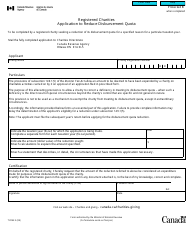

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC364

for the current year.

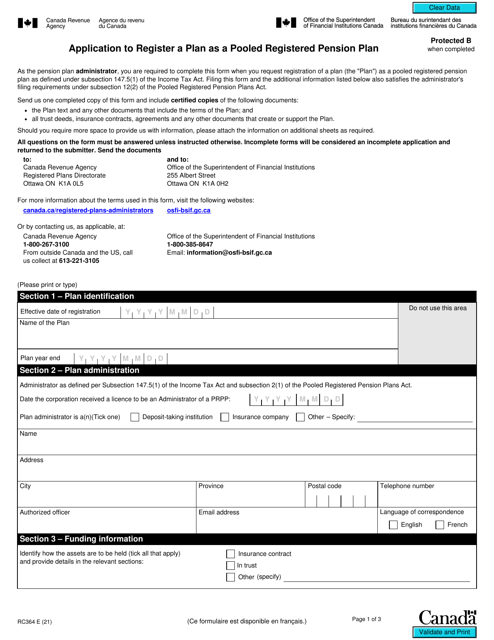

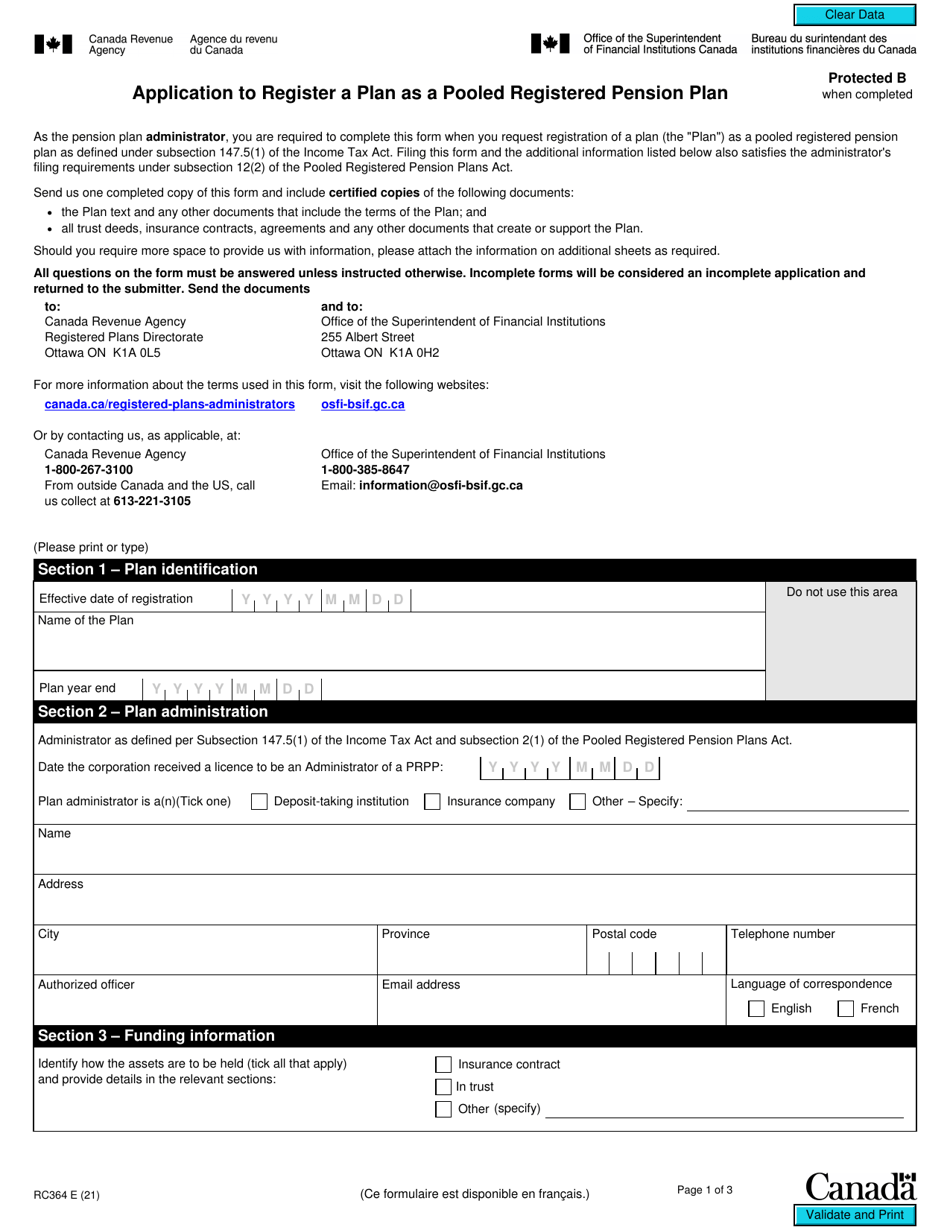

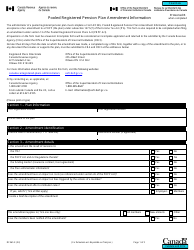

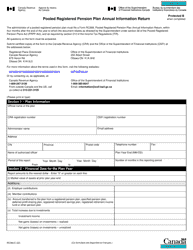

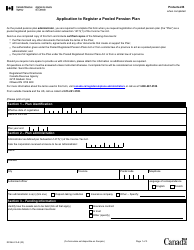

Form RC364 Application to Register a Plan as a Pooled Registered Pension Plan - Canada

