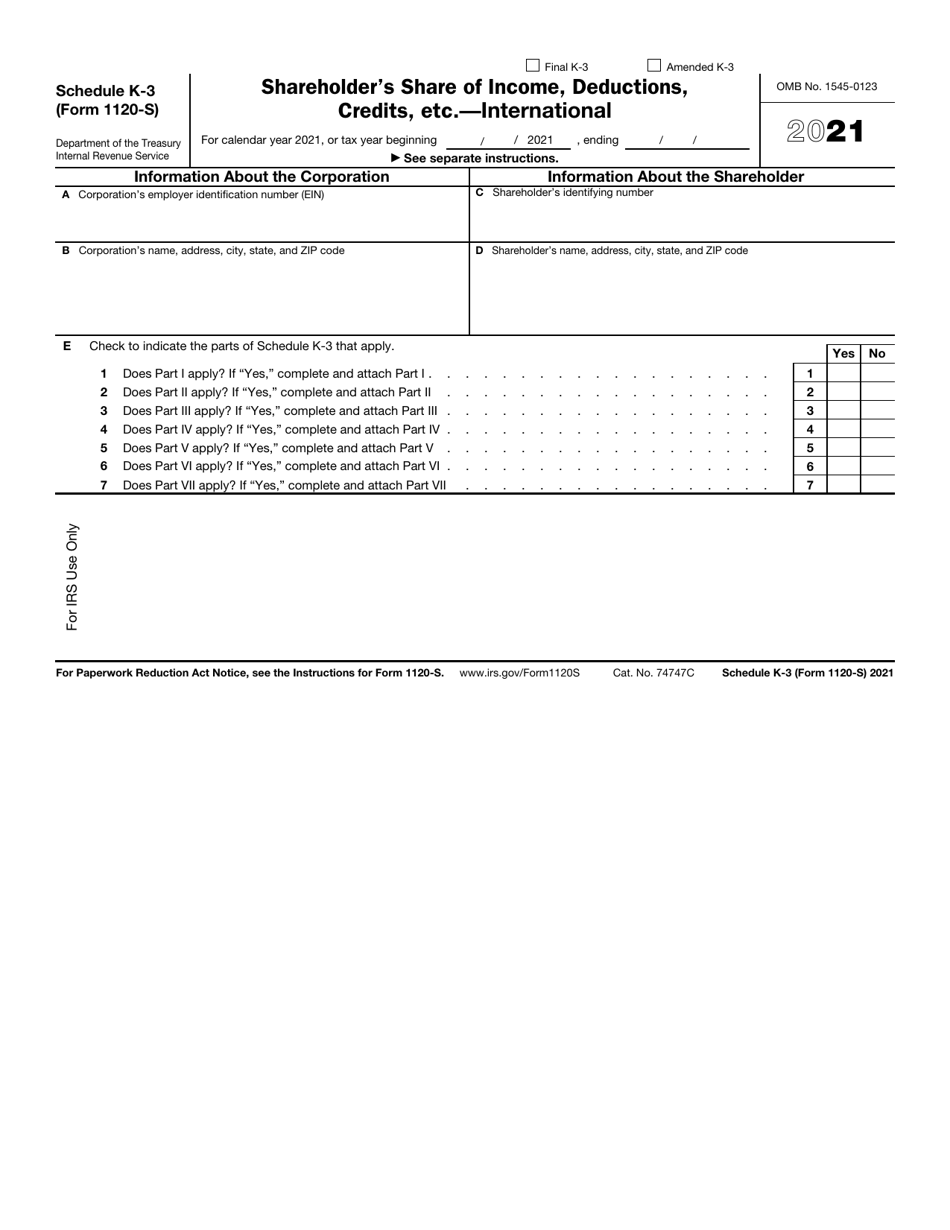

This version of the form is not currently in use and is provided for reference only. Download this version of

