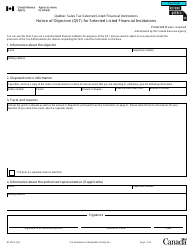

Form GST159 Notice of Objection (Gst / Hst) - Canada

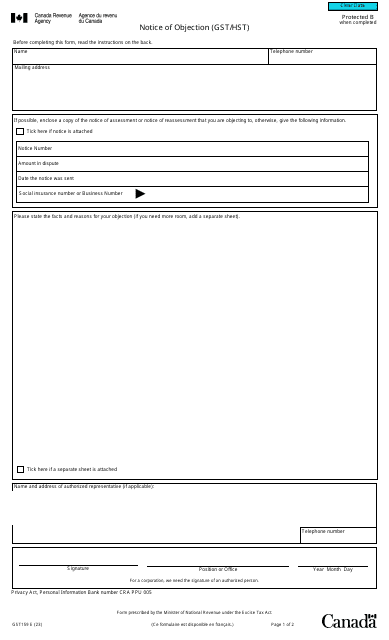

Form GST159, Notice of Objection (GST/HST), is used in Canada to notify the Canada Revenue Agency (CRA) about a taxpayer's objection to a GST/HST assessment or determination. It is the form that individuals or businesses can use to formally dispute a decision made by the CRA regarding GST/HST taxes.

The Form GST159 Notice of Objection is filed by a taxpayer who wishes to dispute a decision made by the Canada Revenue Agency (CRA) regarding their Goods and Services Tax (GST) or Harmonized Sales Tax (HST).

Form GST159 Notice of Objection (Gst/Hst) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form GST159?

A: Form GST159 is a Notice of Objection (GST/HST) form in Canada.

Q: When is Form GST159 used?

A: Form GST159 is used when a taxpayer wishes to object to a GST/HST assessment or determination made by the Canada Revenue Agency (CRA).

Q: How do I fill out Form GST159?