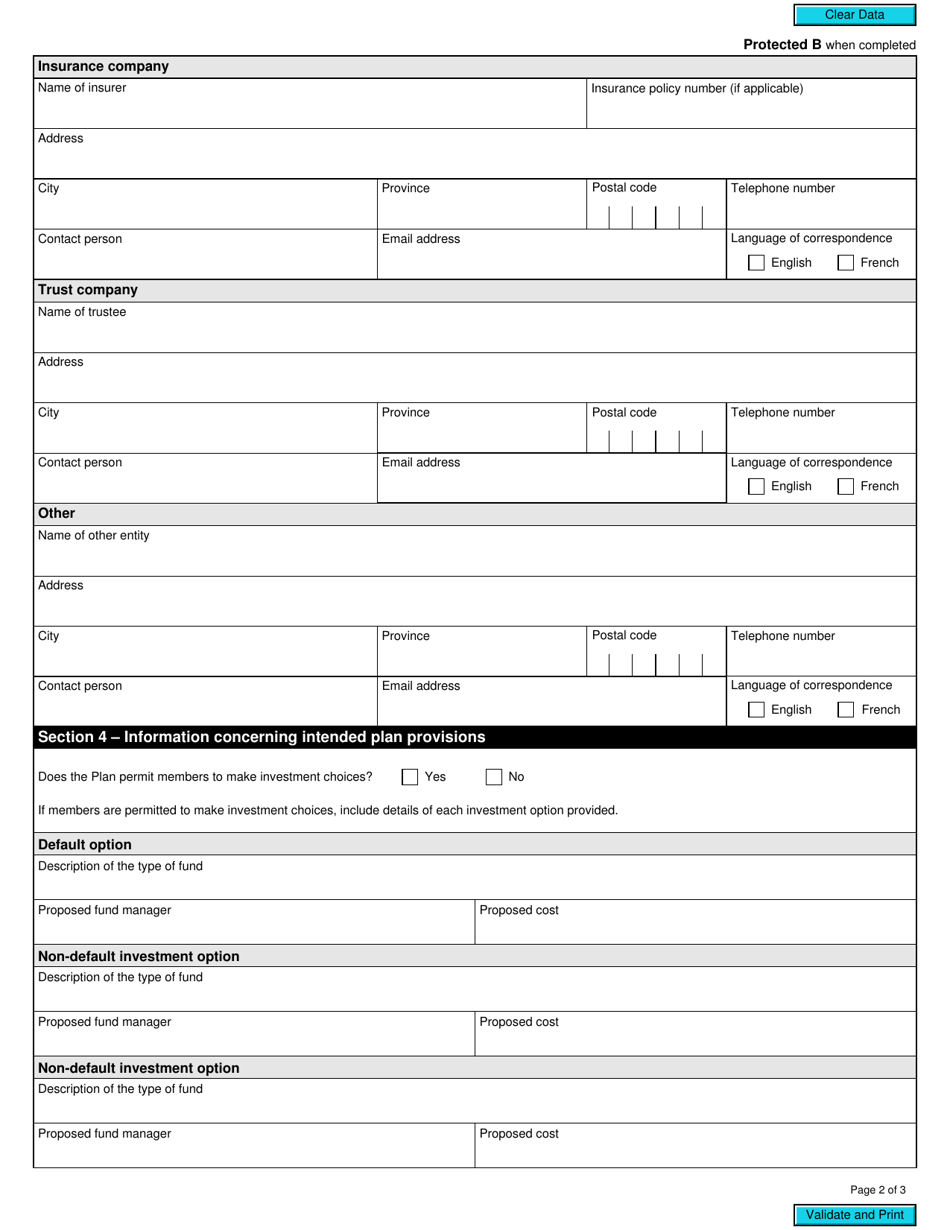

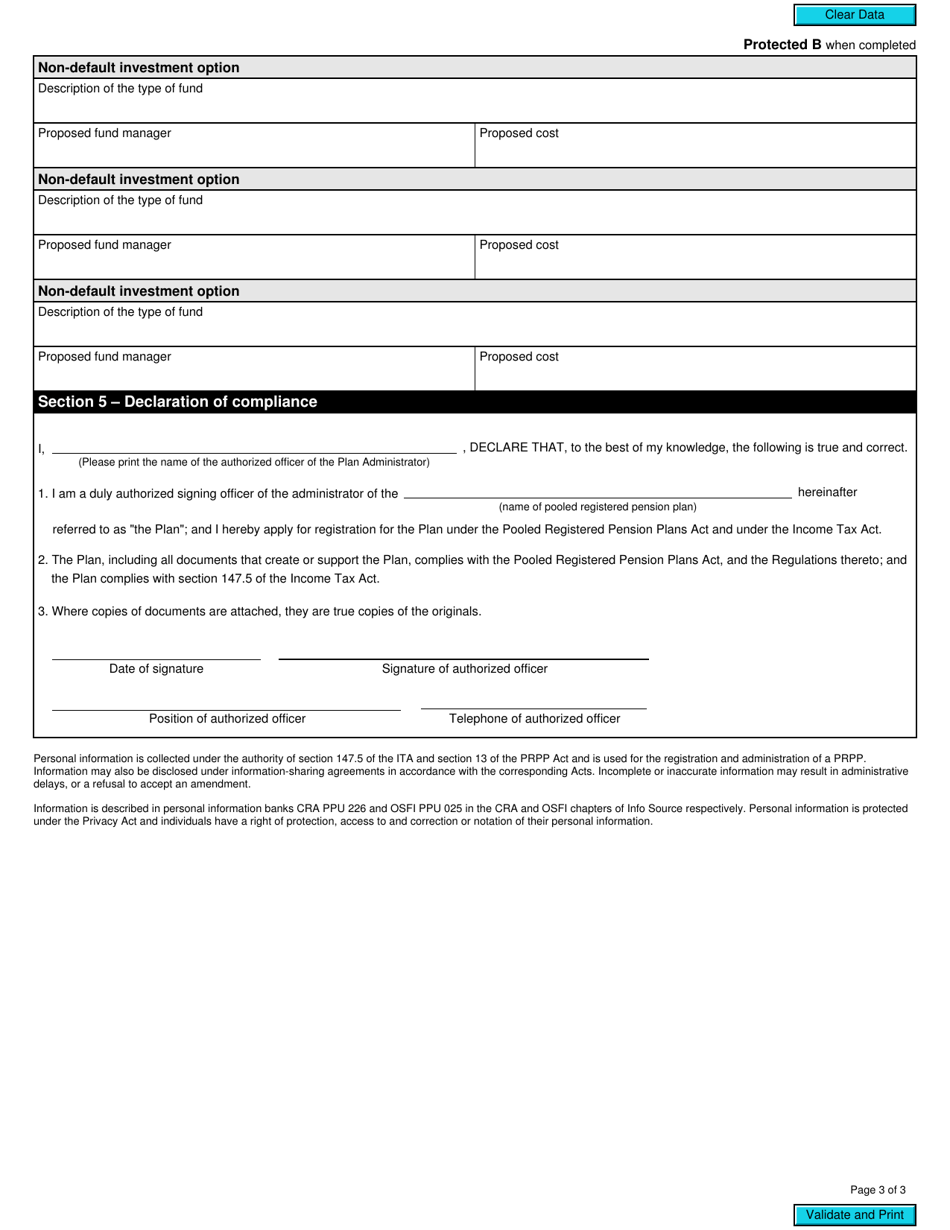

Form RC364 Application to Register a Plan as a Pooled Registered Pension Plan - Canada is used to apply for registration of a plan as a Pooled Registered Pension Plan (PRPP) in Canada. PRPPs are voluntary savings plans that help individuals save for retirement.

The employer or plan administrator files the Form RC364 Application to Register a Plan as a Pooled Registered Pension Plan in Canada.

FAQ

Q: What is Form RC364?

A: Form RC364 is the application to register a plan as a Pooled Registered Pension Plan (PRPP) in Canada.

Q: What is a Pooled Registered Pension Plan (PRPP)?

A: A Pooled Registered Pension Plan (PRPP) is a retirement savings plan available to individuals and small businesses in Canada.

Q: Who can apply for a Pooled Registered Pension Plan (PRPP)?

A: Any individual or small business in Canada can apply for a Pooled Registered Pension Plan (PRPP).

Q: What is the purpose of Form RC364?

