This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST190

for the current year.

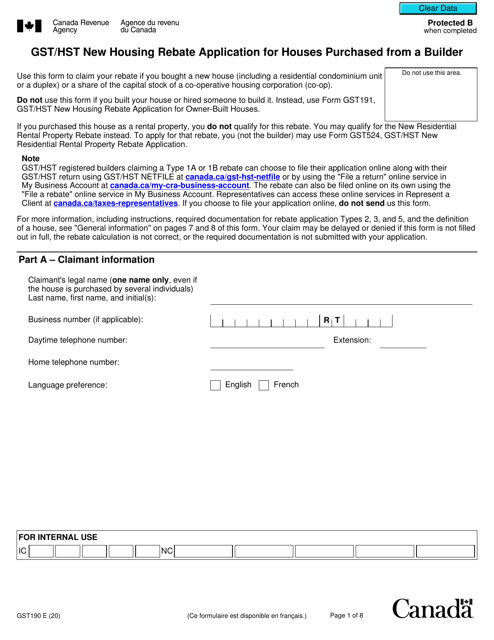

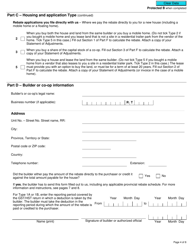

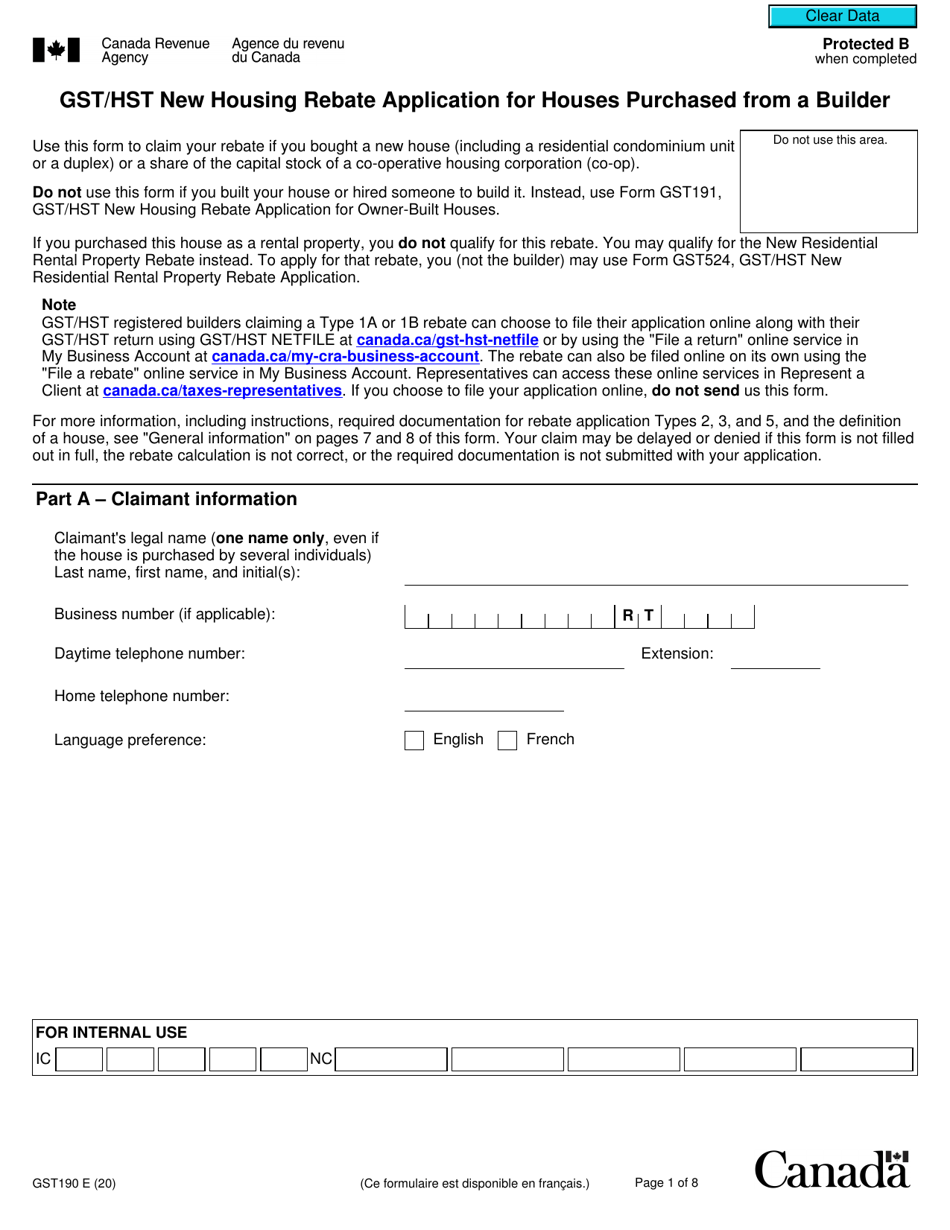

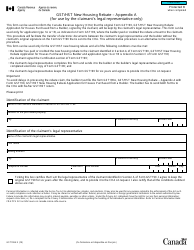

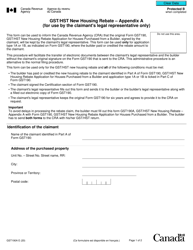

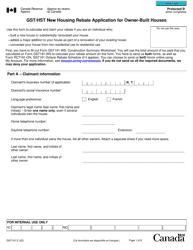

Form GST190 Gst / Hst New Housing Rebate Application for Houses Purchased From a Builder - Canada

