This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040 Schedule H

for the current year.

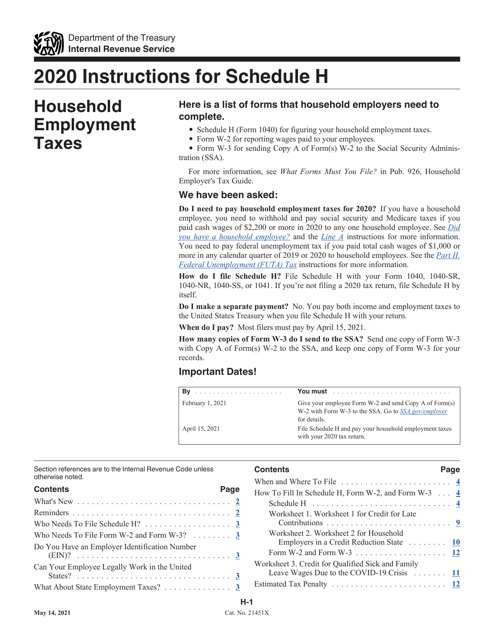

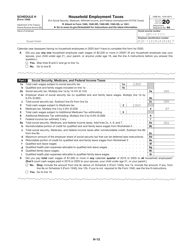

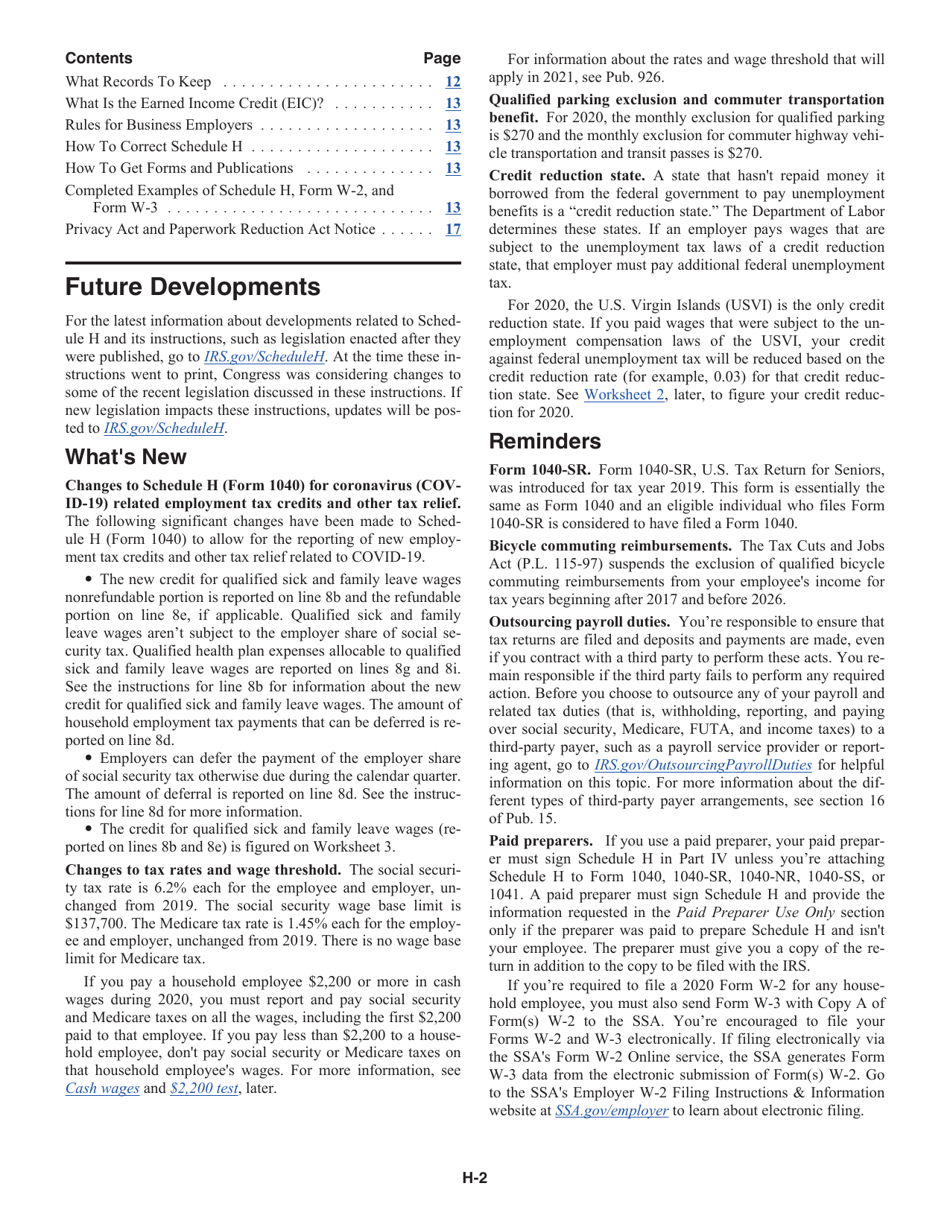

