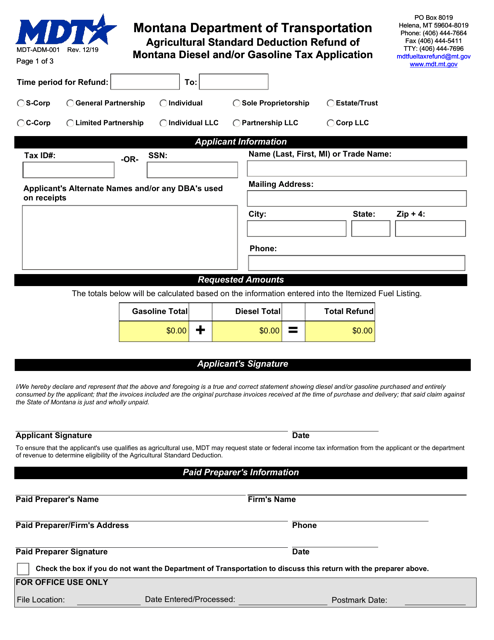

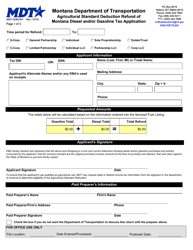

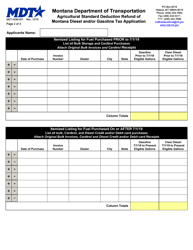

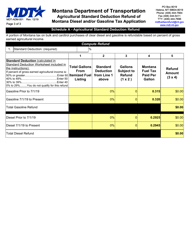

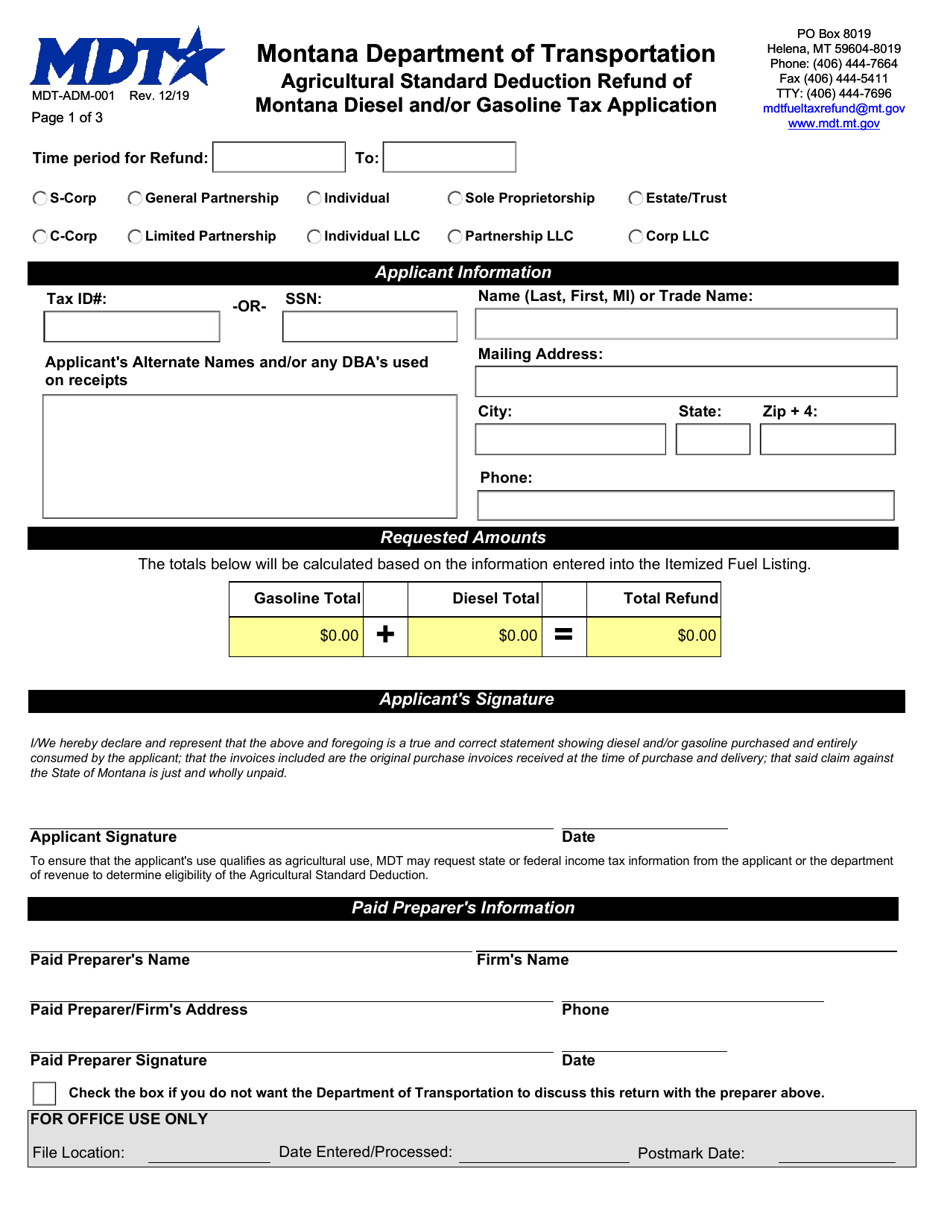

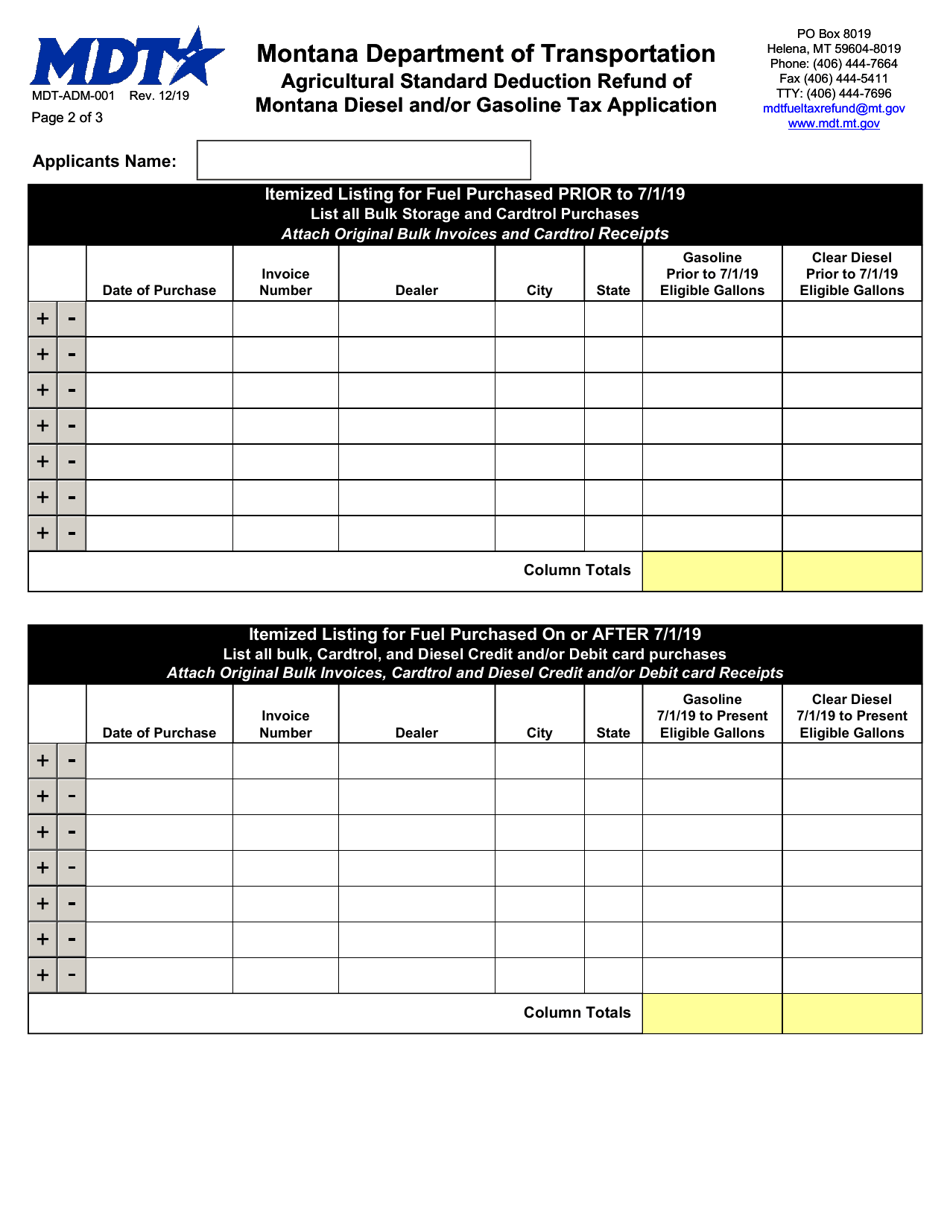

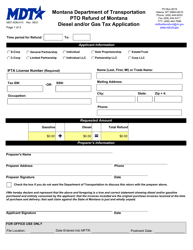

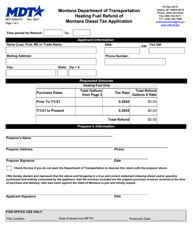

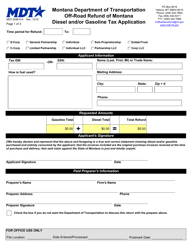

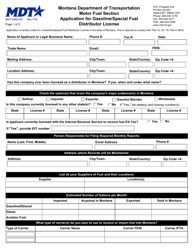

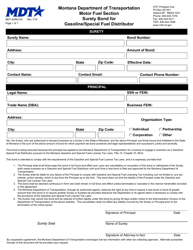

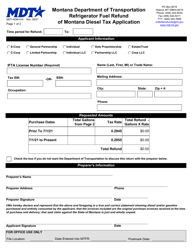

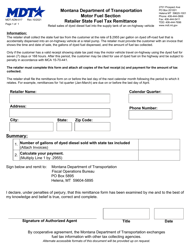

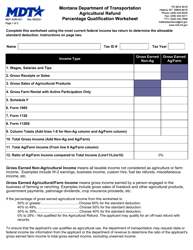

Form MDT-ADM-001 Agricultural Standard Deduction Refund of Montana Diesel and / or Gasoline Tax Application - Montana

What Is Form MDT-ADM-001?

