This version of the form is not currently in use and is provided for reference only. Download this version of

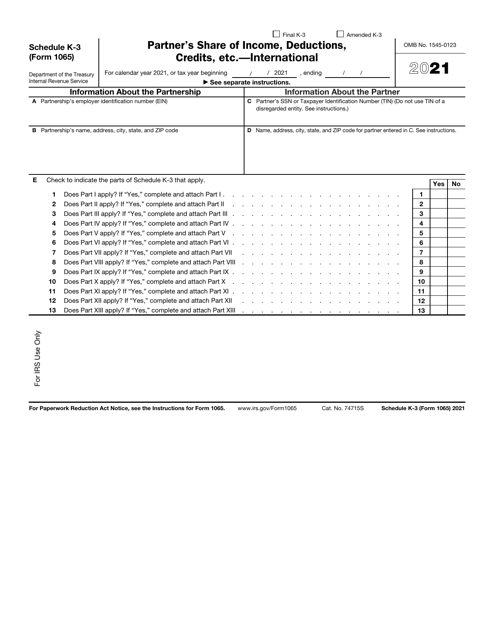

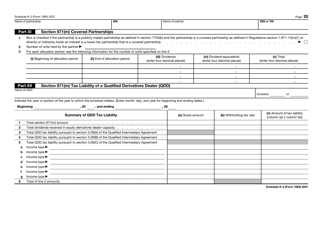