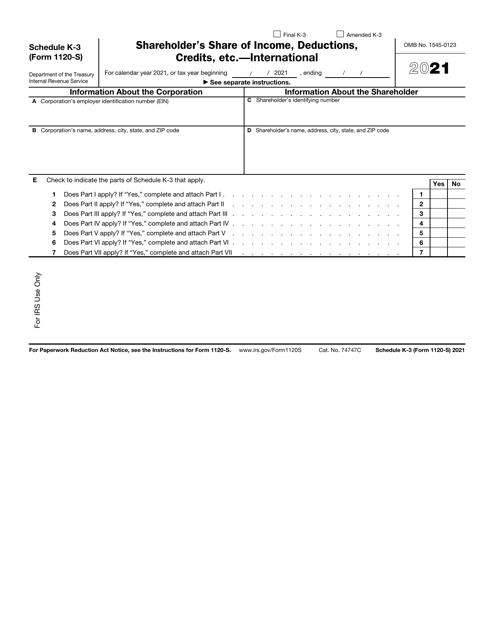

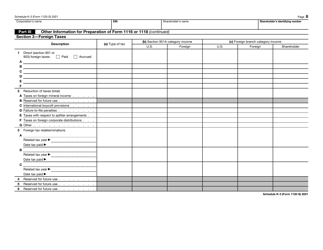

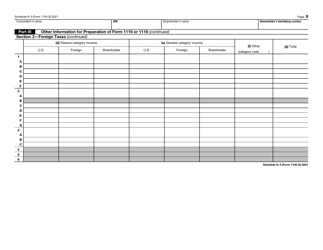

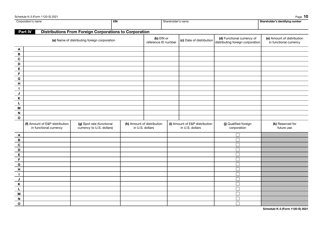

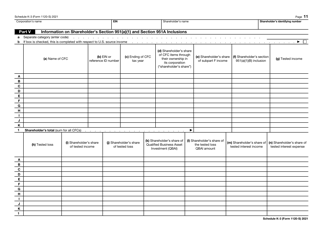

