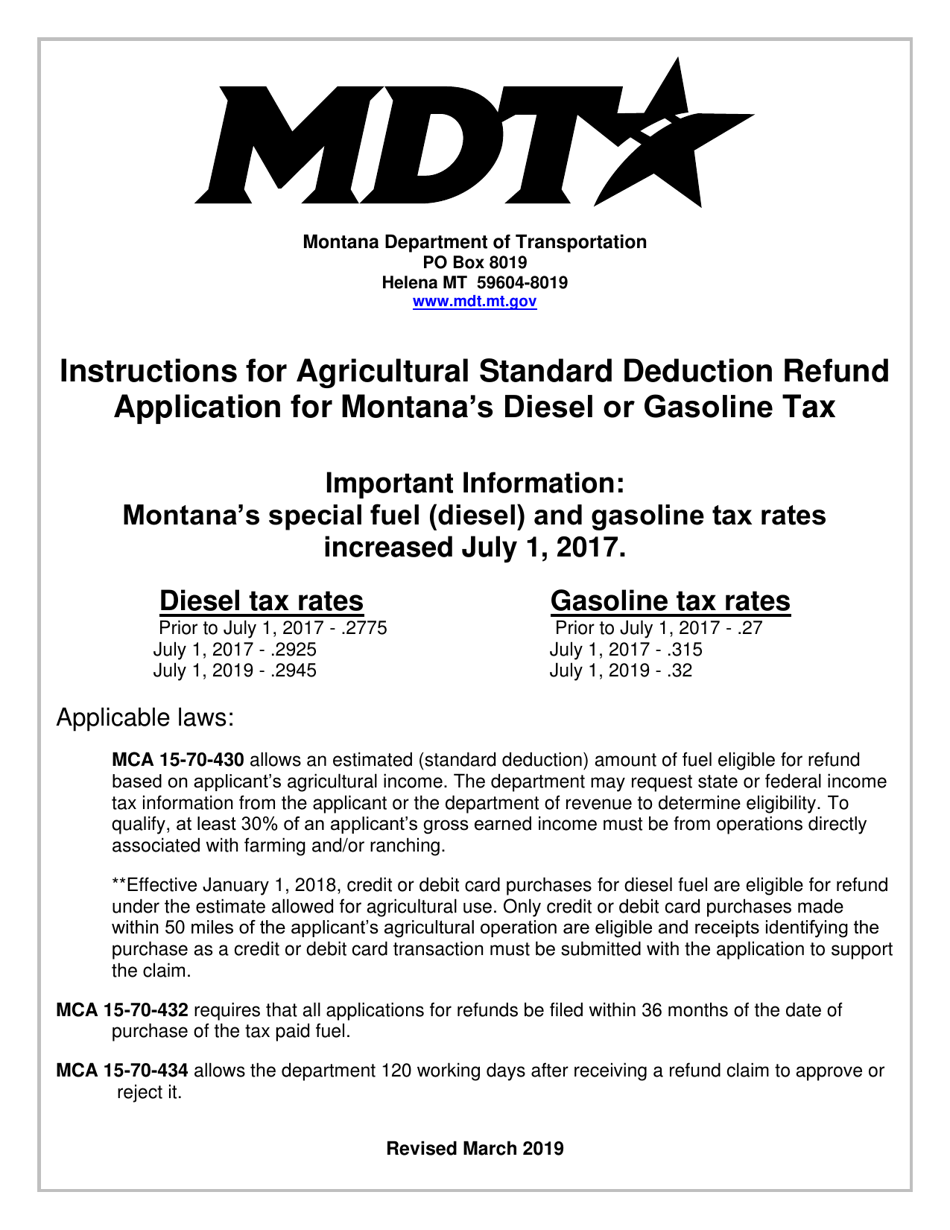

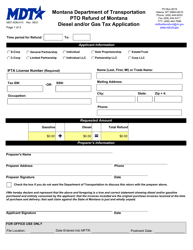

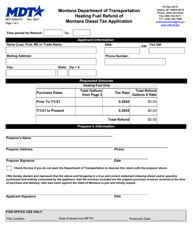

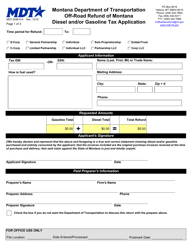

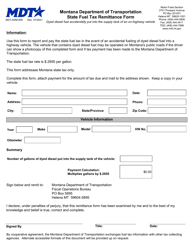

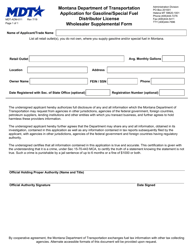

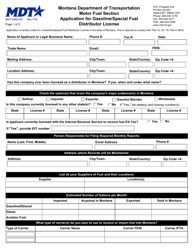

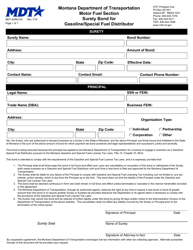

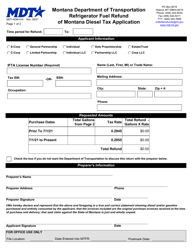

Instructions for Form MDT-ADM-001 Agricultural Standard Deduction Refund of Montana Diesel and / or Gasoline Tax Application - Montana

This document contains official instructions for Form MDT-ADM-001 , Agricultural Standard Deduction Refund of Montana Diesel and/or Gasoline Tax Application - a form released and collected by the Montana Department of Transportation. An up-to-date fillable Form MDT-ADM-001 is available for download through this link.

FAQ

Q: What is Form MDT-ADM-001?

A: Form MDT-ADM-001 is an application for the Agricultural Standard Deduction Refund of Montana Diesel and/or Gasoline Tax.

Q: Who can use Form MDT-ADM-001?

A: The form is specifically for agricultural producers in Montana.

Q: What is the Agricultural Standard Deduction Refund?

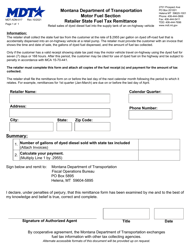

A: The Agricultural Standard Deduction Refund is a refund of diesel and/or gasoline tax paid by eligible agricultural producers.

