This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form CT-3.3

for the current year.

Instructions for Form CT-3.3 Prior Net Operating Loss Conversion (Pnolc) Subtraction - New York

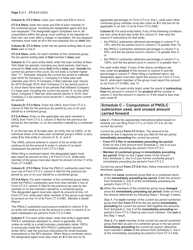

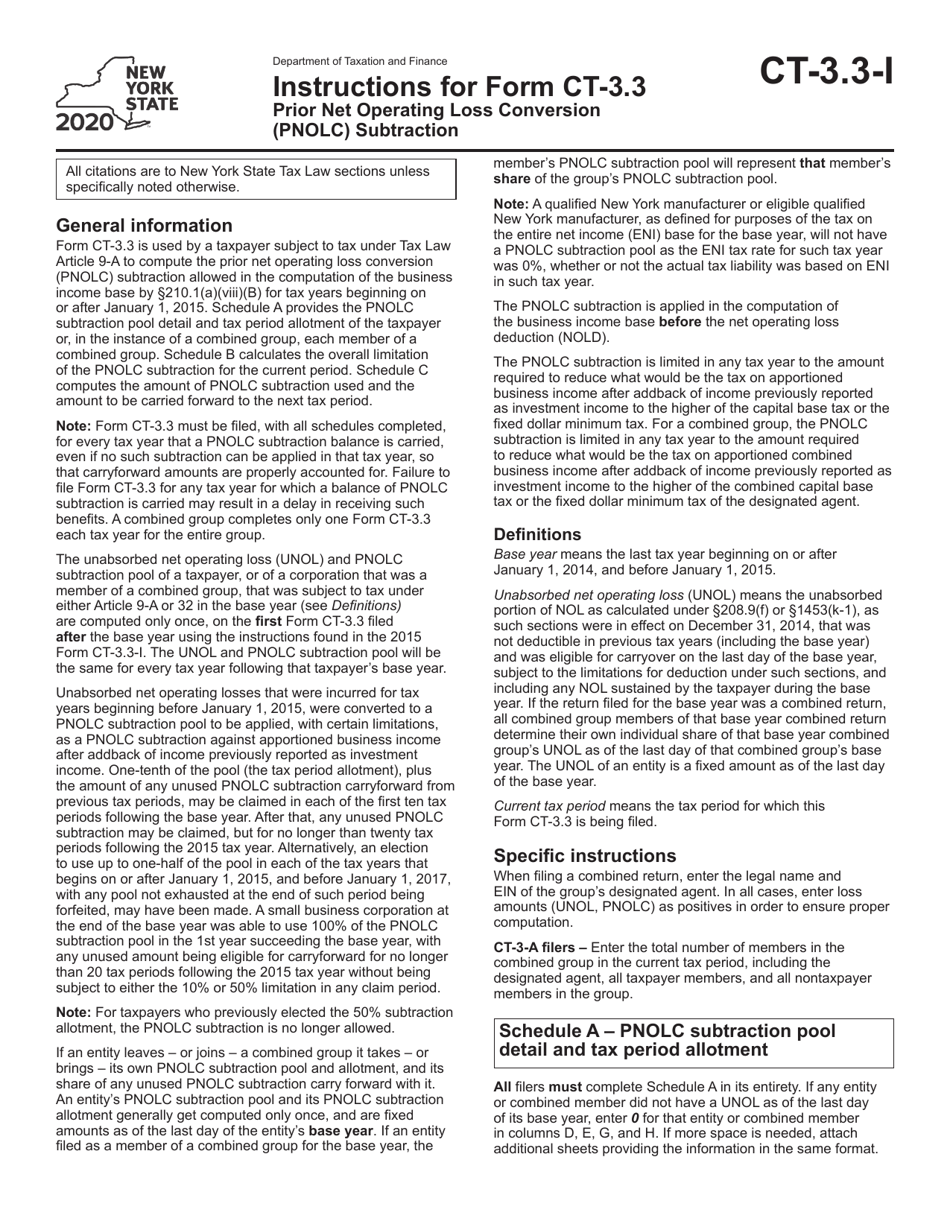

This document contains official instructions for Form CT-3.3 , Prior Net Operating Loss Conversion (Pnolc) Subtraction - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CT-3.3 is available for download through this link.

FAQ

Q: What is Form CT-3.3?

A: Form CT-3.3 is a tax form specific to New York State that is used for the Prior Net Operating Loss Conversion (PNOLC) Subtraction.

Q: What is the Prior Net Operating Loss Conversion (PNOLC) Subtraction?

A: The PNOLC Subtraction is a deduction that allows taxpayers in New York State to carry forward and deduct prior net operating losses from previous tax years.

Q: Who needs to file Form CT-3.3?

A: Taxpayers in New York State who have a prior net operating loss that they want to carry forward and deduct on their current tax return need to file Form CT-3.3.

Q: What information do I need to complete Form CT-3.3?

A: To complete Form CT-3.3, you will need information about your prior net operating loss, including the amount, year incurred, and any modifications.

Q: Are there any specific instructions to follow when filling out Form CT-3.3?

A: Yes, there are specific instructions provided on the form itself. It is important to review and follow these instructions carefully to ensure accurate completion.

Q: When is the deadline to file Form CT-3.3?

A: The deadline to file Form CT-3.3 is the same as the deadline for filing your New York State tax return, which is typically April 15th.

Q: Can I file Form CT-3.3 electronically?

A: Yes, Form CT-3.3 can be filed electronically using the New York State Department of Taxation and Finance's e-file system.

Q: Is there a fee to file Form CT-3.3?

A: No, there is no fee to file Form CT-3.3.

Instruction Details:

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.