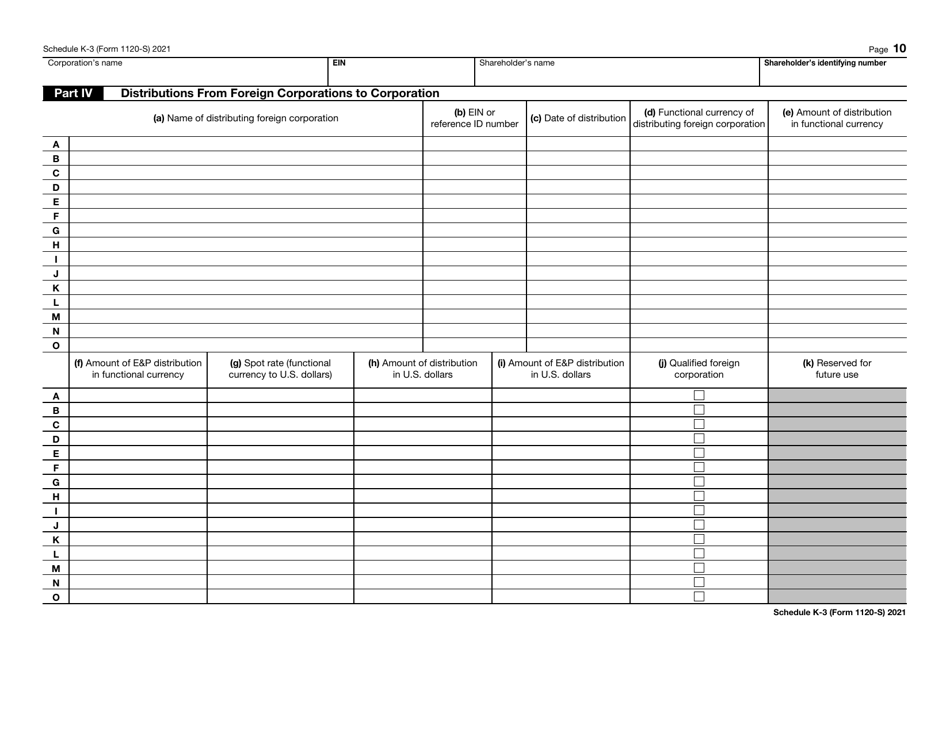

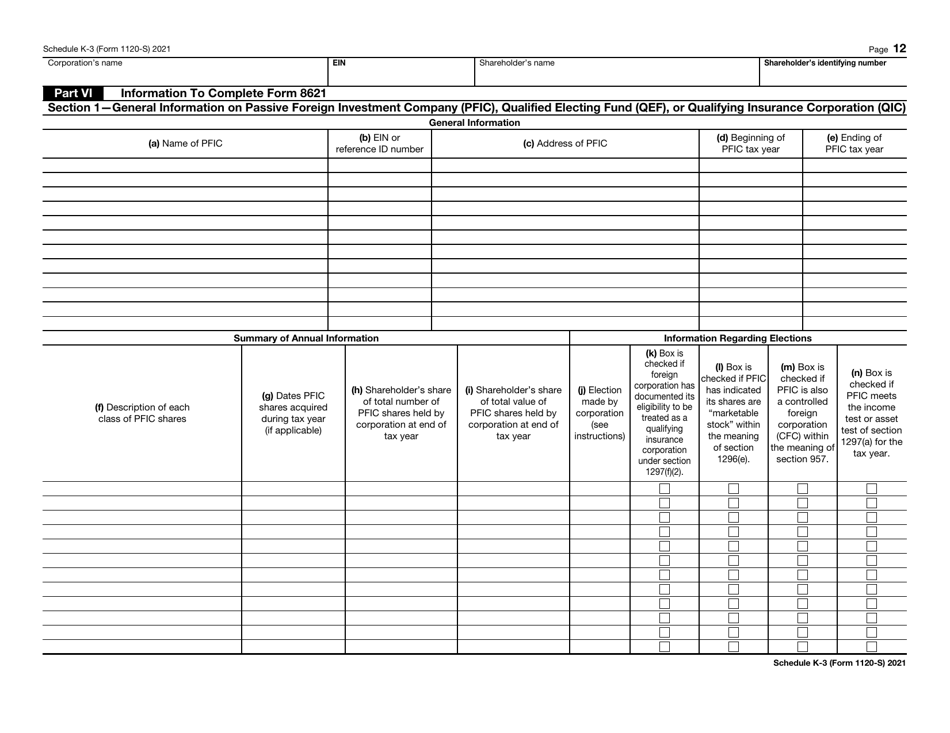

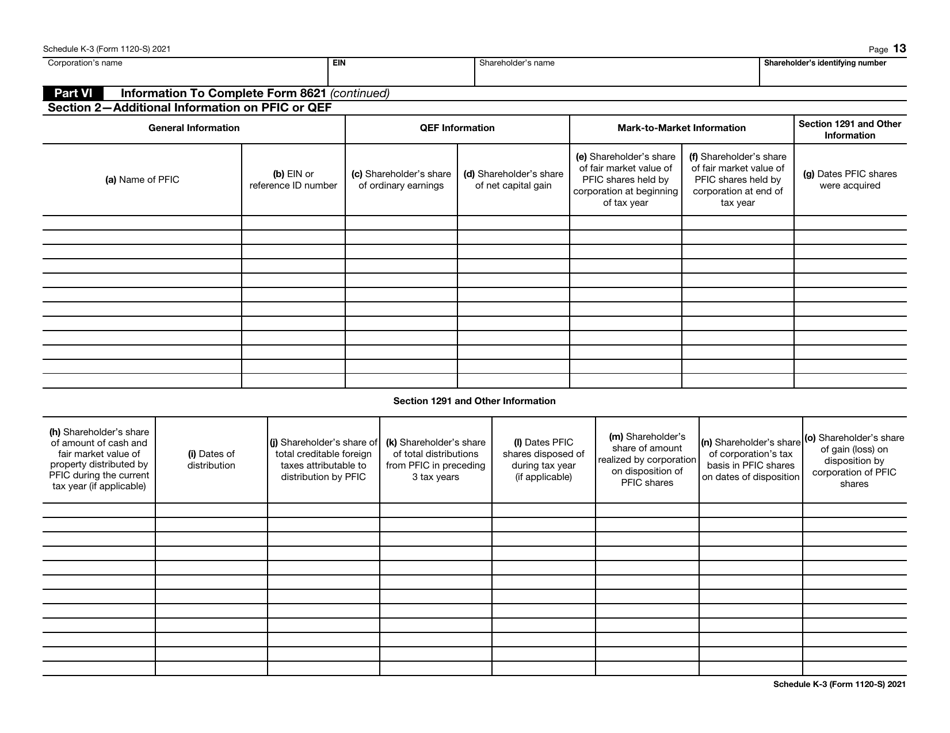

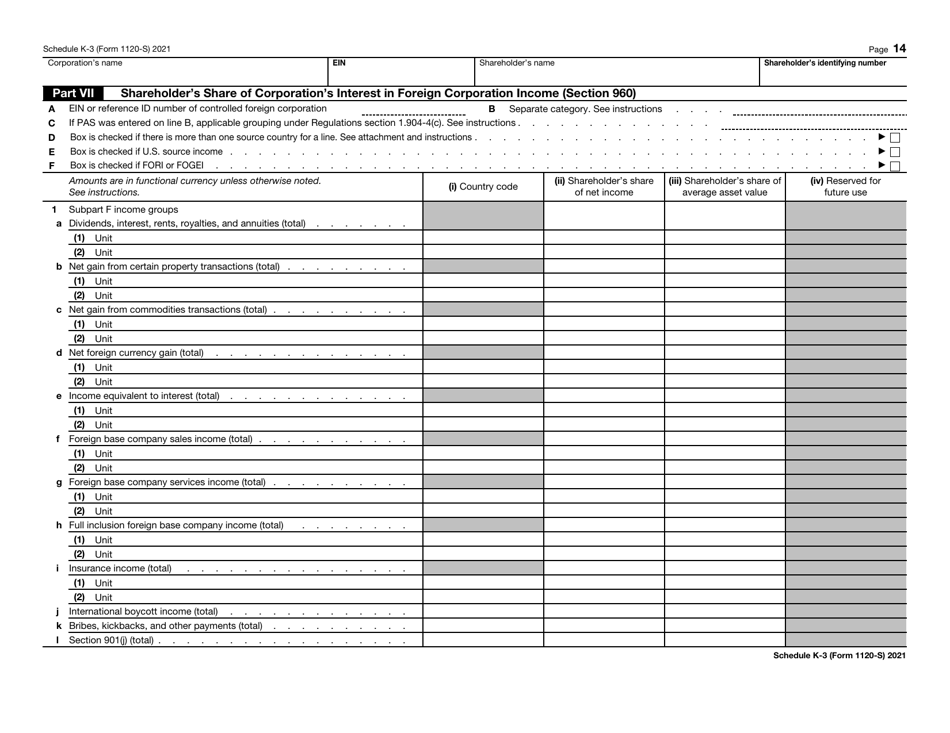

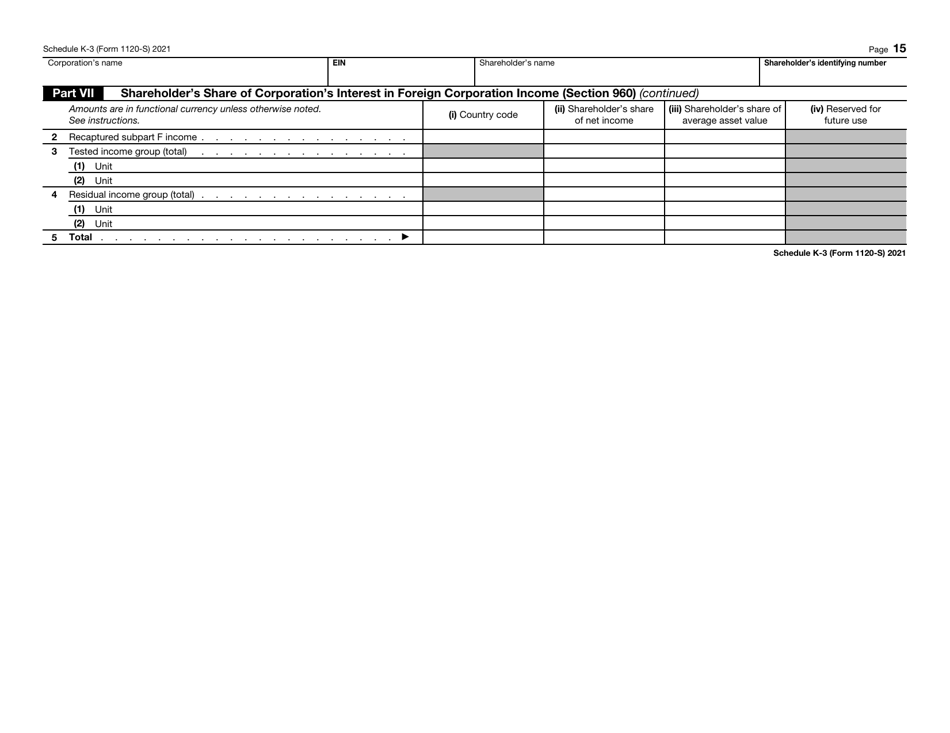

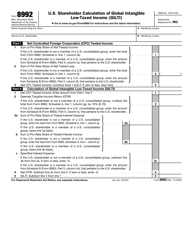

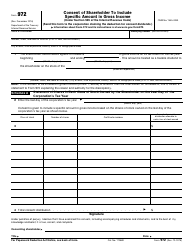

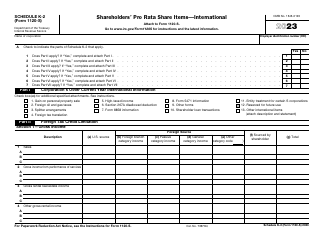

IRS Form 1120-S Schedule K-3

for the current year.

