This version of the form is not currently in use and is provided for reference only. Download this version of

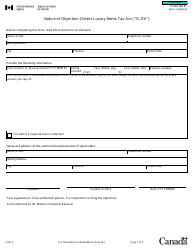

Form GST159

for the current year.

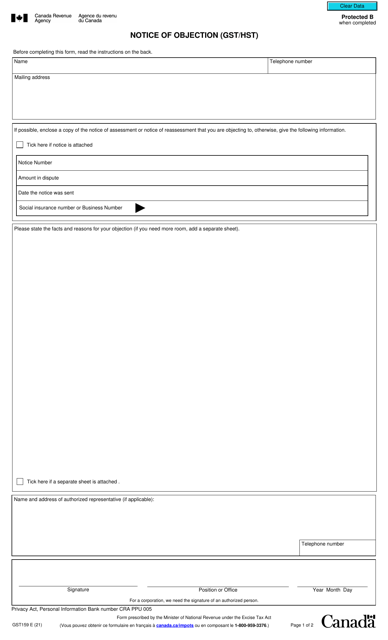

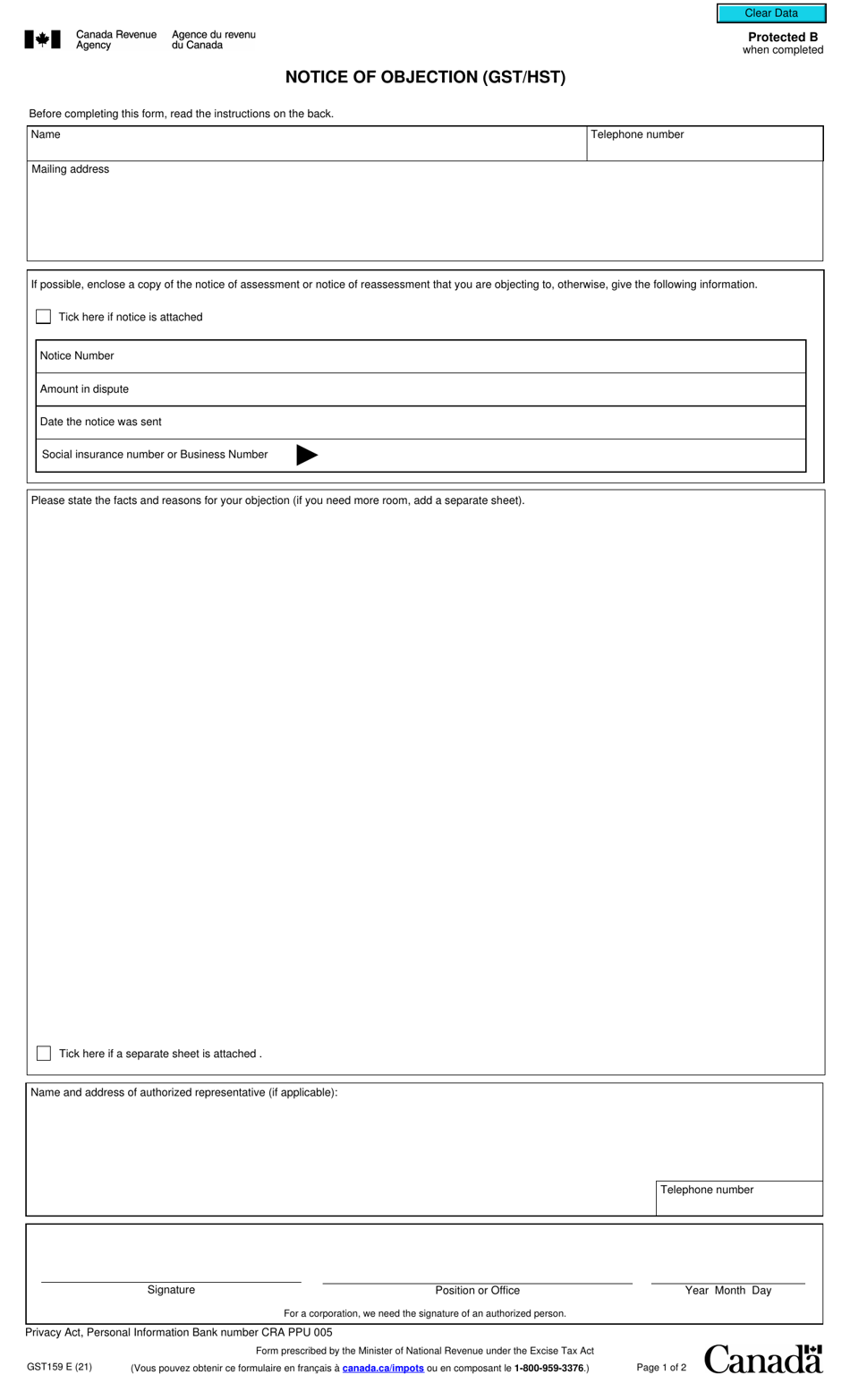

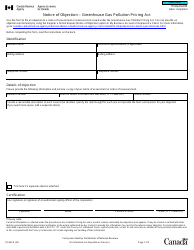

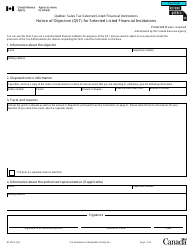

Form GST159 Notice of Objection (Gst / Hst) - Canada

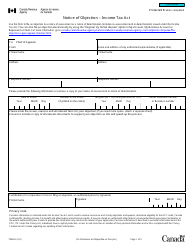

Form GST159 Notice of Objection (GST/HST) in Canada is used to formally object and dispute any errors, assessments, or decisions made by the Canada Revenue Agency (CRA) related to the Goods and Services Tax (GST) or Harmonized Sales Tax (HST).

