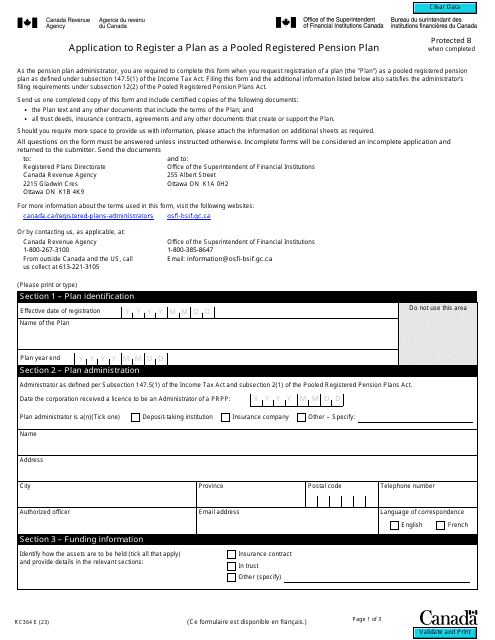

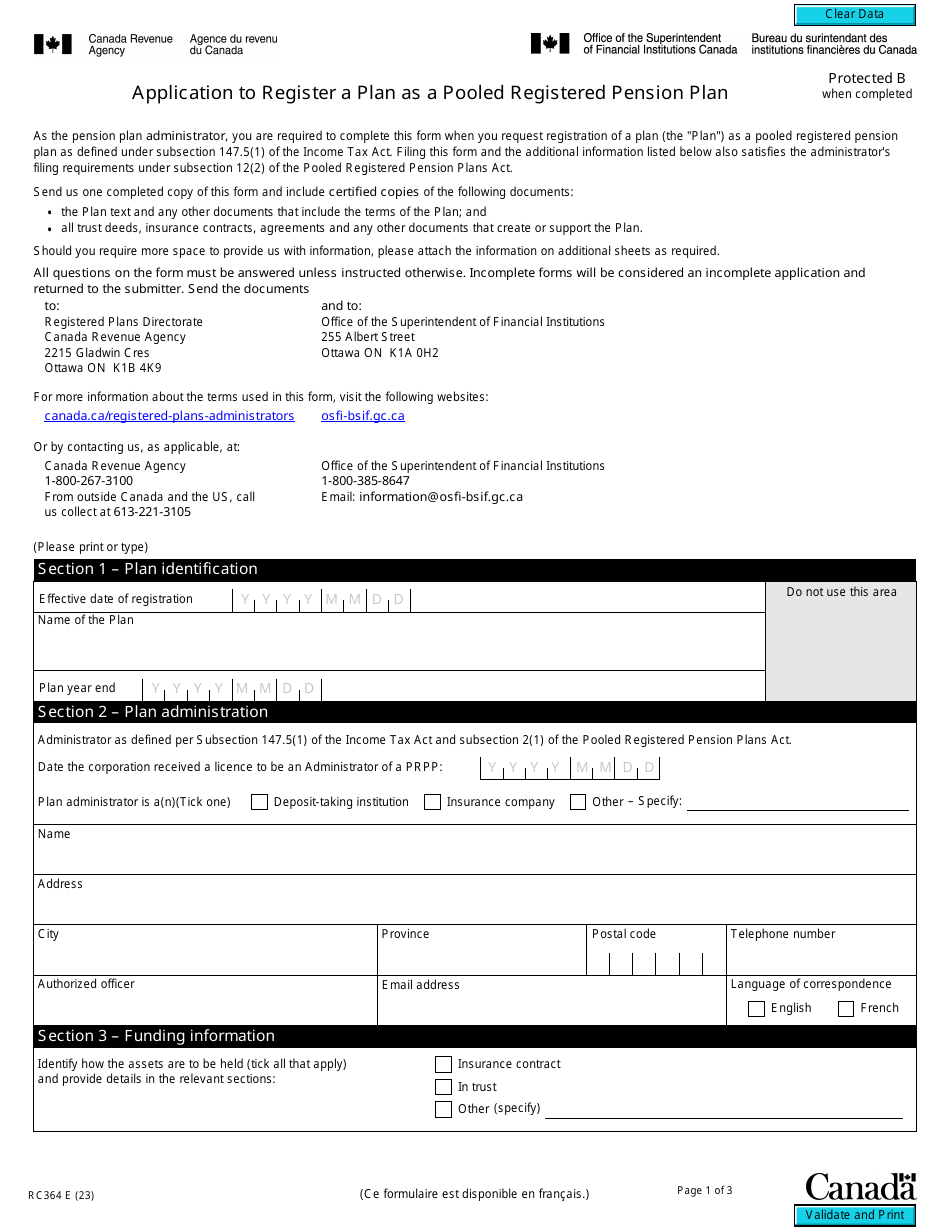

Form RC364 Application to Register a Plan as a Pooled Registered Pension Plan - Canada