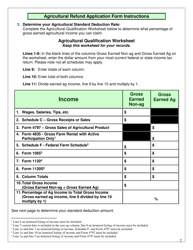

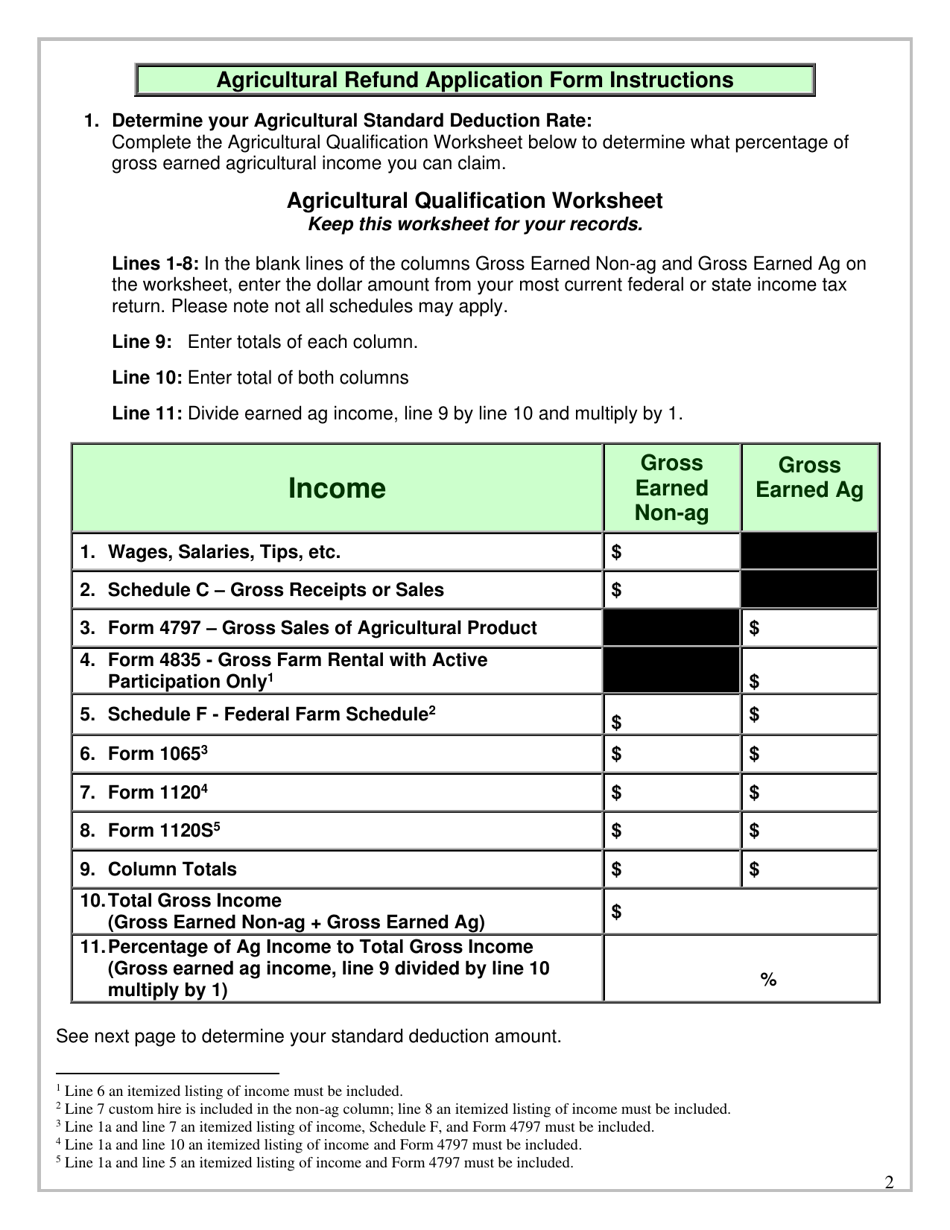

