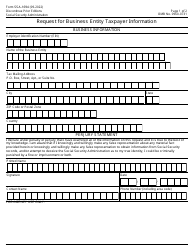

This version of the form is not currently in use and is provided for reference only. Download this version of

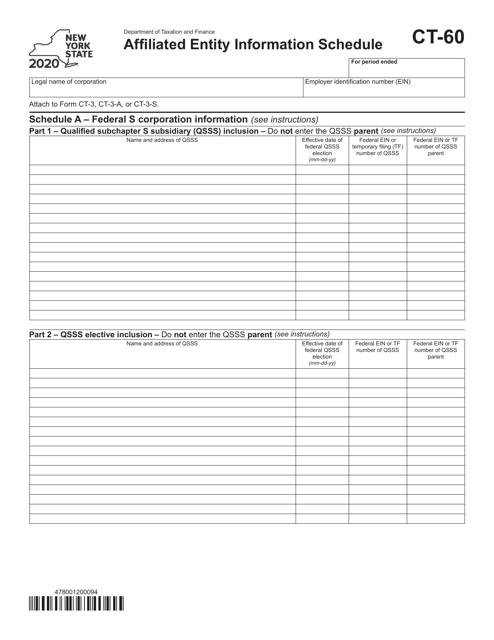

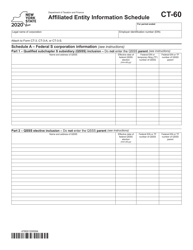

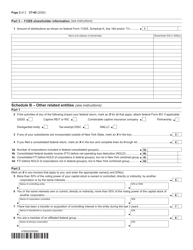

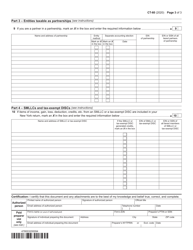

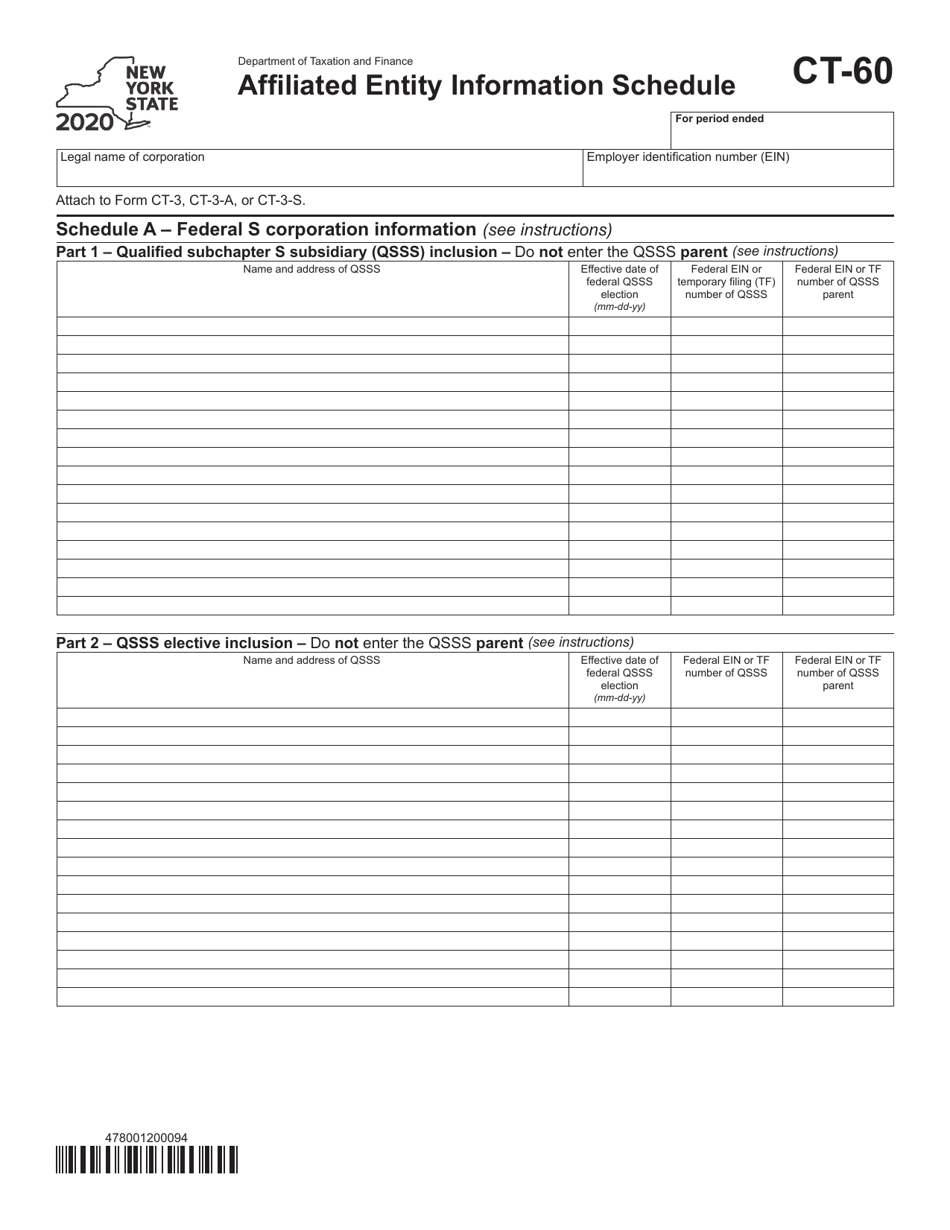

Form CT-60

for the current year.

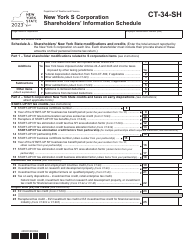

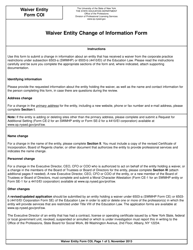

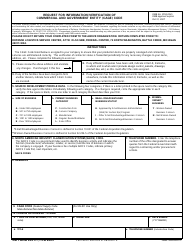

Form CT-60 Affiliated Entity Information Schedule - New York

What Is Form CT-60?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-60?

A: Form CT-60 is the Affiliated Entity Information Schedule for New York.

Q: Who needs to file Form CT-60?

A: Certain New York entities must file Form CT-60.

