This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1040 Schedule H

for the current year.

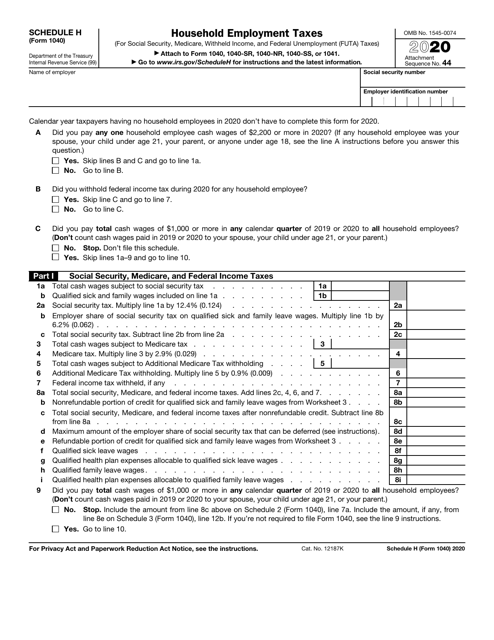

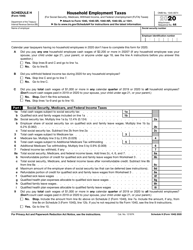

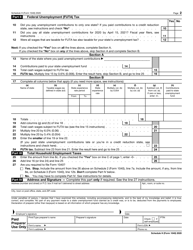

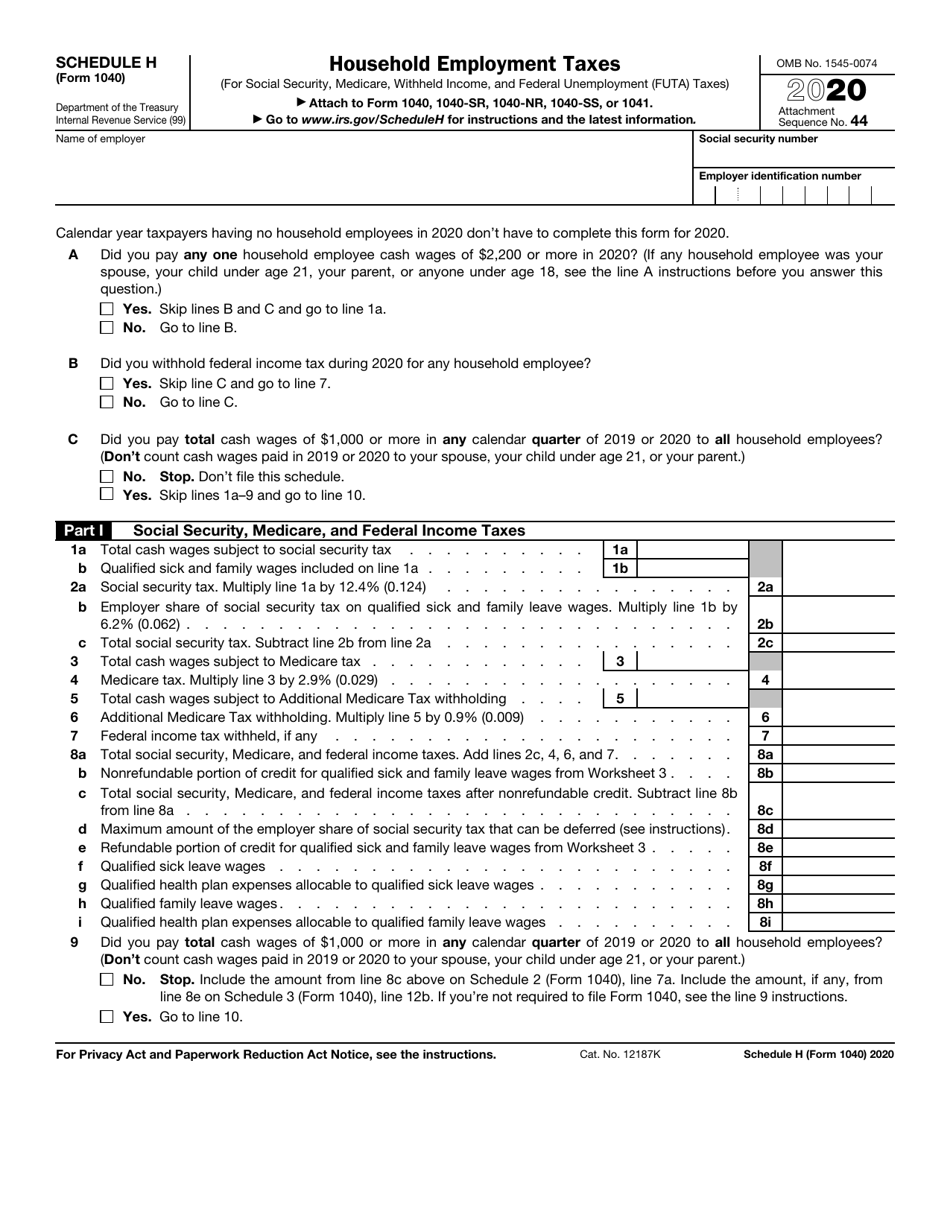

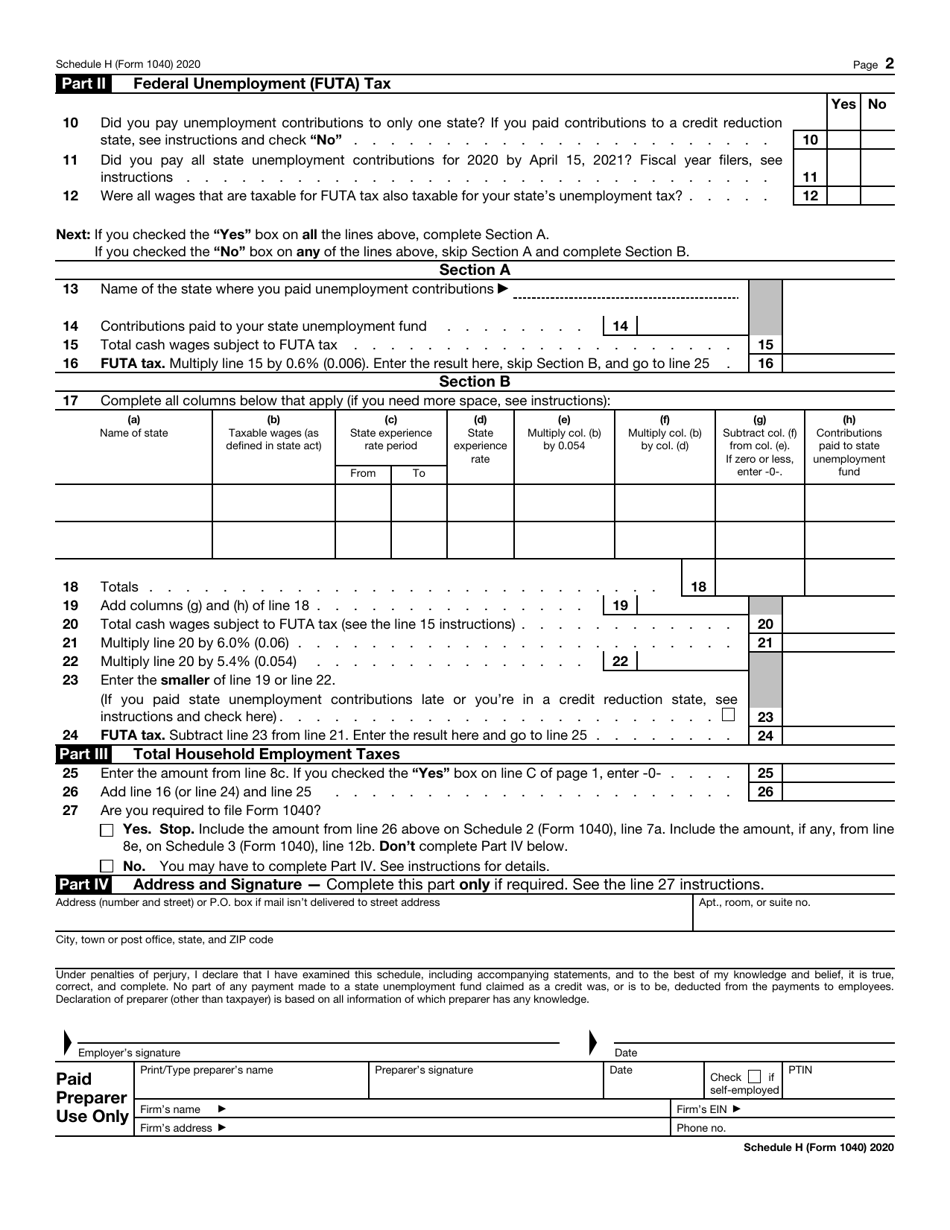

IRS Form 1040 Schedule H Household Employment Taxes

What Is IRS Form 1040 Schedule H?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1040 Schedule H?

A: IRS Form 1040 Schedule H is a form used to report household employment taxes.

Q: Who needs to file IRS Form 1040 Schedule H?

A: You need to file IRS Form 1040 Schedule H if you paid a household employee and withheld federal income tax from their wages.

Q: What are household employment taxes?

A: Household employment taxes are the taxes that need to be paid on wages paid to household employees.

Q: What information is required to complete IRS Form 1040 Schedule H?

A: You will need the total wages paid to household employees, federal income tax withheld, and any other taxes paid.

Q: When is the deadline to file IRS Form 1040 Schedule H?

A: The deadline to file IRS Form 1040 Schedule H is usually April 15th, the same deadline as the regular Form 1040.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 Schedule H through the link below or browse more documents in our library of IRS Forms.