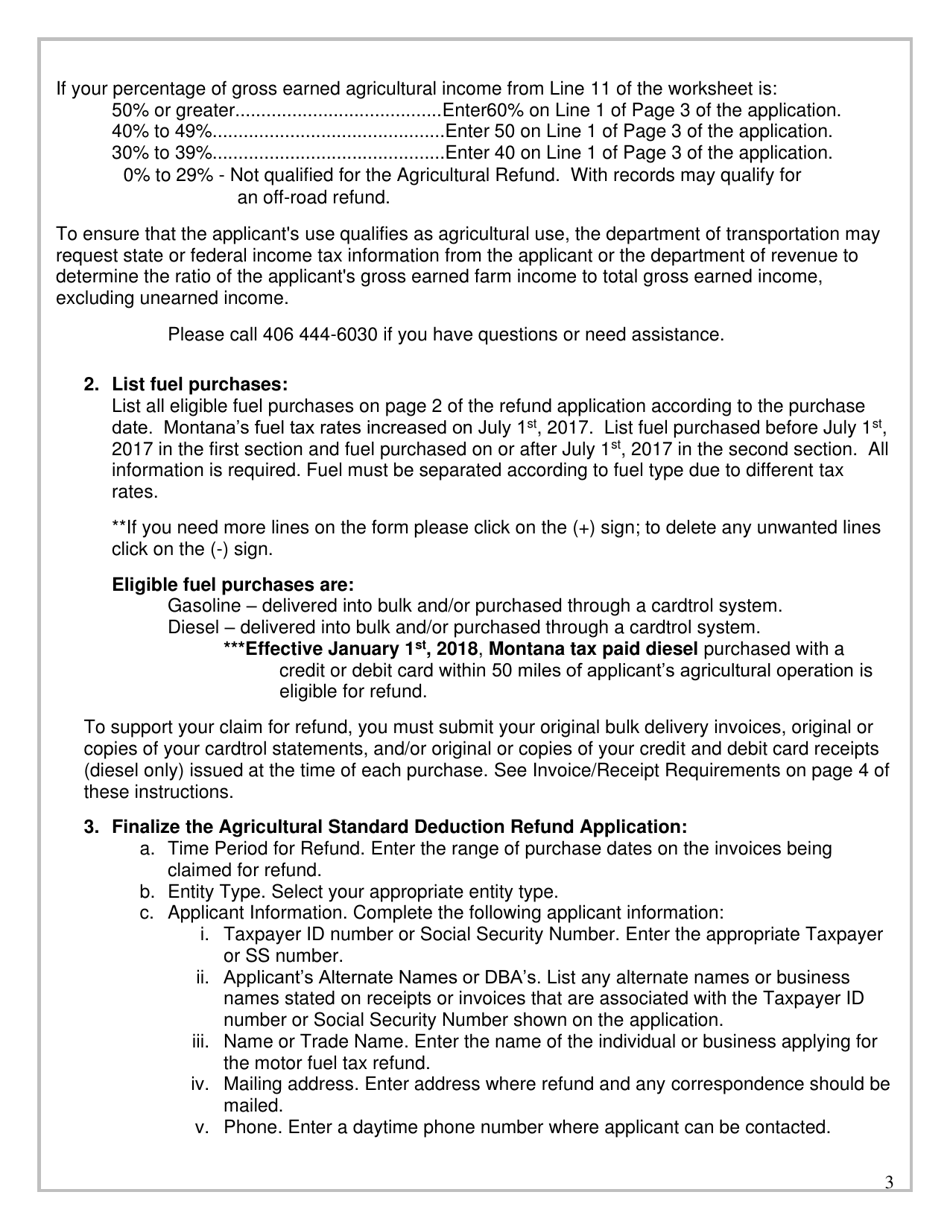

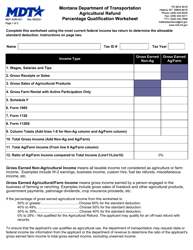

Q: How can I qualify for the refund?

