This version of the form is not currently in use and is provided for reference only. Download this version of

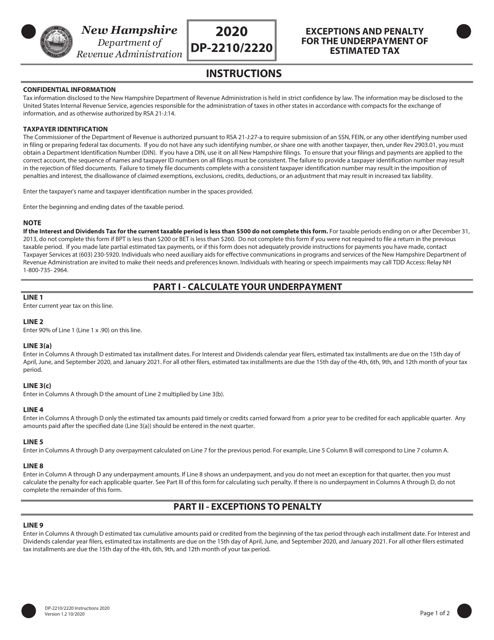

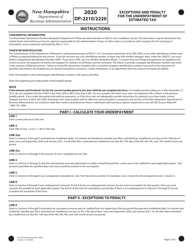

Instructions for Form DP-2210/2220

for the current year.

Instructions for Form DP-2210 / 2220 Exceptions and Penalty for the Underpayment of Estimated Tax - New Hampshire

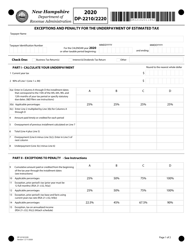

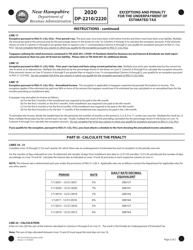

This document contains official instructions for Form DP-2210/2220 , Exceptions and Penalty for the Underpayment of Estimated Tax - a form released and collected by the New Hampshire Department of Revenue Administration. An up-to-date fillable Form DP-2210/2220 is available for download through this link.

FAQ

Q: What is Form DP-2210/2220?

A: Form DP-2210/2220 is a form used in New Hampshire for reporting exceptions and penalties for underpayment of estimated tax.

Q: When is Form DP-2210/2220 used?

A: This form is used when an individual or business in New Hampshire has underpaid their estimated tax payments.

Q: What are exceptions to the penalty for underpayment?

A: Exceptions to the penalty for underpayment include situations where the underpayment was due to reasonable cause and not willful negligence.

Q: How do I file Form DP-2210/2220?

A: Form DP-2210/2220 can be filed electronically or by mail with the New Hampshire Department of Revenue Administration.

Q: What is the penalty for underpayment of estimated tax?

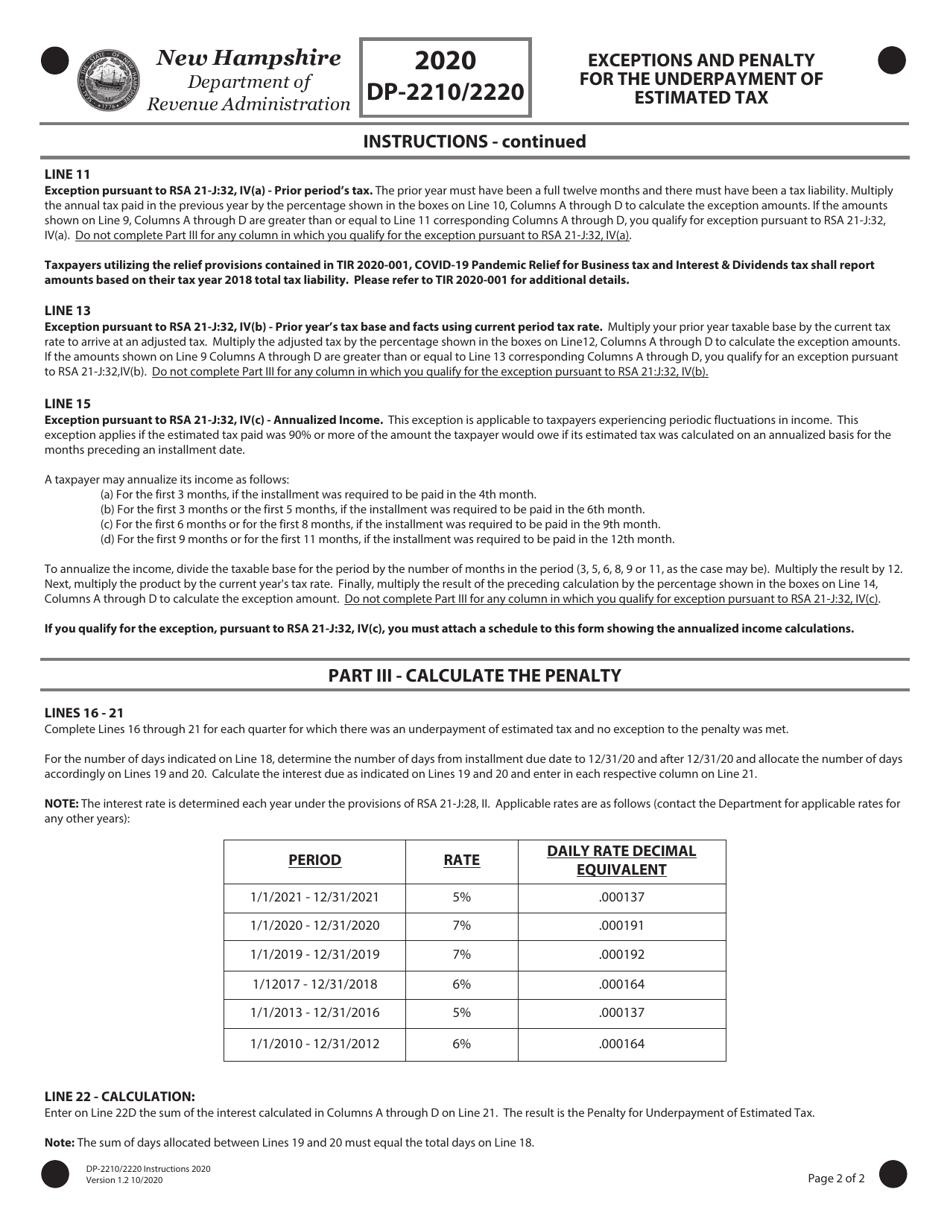

A: The penalty for underpayment of estimated tax in New Hampshire is calculated based on a specific formula provided by the Department of Revenue Administration.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New Hampshire Department of Revenue Administration.