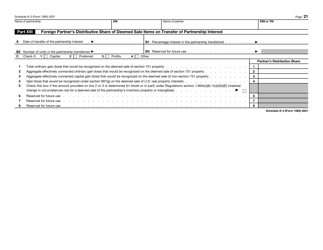

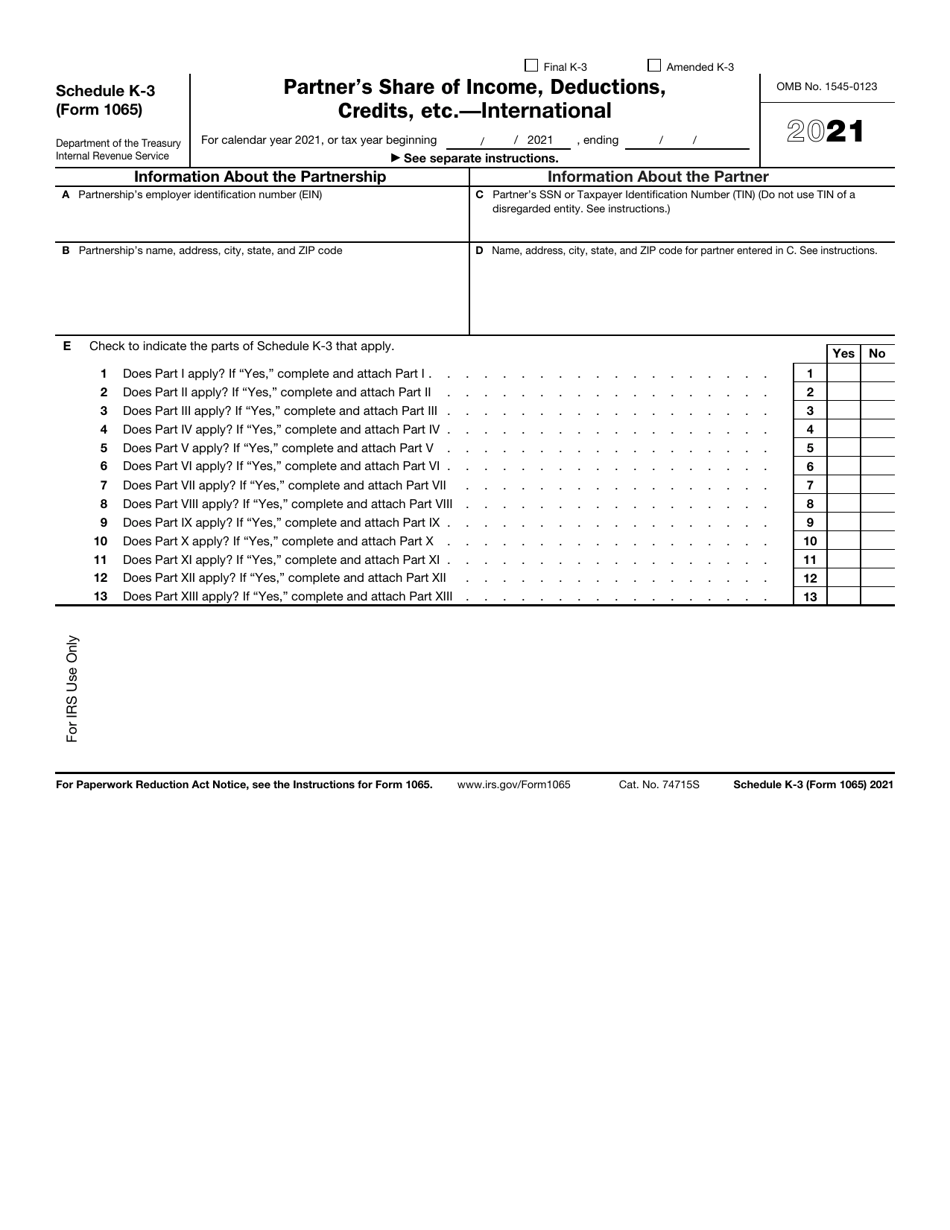

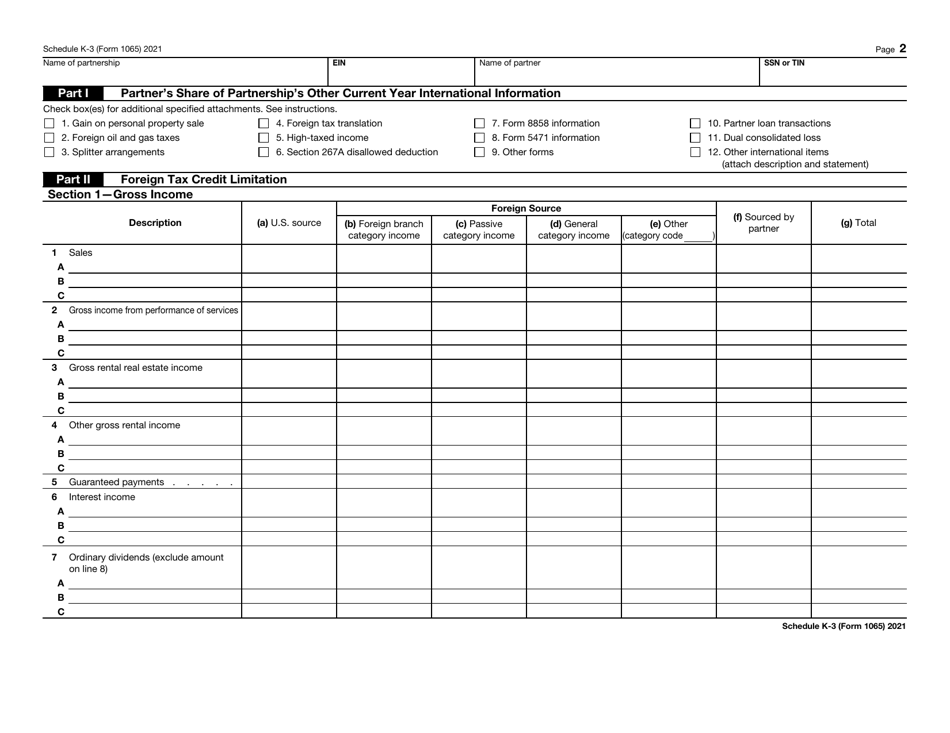

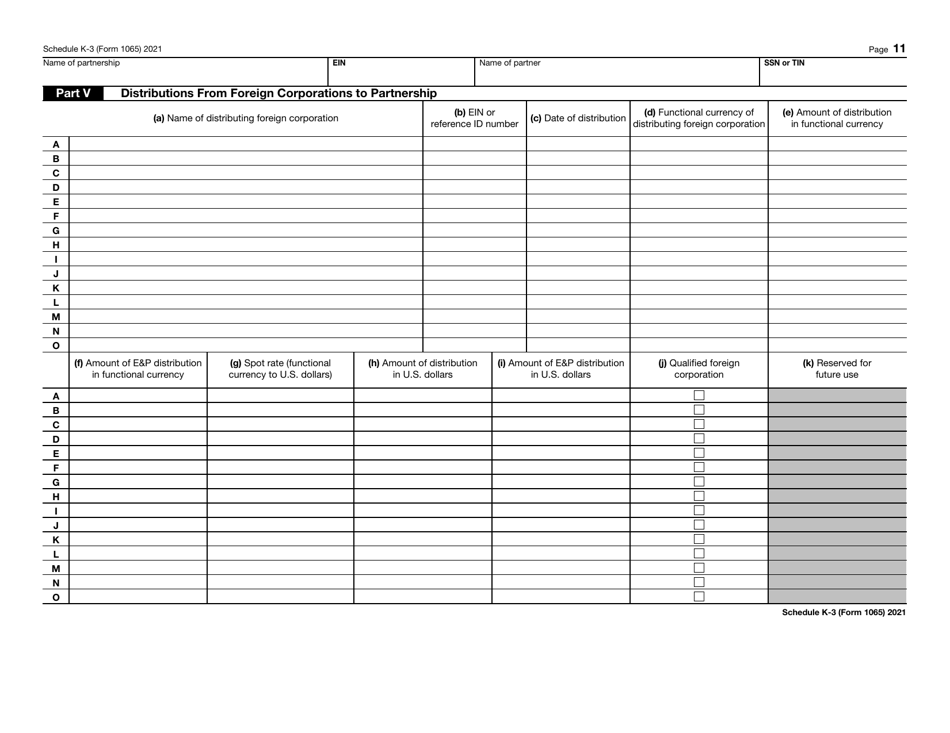

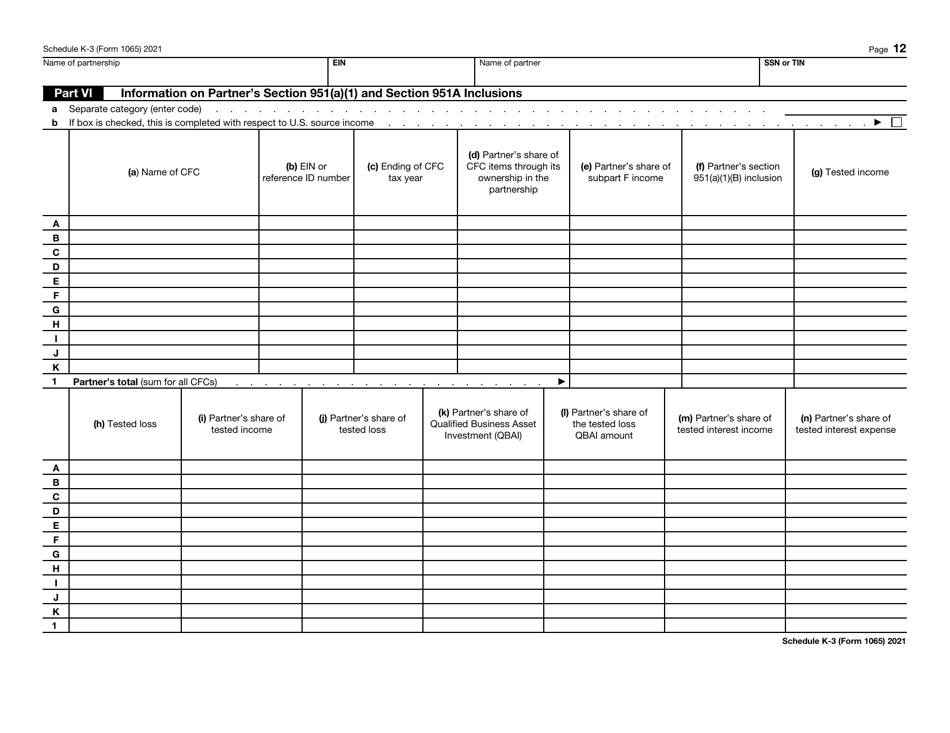