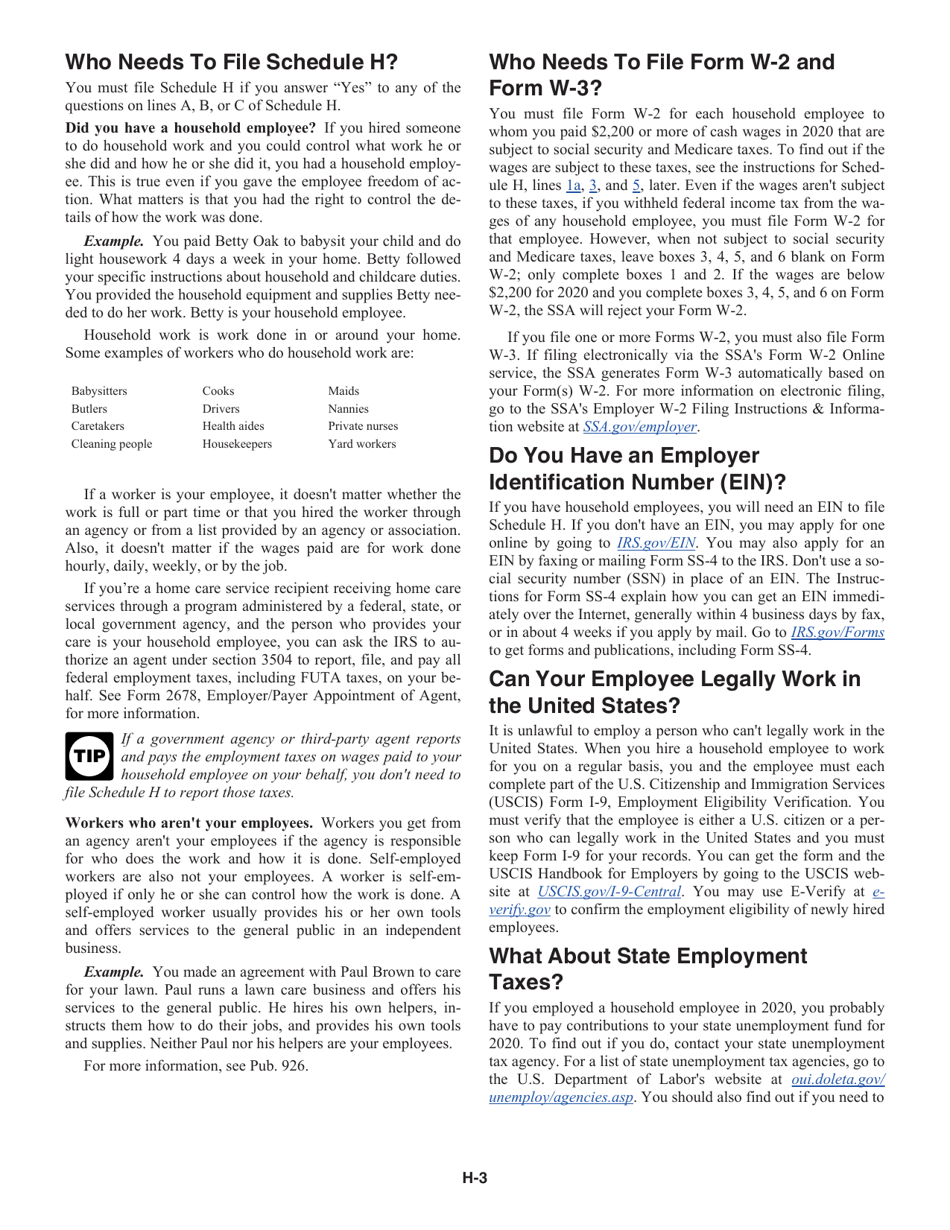

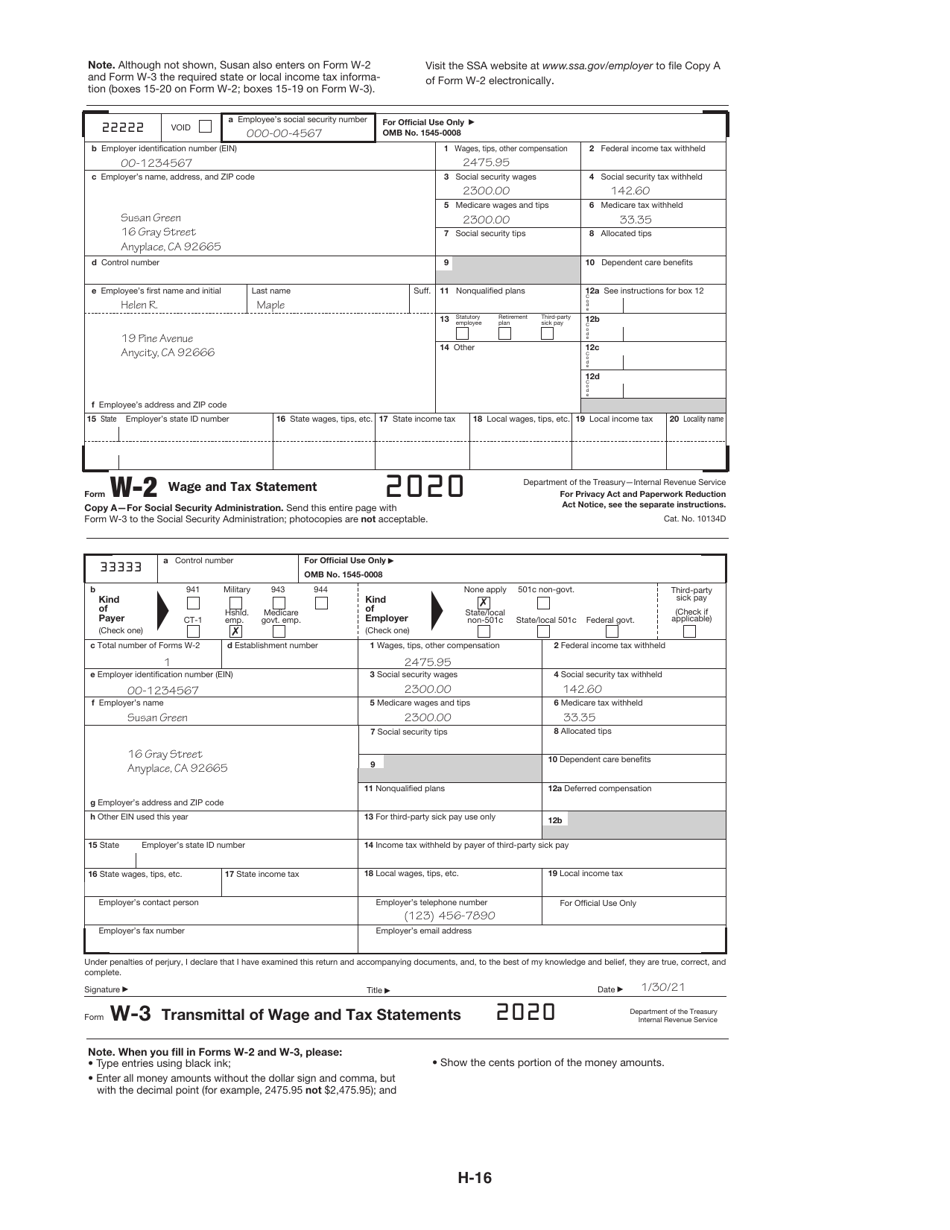

Instructions for IRS Form 1040 Schedule H Household Employment Taxes

This document contains official instructions for IRS Form 1040 Schedule H, Household Employment Taxes - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 Schedule H is available for download through this link.

FAQ

Q: What is IRS Form 1040 Schedule H?