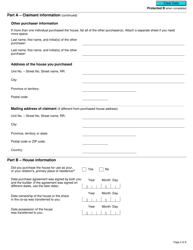

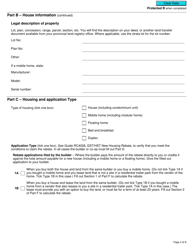

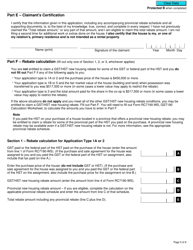

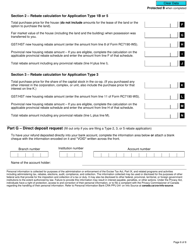

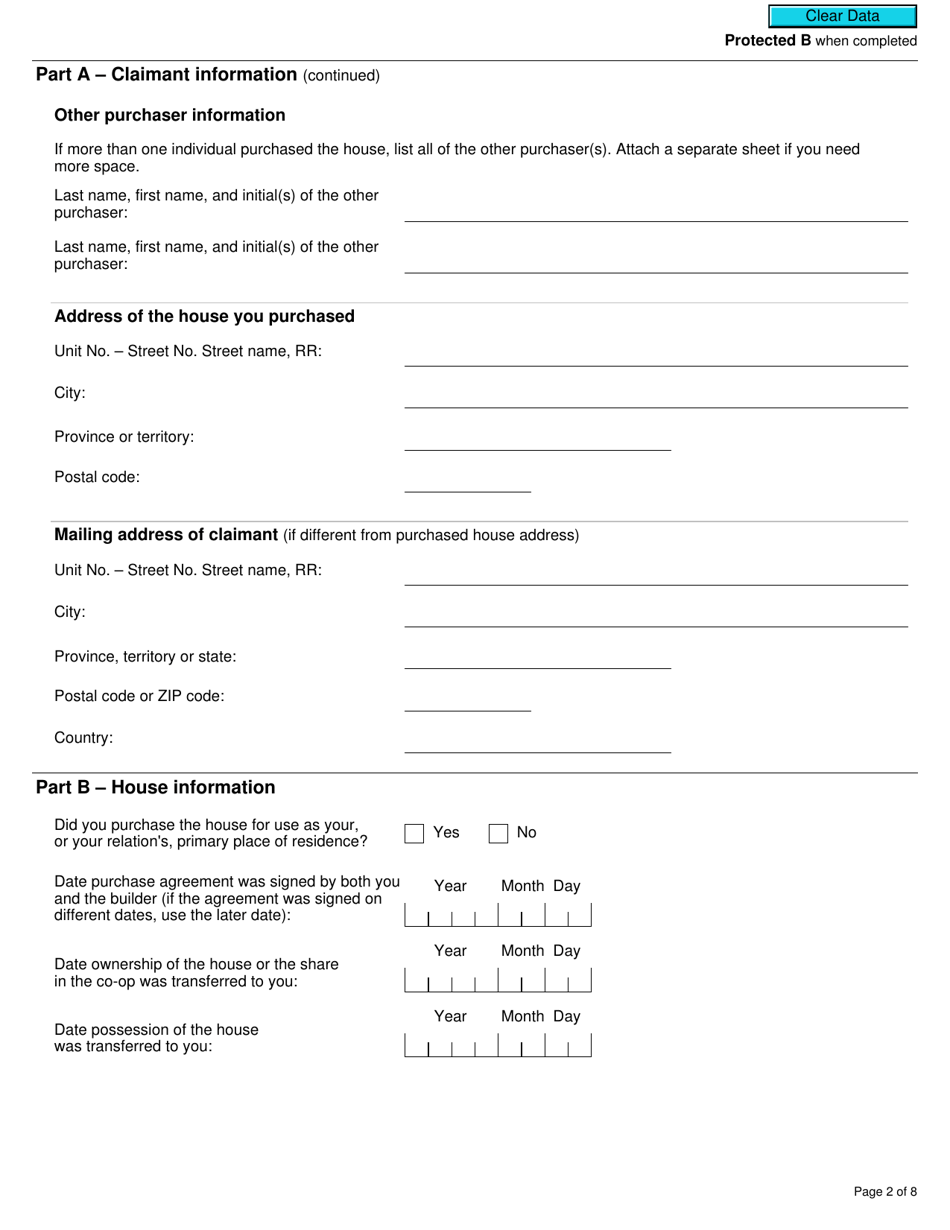