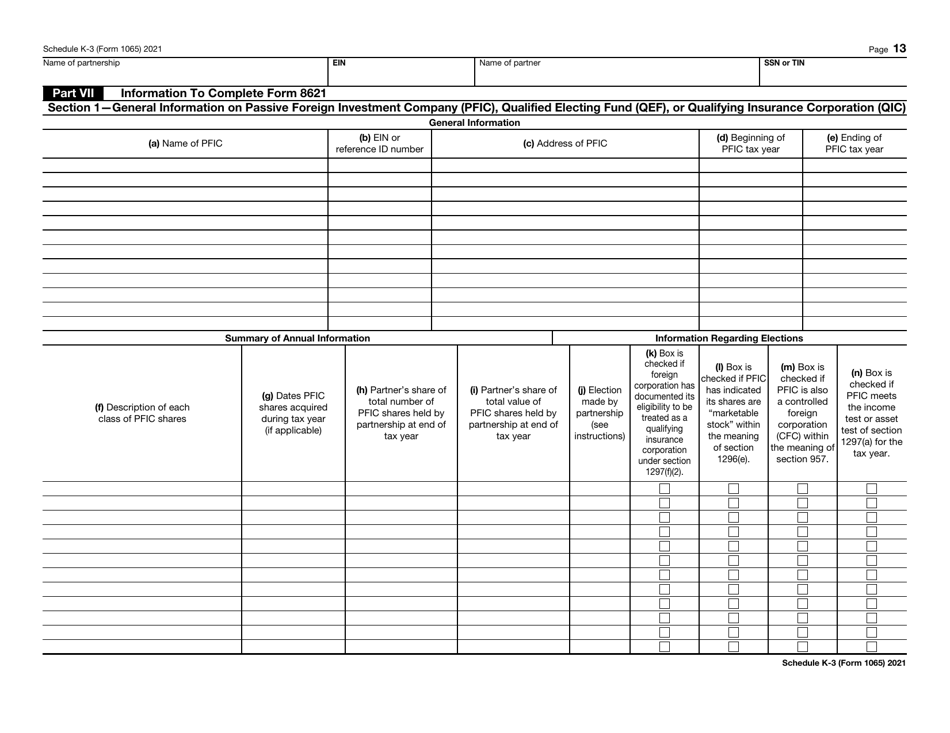

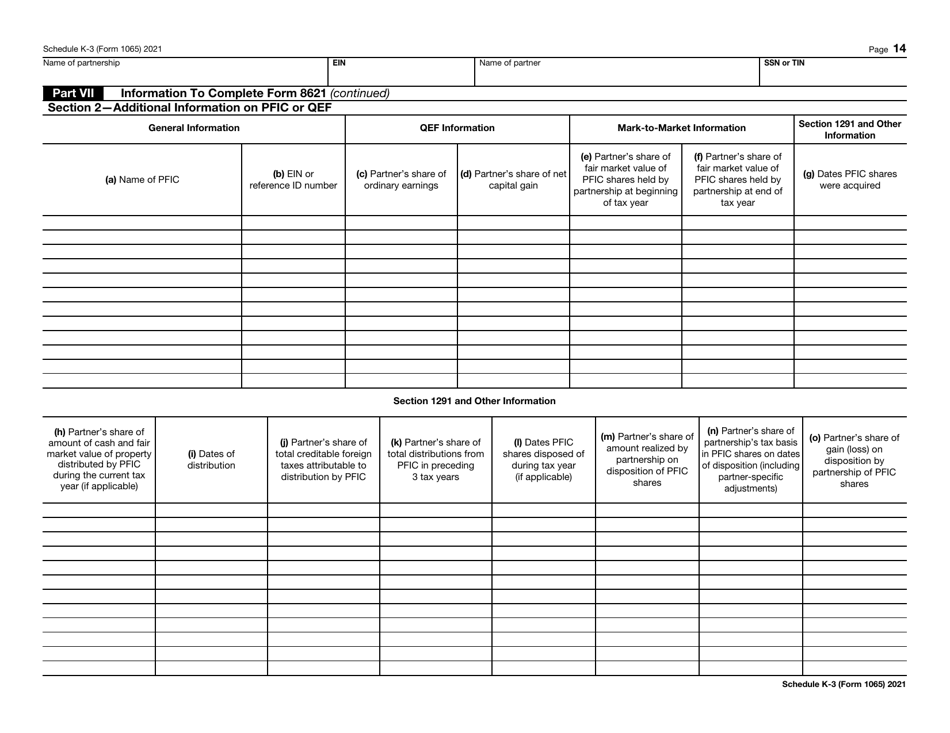

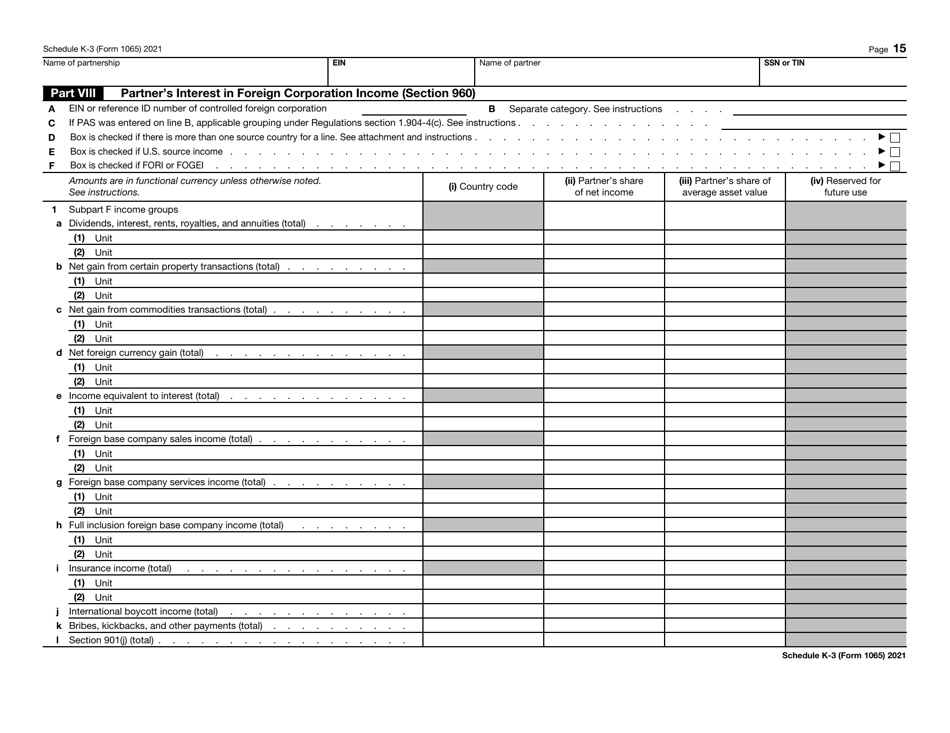

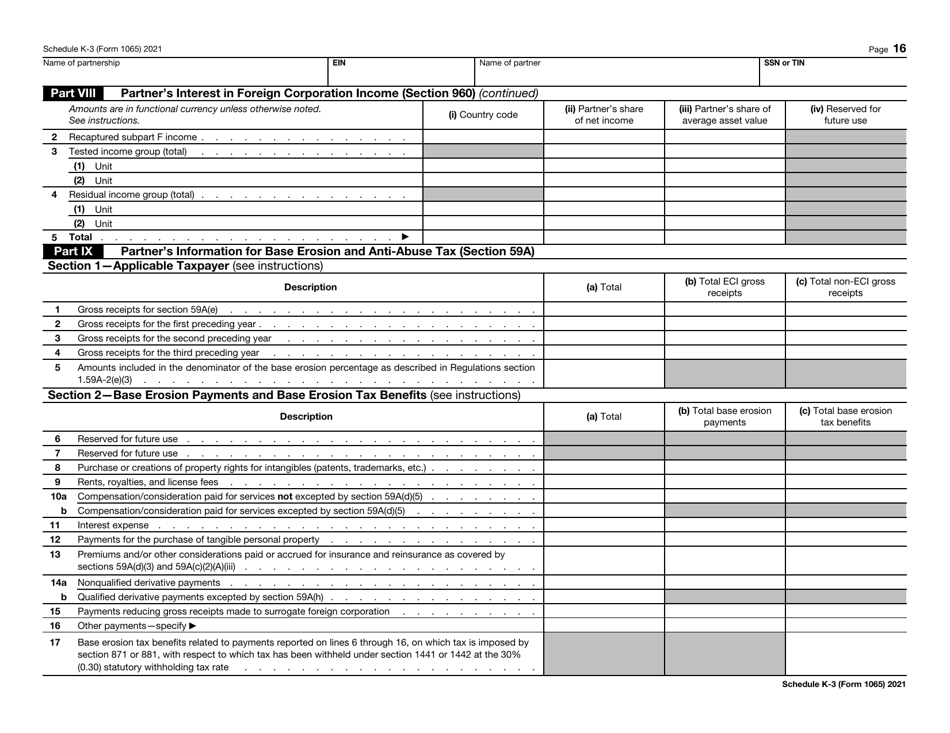

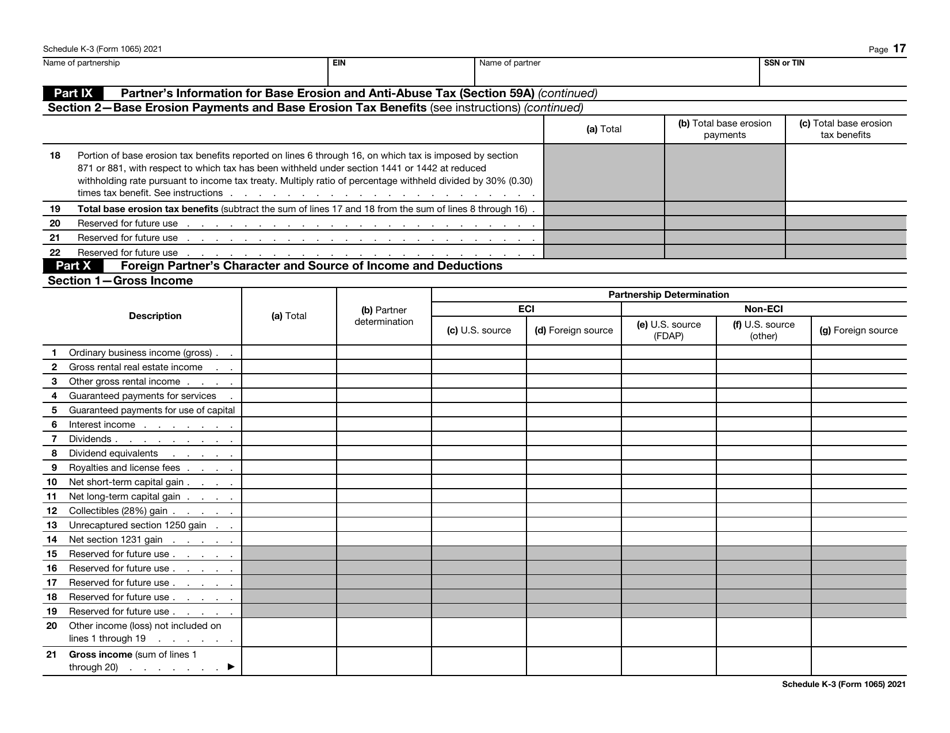

