This version of the form is not currently in use and is provided for reference only. Download this version of

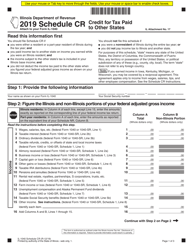

Instructions for Form IL-1040 Schedule CR

for the current year.

Instructions for Form IL-1040 Schedule CR Credit for Tax Paid to Other States for Unemployment Exclusion - Illinois

This document contains official instructions for Form IL-1040 Schedule CR, Credit for Tax Paid to Other States for Unemployment Exclusion - a form released and collected by the Illinois Department of Revenue.

FAQ

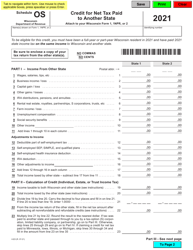

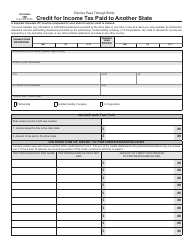

Q: What is the purpose of Form IL-1040 Schedule CR?

A: The purpose of Form IL-1040 Schedule CR is to claim a credit for tax paid to other states for unemployment exclusion in Illinois.

Q: Who is eligible to use Form IL-1040 Schedule CR?

A: Individuals who received unemployment benefits and had income from other states are eligible to use Form IL-1040 Schedule CR.

Q: What is the unemployment exclusion in Illinois?

A: The unemployment exclusion in Illinois allows individuals to exclude a portion of their unemployment benefits from their taxable income.

Q: How do you determine the credit for tax paid to other states?

A: To determine the credit for tax paid to other states, you will need to complete Schedule CR by calculating the tax you would have paid to Illinois on your out-of-state income.

Q: Can I claim a credit for taxes paid to other countries on Form IL-1040 Schedule CR?

A: No, Form IL-1040 Schedule CR is specifically for claiming a credit for tax paid to other states. Taxes paid to other countries are not eligible.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.