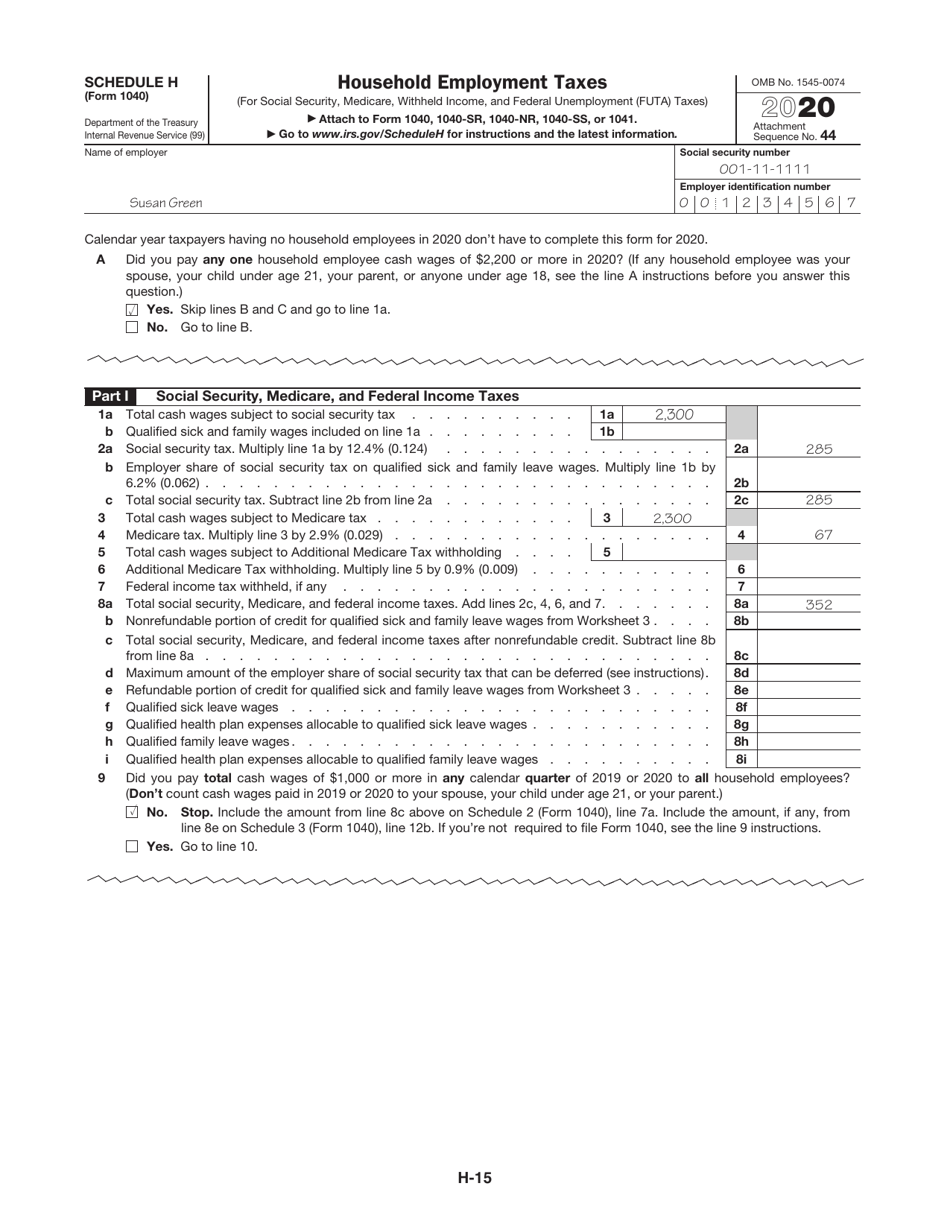

A: IRS Form 1040 Schedule H is used to report household employment taxes.

Q: What are household employment taxes?

A: Household employment taxes are the taxes paid by individuals who employ domestic workers.

Q: Who needs to file IRS Form 1040 Schedule H?

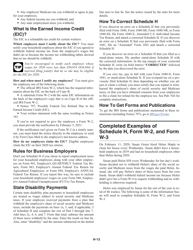

A: You need to file IRS Form 1040 Schedule H if you paid a household employee $2,300 or more in wages in 2020.

Q: What information do I need to complete IRS Form 1040 Schedule H?

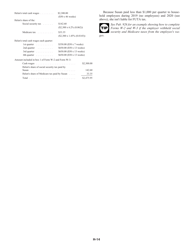

A: You will need the employer's identification number, household employee's Social Security number, and the wages paid to the employee.

