This version of the form is not currently in use and is provided for reference only. Download this version of

Form CT-3.3

for the current year.

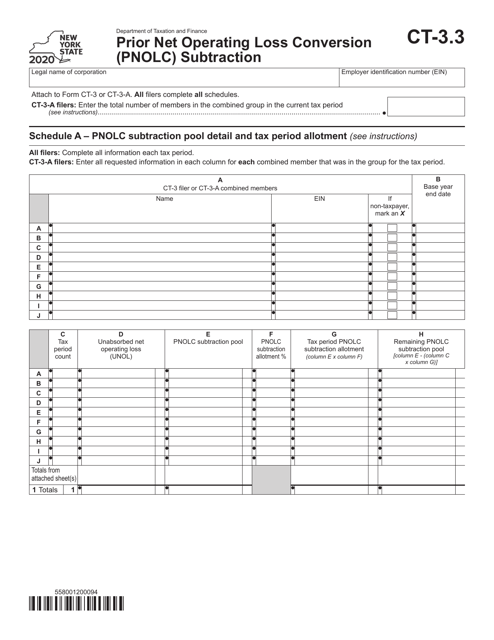

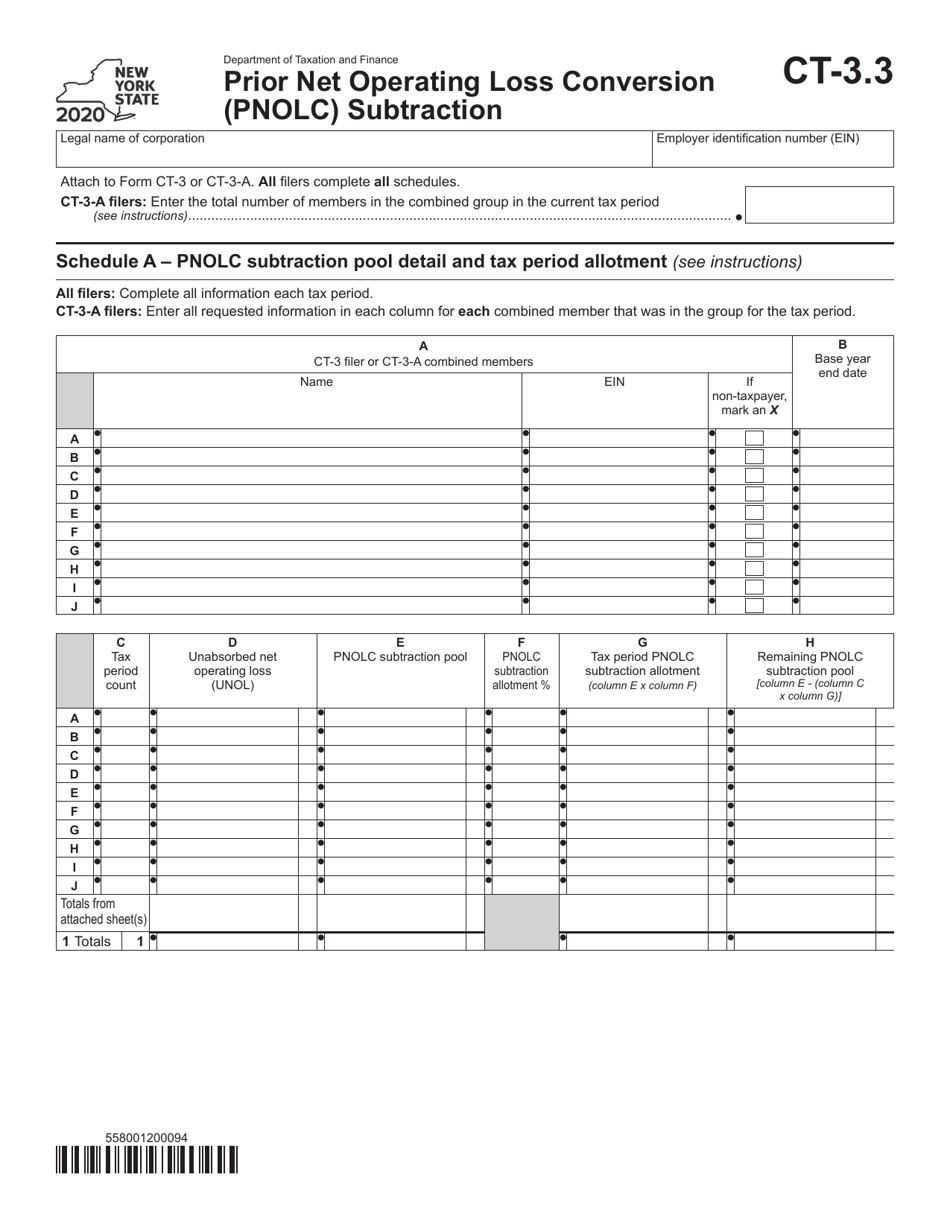

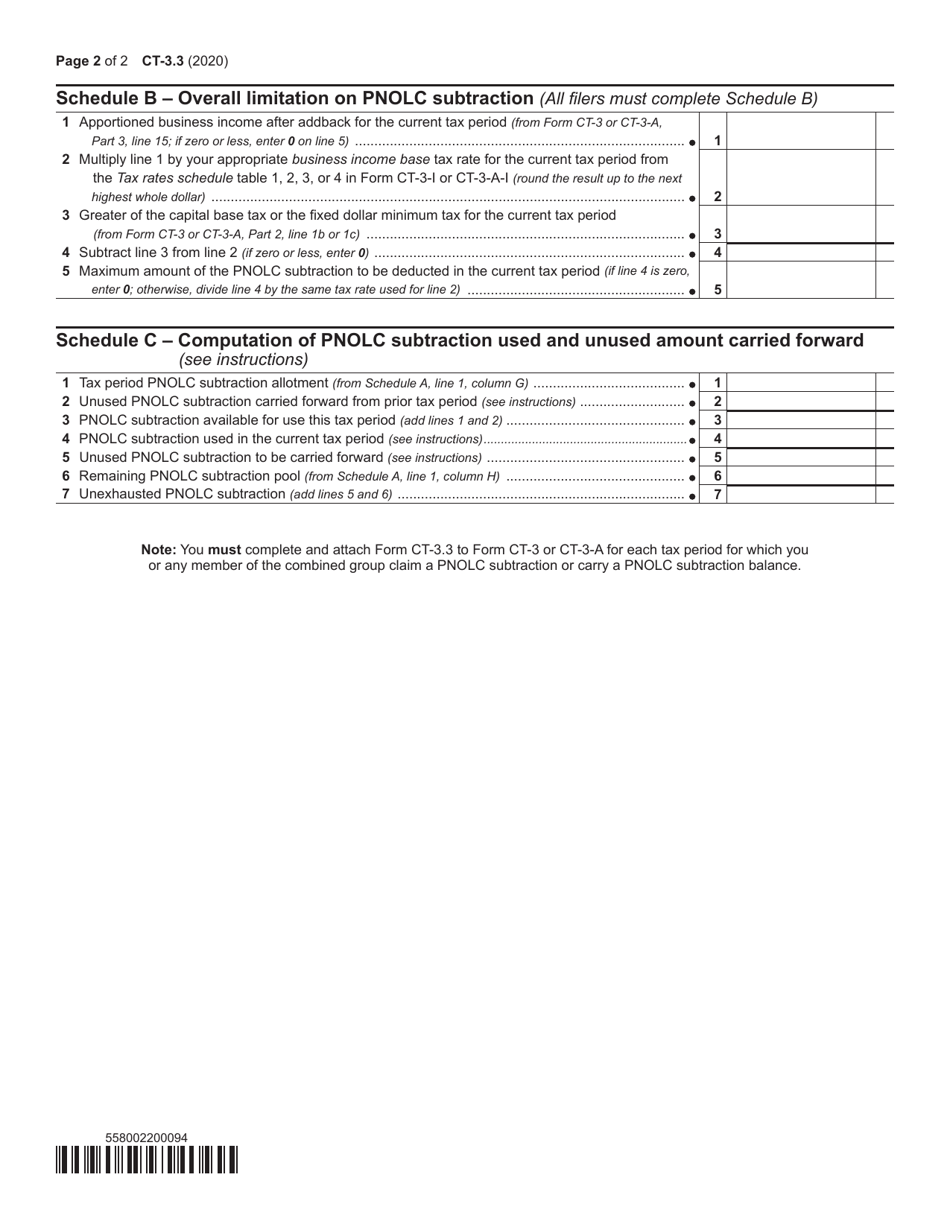

Form CT-3.3 Prior Net Operating Loss Conversion (Pnolc) Subtraction - New York

What Is Form CT-3.3?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-3.3?

A: Form CT-3.3 is a tax form used in New York.

Q: What is Prior Net Operating Loss Conversion (Pnolc) Subtraction?

A: Prior Net Operating Loss Conversion (Pnolc) Subtraction is a subtraction modification used to calculate New York State taxable income.

Q: Who needs to file Form CT-3.3?

A: Businesses that have a prior net operating loss to convert and subtract from their New York State taxable income need to file Form CT-3.3.

Q: What information is required on Form CT-3.3?

A: Form CT-3.3 requires you to provide details about your prior net operating loss, including the year of the loss and the amount to be subtracted.

Q: When is the deadline to file Form CT-3.3?

A: Form CT-3.3 is typically due by the tax filing deadline, which is March 15th for calendar year taxpayers.

Q: Are there any penalties for filing Form CT-3.3 late?

A: Yes, late filing of Form CT-3.3 may result in penalties and interest charges.

Q: Can I e-file Form CT-3.3?

A: Yes, you can e-file Form CT-3.3 using approved software or through a tax professional.

Q: Is Form CT-3.3 used in other states besides New York?

A: No, Form CT-3.3 is specific to New York State.

Q: What should I do if I need help with Form CT-3.3?

A: If you need assistance with Form CT-3.3, you can consult the instructions provided with the form or contact the New York State Department of Taxation and Finance for further guidance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-3.3 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.