This version of the form is not currently in use and is provided for reference only. Download this version of

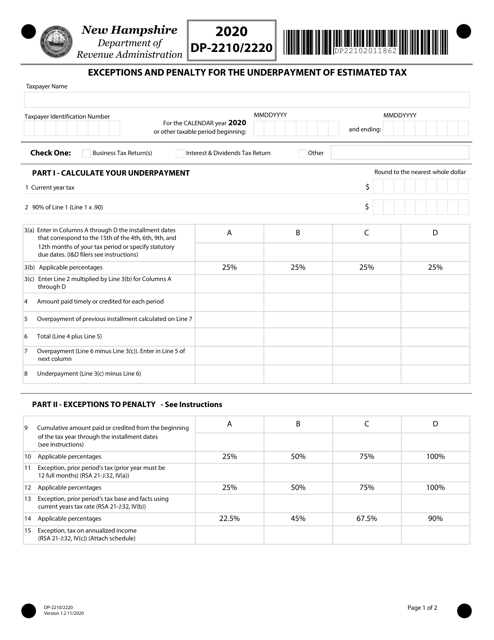

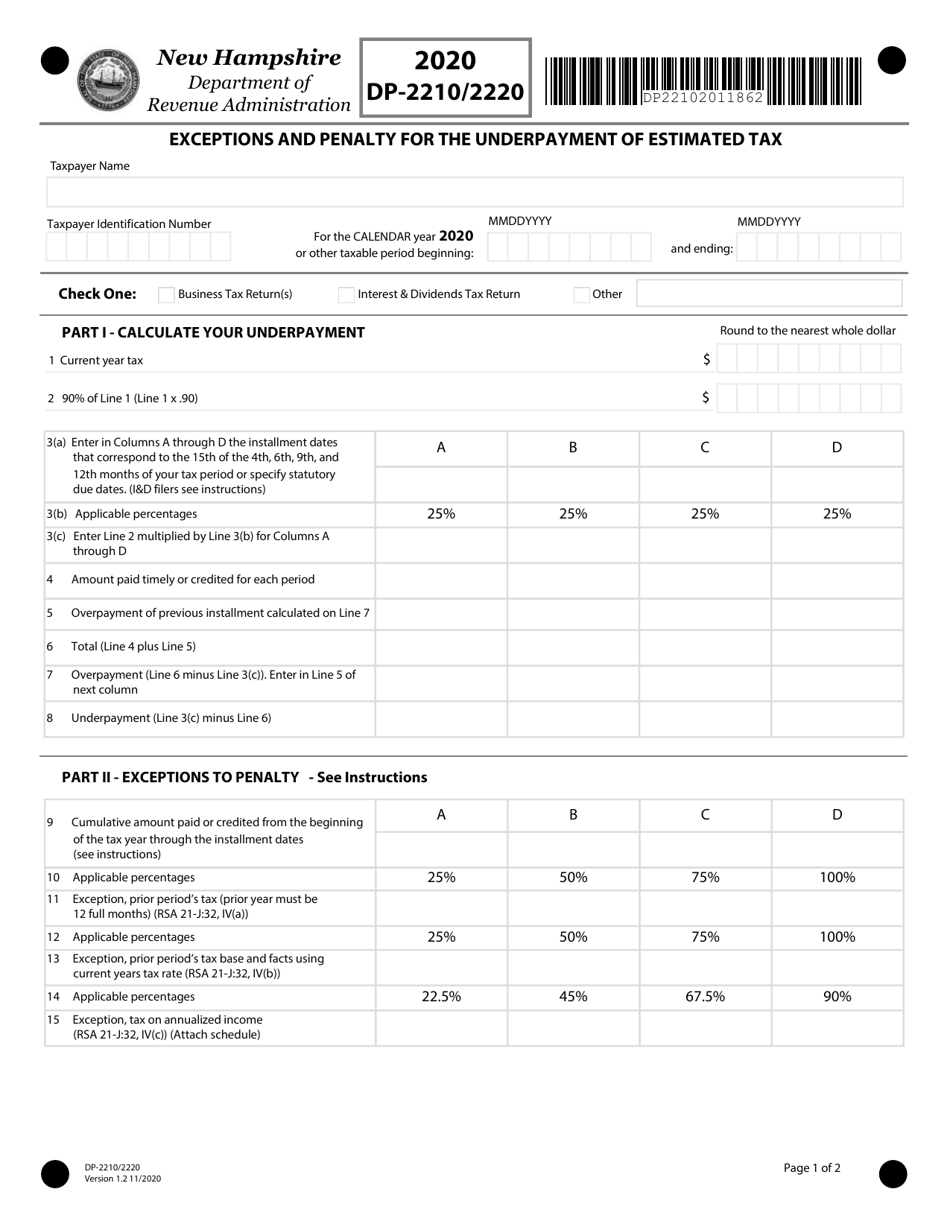

Form DP-2210/2220

for the current year.

Form DP-2210 / 2220 Exceptions and Penalty for the Underpayment of Estimated Tax - New Hampshire

What Is Form DP-2210/2220?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DP-2210/2220?

