This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1261

for the current year.

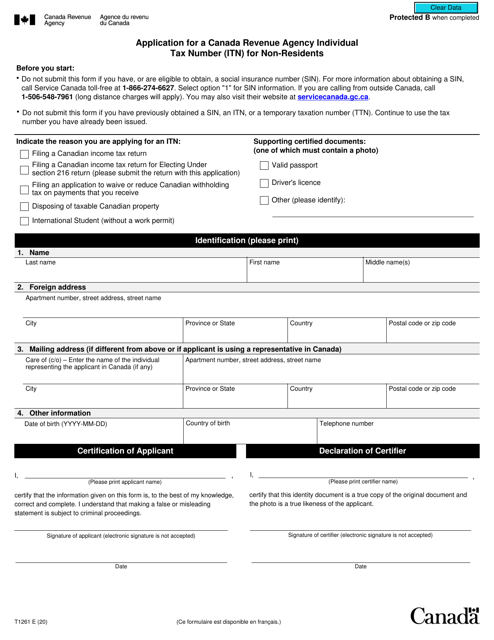

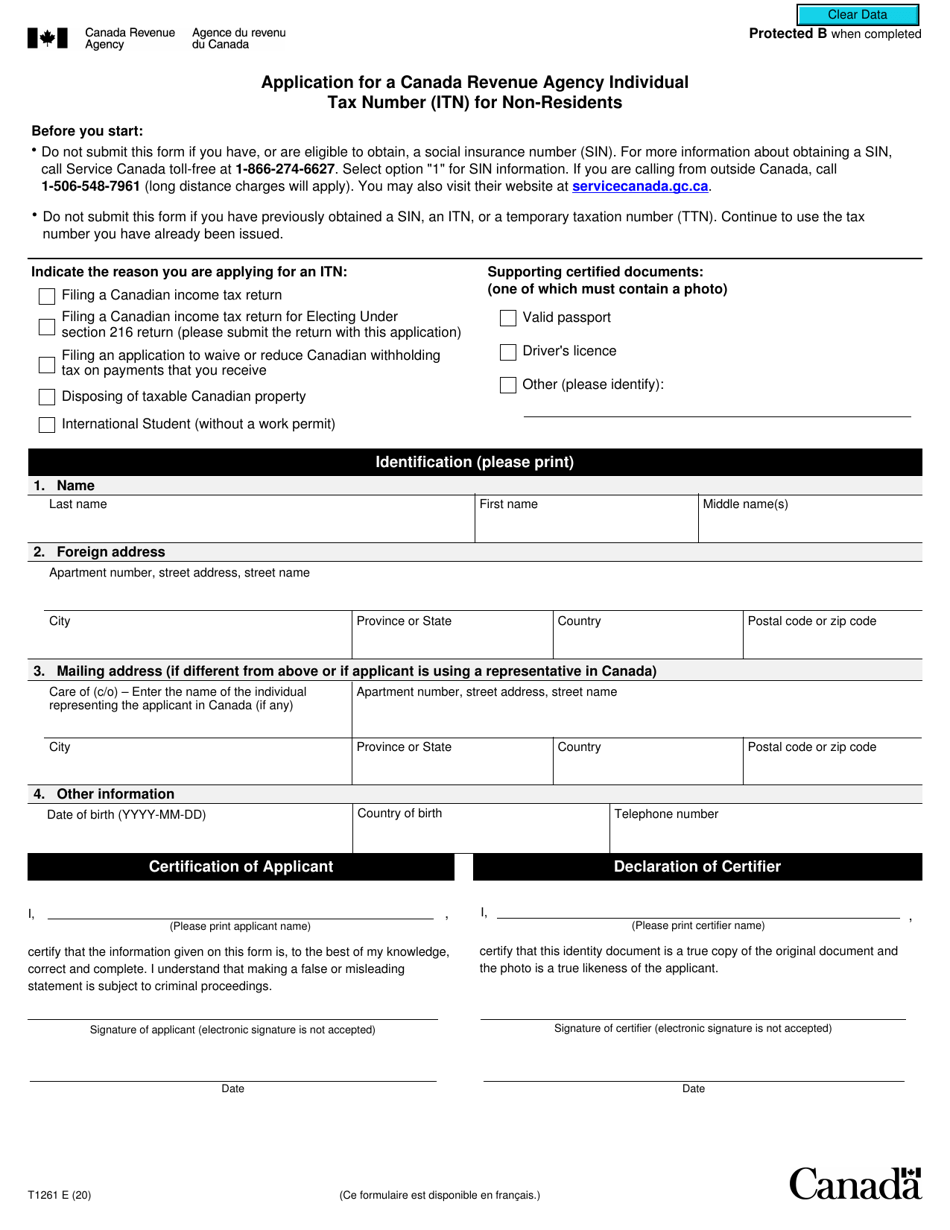

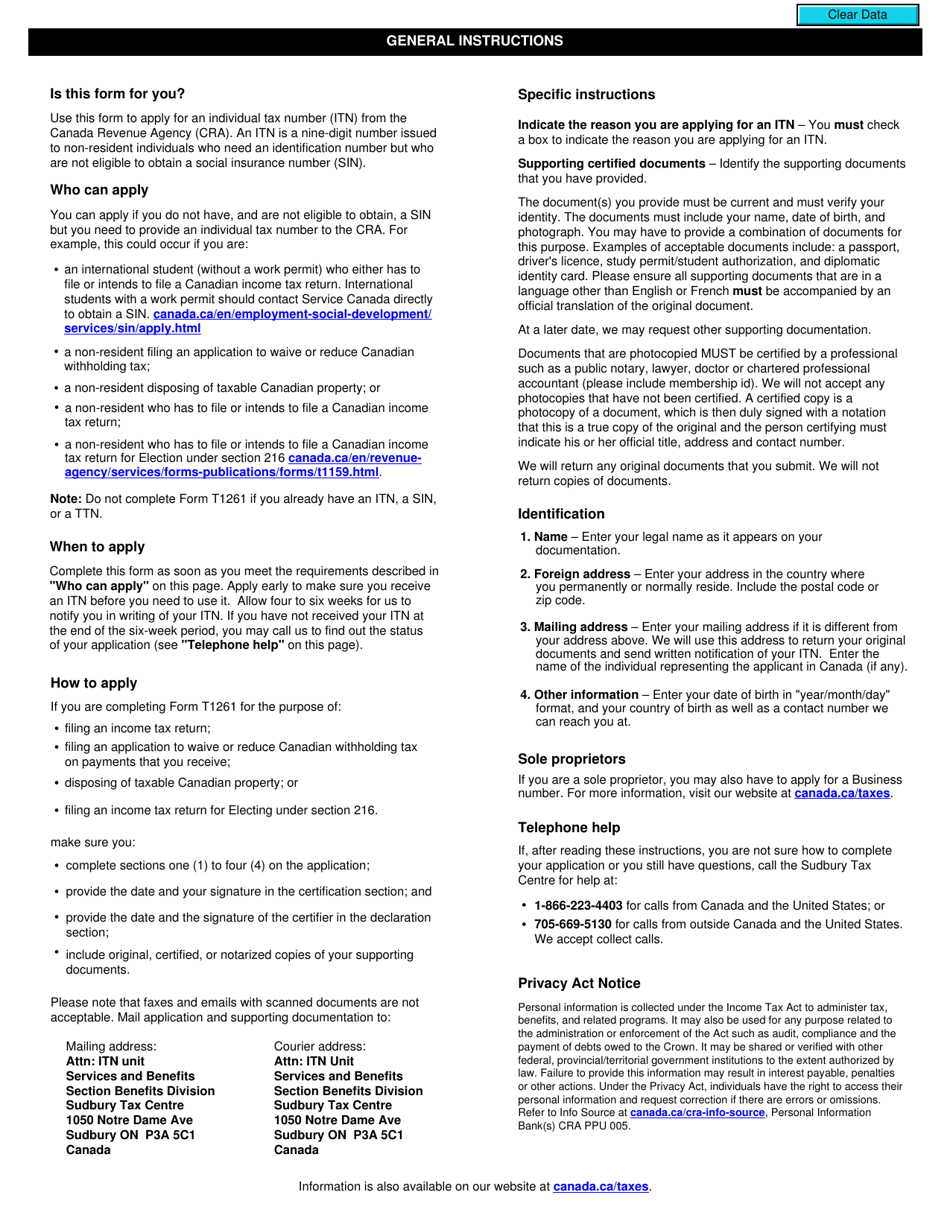

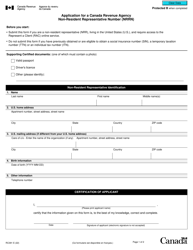

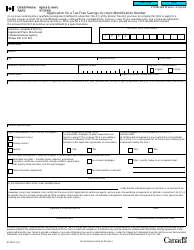

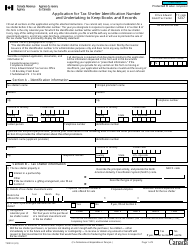

Form T1261 Application for a Canada Revenue Agency Individual Tax Number (Itn) for Non-residents - Canada

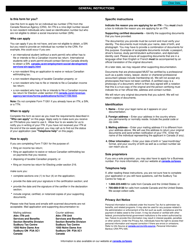

Form T1261, Application for a Canada Revenue Agency Individual Tax Number (ITN) for Non-residents, is used by individuals who do not have a Social Insurance Number (SIN) in Canada but need to report Canadian income or claim benefits under a tax treaty. This form allows non-residents to apply for an ITN, which is a unique identification number used for tax purposes in Canada.

The Form T1261 is typically filed by non-residents who need to obtain an Individual Tax Number (ITN) from the Canada Revenue Agency (CRA).

FAQ

Q: What is Form T1261?

A: Form T1261 is an Application for a Canada Revenue Agency Individual Tax Number (ITN) for non-residents.

Q: Who needs to fill out Form T1261?

A: Non-residents who require a Canada Revenue Agency Individual Tax Number (ITN) need to fill out Form T1261.

Q: What is a Canada Revenue Agency Individual Tax Number (ITN)?

A: A Canada Revenue Agency Individual Tax Number (ITN) is a unique nine-digit number issued to individuals who need to file taxes or receive benefits in Canada.

Q: How long does it take to process Form T1261?

A: The processing time for Form T1261 can vary. It is recommended to submit the application well in advance to allow for sufficient processing time.