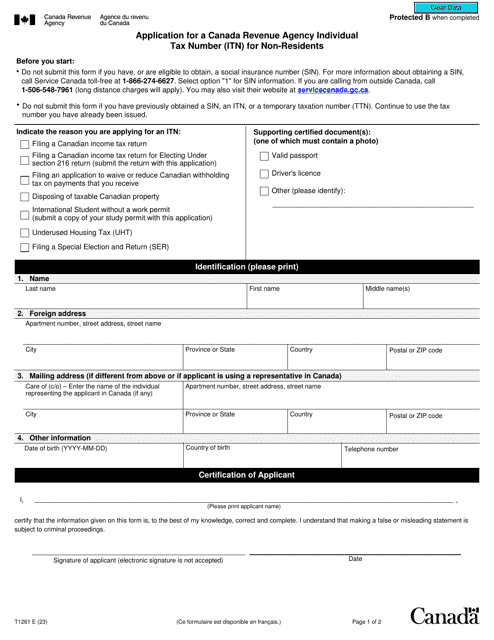

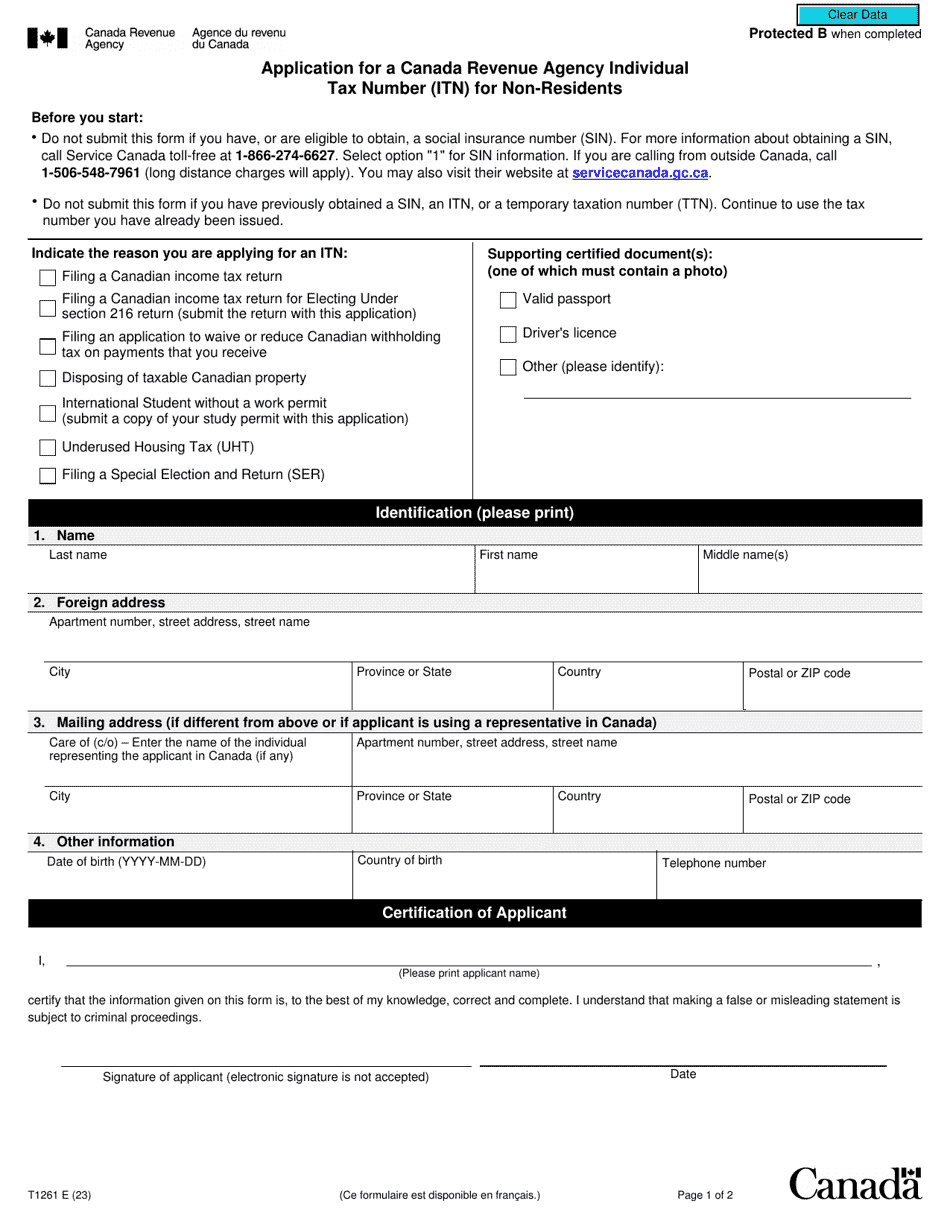

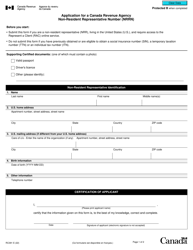

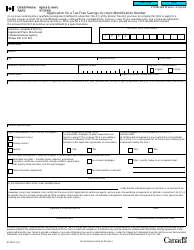

Form T1261 Application for a Canada Revenue Agency Individual Tax Number (Itn) for Non-residents - Canada

Form T1261 Application for a Canada Revenue Agency Individual Tax Number (ITN) for Non-residents is used to apply for an individual tax number for non-residents of Canada. This number is required for individuals who need to report Canadian income and pay taxes in Canada. It allows non-residents to fulfill their tax obligations in Canada.

The Form T1261 Application for a Canada Revenue Agency Individual Tax Number (ITN) for non-residents in Canada is filed by individuals who are non-residents of Canada and need to obtain an ITN.

Form T1261 Application for a Canada Revenue Agency Individual Tax Number (Itn) for Non-residents - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1261?

A: Form T1261 is an application form for a Canada Revenue Agency Individual Tax Number (ITN) for non-residents.

Q: Who needs to fill out Form T1261?

A: Non-residents who need a Canada Revenue Agency Individual Tax Number (ITN) should fill out Form T1261.

Q: What is a Canada Revenue Agency Individual Tax Number (ITN)?

A: A Canada Revenue Agency Individual Tax Number (ITN) is a unique number assigned to individuals who need to file taxes in Canada but do not have a Social Insurance Number (SIN).

Q: Is there a fee to apply for a Canada Revenue Agency Individual Tax Number (ITN)?

A: Yes, there is a fee to apply for a Canada Revenue Agency Individual Tax Number (ITN). The fee amount and payment options are specified on the form.

Q: How long does it take to process Form T1261?

A: The processing time for Form T1261 can vary. It is recommended to submit the application well in advance of the anticipated tax filing deadline.

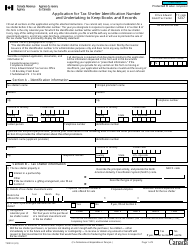

Q: What documents are required to accompany Form T1261?

A: The specific documents required to accompany Form T1261 are listed on the form itself. Generally, you will need to provide proof of identity, proof of legal status in Canada, and other supporting documents as applicable.

Q: Can Form T1261 be submitted electronically?

A: No, Form T1261 cannot be submitted electronically. The completed form and supporting documents must be mailed to the appropriate tax services office.

Q: How long is a Canada Revenue Agency Individual Tax Number (ITN) valid for?

A: A Canada Revenue Agency Individual Tax Number (ITN) does not expire and remains valid until the individual's circumstances change.