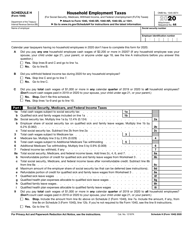

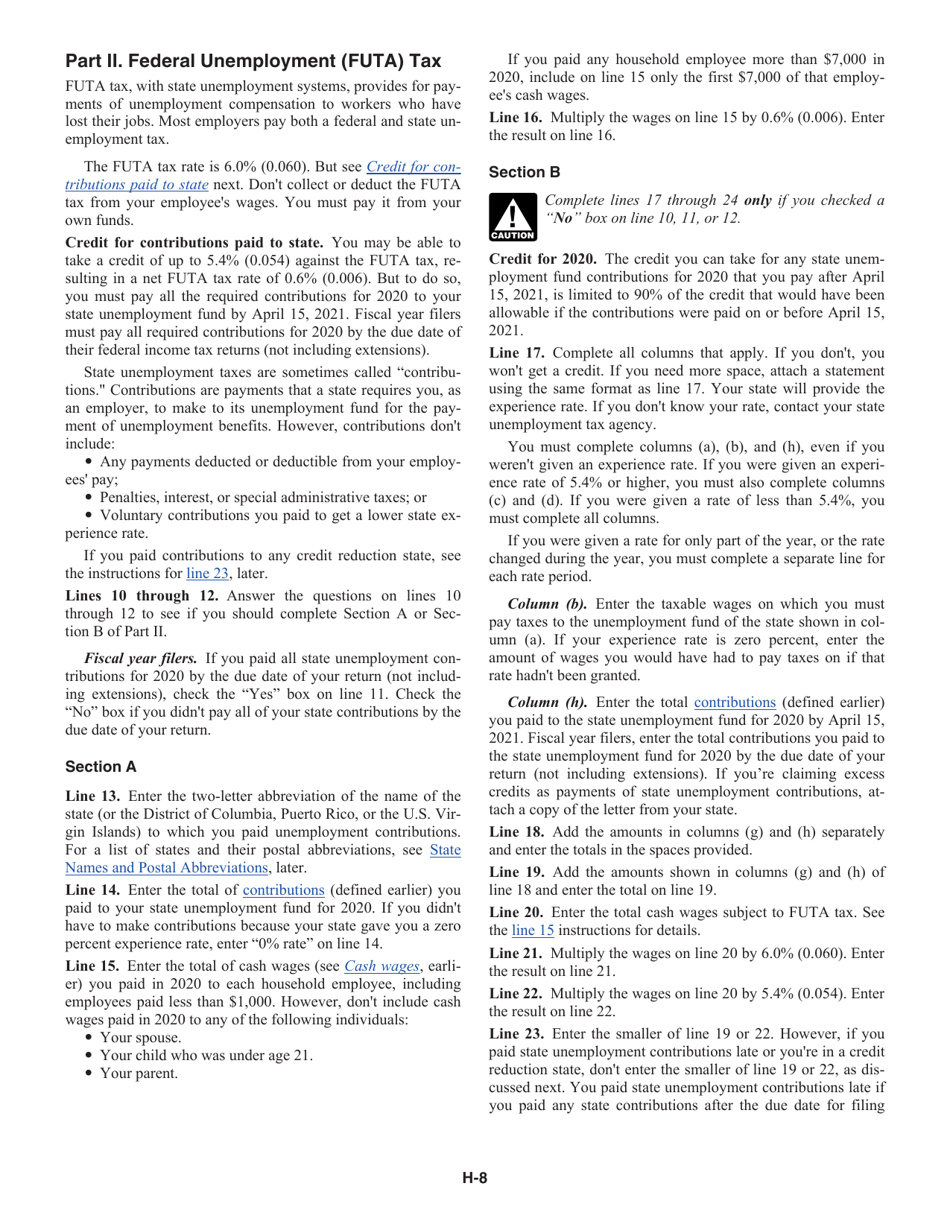

