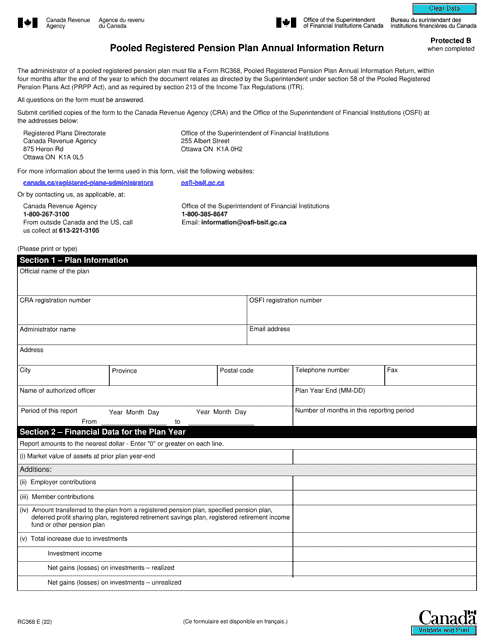

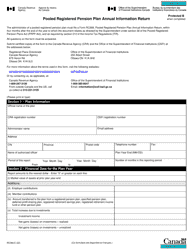

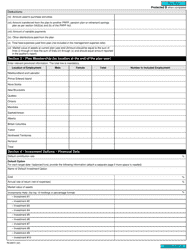

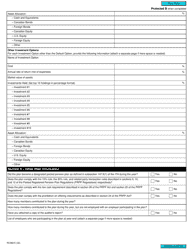

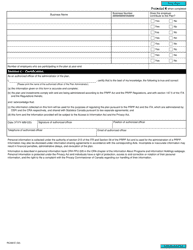

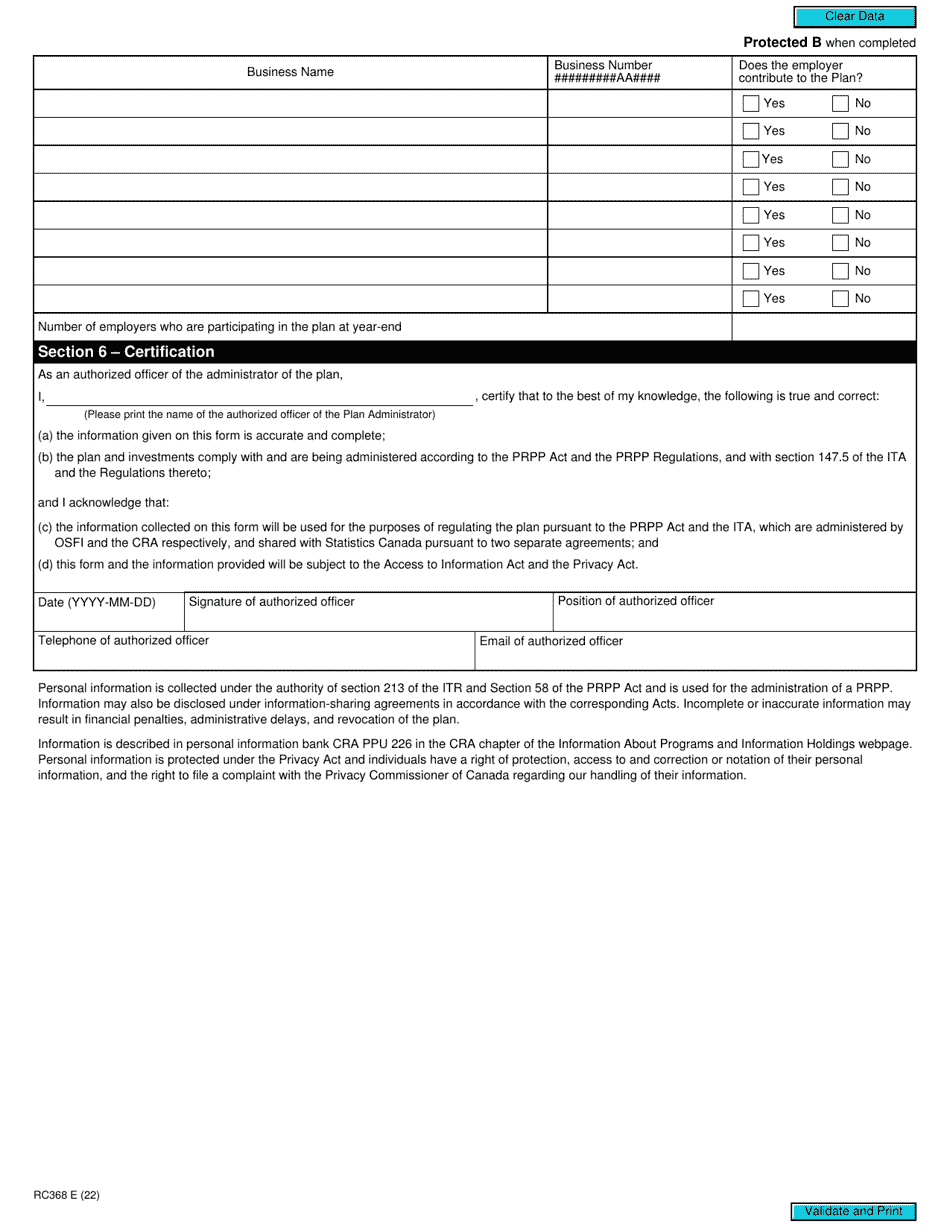

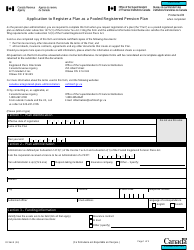

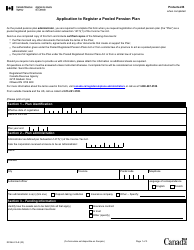

Form RC368 Pooled Registered Pension Plan Annual Information Return - Canada

Form RC368 Pooled Registered Pension Plan Annual Information Return is used by the administrators of Pooled Registered Pension Plans (PRPPs) in Canada to report information about the Plan to the Canada Revenue Agency (CRA).

The Pooled Registered Pension Plan (PRPP) Administrator is responsible for filing the Form RC368 Pooled Registered Pension Plan Annual Information Return in Canada.

Form RC368 Pooled Registered Pension Plan Annual Information Return - Canada - Frequently Asked Questions (FAQ)

Q: What is Form RC368?

A: Form RC368 is the Pooled Registered Pension Plan (PRPP) Annual Information Return in Canada.

Q: What is a Pooled Registered Pension Plan (PRPP)?

A: A Pooled Registered Pension Plan (PRPP) is a retirement savings plan offered by employers to their employees and the self-employed in Canada.

Q: Who is required to file Form RC368?

A: Employers who offer a Pooled Registered Pension Plan (PRPP) must file Form RC368 annually.