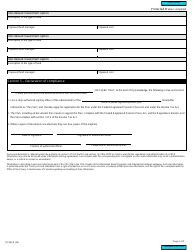

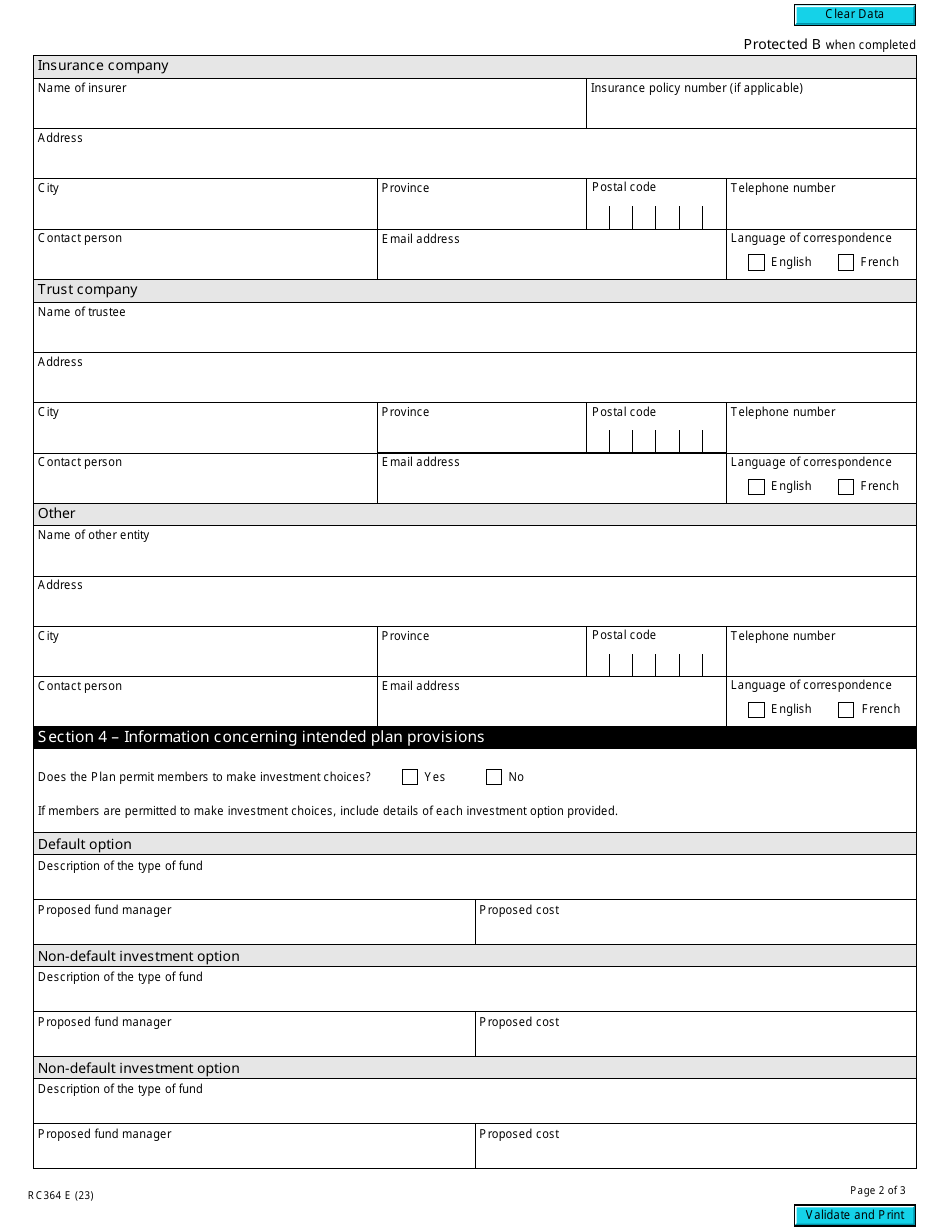

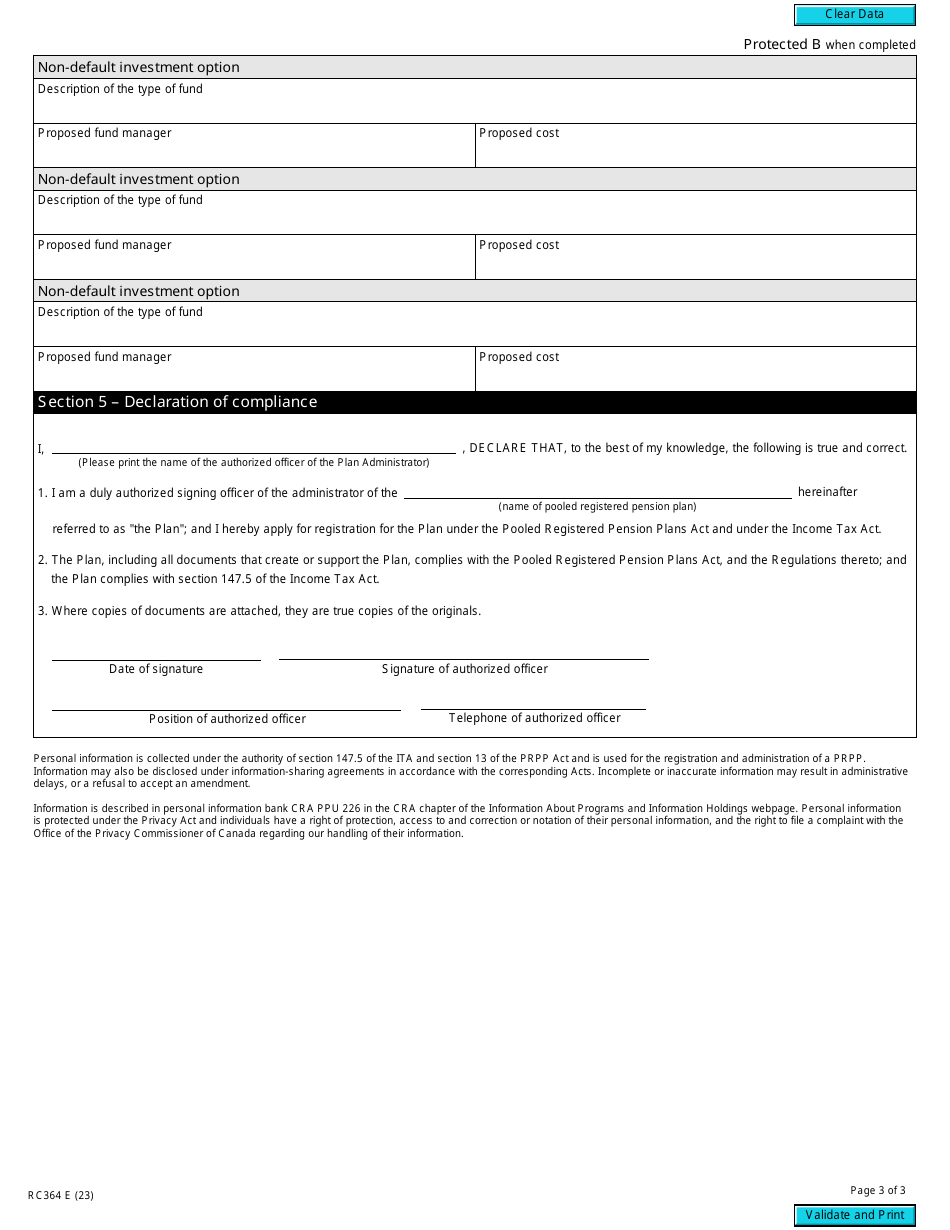

Form RC364 "Application to Register a Plan as a Pooled Registered Pension Plan" in Canada is used to apply for the registration of a Pooled Registered Pension Plan (PRPP). A PRPP is a type of retirement savings plan available to individuals, including self-employed individuals, who do not have access to a workplace pension plan. It allows individuals to contribute to a retirement savings account, which is managed by an administrator. The purpose of this form is to apply for the registration of a PRPP with the Canada Revenue Agency (CRA).

The employer or plan administrator files the Form RC364 Application to Register a Plan as a Pooled Registered Pension Plan in Canada.

Form RC364 Application to Register a Plan as a Pooled Registered Pension Plan - Canada - Frequently Asked Questions (FAQ)

Q: What is the RC364?

A: RC364 is an application form to register a plan as a Pooled Registered Pension Plan (PRPP) in Canada.

Q: What is a Pooled Registered Pension Plan (PRPP)?

A: A PRPP is a type of retirement savings plan available in Canada that allows individuals and employers to contribute to a common investment pool.

Q: Who can apply to register a plan as a PRPP?

A: Any entity, such as an employer or financial institution, can apply to register a plan as a PRPP.

Q: What are the benefits of a PRPP?

A: PRPPs provide a simple and cost-effective way for individuals to save for retirement, particularly for those who do not have access to a workplace pension plan.

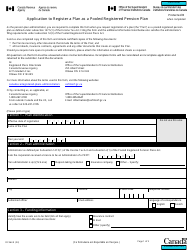

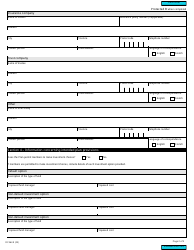

Q: How do I complete the RC364 form?

A: To complete the RC364 form, you will need to provide information about the plan, the plan administrator, and the plan members.