This version of the form is not currently in use and is provided for reference only. Download this version of

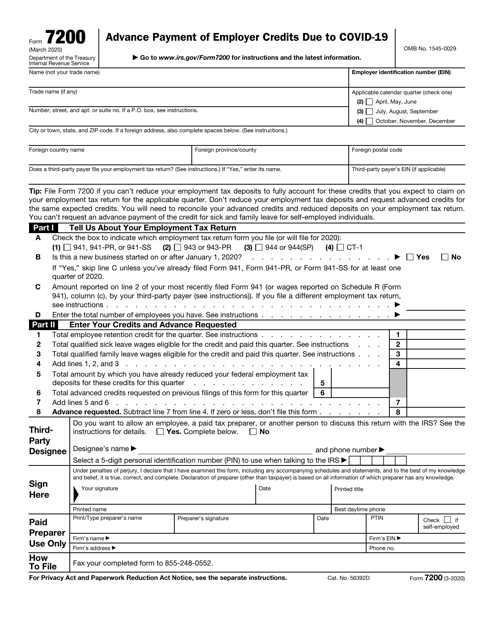

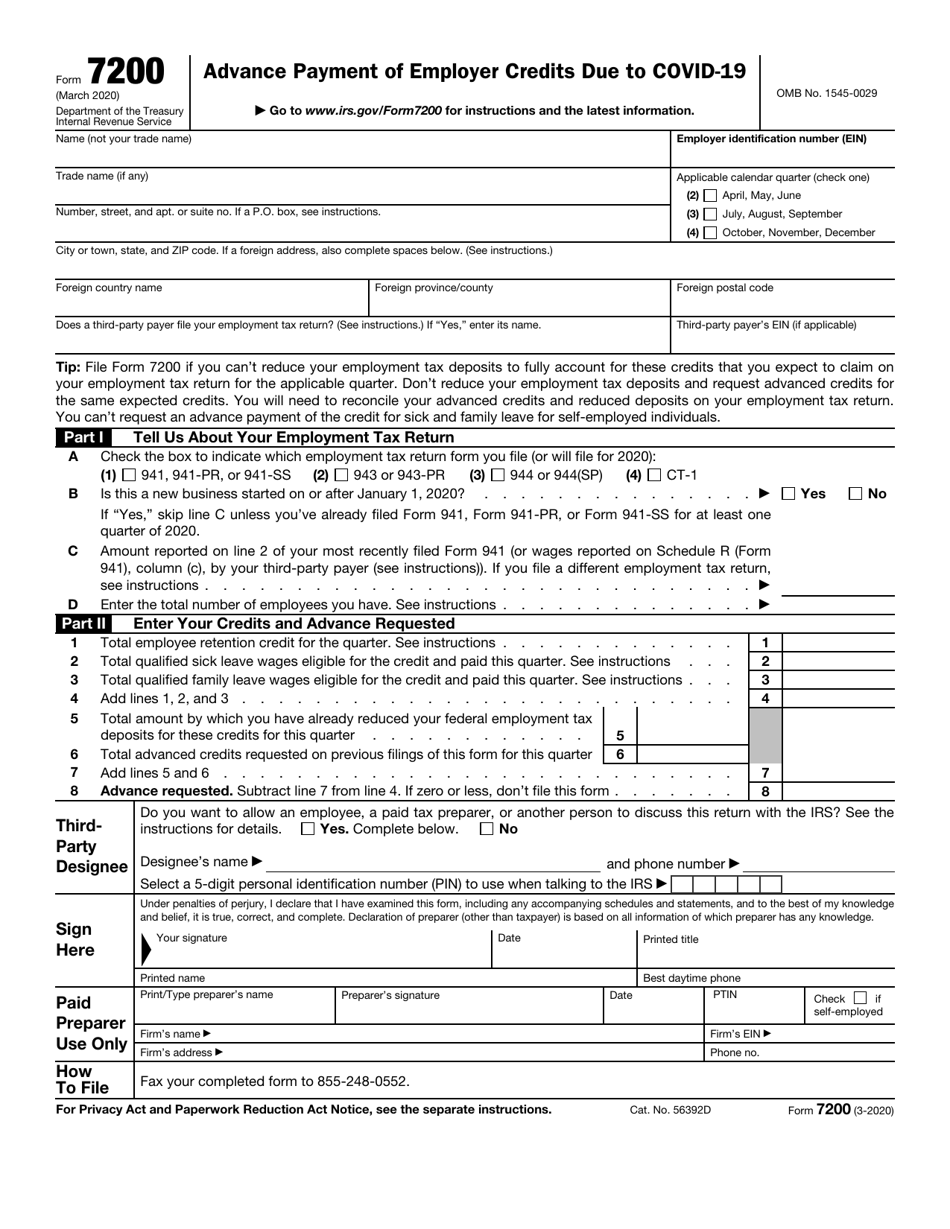

IRS Form 7200

for the current year.

IRS Form 7200 Advance Payment of Employer Credits Due to Covid-19

What Is IRS Form 7200?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on March 1, 2020. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 7200?

A: IRS Form 7200 is used for requesting advance payment of employer credits due to Covid-19.

Q: What are employer credits due to Covid-19?

A: Employer credits due to Covid-19 refer to the tax credits provided by the IRS to help businesses affected by the pandemic.

Q: Who can use IRS Form 7200?

A: Employers who are eligible for the Covid-19-related tax credits can use IRS Form 7200 to request advance payment.

Q: How can I request advance payment of employer credits?

A: You can request advance payment by filing IRS Form 7200 with the IRS.

Q: What information is required on IRS Form 7200?

A: IRS Form 7200 requires information such as employer identification number, tax period, the total amount of anticipated credits, and the amount of advance payment requested.

Q: Is there a deadline for filing IRS Form 7200?

A: Yes, IRS Form 7200 should be filed as soon as possible after you have determined the qualified wages and credits, and you can file it before you file your employment tax return.

Q: What happens after I file IRS Form 7200?

A: The IRS will review your form and, if approved, will issue a refund or credit the requested amount.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 7200 through the link below or browse more documents in our library of IRS Forms.