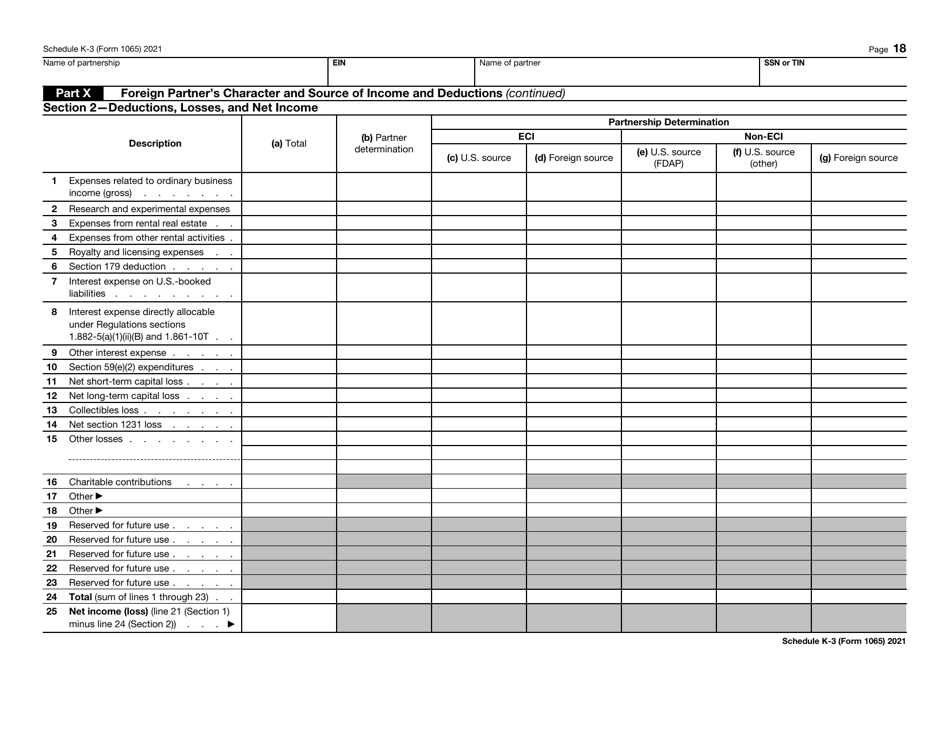

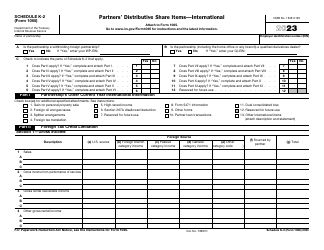

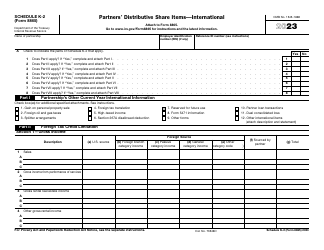

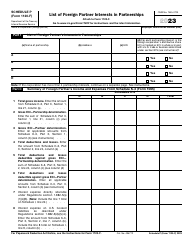

IRS Form 1065 Schedule K-3

for the current year.