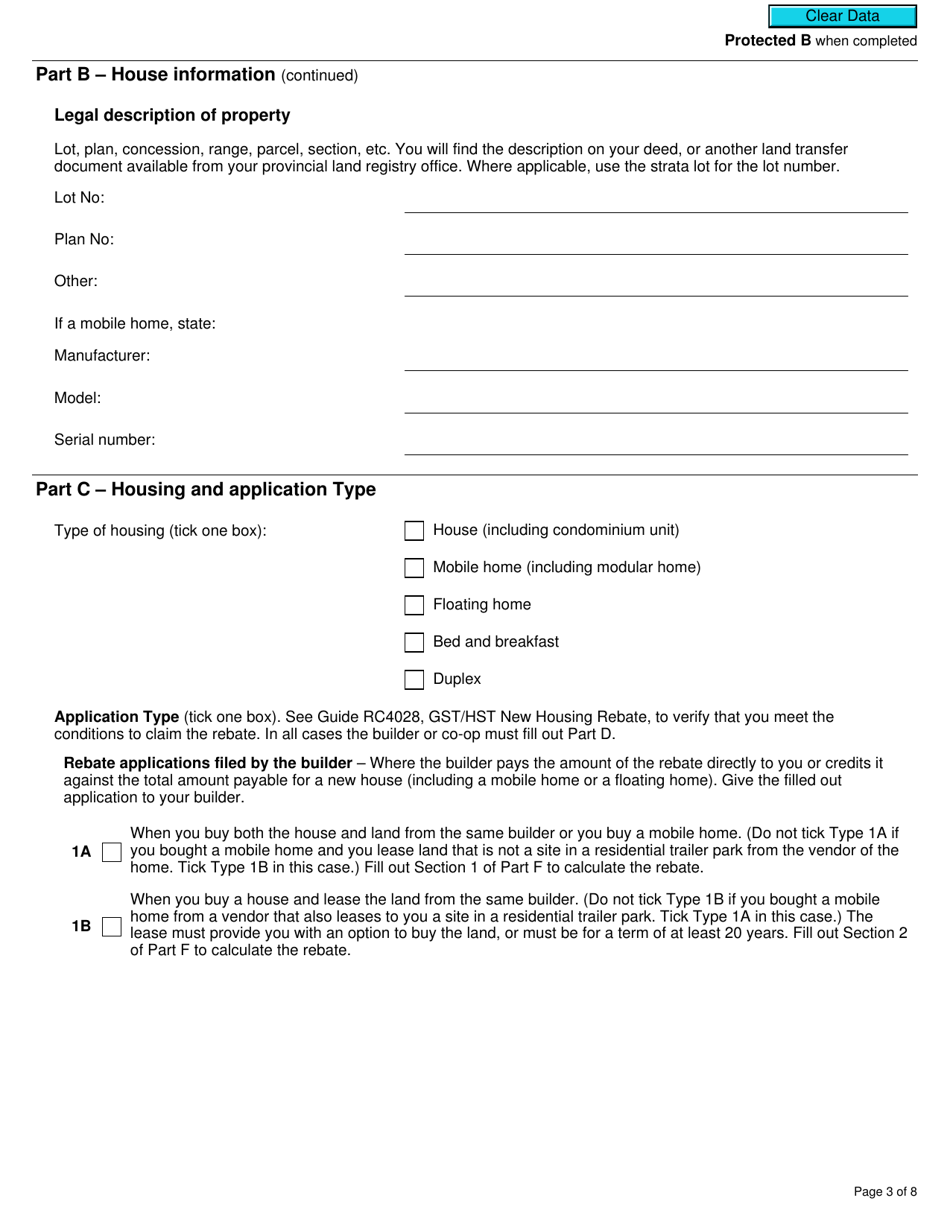

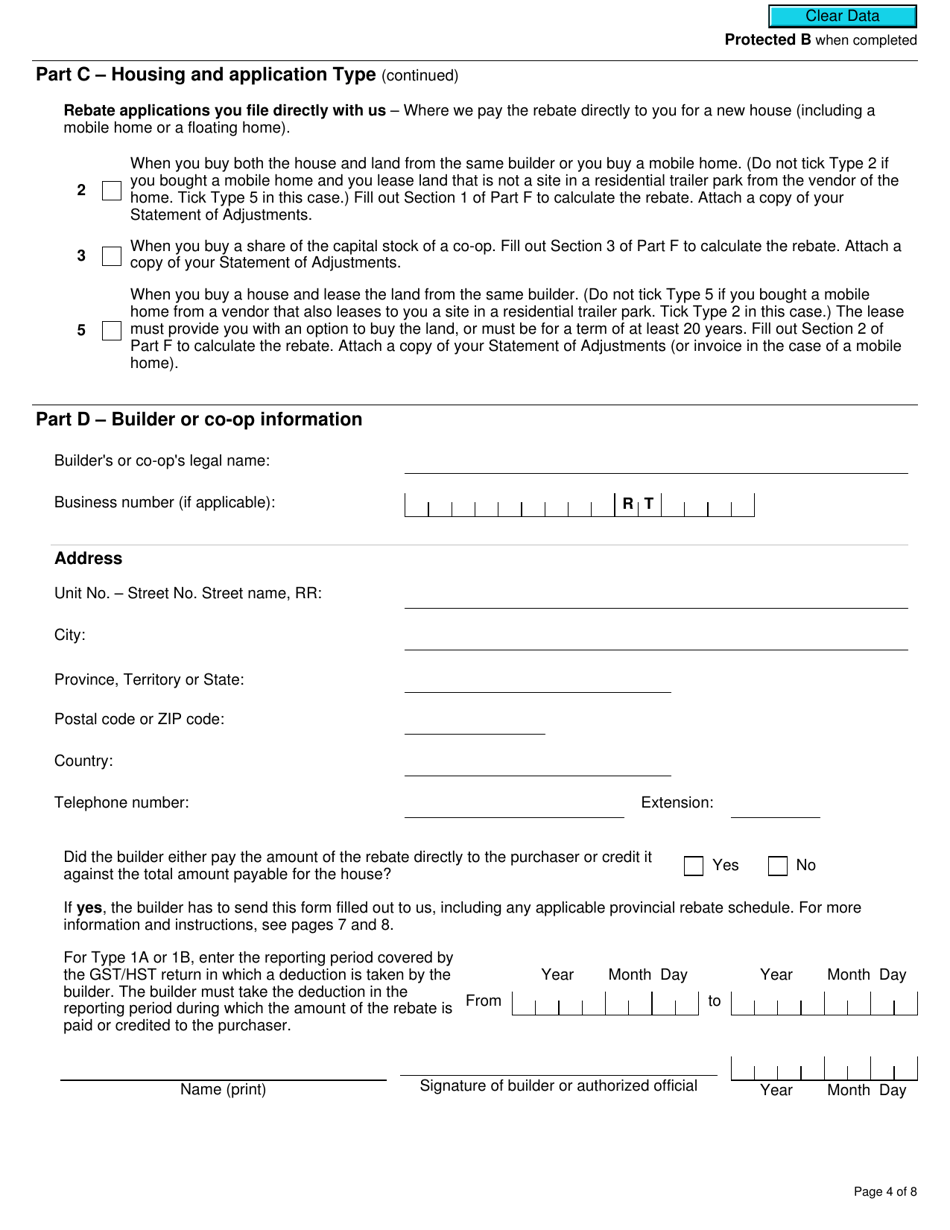

