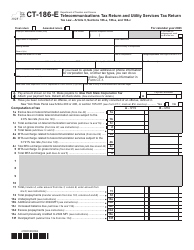

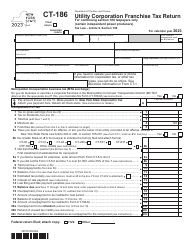

This version of the form is not currently in use and is provided for reference only. Download this version of

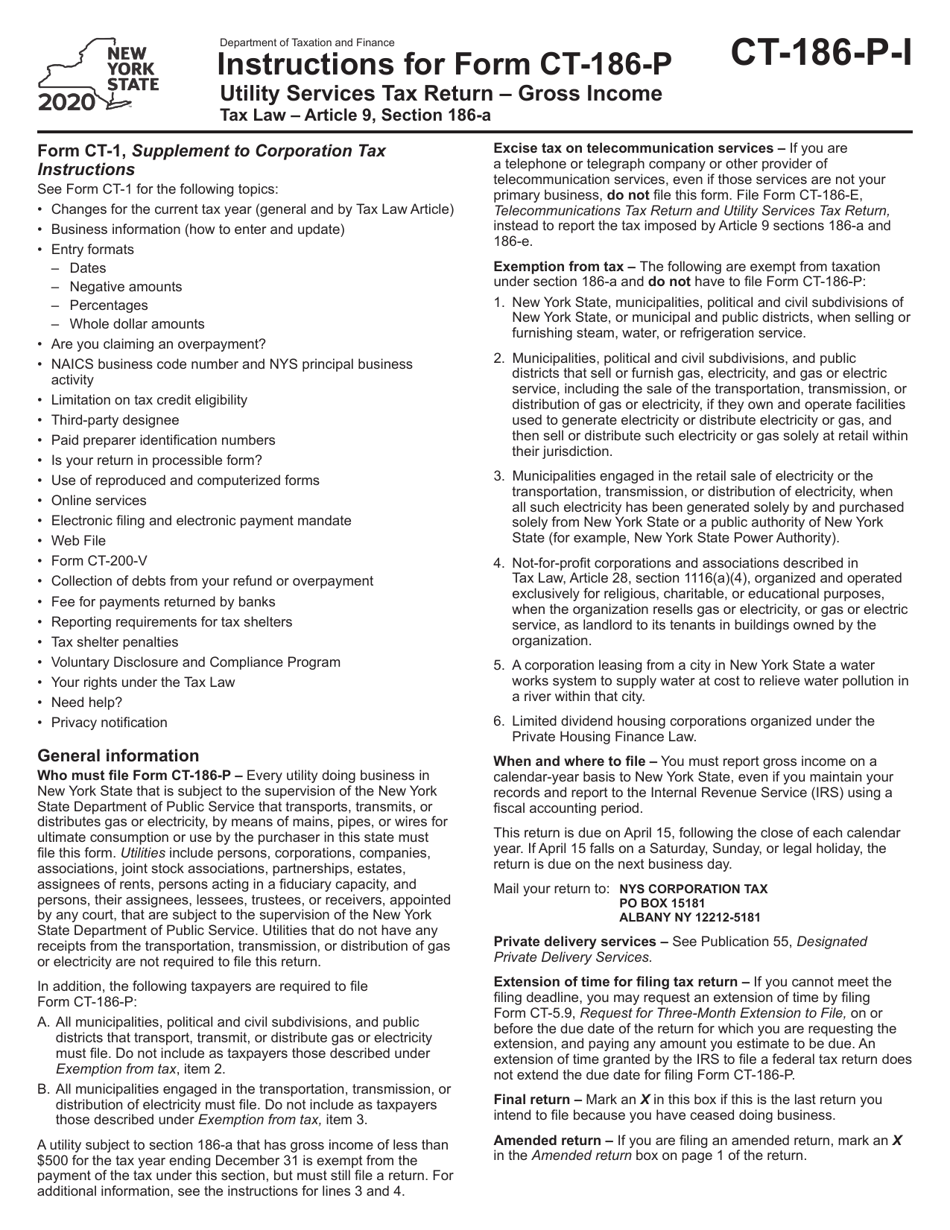

Instructions for Form CT-186-P

for the current year.

Instructions for Form CT-186-P Utility Services Tax Return - Gross Income - New York

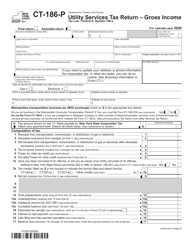

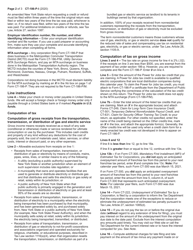

This document contains official instructions for Form CT-186-P , Utility Services Tax Return - Gross Income - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CT-186-P is available for download through this link.

FAQ

Q: What is Form CT-186-P?

A: Form CT-186-P is the Utility Services Tax Return for reporting gross income in New York.

Q: What is the purpose of Form CT-186-P?

A: Form CT-186-P is used to report gross income from utility services in New York.

Q: Who needs to file Form CT-186-P?

A: Any business entity that provides utility services and has gross income from those services in New York needs to file Form CT-186-P.

Q: What is considered utility services?

A: Utility services include electricity, gas, water, steam, or telecommunications services.

Q: What is meant by gross income?

A: Gross income refers to the total income before subtracting any expenses or deductions.

Q: Are there any exemptions or deductions available for utility services?

A: Yes, certain exemptions and deductions may be available. Please refer to the instructions for Form CT-186-P for more details.

Q: When is Form CT-186-P due?

A: The due date for filing Form CT-186-P varies. Please refer to the instructions or contact the New York State Department of Taxation and Finance for the specific due date.

Instruction Details:

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.