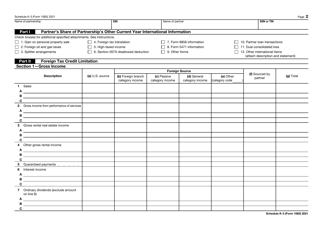

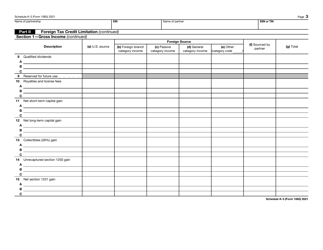

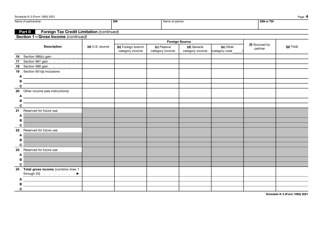

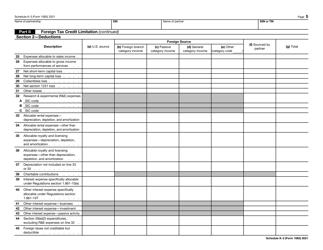

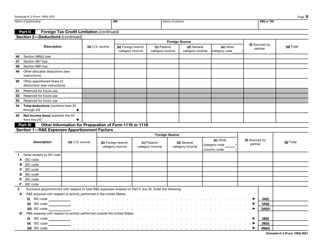

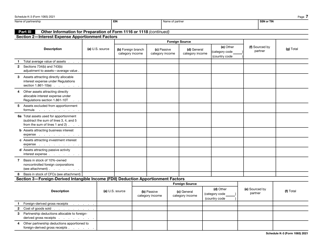

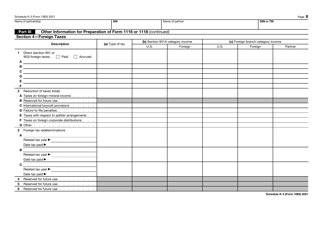

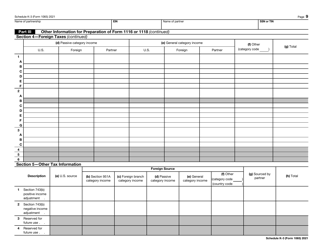

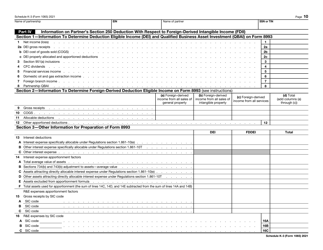

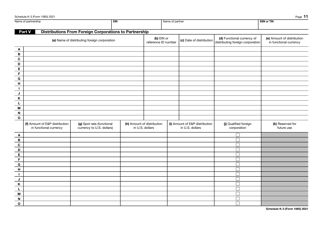

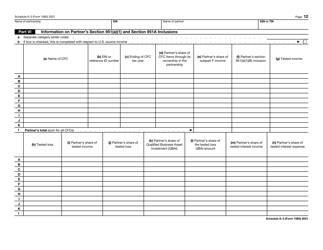

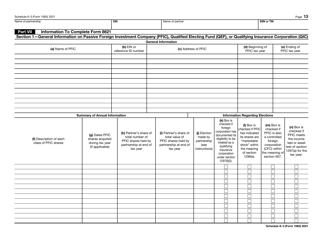

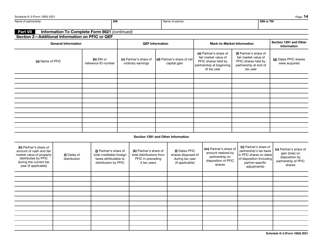

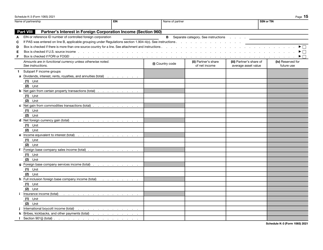

