This version of the form is not currently in use and is provided for reference only. Download this version of

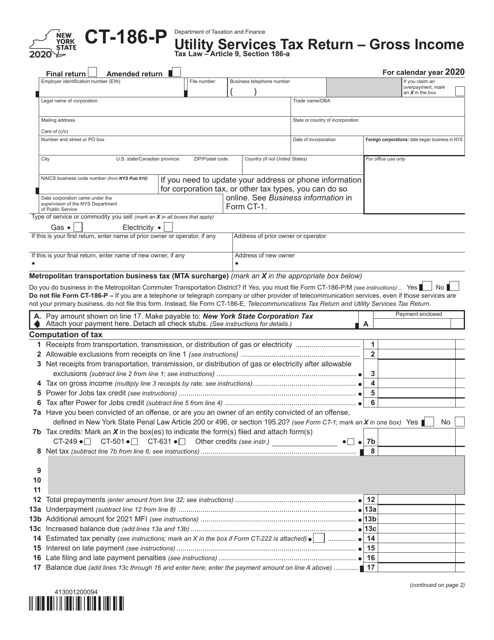

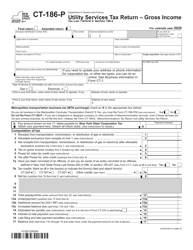

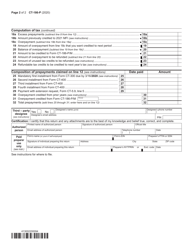

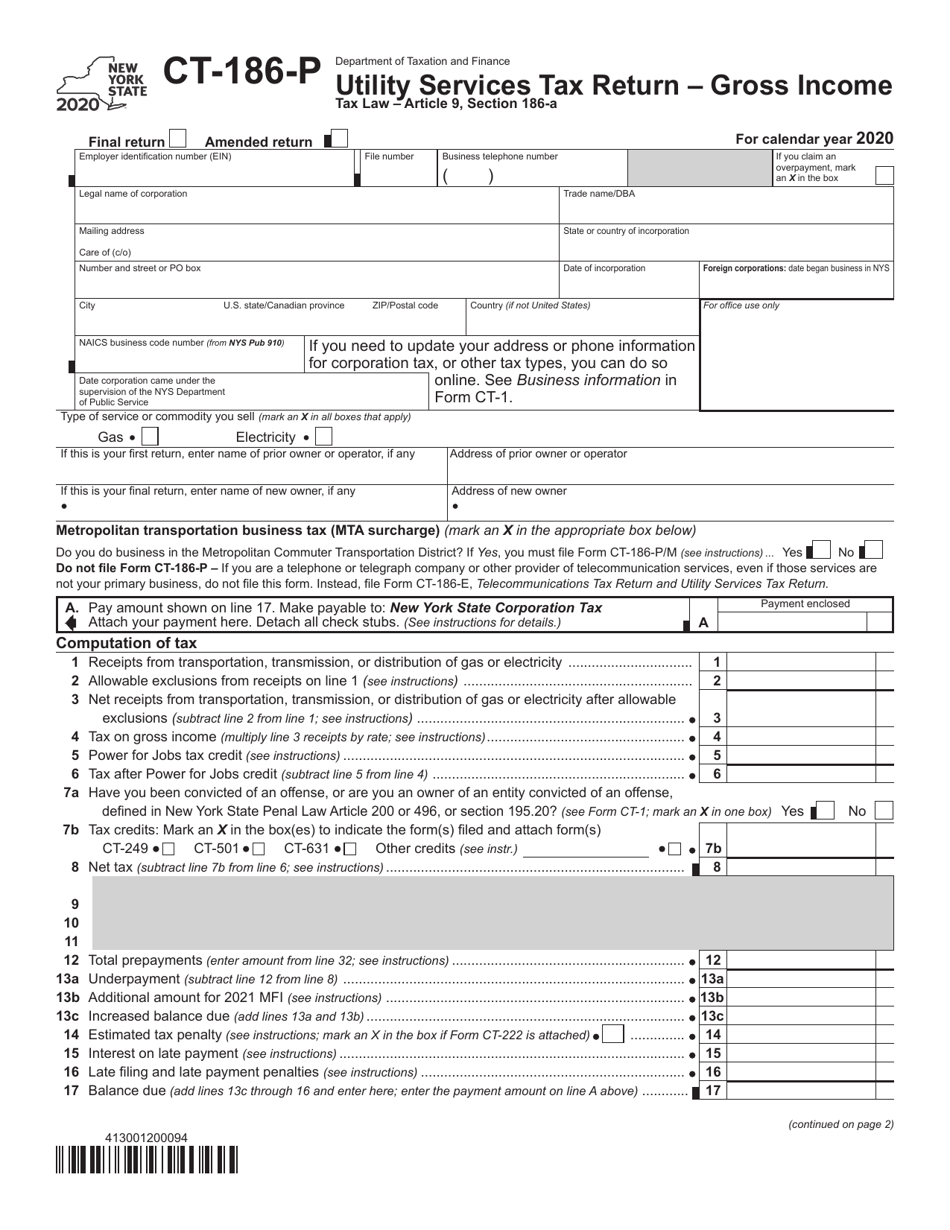

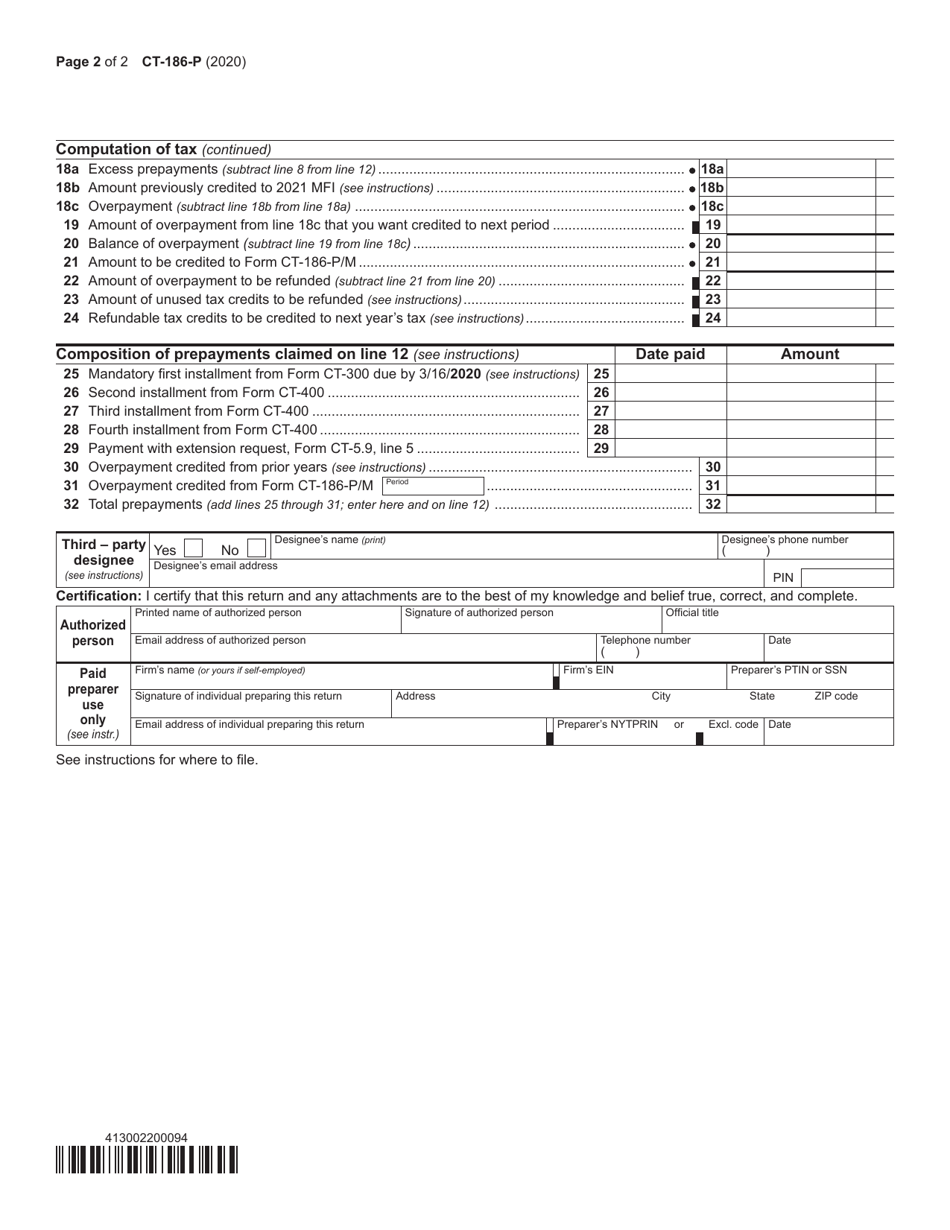

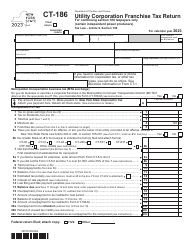

Form CT-186-P

for the current year.

Form CT-186-P Utility Services Tax Return - Gross Income - New York

What Is Form CT-186-P?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-186-P?

A: Form CT-186-P is the Utility Services Tax Return in New York.

Q: What does Form CT-186-P calculate?

A: Form CT-186-P calculates the gross income for utility services in New York.

Q: Who needs to file Form CT-186-P?

A: Businesses that provide utility services in New York need to file Form CT-186-P.

Q: What is considered gross income for utility services?

A: Gross income for utility services includes all revenues received from providing utility services in New York.

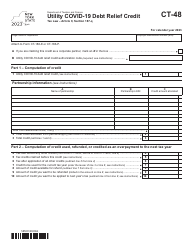

Q: Are there any exemptions or deductions available?

A: There may be exemptions and deductions available based on the specific circumstances. It is recommended to consult the instructions for Form CT-186-P or a tax professional for more information.

Q: When is the due date for filing Form CT-186-P?

A: The due date for filing Form CT-186-P may vary. It is typically due annually, but specific deadlines can be found in the instructions or through the New York State Department of Taxation and Finance.

Q: Are there any penalties for late filing or non-compliance?

A: Penalties may apply for late filing or non-compliance. It is important to file the form on time and fulfill all necessary requirements to avoid penalties.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-186-P by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.