This is a legal form that was released by the Montana Department of Transportation - a government authority operating within Montana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form MDT-ADM-001?

A: Form MDT-ADM-001 is the application for the Agricultural Standard Deduction Refund of Montana Diesel and/or Gasoline Tax.

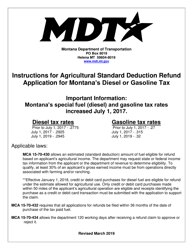

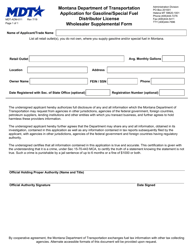

Q: Who can use Form MDT-ADM-001?

A: Montana residents who are engaged in agricultural production and meet certain requirements can use Form MDT-ADM-001.

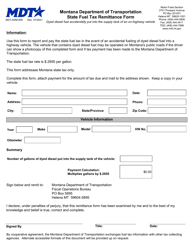

Q: What is the Agricultural Standard Deduction refund?

A: The Agricultural Standard Deduction refund is a refund of the Montana diesel and/or gasoline tax paid by eligible agricultural producers.

Q: What are the requirements to be eligible for the Agricultural Standard Deduction refund?

A: To be eligible for the refund, you must be engaged in agricultural production and meet certain income and tax liability requirements.

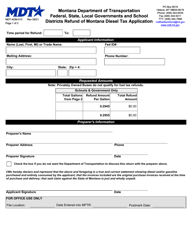

Q: When should I file Form MDT-ADM-001?

A: Form MDT-ADM-001 should be filed annually by April 1st for the previous calendar year.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Montana Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MDT-ADM-001 by clicking the link below or browse more documents and templates provided by the Montana Department of Transportation.