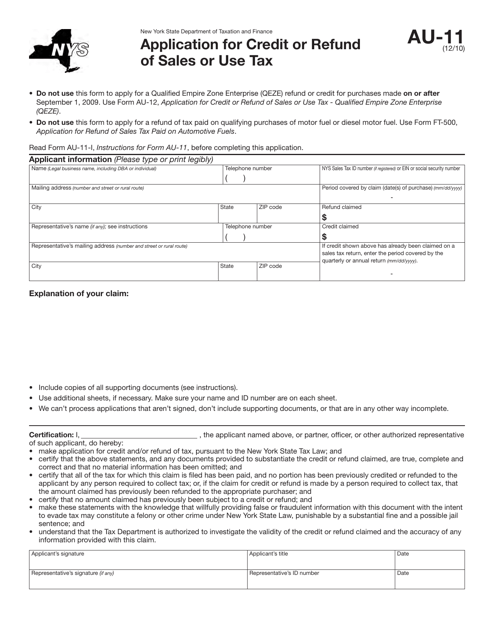

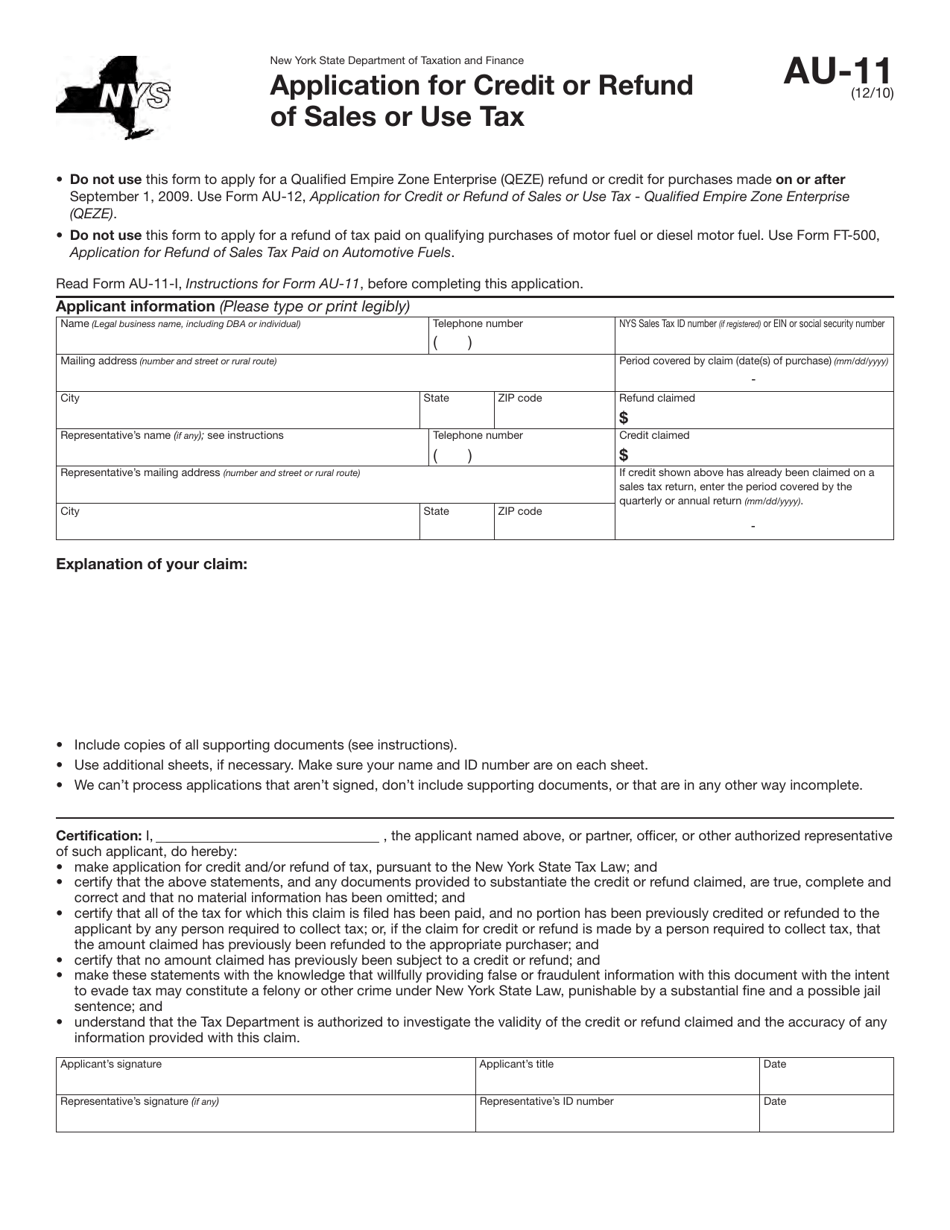

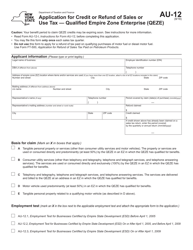

Form AU-11 Application for Credit or Refund of Sales or Use Tax - New York

What Is Form AU-11?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form AU-11?

A: Form AU-11 is an application for credit or refund of sales or use tax in the state of New York.

Q: Who can use Form AU-11?

A: Any individual or business that paid sales or use tax in New York and wants to apply for a credit or refund can use Form AU-11.

Q: What information do I need to provide on Form AU-11?

A: You will need to provide your personal or business information, details of the tax payment, and reasons for requesting a credit or refund.

Q: How long does it take to process Form AU-11?

A: The processing time for Form AU-11 can vary, but it typically takes several weeks to receive a response from the tax department.

Q: What should I do if I made a mistake on Form AU-11?

A: If you made a mistake on Form AU-11, you should contact the New York State Department of Taxation and Finance to amend your application.

Q: What happens after submitting Form AU-11?

A: After submitting Form AU-11, the New York State Department of Taxation and Finance will review your application and notify you of their decision regarding the credit or refund.

Form Details:

- Released on December 1, 2010;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AU-11 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.