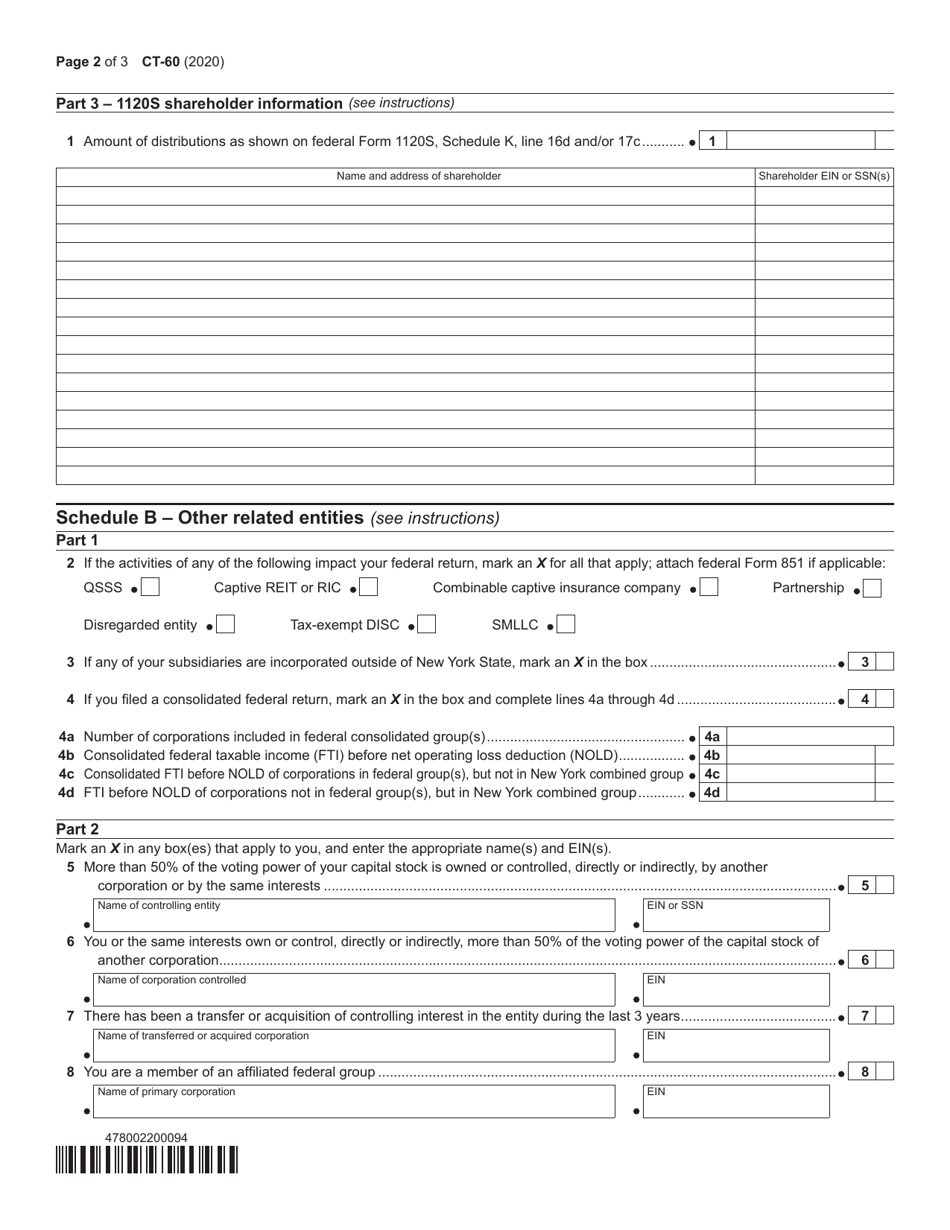

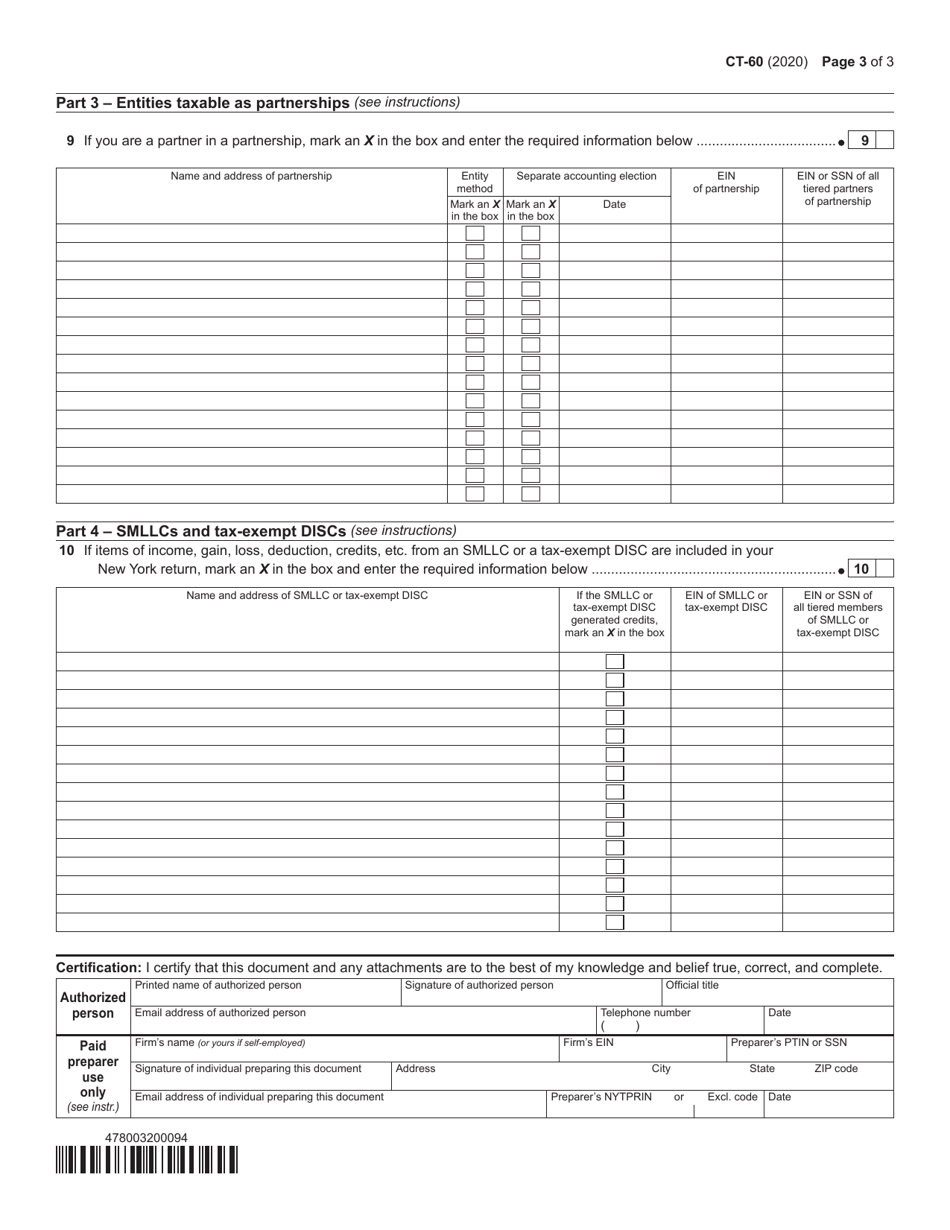

Q: What information does Form CT-60 require?

A: Form CT-60 requires information about affiliated entities.

Q: When is Form CT-60 due?

A: Form CT-60 is due on the same date as the New York entity's tax return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-60 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.