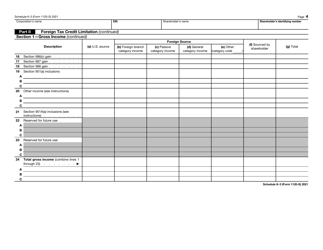

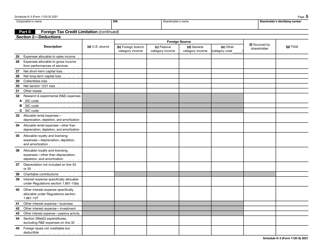

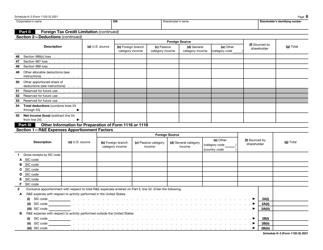

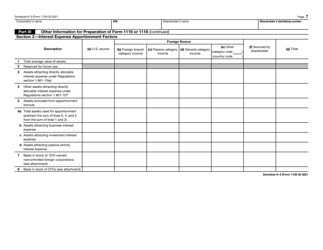

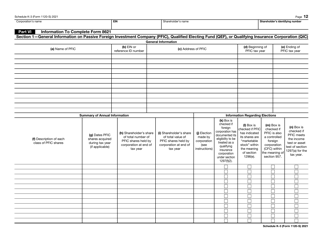

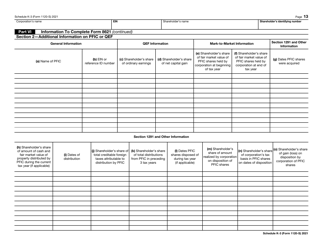

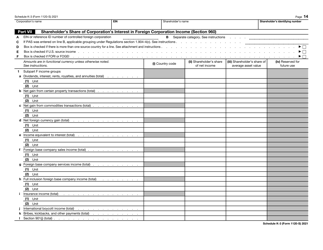