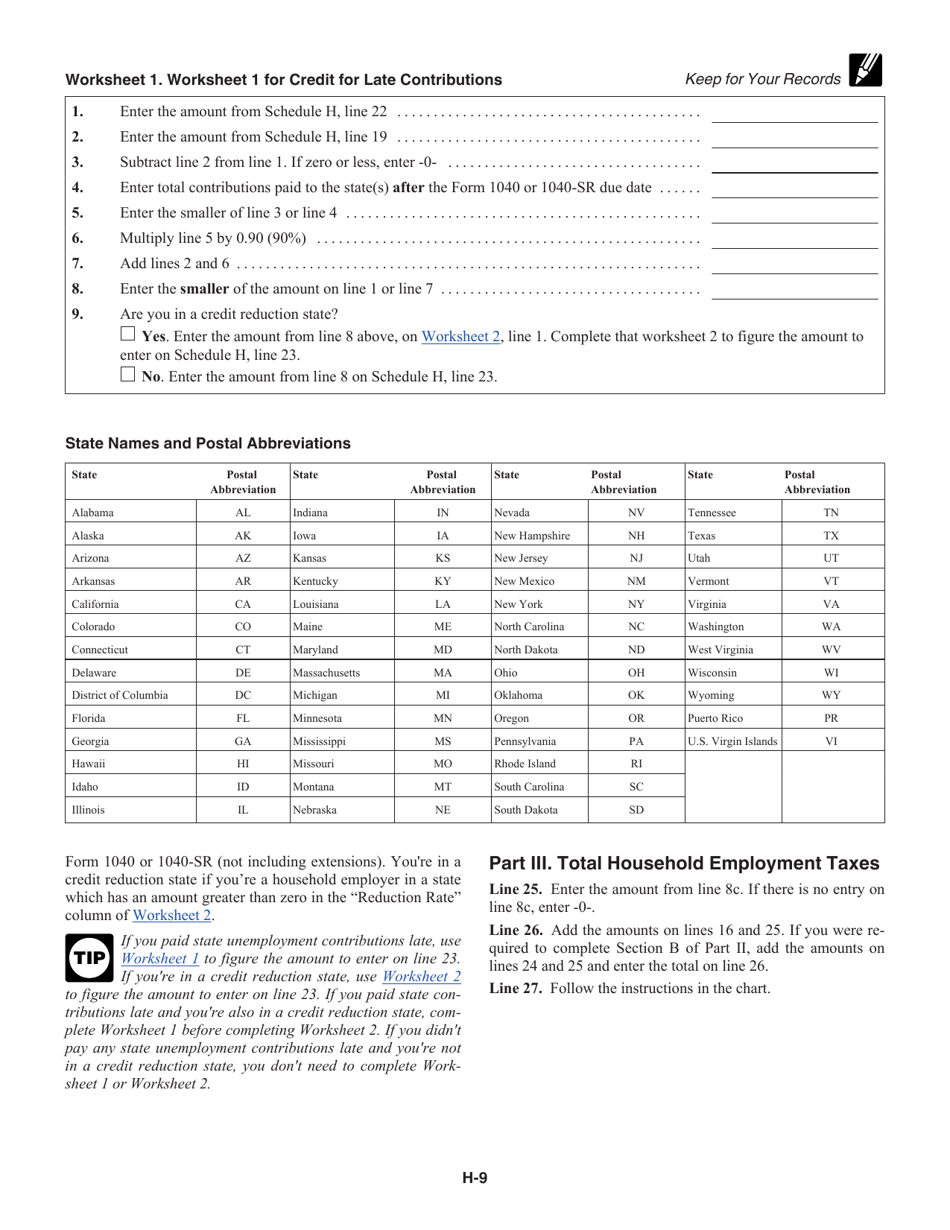

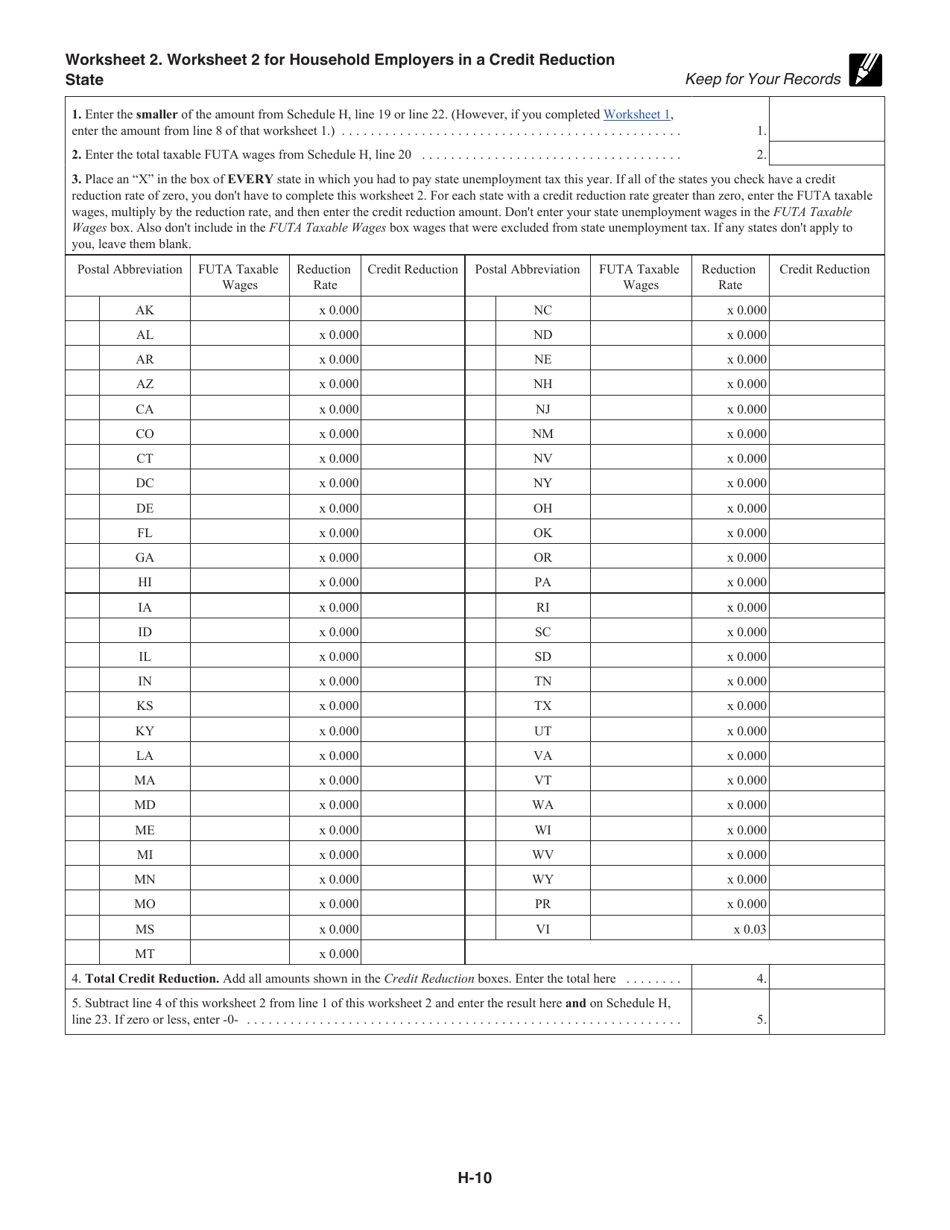

