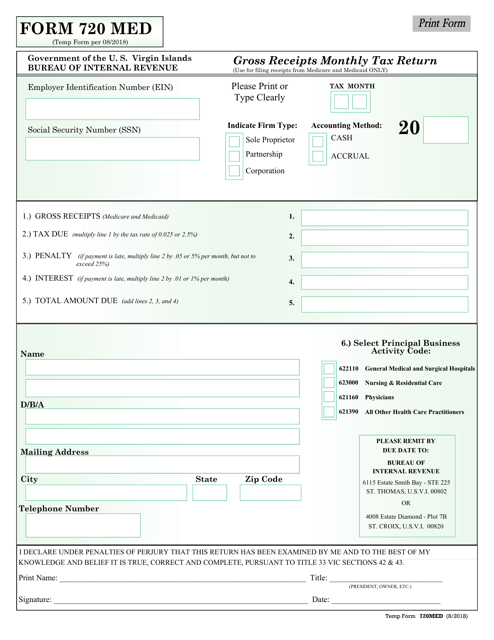

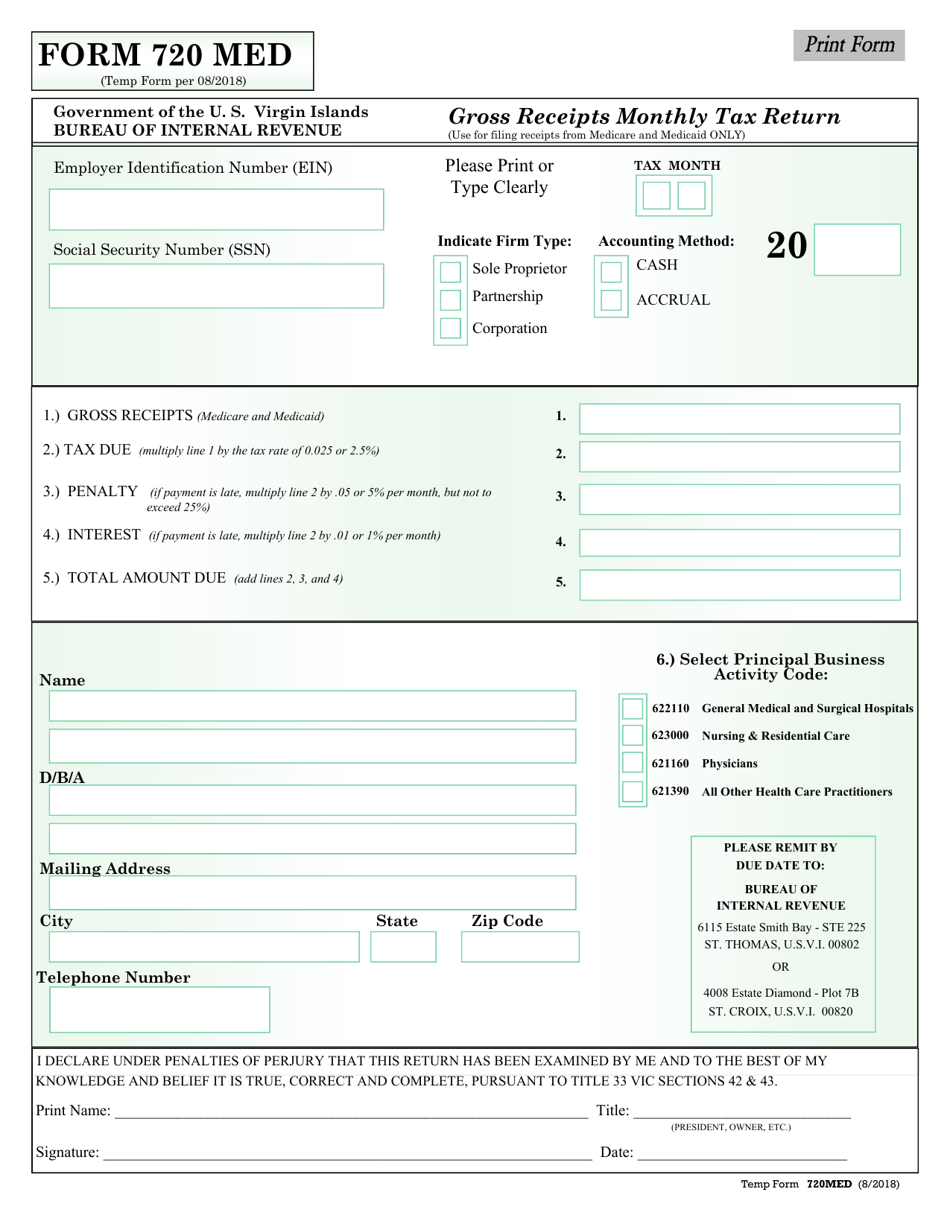

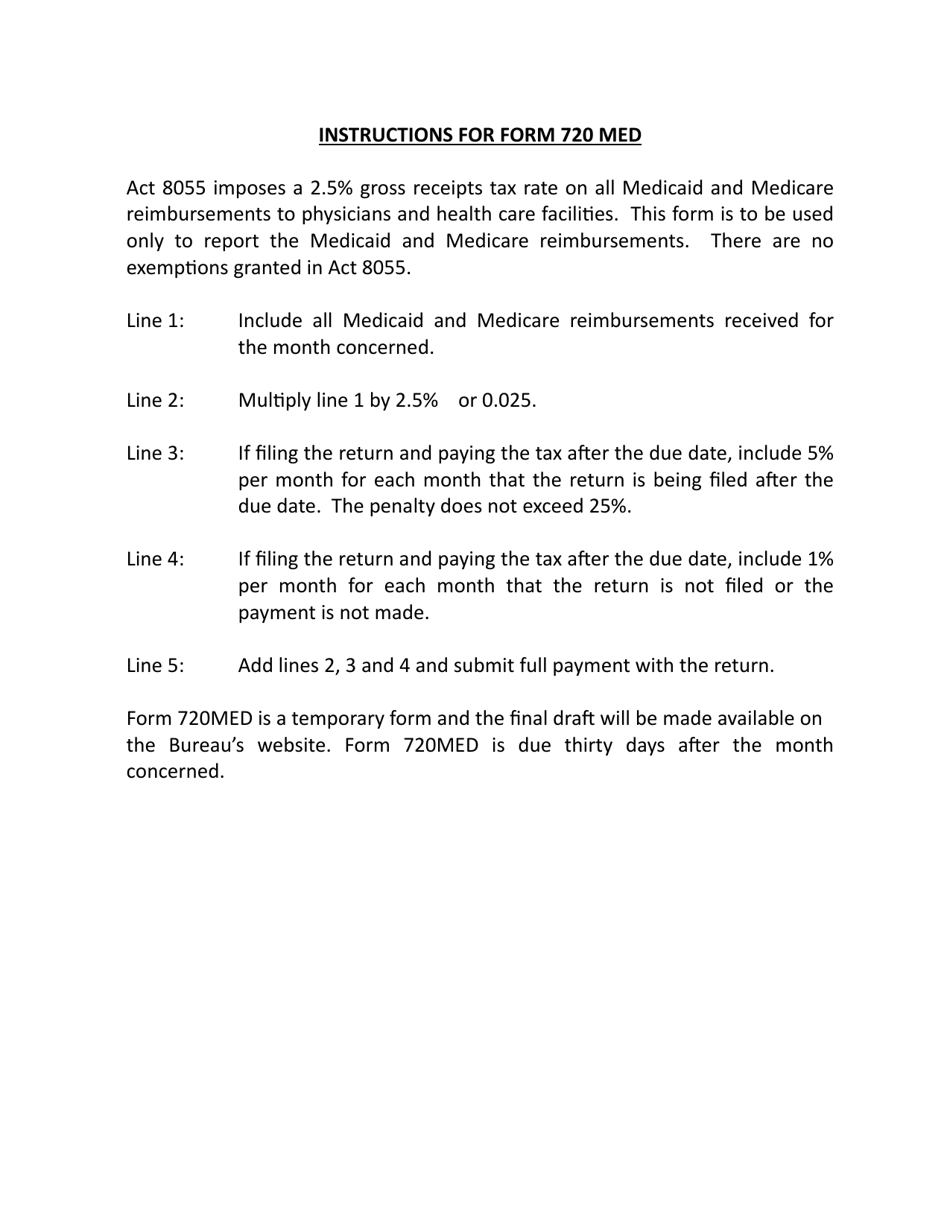

Form 720 MED Gross Receipts Monthly Tax Return - Virgin Islands

What Is Form 720 MED?

This is a legal form that was released by the Virgin Islands Bureau of Internal Revenue - a government authority operating within Virgin Islands. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 720 MED?

A: Form 720 MED is a tax return form used for reporting gross receipts in the Virgin Islands.

Q: Who should file Form 720 MED?

A: Any person or business engaged in a trade or business in the Virgin Islands that has gross receipts over a certain threshold should file Form 720 MED.

Q: What are gross receipts?

A: Gross receipts refer to the total amount of money received from sales or business activities before deducting any expenses.

Q: What information is required on Form 720 MED?

A: Form 720 MED requires information about the taxpayer's name, address, gross receipts, and any exemptions or reductions in tax liability.

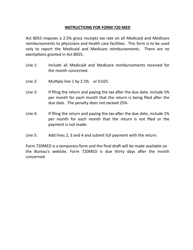

Q: When is the deadline for filing Form 720 MED?

A: Form 720 MED must be filed on a monthly basis, and the deadline is typically the last day of the month following the reporting period.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Virgin Islands Bureau of Internal Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 720 MED by clicking the link below or browse more documents and templates provided by the Virgin Islands Bureau of Internal Revenue.