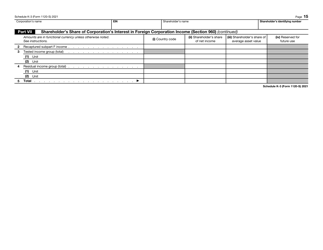

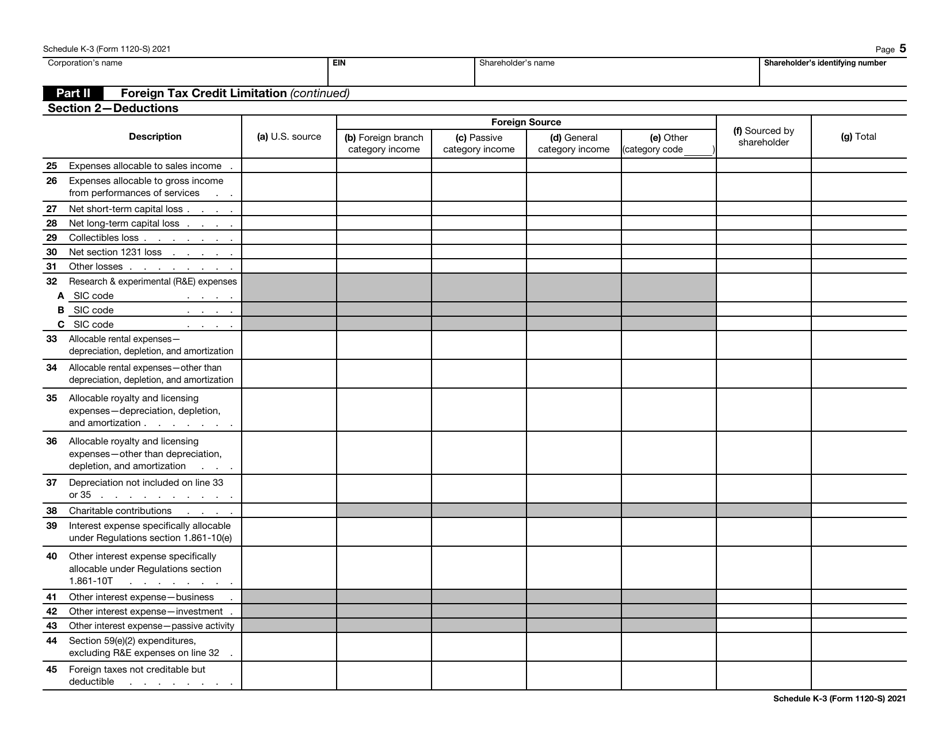

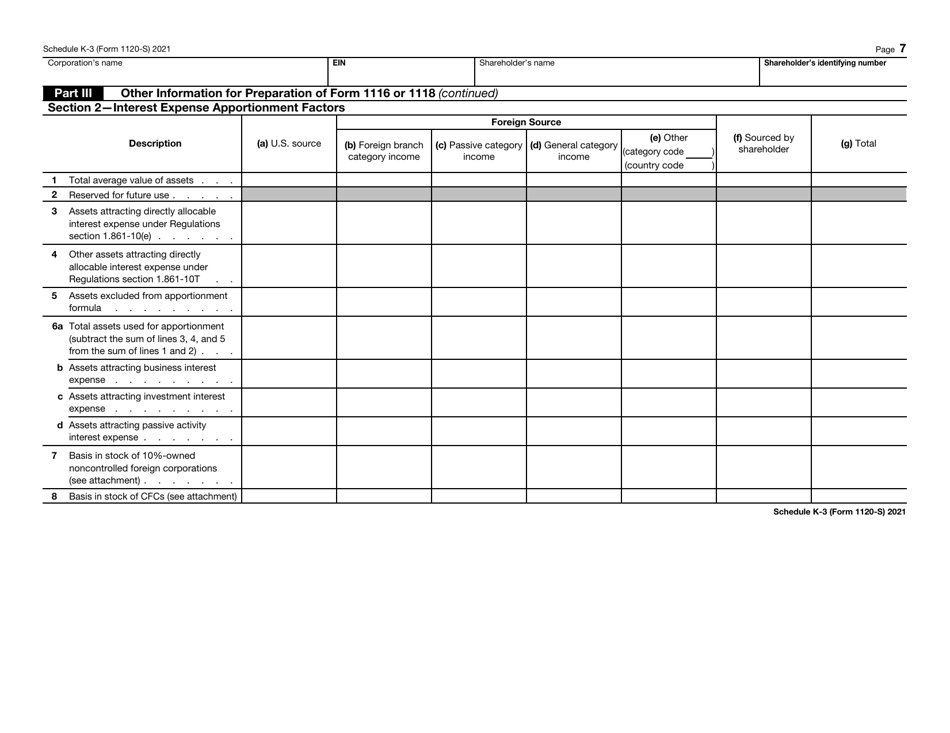

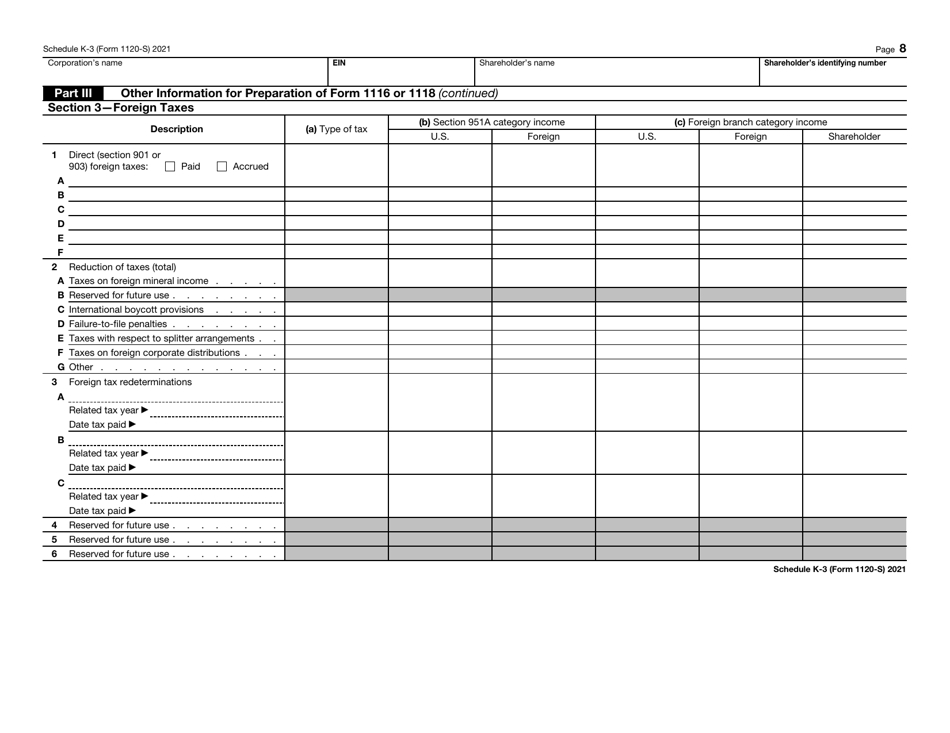

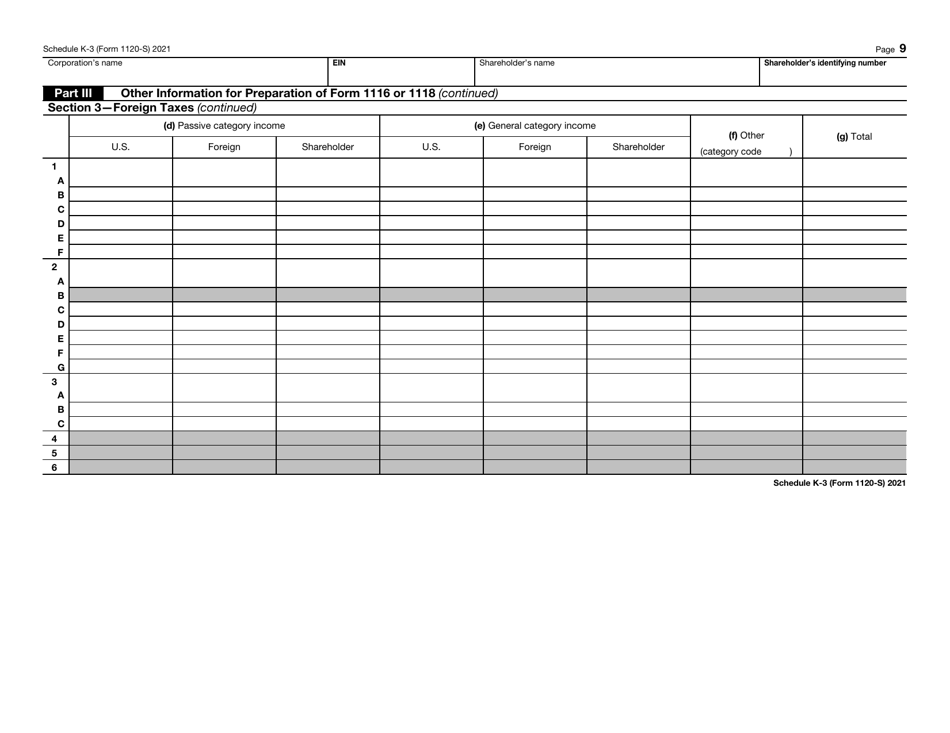

IRS Form 1120-S Schedule K-3 Shareholder's Share of Income, Deductions, Credits, Etc. - International