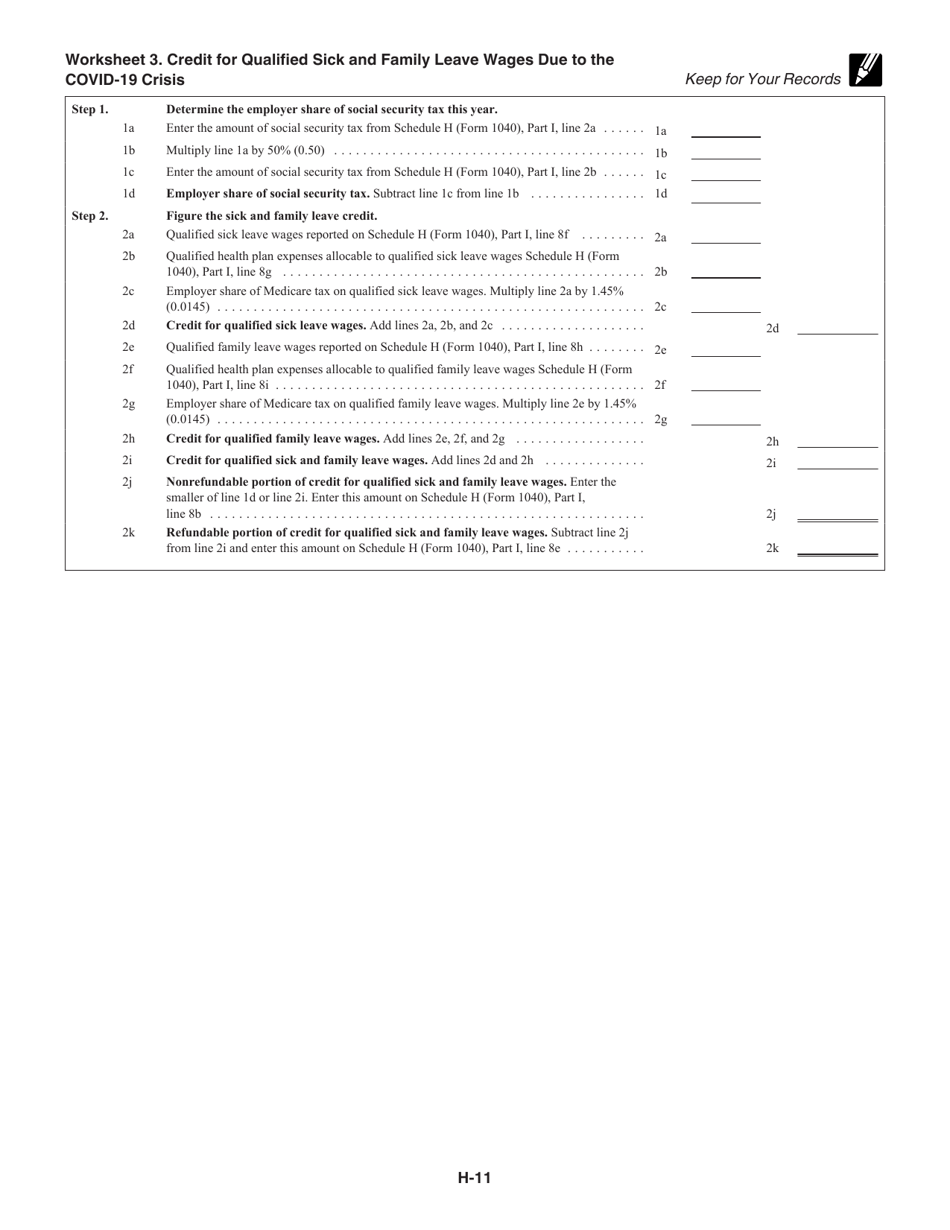

Q: How do I calculate household employment taxes?