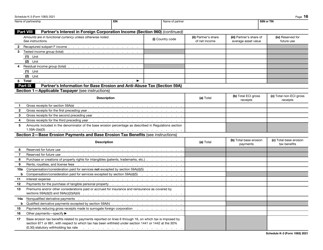

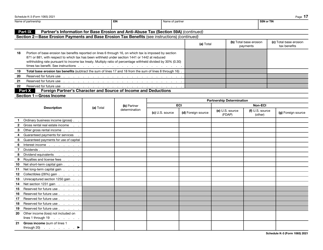

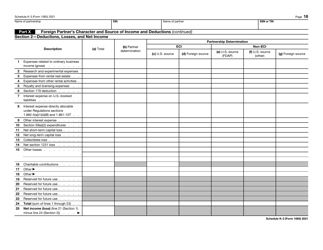

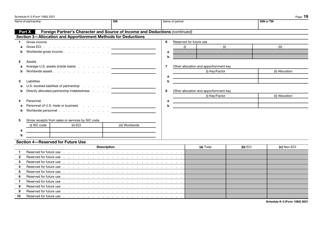

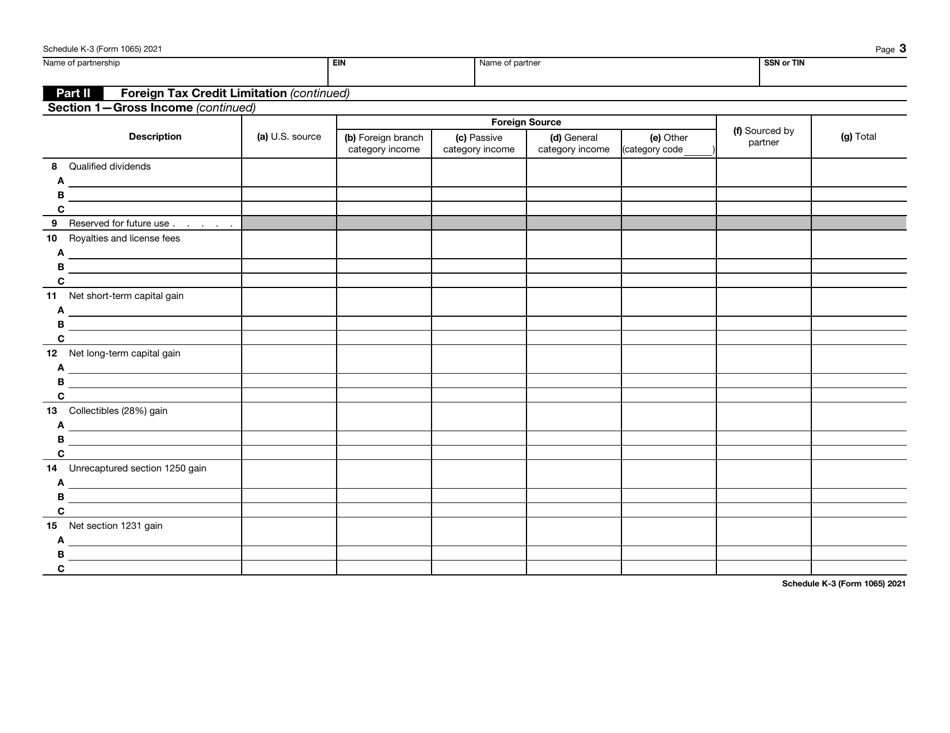

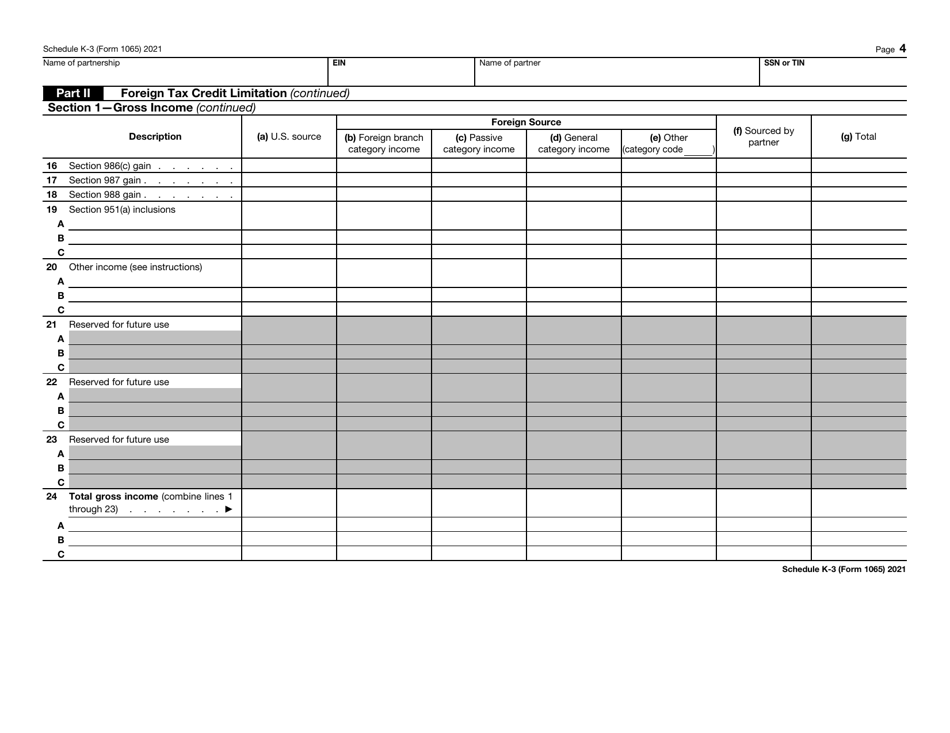

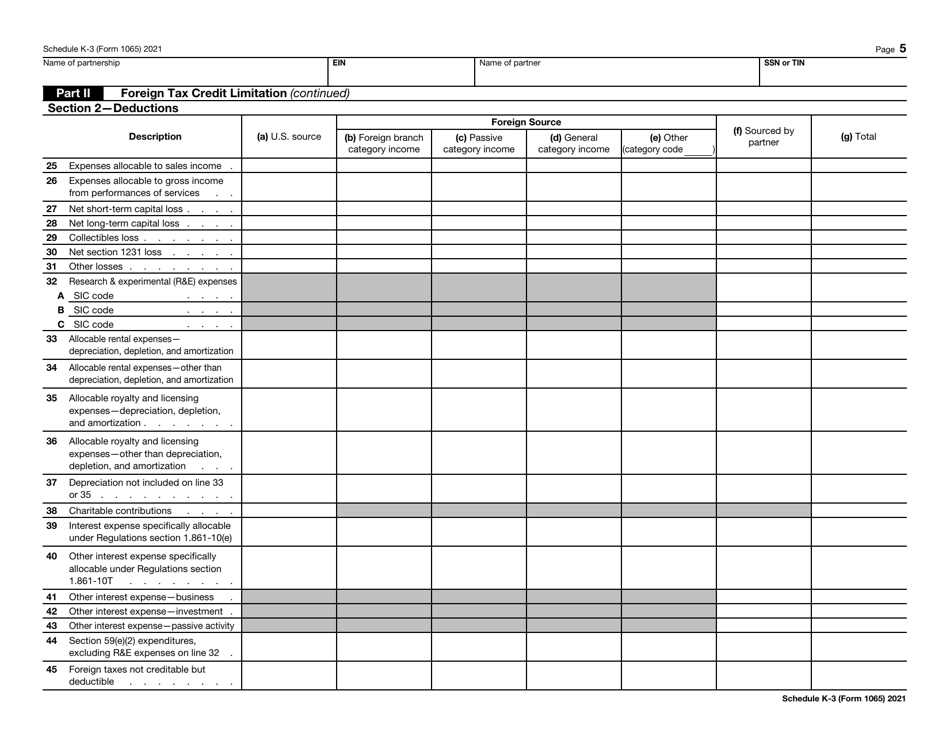

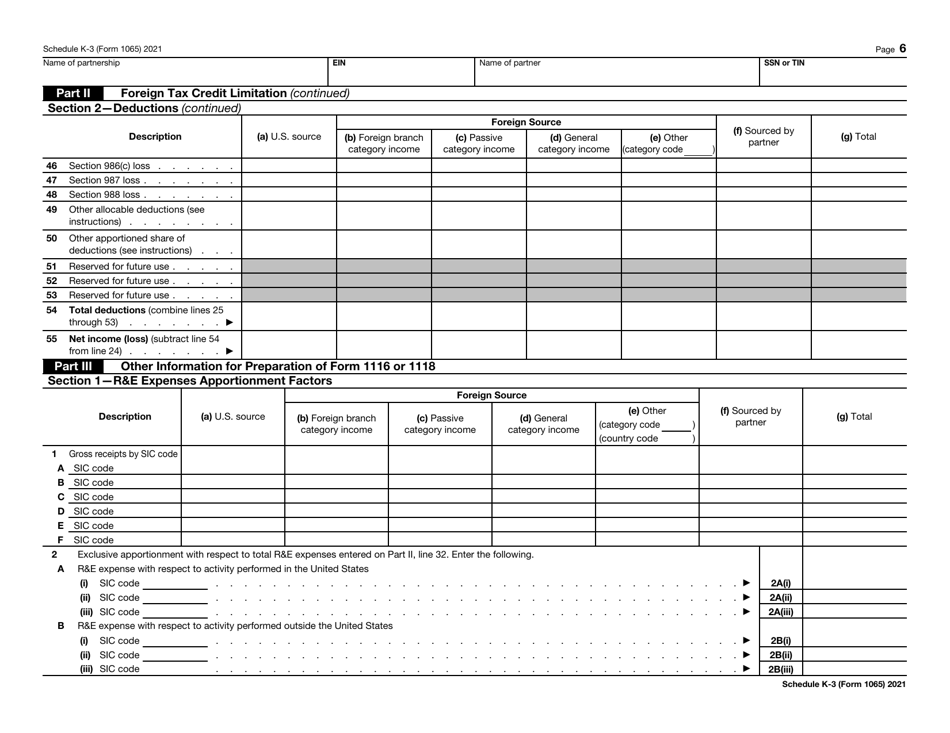

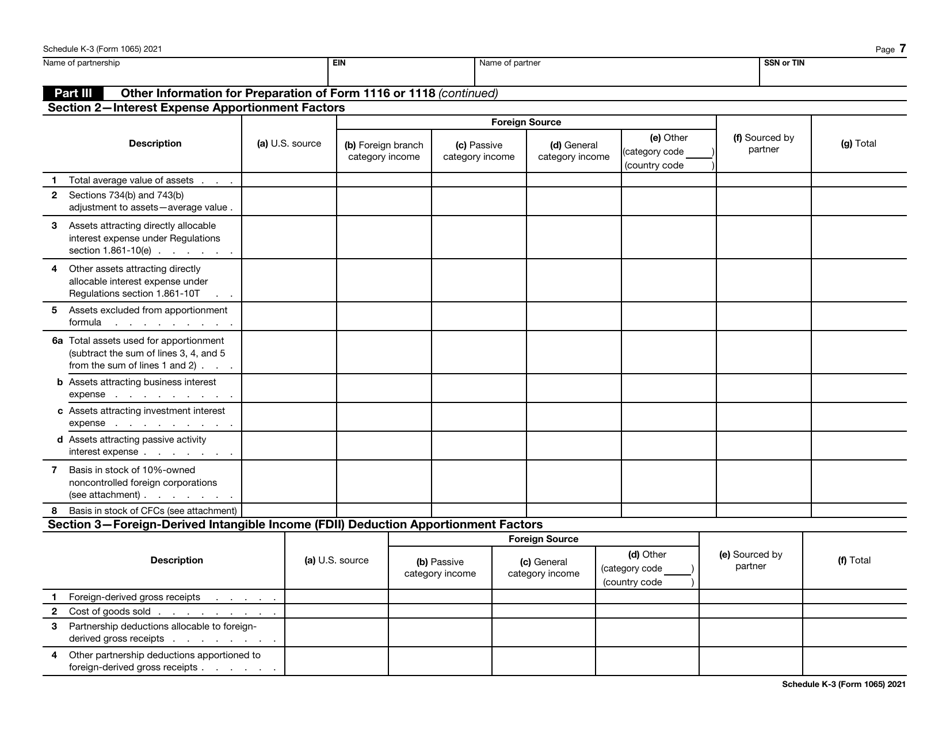

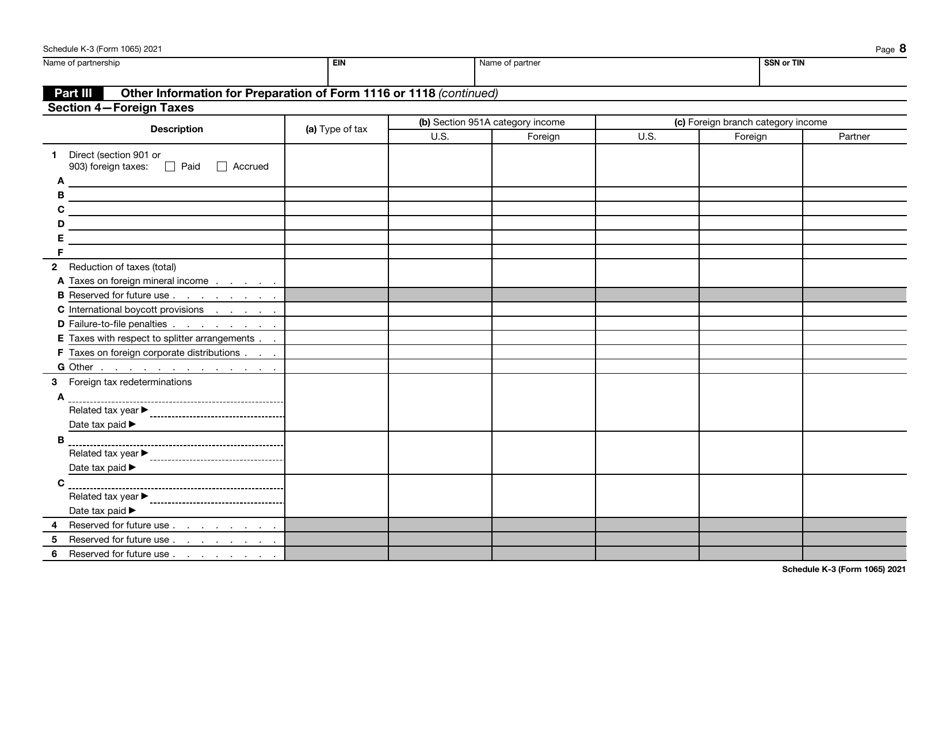

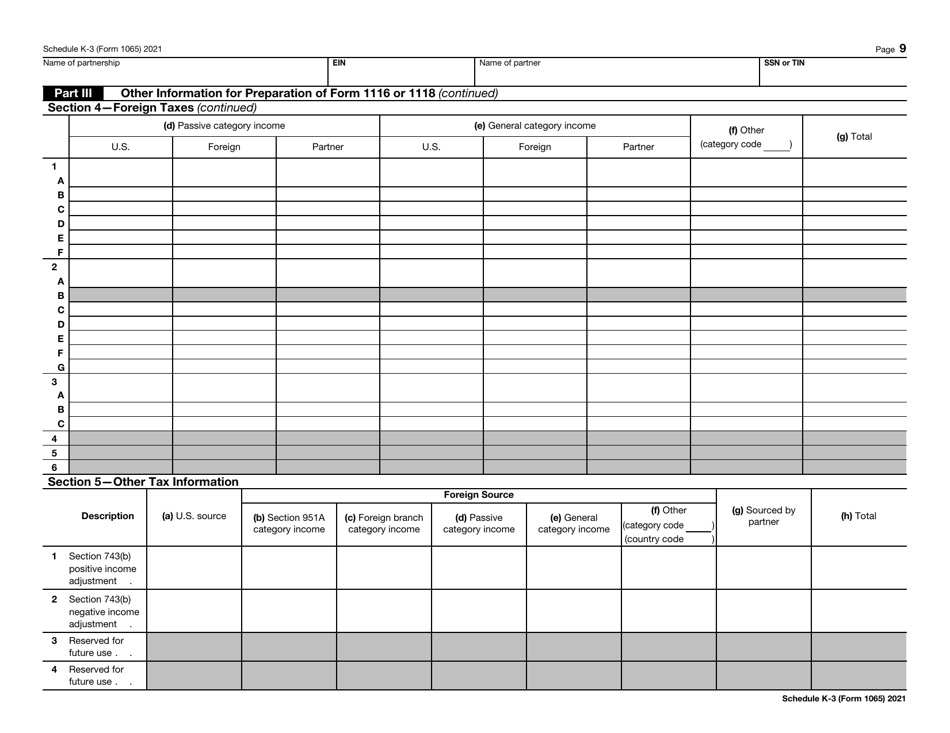

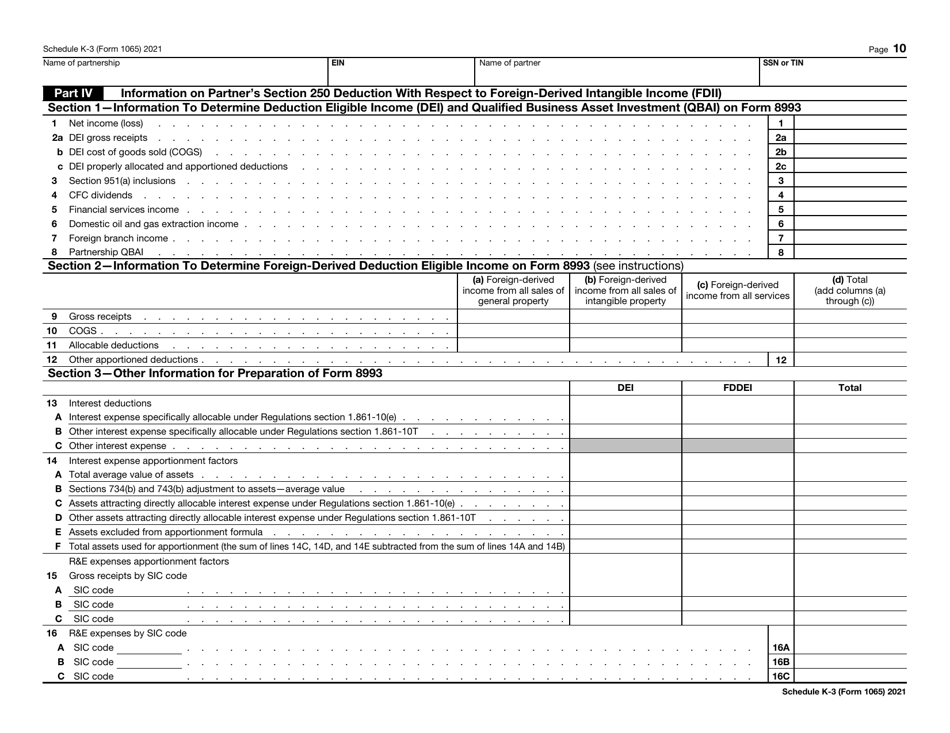

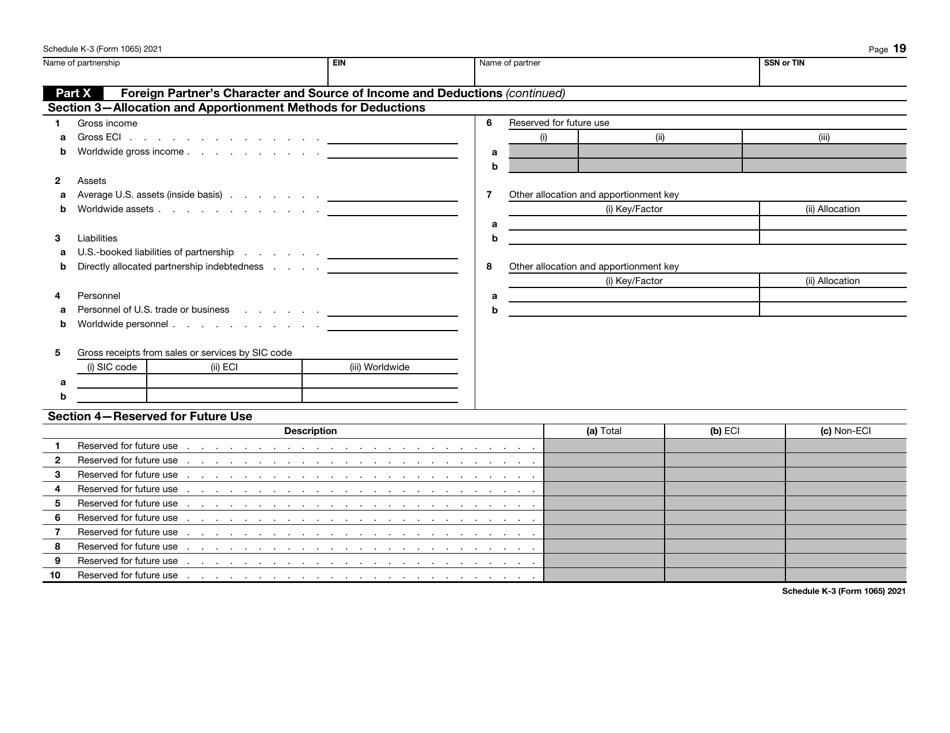

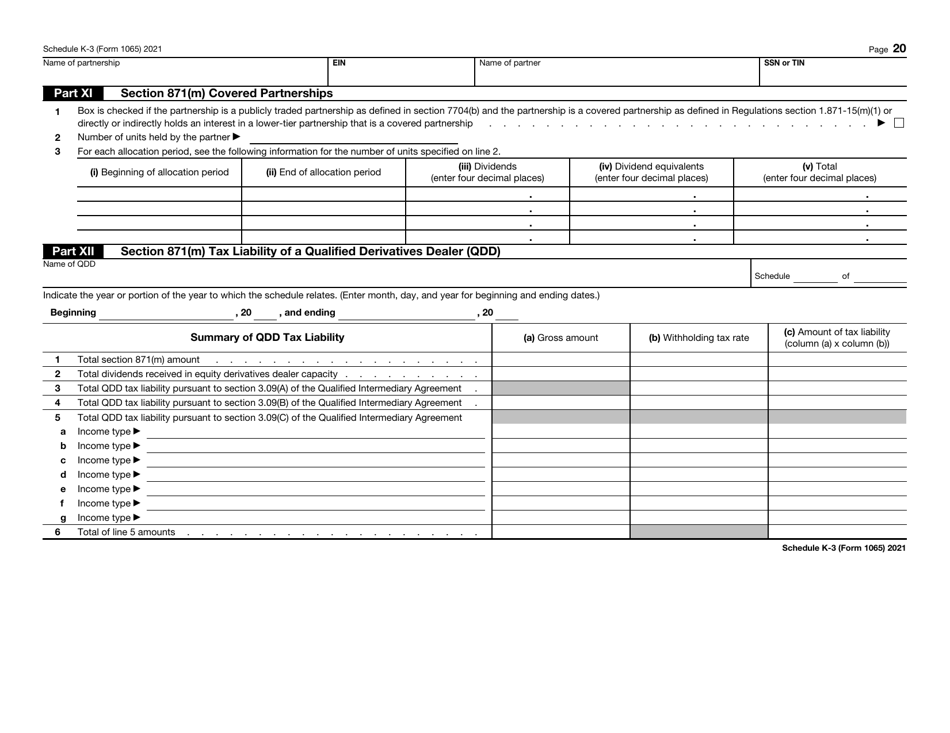

