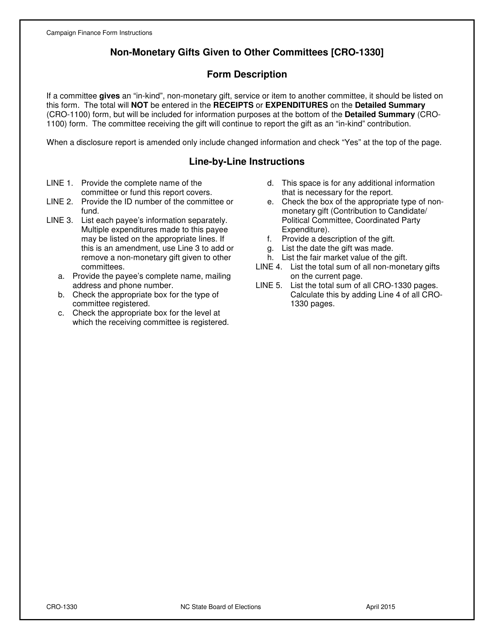

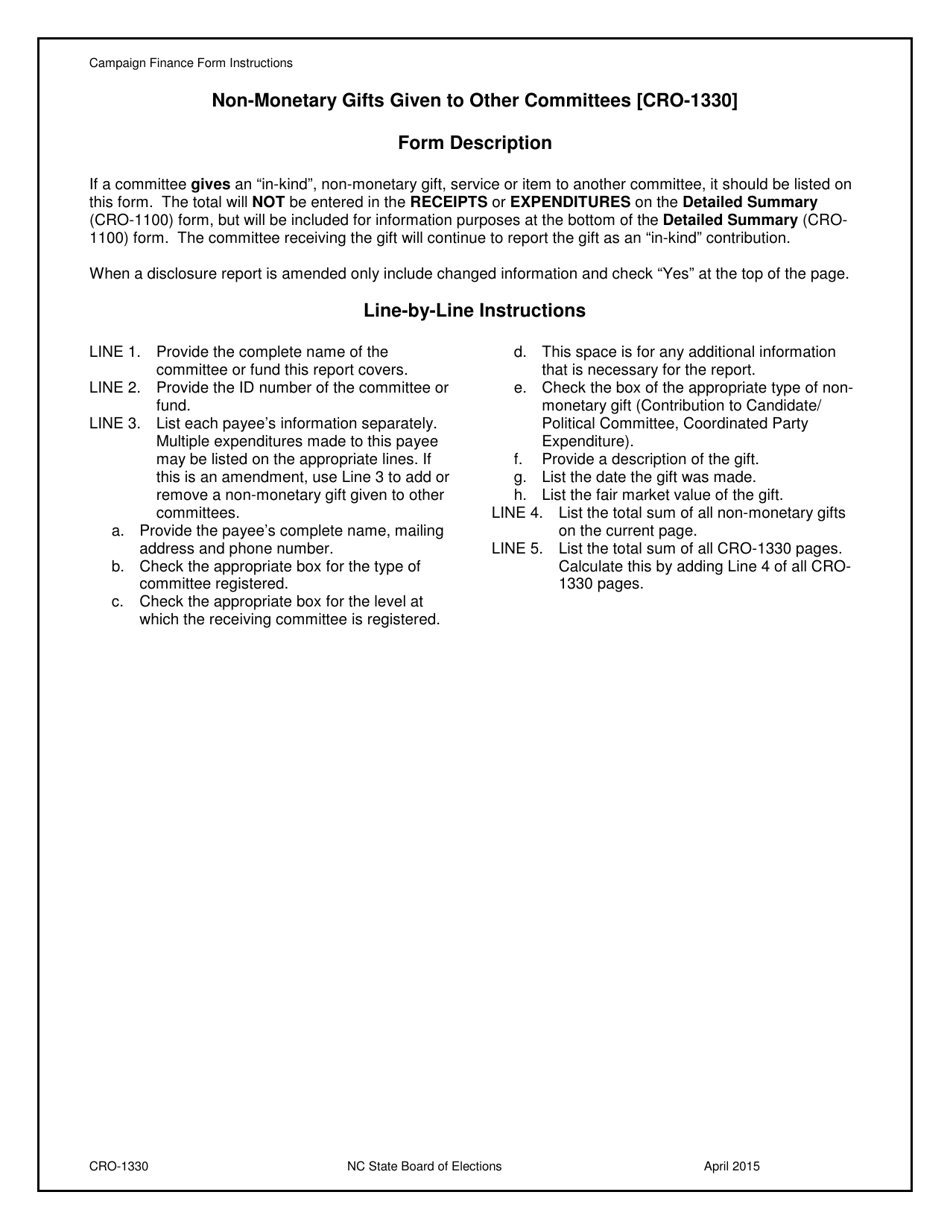

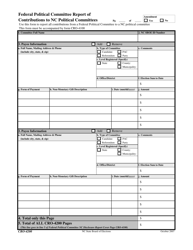

Instructions for Form CRO-1330 Non-monetary Gifts Given to Other Committees - North Carolina

This document contains official instructions for Form CRO-1330 , Non-monetary Gifts Given to Other Committees - a form released and collected by the North Carolina State Board of Elections. An up-to-date fillable Form CRO-1330 is available for download through this link.

FAQ

Q: What is Form CRO-1330?

A: Form CRO-1330 is a document used in North Carolina to report non-monetary gifts given to other committees.

Q: What are non-monetary gifts?

A: Non-monetary gifts are gifts in kind, such as equipment, supplies, or services, that are given to other committees.

Q: When should Form CRO-1330 be filed?

A: Form CRO-1330 should be filed within 30 days of the gift being given.

Q: Who needs to file Form CRO-1330?

A: Any committee in North Carolina that gives non-monetary gifts to other committees needs to file Form CRO-1330.

Q: Are there any penalties for not filing Form CRO-1330?

A: Yes, failure to file Form CRO-1330 can result in penalties and fines.

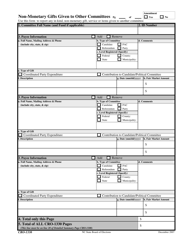

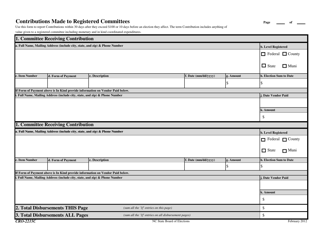

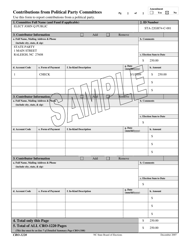

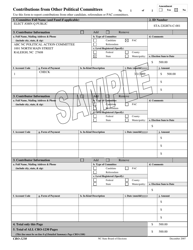

Q: What information is required on Form CRO-1330?

A: Form CRO-1330 requires information about the gift recipient, description of the gift, and estimated value of the gift.

Q: Is there a fee for filing Form CRO-1330?

A: No, there is no fee for filing Form CRO-1330.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the North Carolina State Board of Elections.