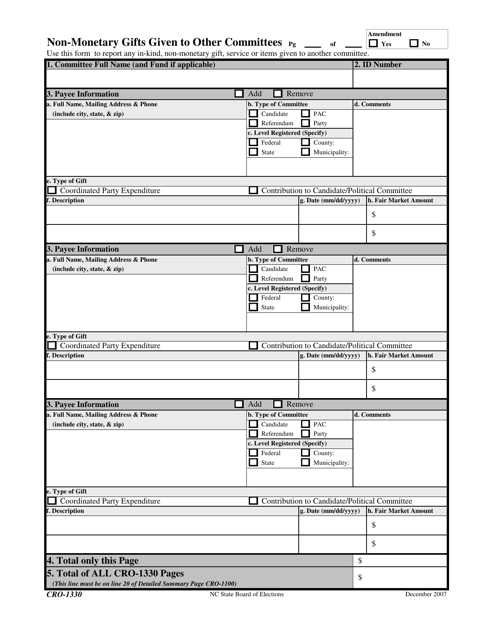

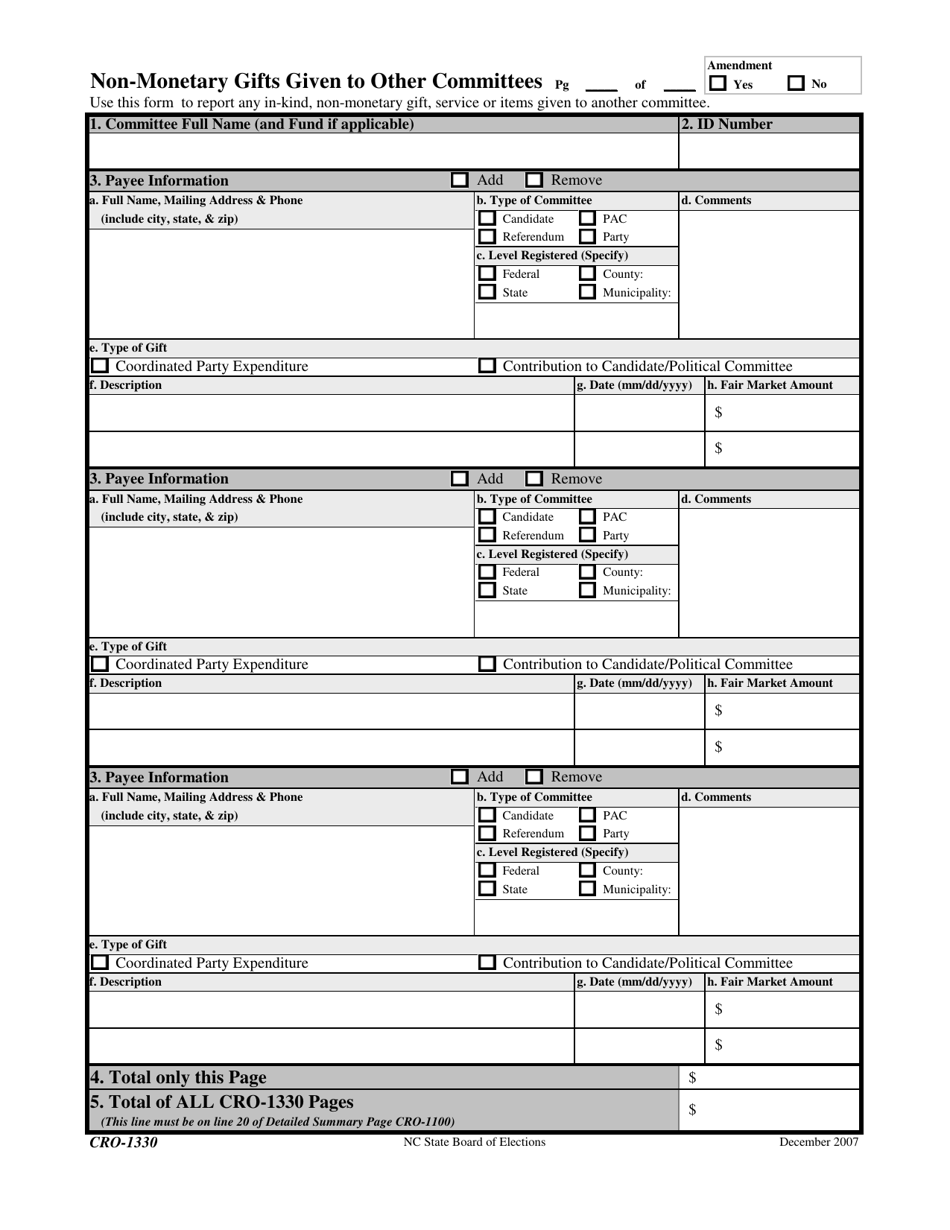

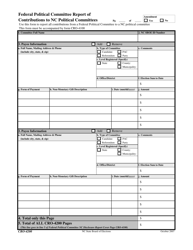

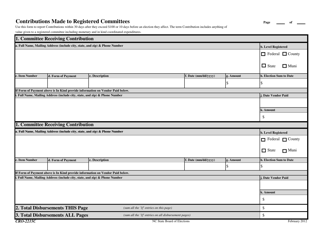

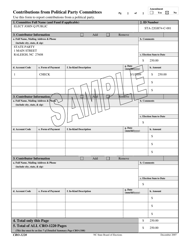

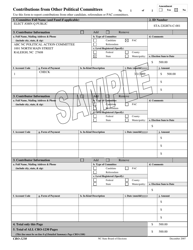

Form CRO-1330 Non-monetary Gifts Given to Other Committees - North Carolina

What Is Form CRO-1330?

This is a legal form that was released by the North Carolina State Board of Elections - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CRO-1330?

A: Form CRO-1330 is a form used in North Carolina to report non-monetary gifts given to other committees.

Q: Who is required to use Form CRO-1330?

A: Committees in North Carolina that give non-monetary gifts to other committees are required to use Form CRO-1330.

Q: What are non-monetary gifts?

A: Non-monetary gifts refer to gifts that are not in the form of money, such as goods or services.

Q: Why do committees need to report non-monetary gifts?

A: Committees need to report non-monetary gifts to ensure transparency and compliance with campaign finance regulations.

Q: When should Form CRO-1330 be filed?

A: Form CRO-1330 should be filed within 30 days after the end of the reporting period in which the gift was given.

Q: What information is required on Form CRO-1330?

A: Form CRO-1330 requires information about the recipient committee, the gift details, and the value of the gift.

Q: Are there any exceptions to filing Form CRO-1330?

A: Yes, gifts with a value of less than $100 do not need to be reported on Form CRO-1330.

Q: Is there a penalty for not filing Form CRO-1330?

A: Failure to file Form CRO-1330 or providing false information can result in penalties and legal consequences.

Form Details:

- Released on December 1, 2007;

- The latest edition provided by the North Carolina State Board of Elections;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CRO-1330 by clicking the link below or browse more documents and templates provided by the North Carolina State Board of Elections.