This version of the form is not currently in use and is provided for reference only. Download this version of

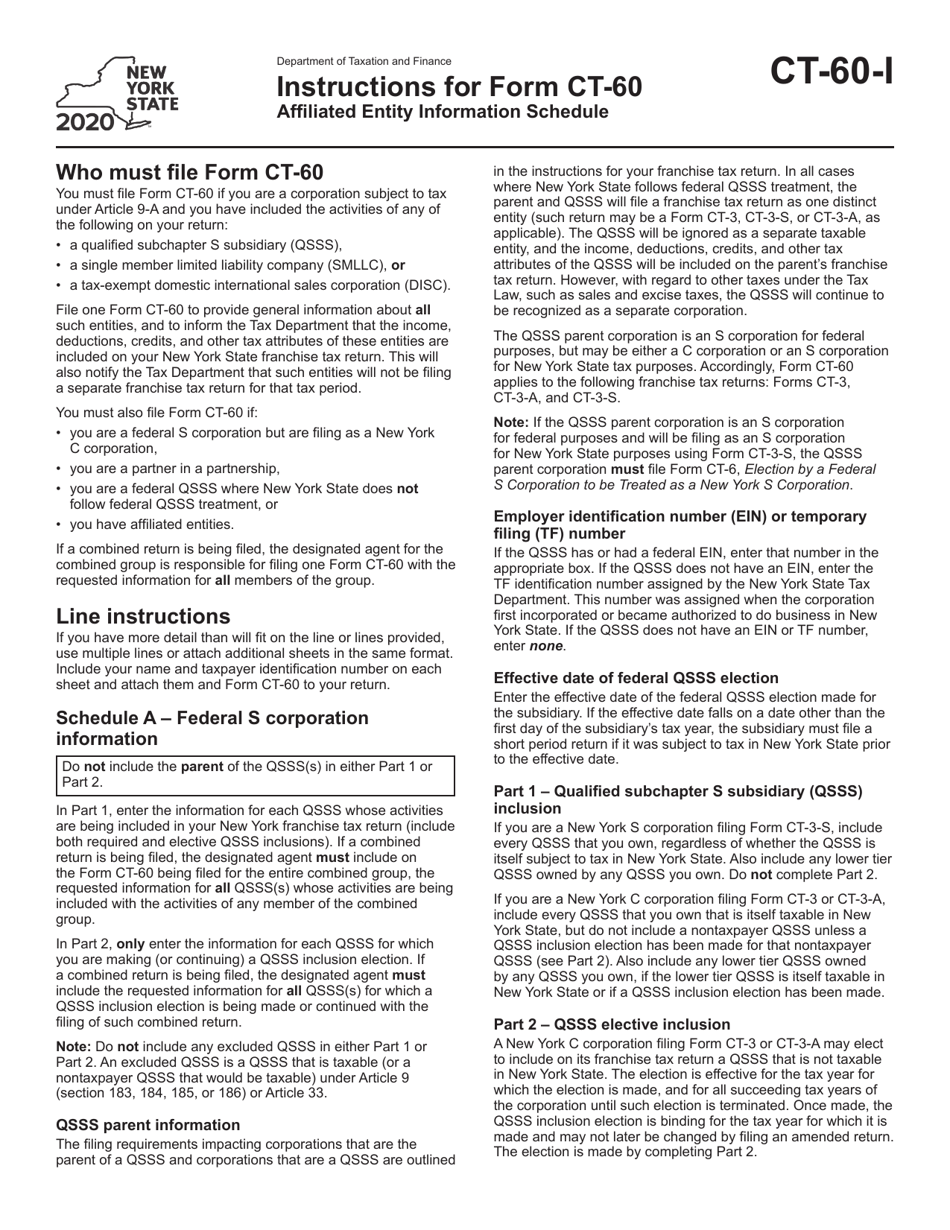

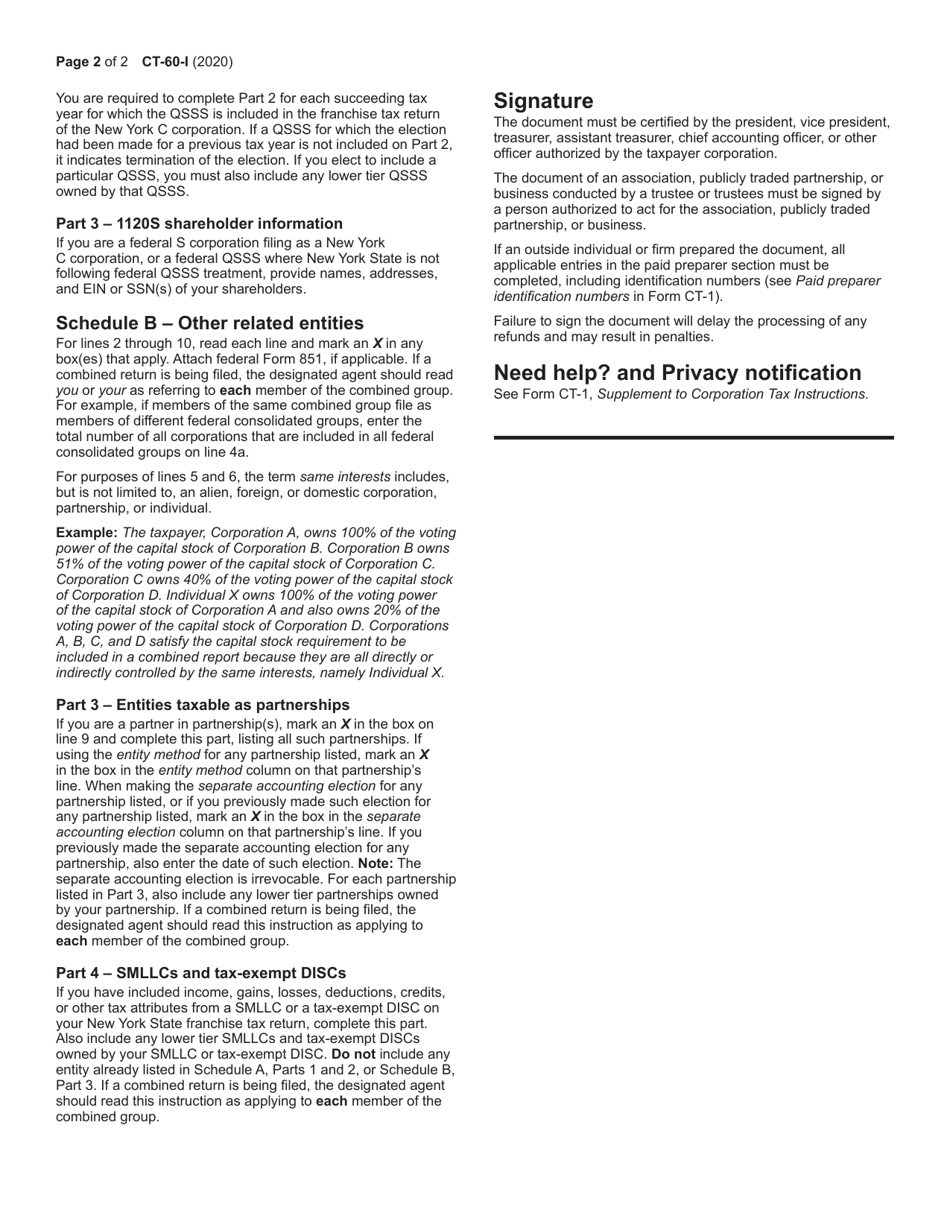

Instructions for Form CT-60

for the current year.

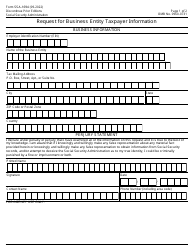

Instructions for Form CT-60 Affiliated Entity Information Schedule - New York

This document contains official instructions for Form CT-60 , Affiliated Entity Information Schedule - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CT-60 is available for download through this link.

FAQ

Q: What is Form CT-60?

A: Form CT-60 is the Affiliated Entity Information Schedule in New York.

Q: Who needs to file Form CT-60?

A: Form CT-60 needs to be filed by affiliated entities in New York.

Q: What is an affiliated entity?

A: An affiliated entity is a business or organization that is related to another entity by ownership or control.

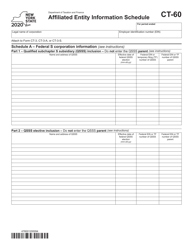

Q: What information is required on Form CT-60?

A: Form CT-60 requires information about the affiliated entity, including ownership details and control relationships.

Q: When is Form CT-60 due?

A: Form CT-60 is typically due with the entity's annual franchise tax return.

Q: Is there a fee for filing Form CT-60?

A: No, there is no fee associated with filing Form CT-60.

Q: Are there any penalties for not filing Form CT-60?

A: Yes, there may be penalties for failure to file Form CT-60 as required by the New York State tax laws.

Q: Can I get an extension to file Form CT-60?

A: Yes, extensions may be granted for filing Form CT-60, but the request must be made before the original due date.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.