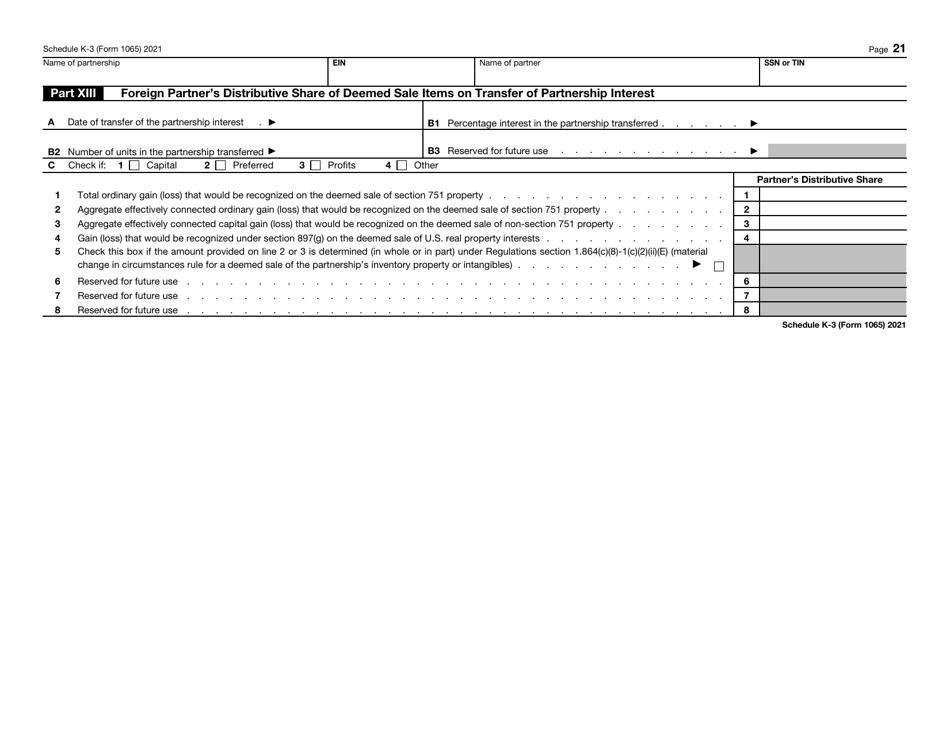

IRS Form 1065 Schedule K-3 Partner's Share of Income, Deductions, Credits, Etc. - International

What Is IRS Form 1065 Schedule K-3?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1065, U.S. Return of Partnership Income. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1065 Schedule K-3?

A: IRS Form 1065 Schedule K-3 is a tax form used by partnerships to report each partner's share of income, deductions, credits, and other tax information.

Q: Who uses IRS Form 1065 Schedule K-3?

A: Partnerships use IRS Form 1065 Schedule K-3 to report tax information for each partner.

Q: What information is reported on IRS Form 1065 Schedule K-3?

A: IRS Form 1065 Schedule K-3 reports each partner's share of income, deductions, credits, and other tax information.

Q: Is IRS Form 1065 Schedule K-3 required?

A: Yes, partnerships are required to file IRS Form 1065 Schedule K-3 along with their annual tax return, Form 1065.

Form Details:

- A 21-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1065 Schedule K-3 through the link below or browse more documents in our library of IRS Forms.