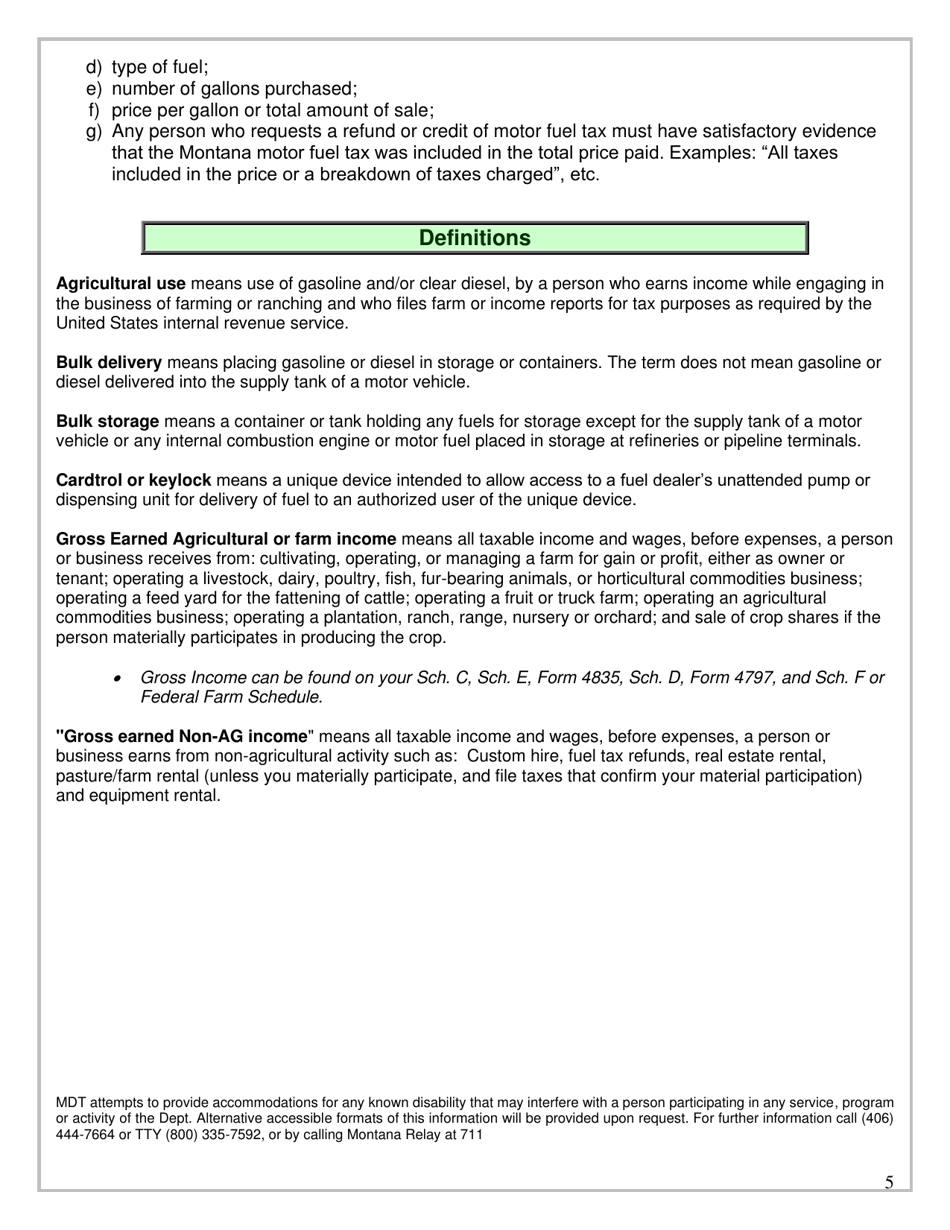

A: To qualify for the refund, you must be an eligible agricultural producer and use diesel and/or gasoline for agricultural purposes.