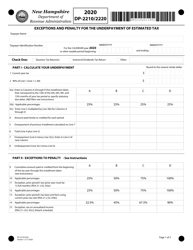

A: Form DP-2210/2220 is used to calculate the exceptions and penalties for underpayment of estimated tax in New Hampshire.

Q: Who needs to use Form DP-2210/2220?

A: Anyone who underpaid their estimated tax in New Hampshire may need to use Form DP-2210/2220.

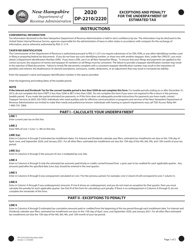

Q: What are the exceptions for underpayment of estimated tax?

A: Exceptions for underpayment of estimated tax include being a farmer or fisherman, or having a small tax liability.

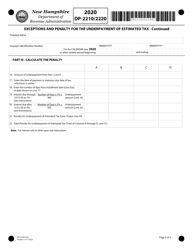

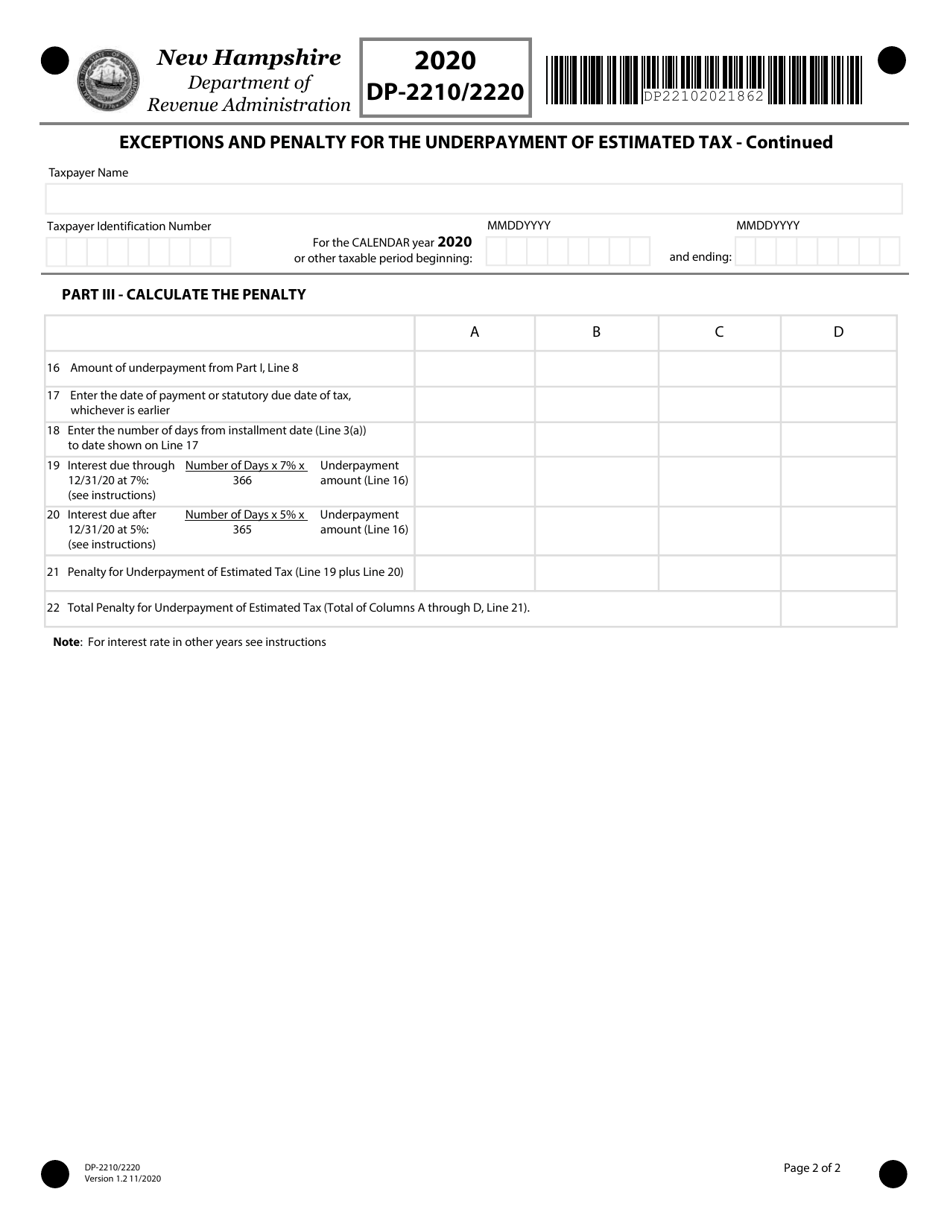

Q: What is the penalty for underpayment of estimated tax in New Hampshire?

A: The penalty for underpayment of estimated tax in New Hampshire is calculated based on the amount of underpayment and the interest rate.

Q: How do I calculate the penalty for underpayment of estimated tax?

A: You can calculate the penalty for underpayment of estimated tax using the instructions provided with Form DP-2210/2220.

Q: When is the deadline for filing Form DP-2210/2220?

A: The deadline for filing Form DP-2210/2220 in New Hampshire is the same as the deadline for filing your state income tax return, typically April 15th.

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-2210/2220 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.