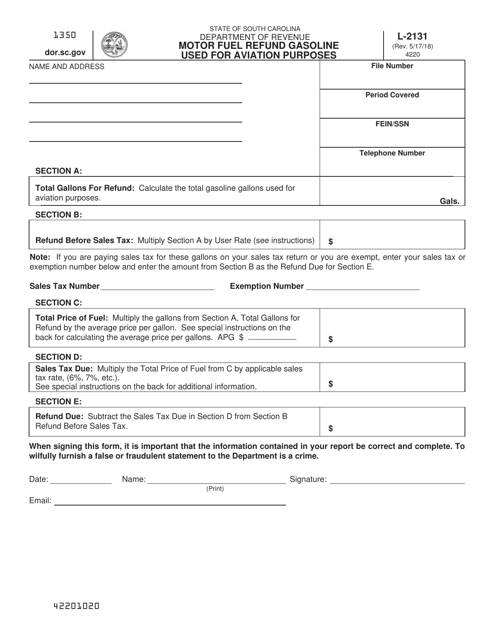

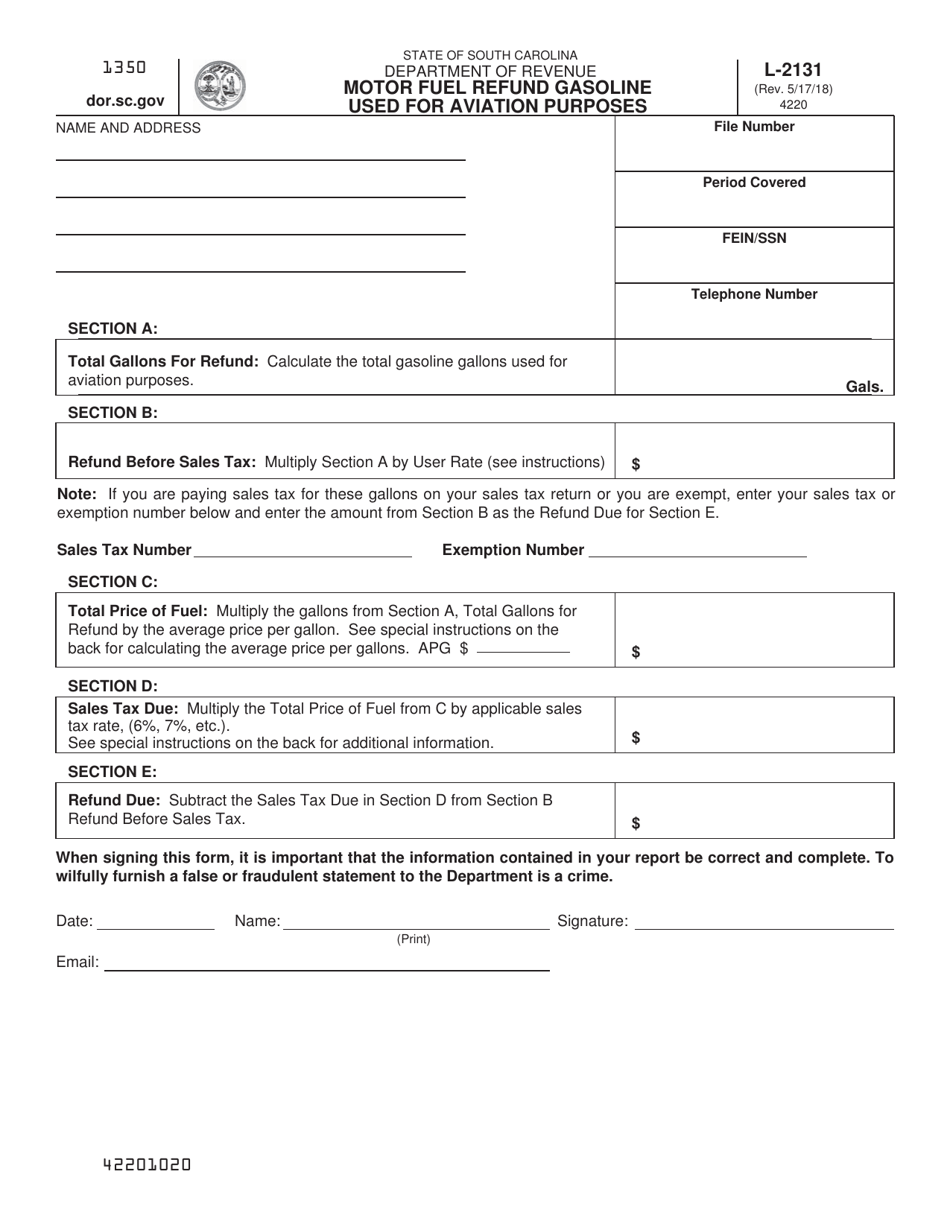

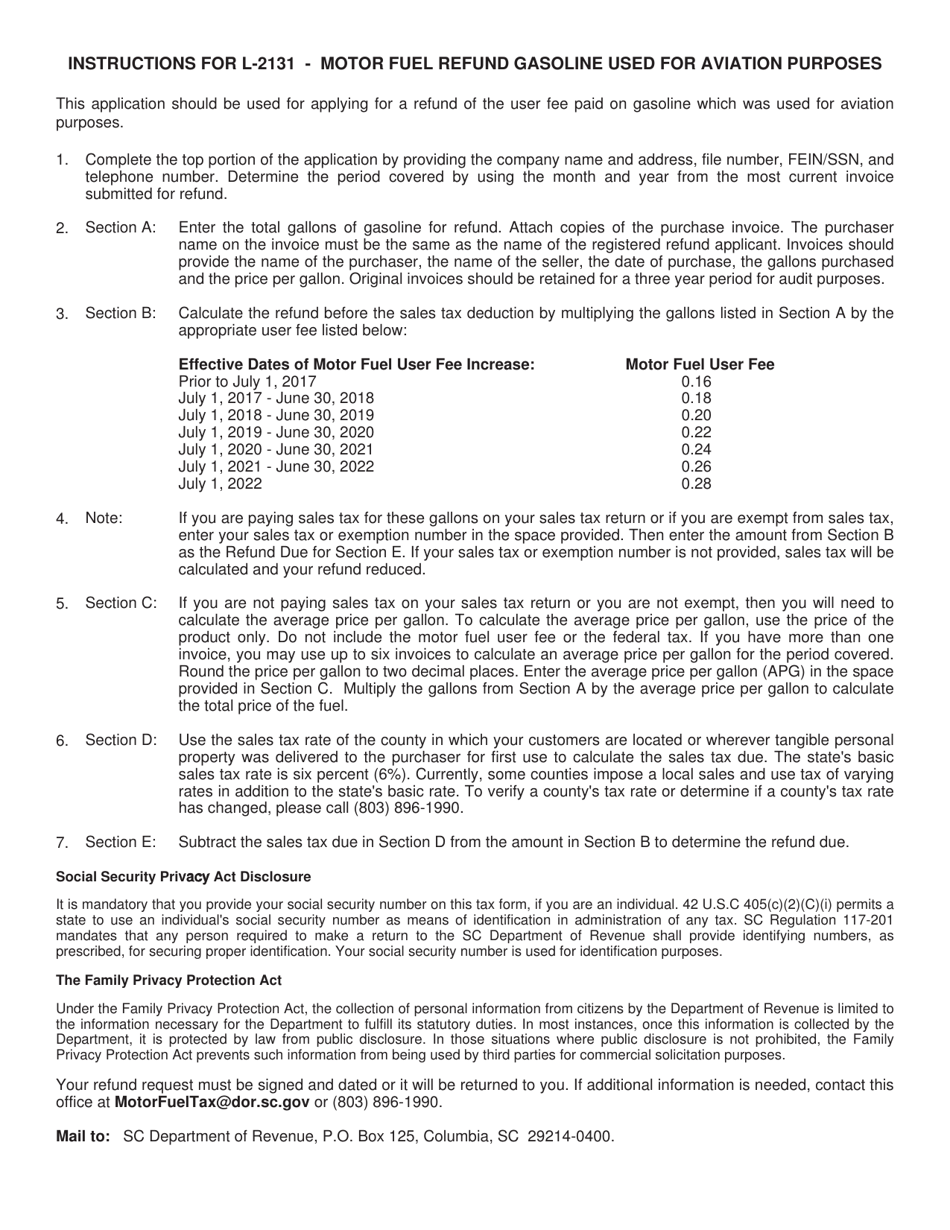

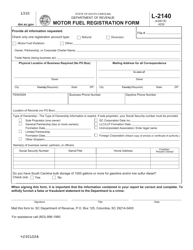

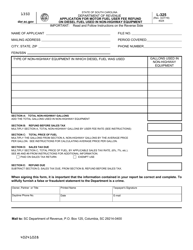

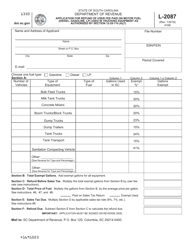

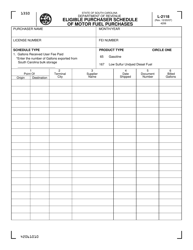

Form L-2131 Motor Fuel Refund Gasoline Used for Aviation Purposes - South Carolina

What Is Form L-2131?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form L-2131?

A: Form L-2131 is a Motor Fuel Refund form in South Carolina.

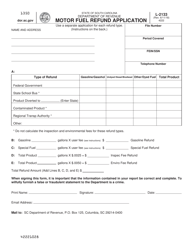

Q: What is Motor Fuel Refund?

A: Motor Fuel Refund is a program that allows certain entities to claim a refund for motor fueltax paid on fuel used for specific purposes.

Q: What is gasoline used for aviation purposes?

A: Gasoline used for aviation purposes refers to the fuel used in aircraft.

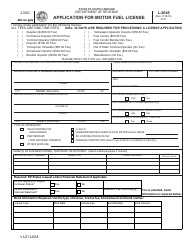

Q: Who can use Form L-2131?

A: This form is used by entities in South Carolina that operate aircraft and want to claim a refund for the motor fuel tax paid on gasoline used for aviation purposes.

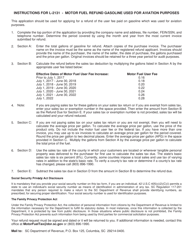

Q: What information is required on Form L-2131?

A: The form requires information such as the taxpayer's name, address, aircraft information, fuel purchase details, and the amount of refund being claimed.

Q: Is there a deadline for filing Form L-2131?

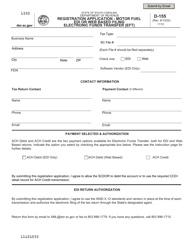

A: Yes, Form L-2131 must be filed by the 20th day of the month following the end of the quarter in which the motor fuel was purchased.

Q: Is there a fee for filing Form L-2131?

A: No, there is no fee for filing Form L-2131.

Q: What supporting documents should be included with Form L-2131?

A: Supporting documents such as fuel receipts, invoices, and other records of fuel purchases should be included.

Q: Are there any penalties for late or incorrect filing of Form L-2131?

A: Yes, there may be penalties for late or incorrect filing of Form L-2131, including interest on the unpaid tax amount.

Form Details:

- Released on May 17, 2018;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form L-2131 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.