The form GST159 Notice of Objection (GST/HST) in Canada is filed by individuals or businesses who want to dispute a reassessment or assessment made by the Canada Revenue Agency (CRA).

FAQ

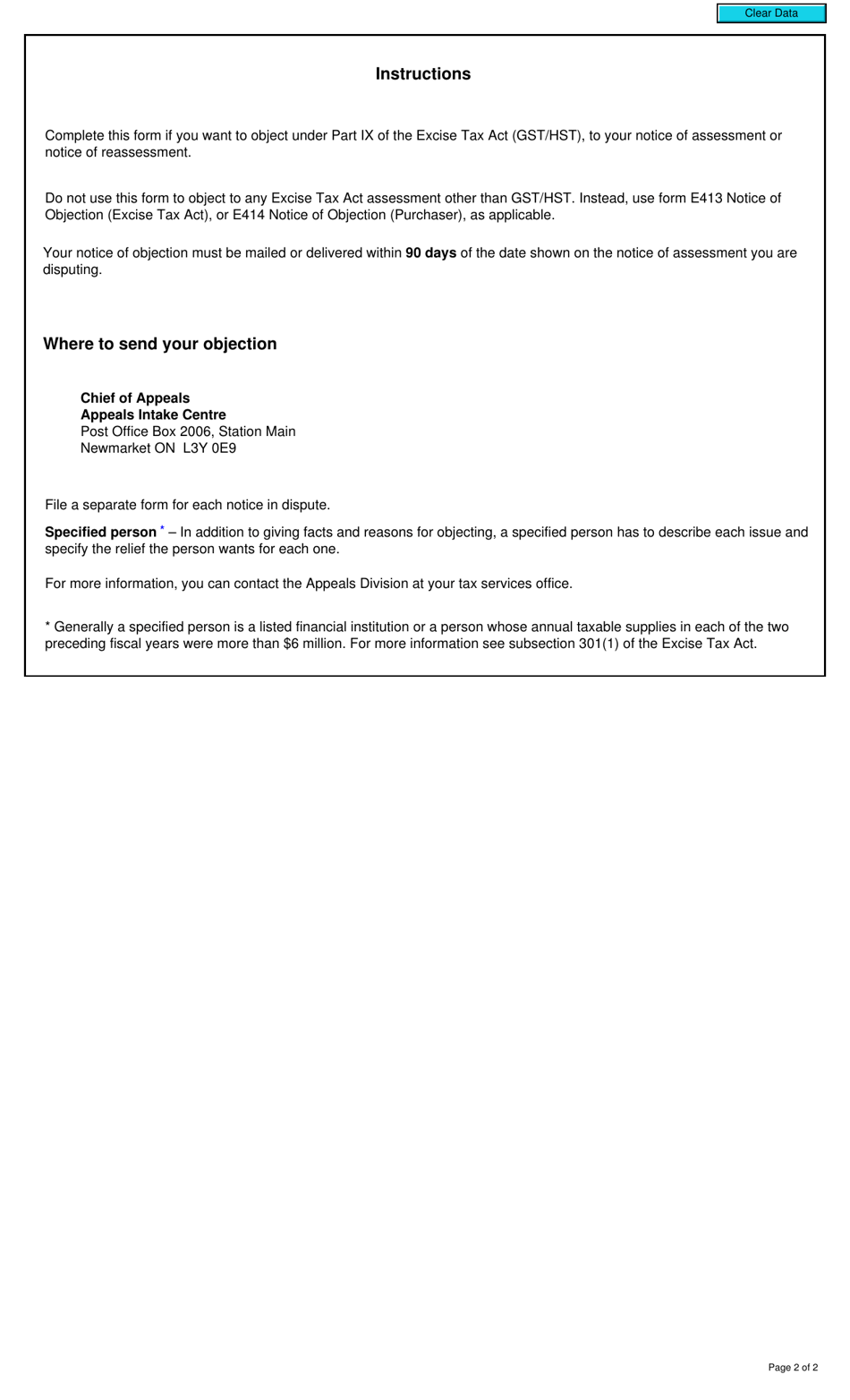

Q: What is Form GST159?

A: Form GST159 is the Notice of Objection for GST/HST in Canada.

Q: When should I use Form GST159?

A: You should use Form GST159 when you want to object to a GST/HST assessment by the Canada Revenue Agency (CRA).

Q: What information is required on Form GST159?

A: Form GST159 requires your personal details, the reasons for your objection, the amount being disputed, and supporting documents.

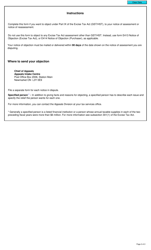

Q: Is there a deadline for filing Form GST159?

A: Yes, you must file Form GST159 within 90 days from the date on the notice of assessment you want to object.

Q: What happens after I submit Form GST159?

A: After submitting Form GST159, the CRA will review your objection and make a decision. You will be notified of their decision in writing.

Q: Can I appeal a decision made by the CRA on my GST/HST objection?

A: Yes, if you disagree with the CRA's decision, you can appeal to the Tax Court of Canada within 90 days from the date of the decision.

Q: Are there any fees involved in filing Form GST159?

A: No, there are no fees to file Form GST159 or to appeal to the Tax Court of Canada.