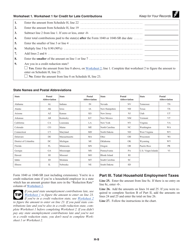

A: Household employment taxes include Social Security and Medicare taxes, federal unemployment taxes, and any applicable state taxes.

Q: When is the deadline for filing IRS Form 1040 Schedule H?

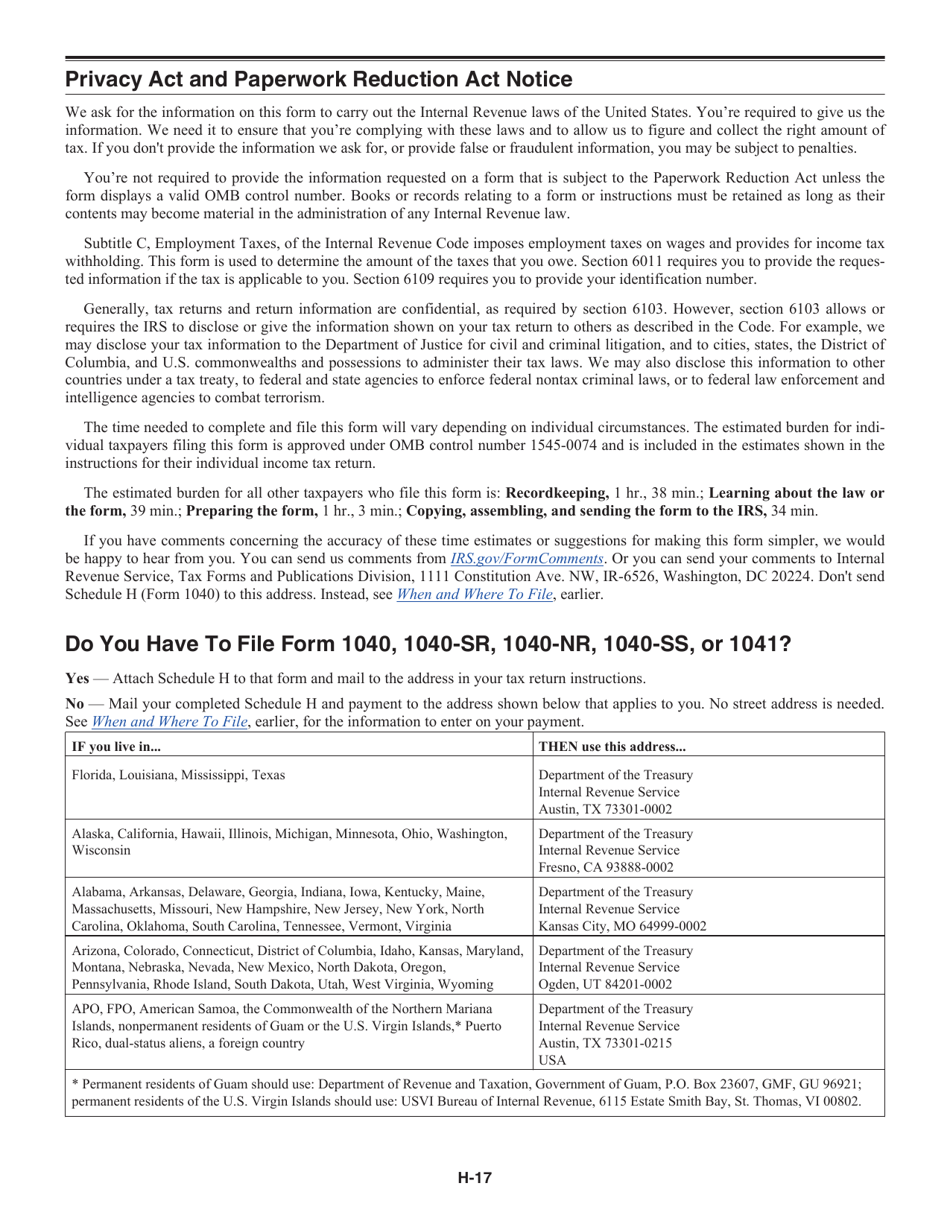

A: The deadline for filing IRS Form 1040 Schedule H is usually April 15th, unless it falls on a weekend or holiday.

Q: Can I e-file IRS Form 1040 Schedule H?

A: No, you cannot e-file IRS Form 1040 Schedule H. It must be filed by mail.

Instruction Details:

- This 17-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.