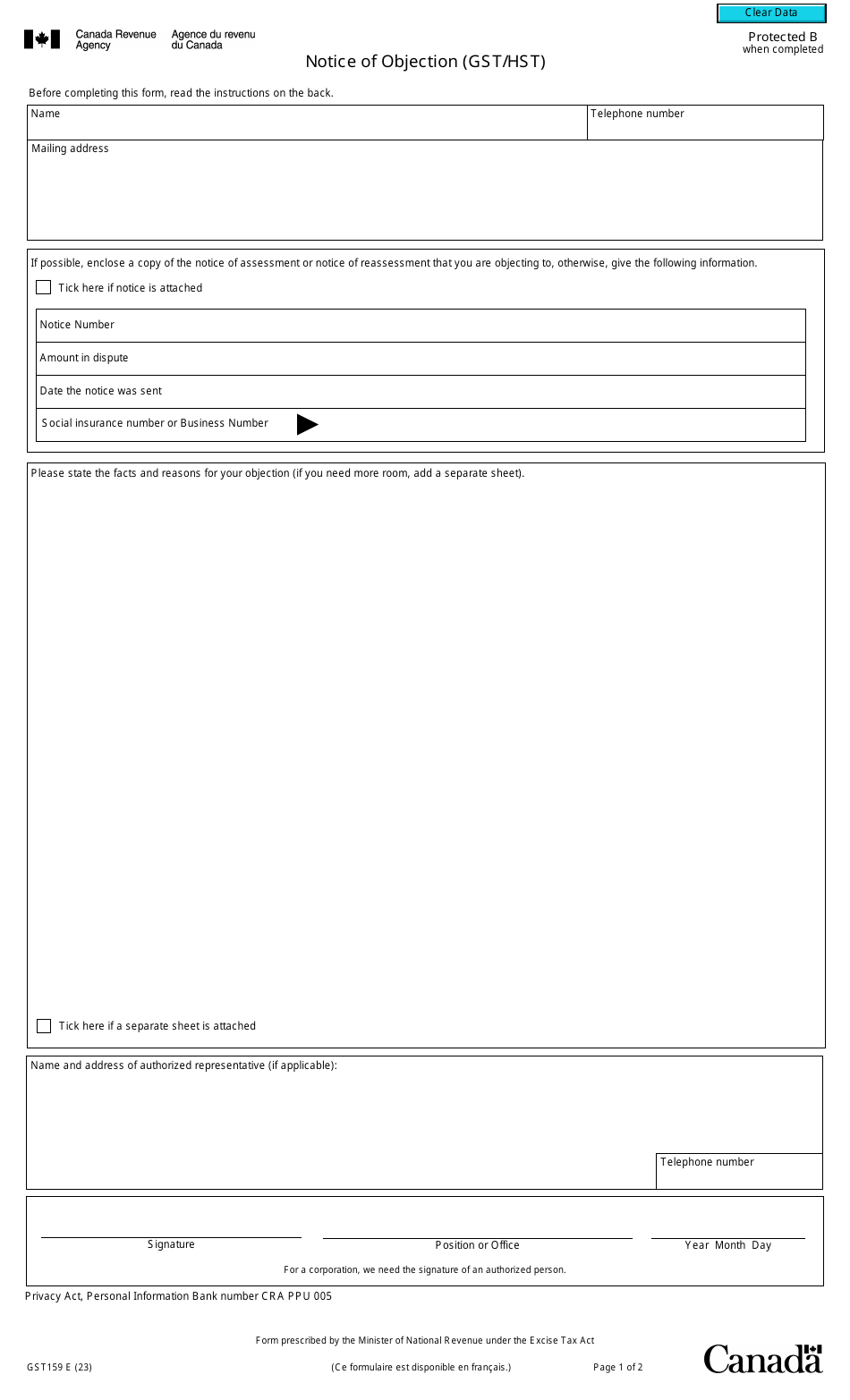

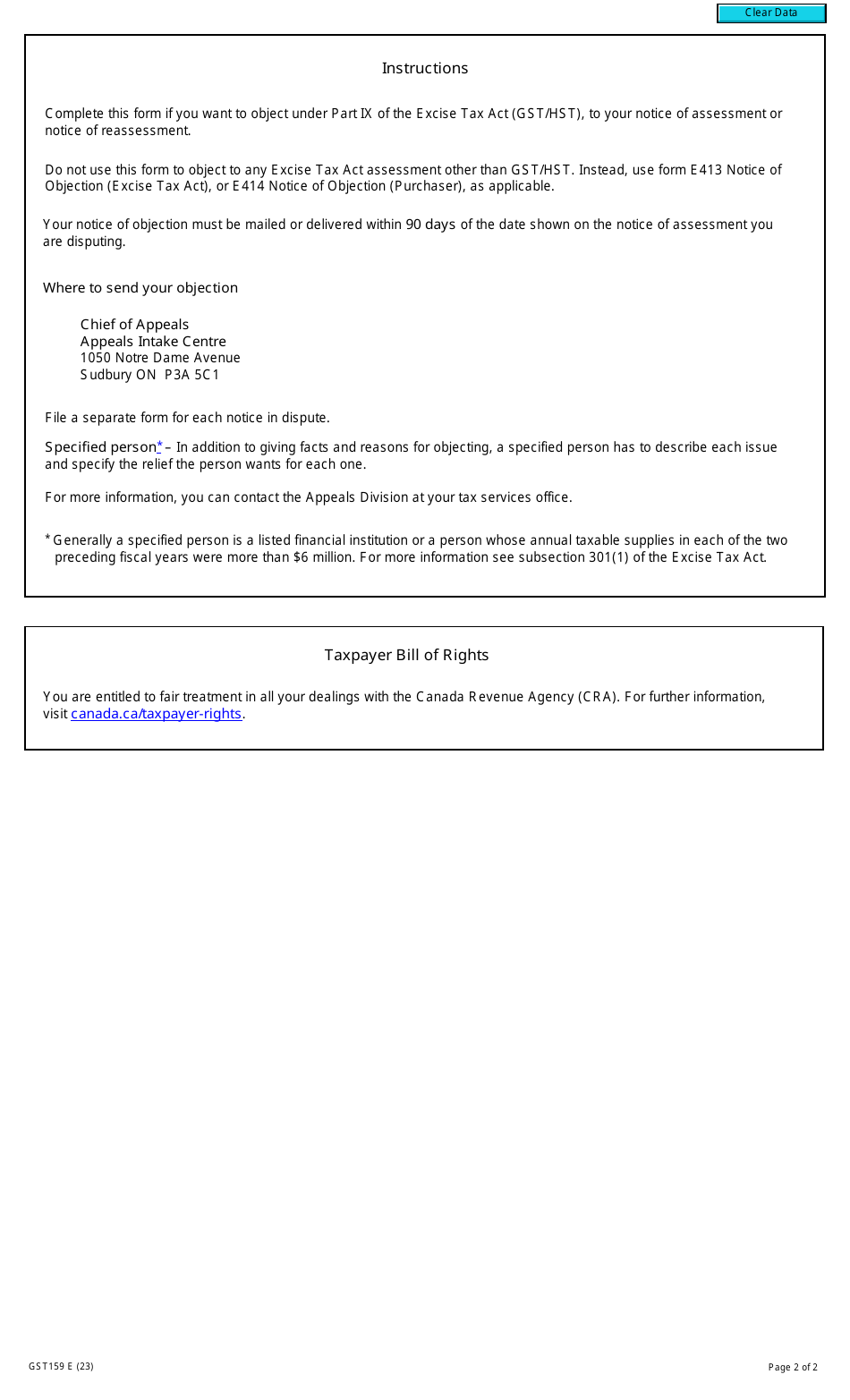

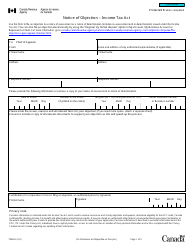

A: To fill out Form GST159, you need to provide your identification and contact information, details of the assessment or determination being objected to, reasons for the objection, and supporting documents.

Q: What is the deadline for submitting Form GST159?

A: The deadline for submitting Form GST159 is within 90 days from the date of the assessment or determination.

Q: What happens after I submit Form GST159?

A: After submitting Form GST159, the CRA will review your objection and notify you of their decision in writing.

Q: Can I appeal the CRA's decision on my GST/HST objection?

A: Yes, if you disagree with the CRA's decision on your GST/HST objection, you have the option to appeal to the Tax Court of Canada within 90 days of receiving the CRA's decision.