A: Form RC364 is used to apply for the registration of a plan as a Pooled Registered Pension Plan (PRPP) in Canada.

Q: Are there any fees to submit Form RC364?

A: Yes, there are fees associated with submitting Form RC364. You can refer to the CRA's fee schedule for more information.

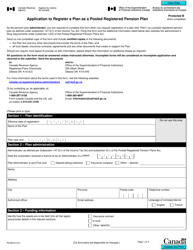

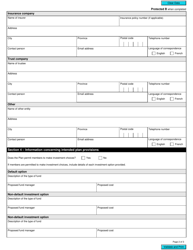

Q: What documents do I need to submit along with Form RC364?

A: You will need to submit various supporting documents along with Form RC364, such as a plan text, financial statements, and a statement of investment policies and procedures.

Q: Who do I contact if I have questions about Form RC364?

A: If you have questions about Form RC364, you can contact the Canada Revenue Agency (CRA) or seek assistance from a tax professional.

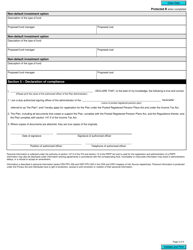

Q: Can I make changes to Form RC364 after submitting it?

A: Once you have submitted Form RC364, any changes or amendments will need to be made through a separate process. It is best to consult with the CRA for guidance on making changes.