This version of the form is not currently in use and is provided for reference only. Download this version of

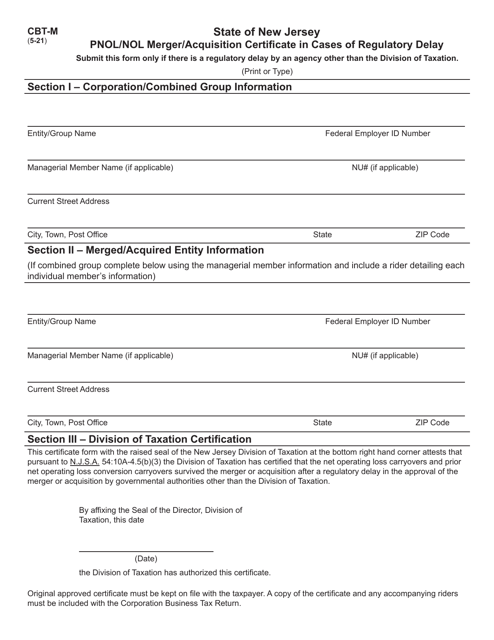

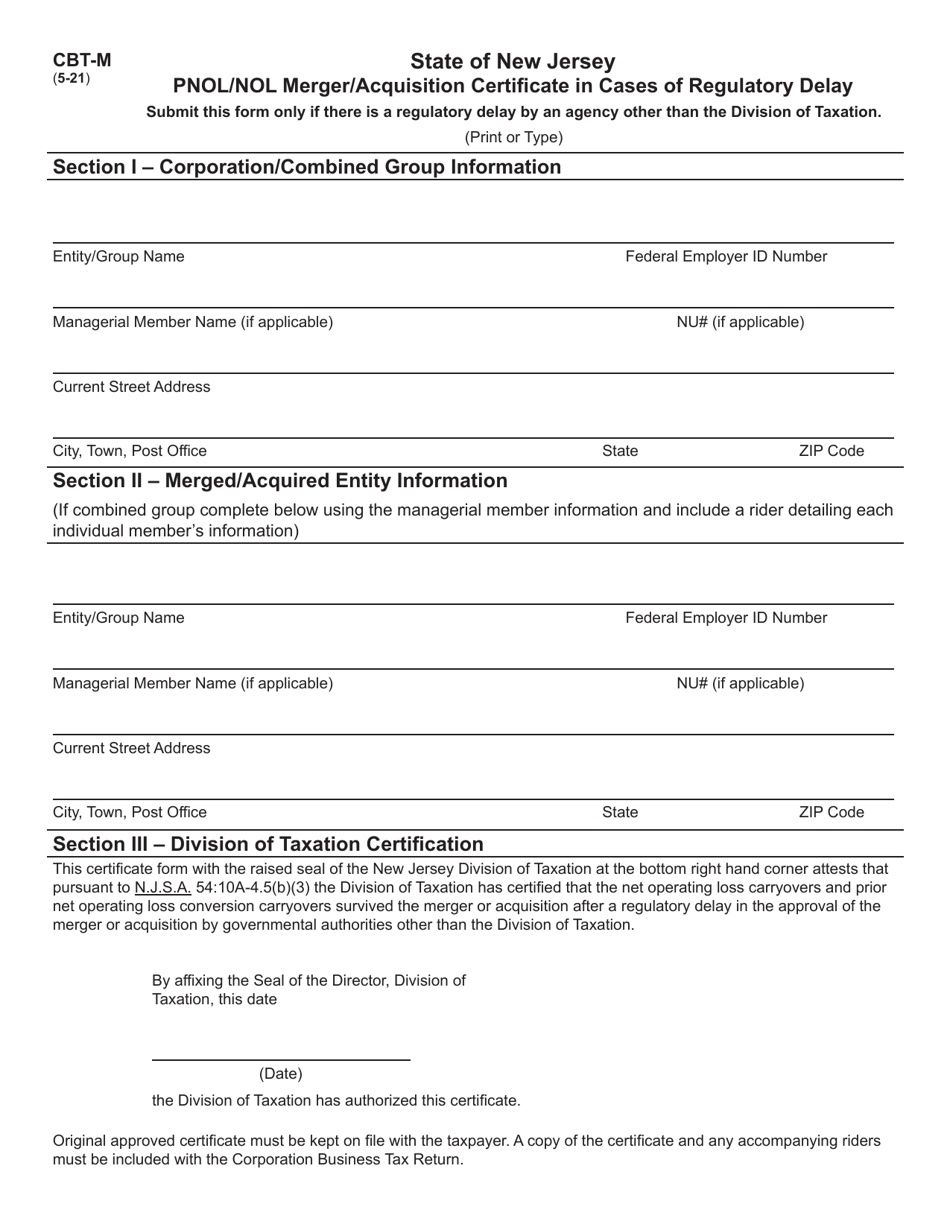

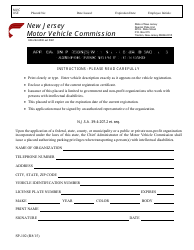

Form CBT-M

for the current year.