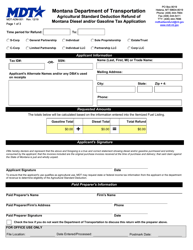

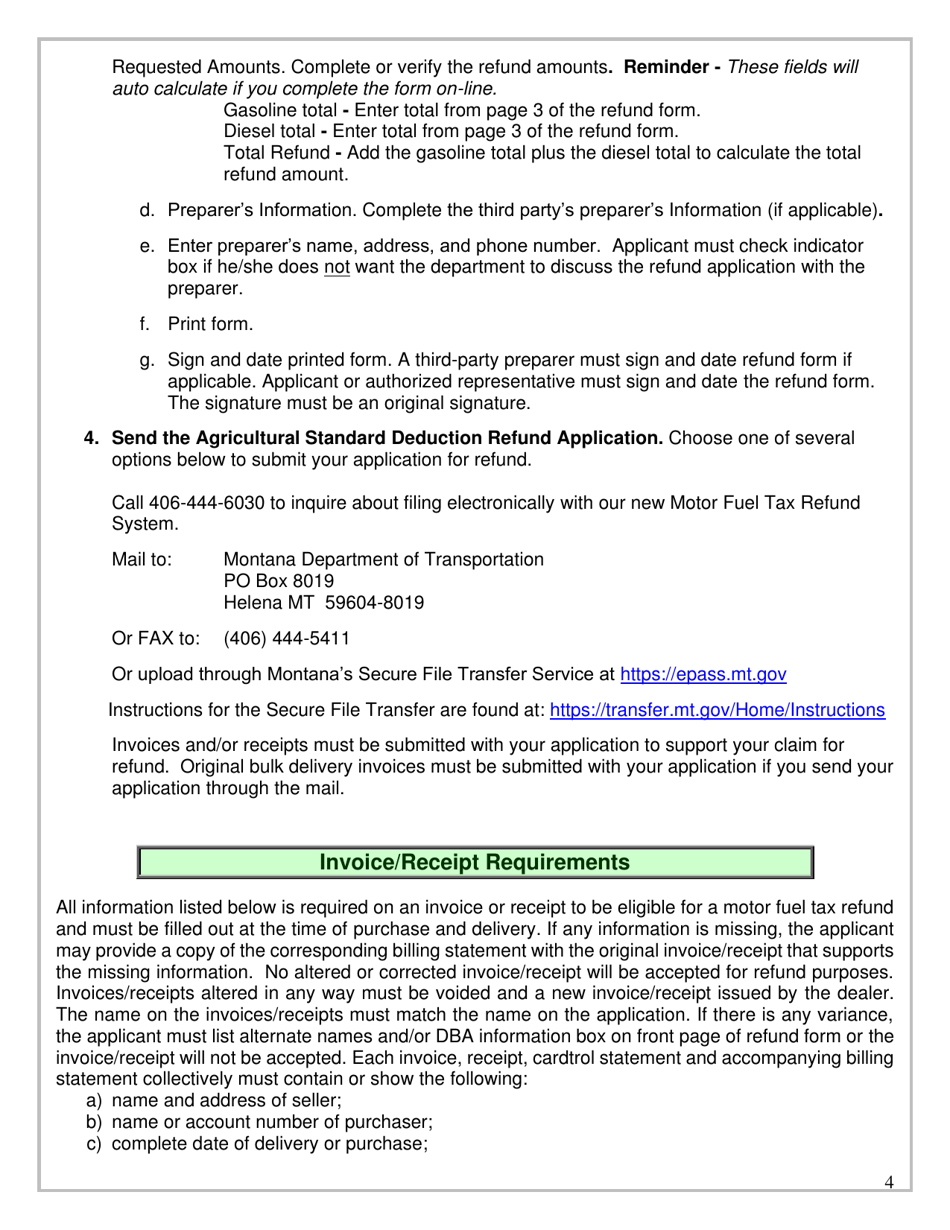

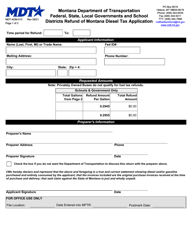

Q: What information do I need to provide on the form?

A: You will need to provide your personal and business information, as well as details about your agricultural operation and fuel purchases.

Q: When is the deadline to submit Form MDT-ADM-001?

A: The form must be submitted on or before the last day of the 12th month following the end of the calendar year in which the tax was paid.

Q: How long does it take to receive the refund?

A: The refund processing time may vary, but it typically takes 4-6 weeks after the form is submitted.

Q: What supporting documentation do I need to include with the form?

A: You must include copies of your fuel purchase receipts, as well as any other supporting documentation requested on the form.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Montana Department of Transportation.