What Is IRS Form 1120-S Schedule K-3?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-S Schedule K-3?

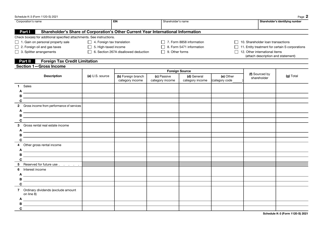

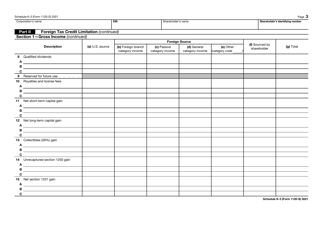

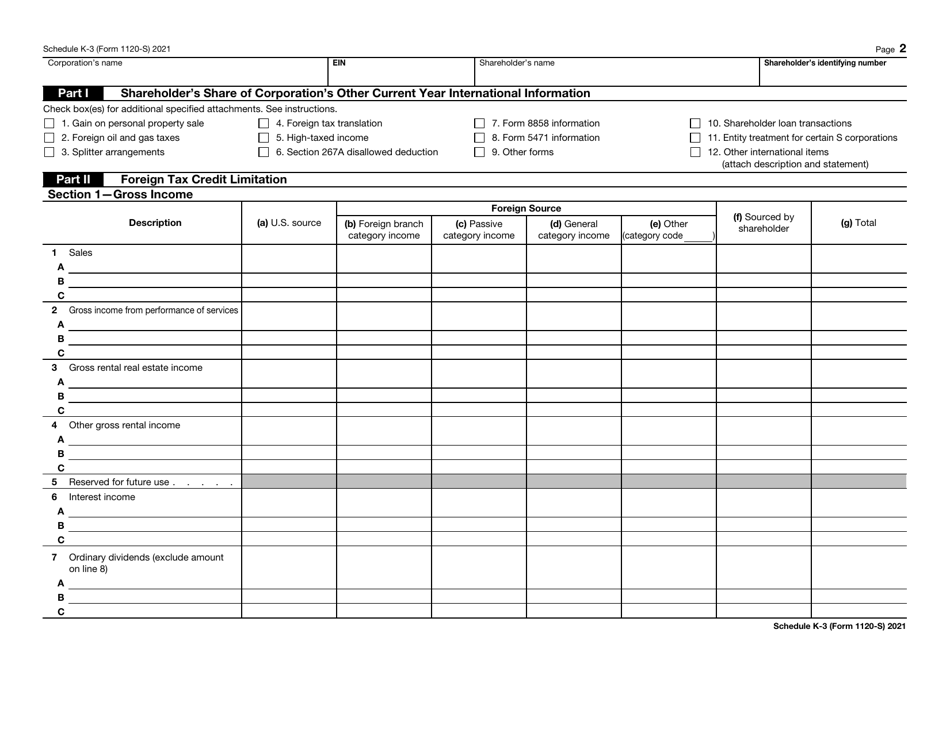

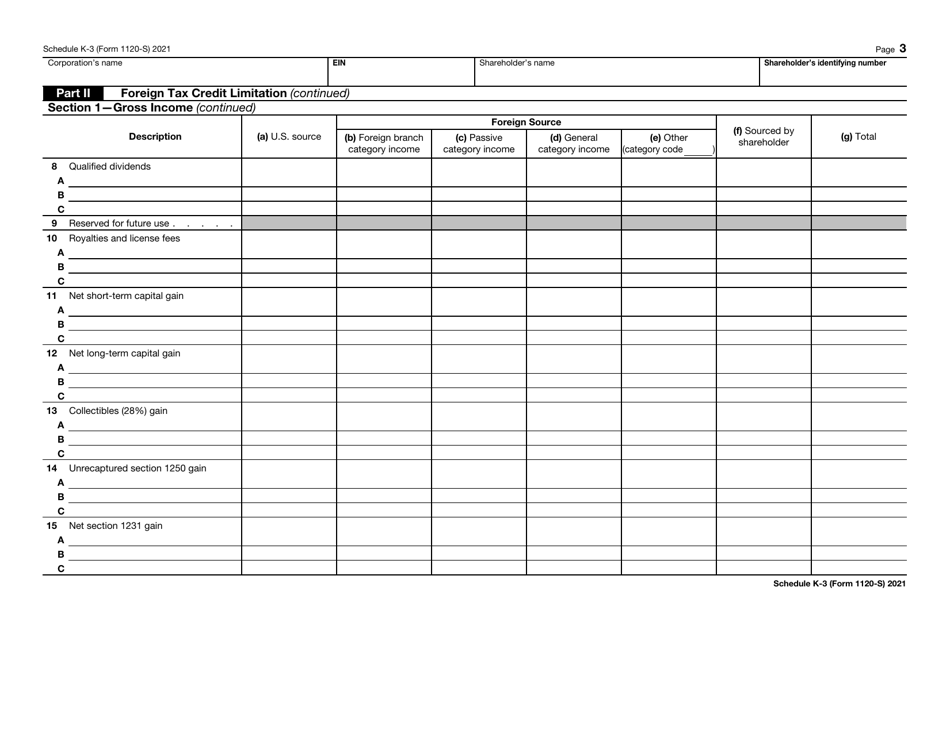

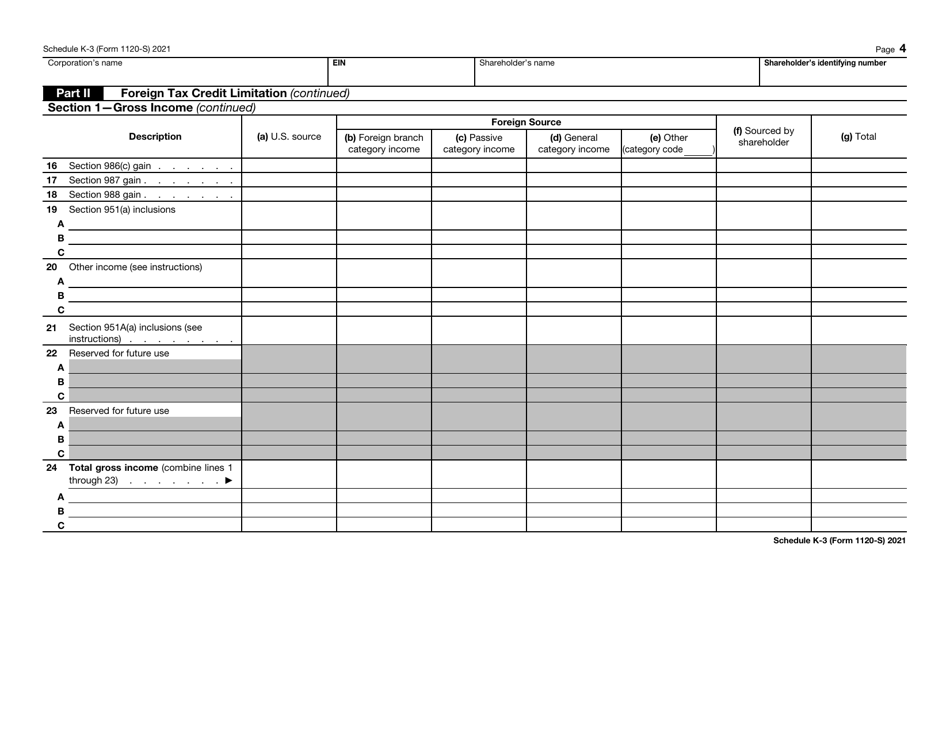

A: IRS Form 1120-S Schedule K-3 is a form used to report a shareholder's share of income, deductions, credits, etc. from an S corporation that has international operations.

Q: Who needs to file IRS Form 1120-S Schedule K-3?

A: Shareholders of an S corporation with international operations need to file IRS Form 1120-S Schedule K-3.

Q: What information is reported on IRS Form 1120-S Schedule K-3?

A: IRS Form 1120-S Schedule K-3 reports a shareholder's share of income, deductions, credits, etc. from the S corporation's international operations.

Q: When is IRS Form 1120-S Schedule K-3 due?

A: IRS Form 1120-S Schedule K-3 is due on the same date as the S corporation's Form 1120-S, which is typically due on the 15th day of the third month after the end of the corporation's tax year.

Q: Can IRS Form 1120-S Schedule K-3 be filed electronically?

A: Yes, IRS Form 1120-S Schedule K-3 can be filed electronically.

Q: Are there any penalties for not filing IRS Form 1120-S Schedule K-3?

A: Failure to file IRS Form 1120-S Schedule K-3 can result in penalties imposed by the IRS.

Q: Is IRS Form 1120-S Schedule K-3 used for international operations only?

A: Yes, IRS Form 1120-S Schedule K-3 is specifically used to report a shareholder's share of income, deductions, credits, etc. from an S corporation's international operations.

Form Details:

- A 15-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-S Schedule K-3 through the link below or browse more documents in our library of IRS Forms.