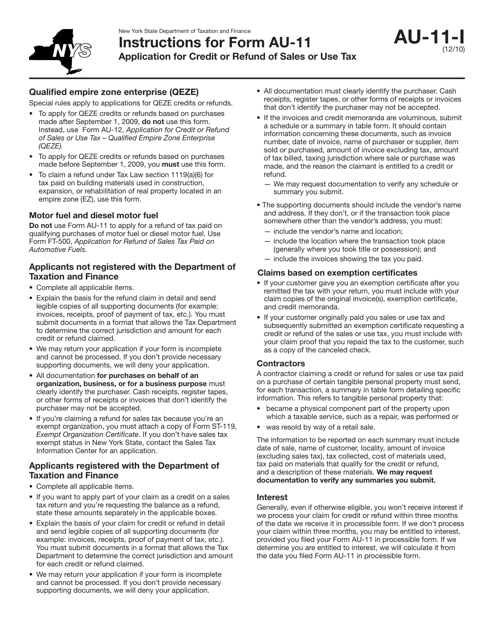

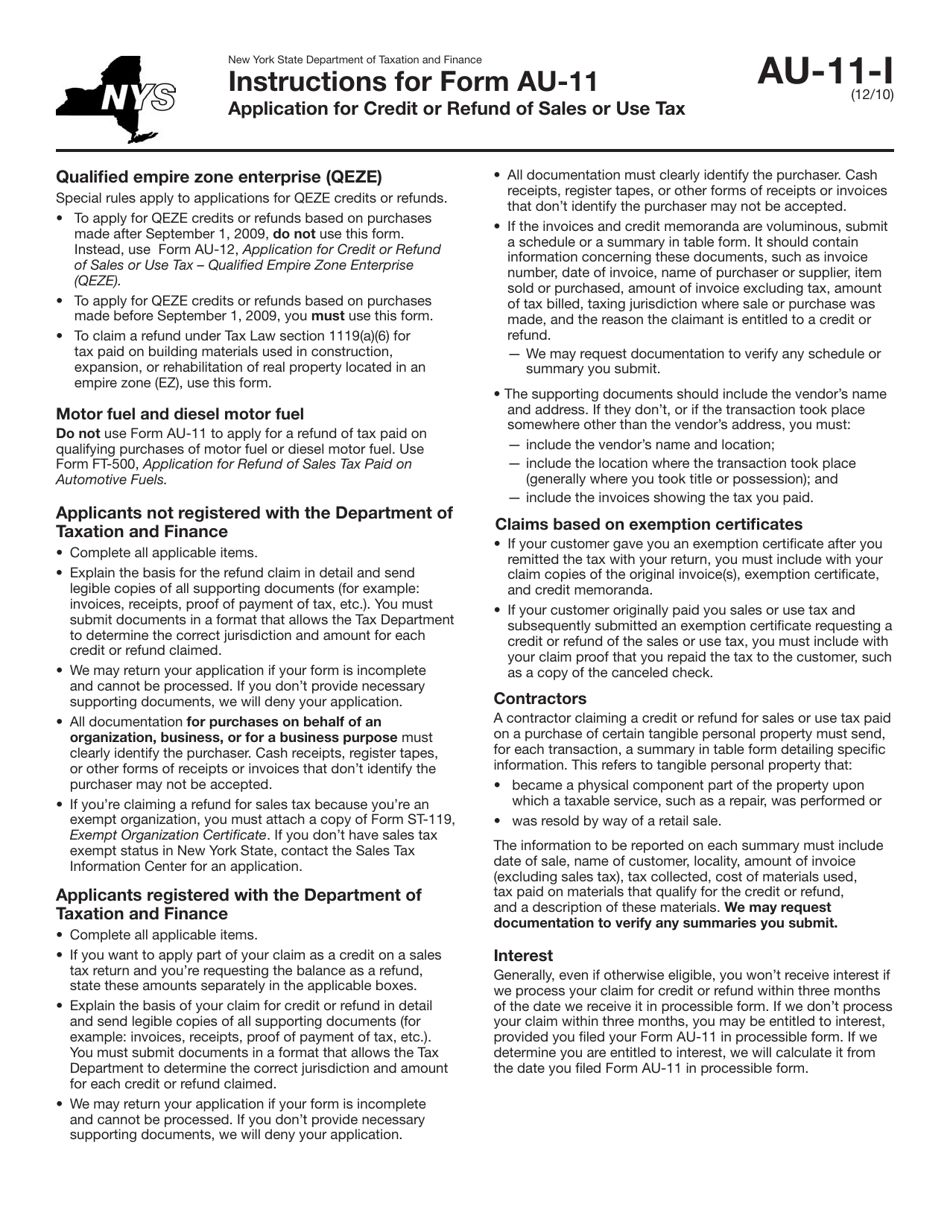

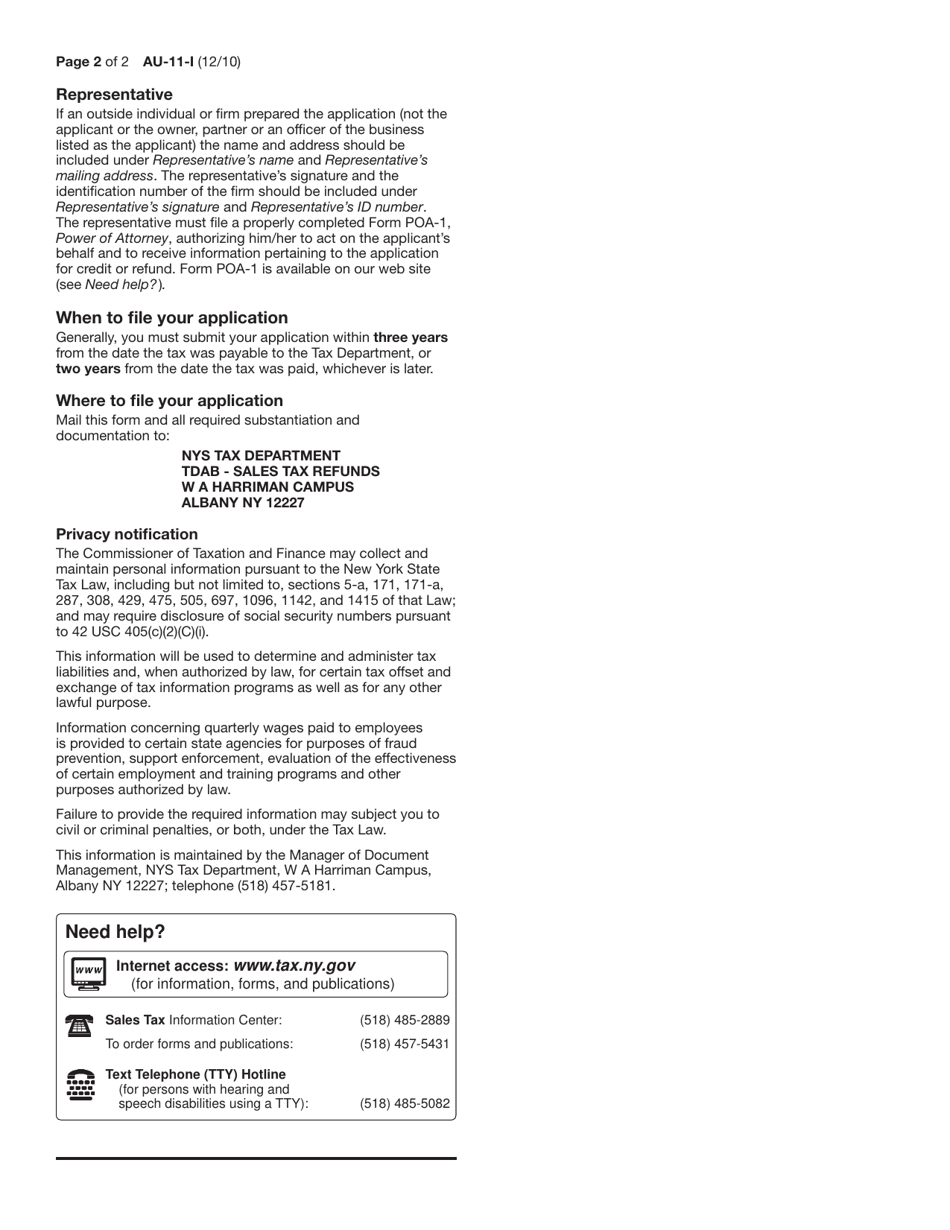

Instructions for Form AU-11 Application for Credit or Refund of Sales or Use Tax - New York

This document contains official instructions for Form AU-11 , Application for Credit or Refund of Sales or Use Tax - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form AU-11 is available for download through this link.

FAQ

Q: What is Form AU-11?

A: Form AU-11 is an application used to request a credit or refund for sales or use tax in New York.

Q: Who should use Form AU-11?

A: Any individual or business who wants to apply for a credit or refund of sales or use tax in New York can use Form AU-11.

Q: What is the purpose of Form AU-11?

A: The purpose of Form AU-11 is to request a credit or refund of sales or use tax that was overpaid or incorrectly paid in New York.

Q: What information do I need to provide on Form AU-11?

A: You will need to provide your personal or business information, details of the sales or use tax transaction, and the reason for the credit or refund request.

Q: Are there any additional documents required along with Form AU-11?

A: Depending on your specific situation, you may need to include supporting documents such as receipts, invoices, or other proof of payment.

Q: Is there a deadline to submit Form AU-11?

A: Yes, there is a deadline to submit Form AU-11. The form must be filed within three years from the date of the overpayment or erroneous payment of sales or use tax.

Q: How long does it take to receive a response to Form AU-11?

A: The processing time for Form AU-11 can vary, but you can generally expect to receive a response from the New York State Department of Taxation and Finance within a few weeks to a few months.

Q: What should I do if my Form AU-11 is denied?

A: If your Form AU-11 is denied, you have the option to request a reconsideration or file an appeal with the New York State Department of Taxation and Finance.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.