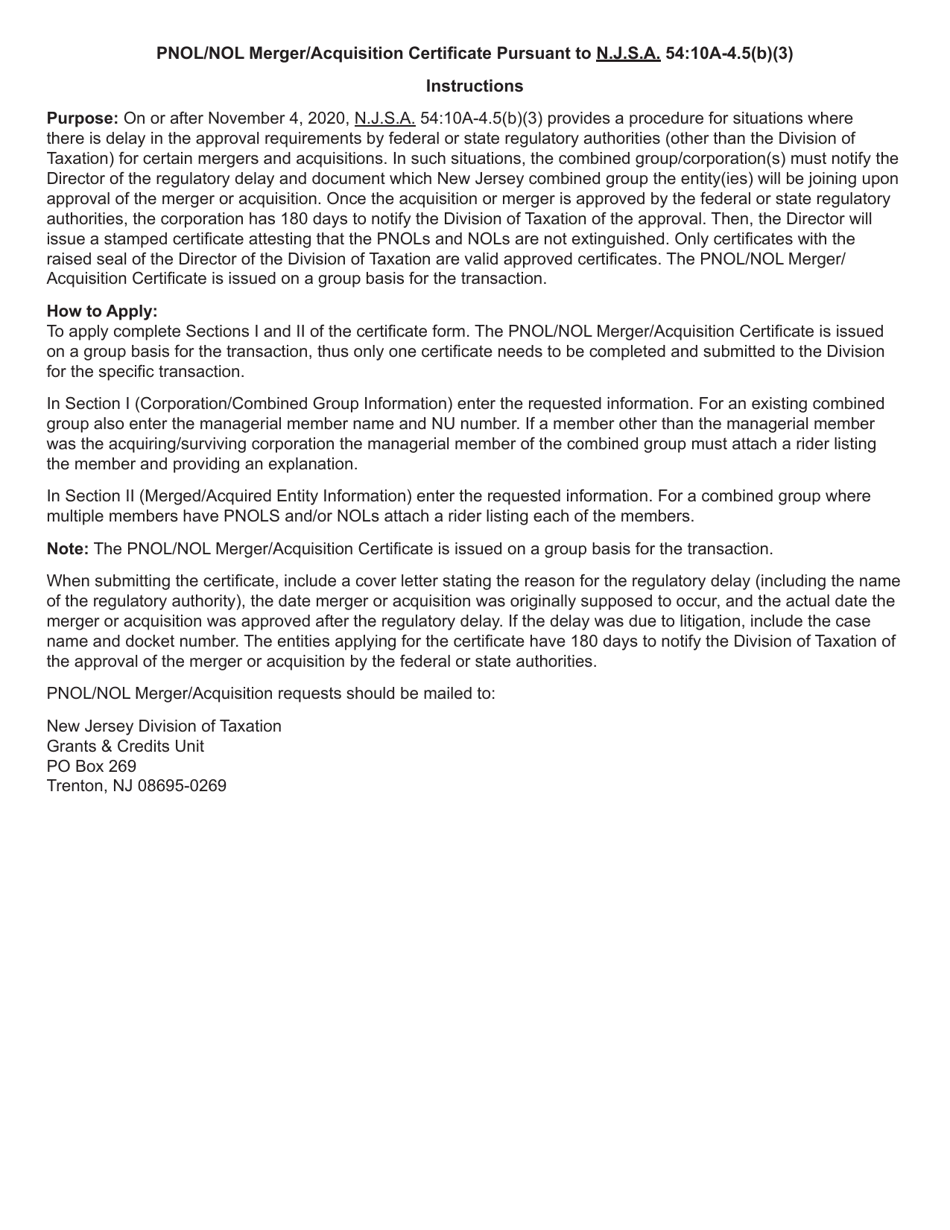

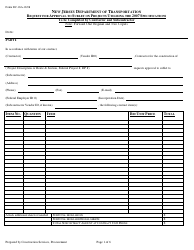

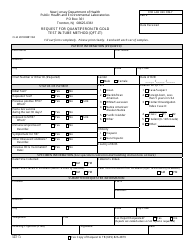

Form CBT-M Pnol / Nol Merger / Acquisition Certificate in Cases of Regulatory Delay - New Jersey

What Is Form CBT-M?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

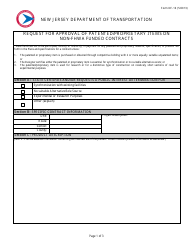

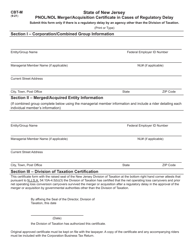

Q: What is a CBT-M Pnol/Nol Merger/Acquisition Certificate?

A: CBT-M Pnol/Nol Merger/Acquisition Certificate is a certificate issued in cases of regulatory delay in New Jersey.

Q: What is the purpose of the CBT-M Pnol/Nol Merger/Acquisition Certificate?

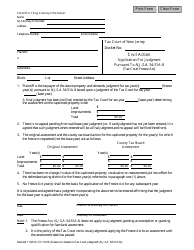

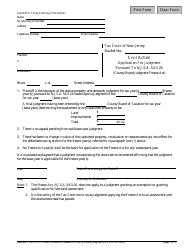

A: The purpose of the certificate is to allow a corporation to utilize net operating loss carryovers or net operating loss deductions after a merger or acquisition, in cases where there is regulatory delay.

Q: Who can apply for a CBT-M Pnol/Nol Merger/Acquisition Certificate?

A: Corporations that experience regulatory delay after a merger or acquisition in New Jersey can apply for the certificate.

Q: How does the CBT-M Pnol/Nol Merger/Acquisition Certificate help corporations?

A: The certificate helps corporations by allowing them to utilize net operating loss carryovers or net operating loss deductions despite regulatory delays.

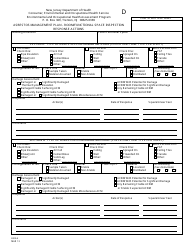

Form Details:

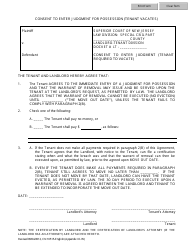

- Released on May 1, 2021;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CBT-M by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.