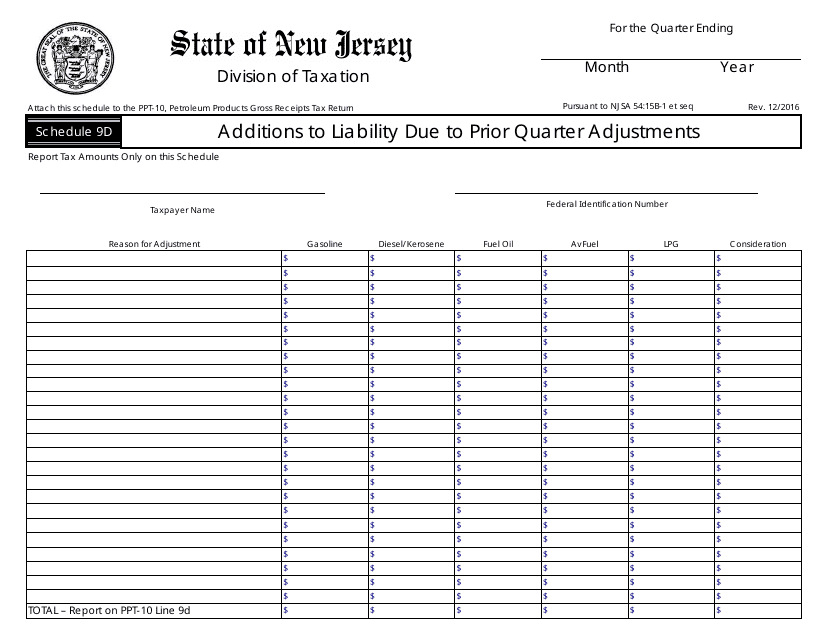

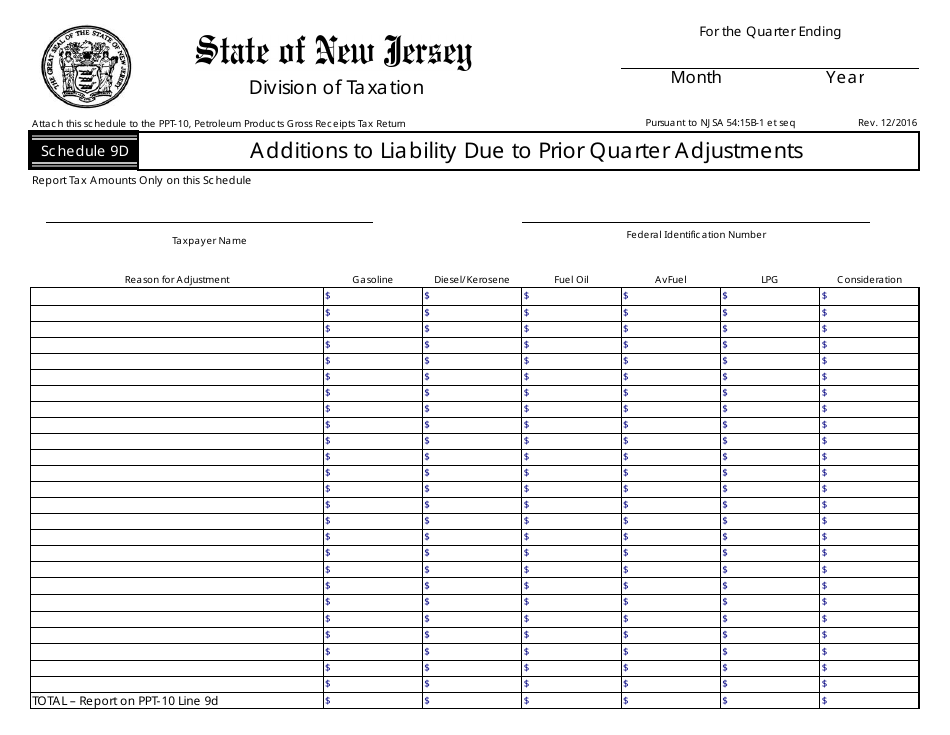

Form PPT-10 Schedule 9D Additions to Liability Due to Prior Quarter Adjustments - New Jersey

What Is Form PPT-10 Schedule 9D?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey.The document is a supplement to Form PPT-10, Petroleum Products Gross Receipts Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PPT-10?

A: Form PPT-10 is a tax form used in New Jersey.

Q: What is Schedule 9D?

A: Schedule 9D is a specific section of Form PPT-10.

Q: What does Schedule 9D cover?

A: Schedule 9D covers additions to liability due to prior quarter adjustments.

Q: What are additions to liability due to prior quarter adjustments?

A: Additions to liability due to prior quarter adjustments refer to changes in tax liability from previous quarters.

Q: Is Schedule 9D specific to New Jersey?

A: Yes, Schedule 9D is specific to New Jersey.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PPT-10 Schedule 9D by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.