provide information about the PRPPs, including contributions, investments, and beneficiaries.

Q: When is Form RC368 due?

A: Form RC368 is due within 6 months after the end of the PRPP's fiscal year.