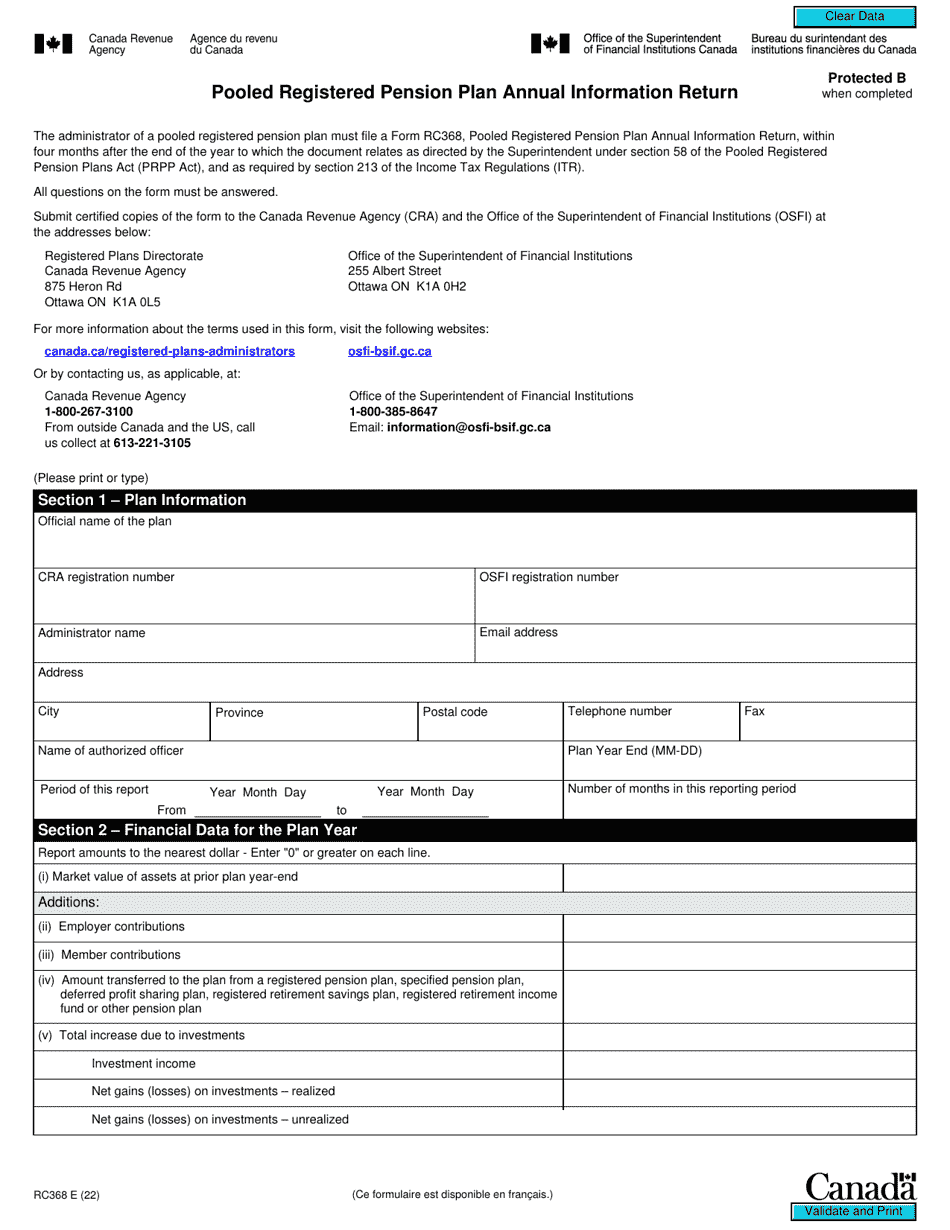

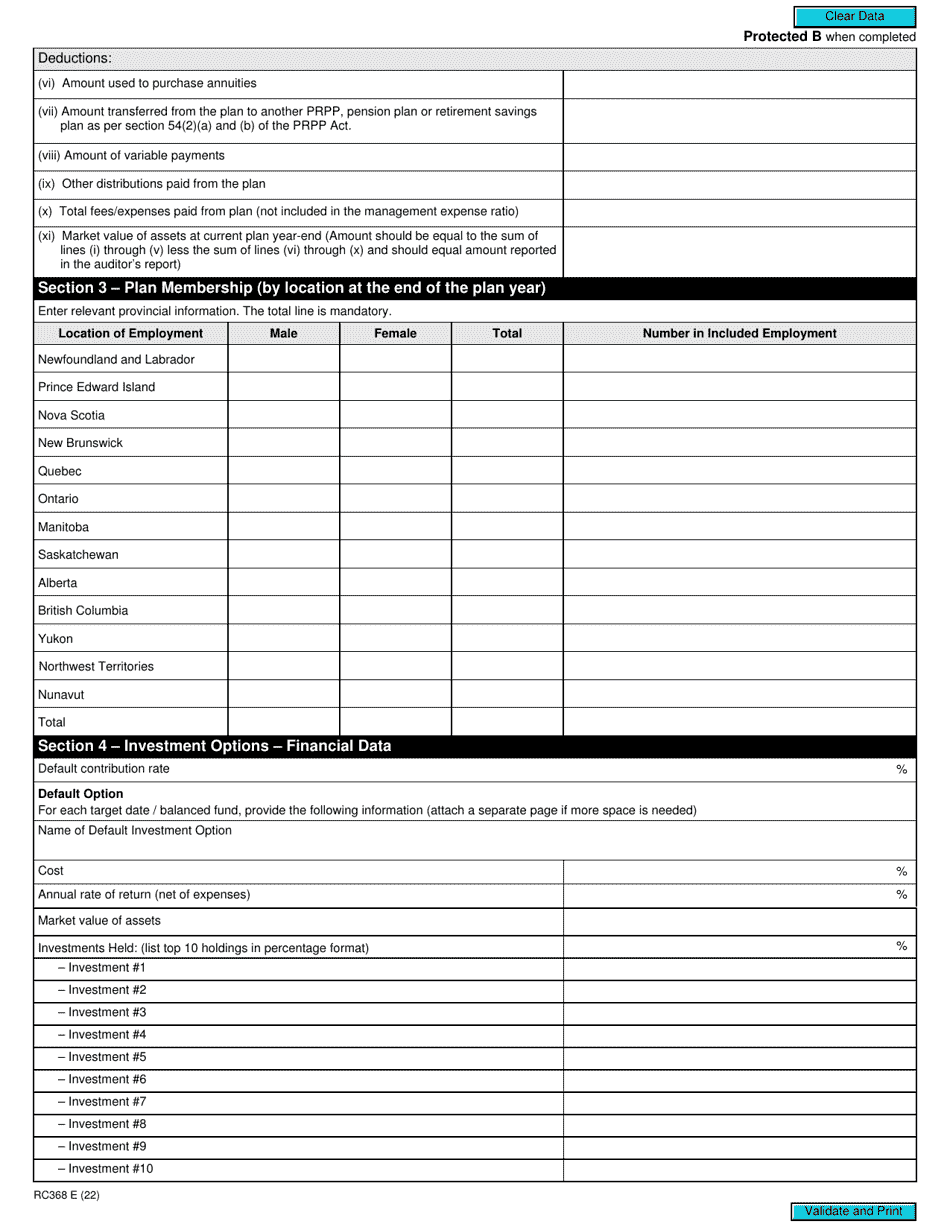

Q: What information is required on Form RC368?

A: Form RC368 requires information about the PRPP contributions made by the employer and the member employees.

Q: When is the deadline for filing Form RC368?

A: The deadline for filing Form RC368 is 90 days after the end of the calendar year.