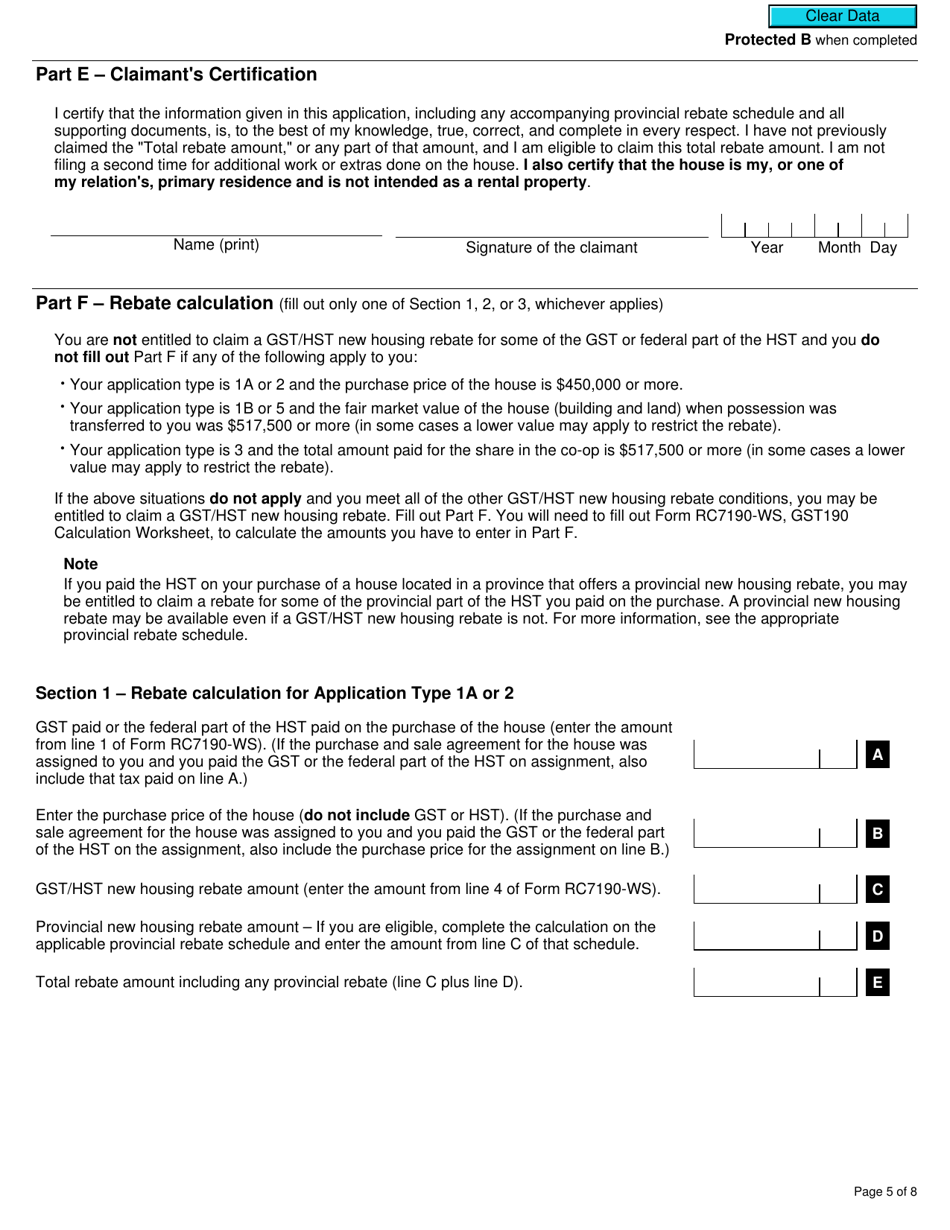

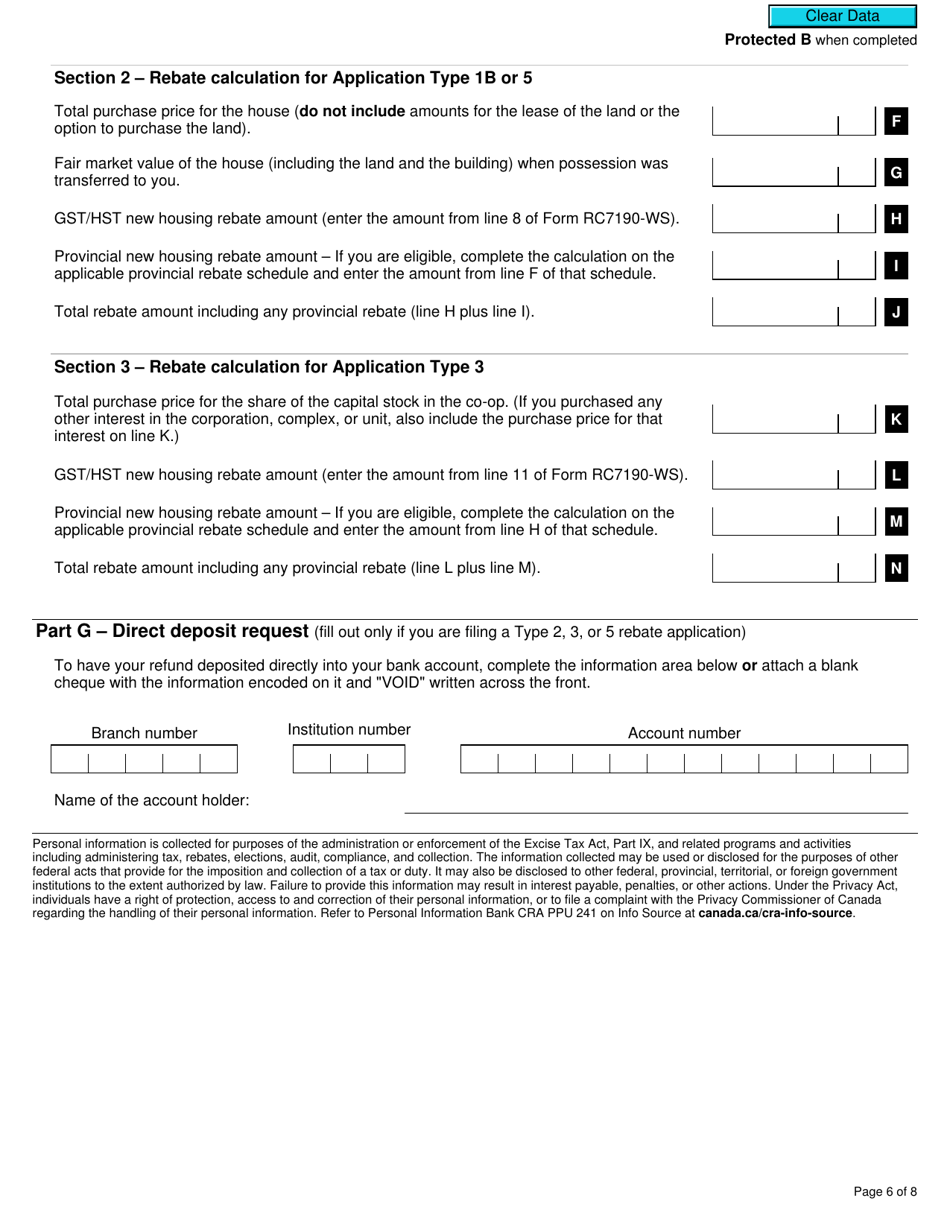

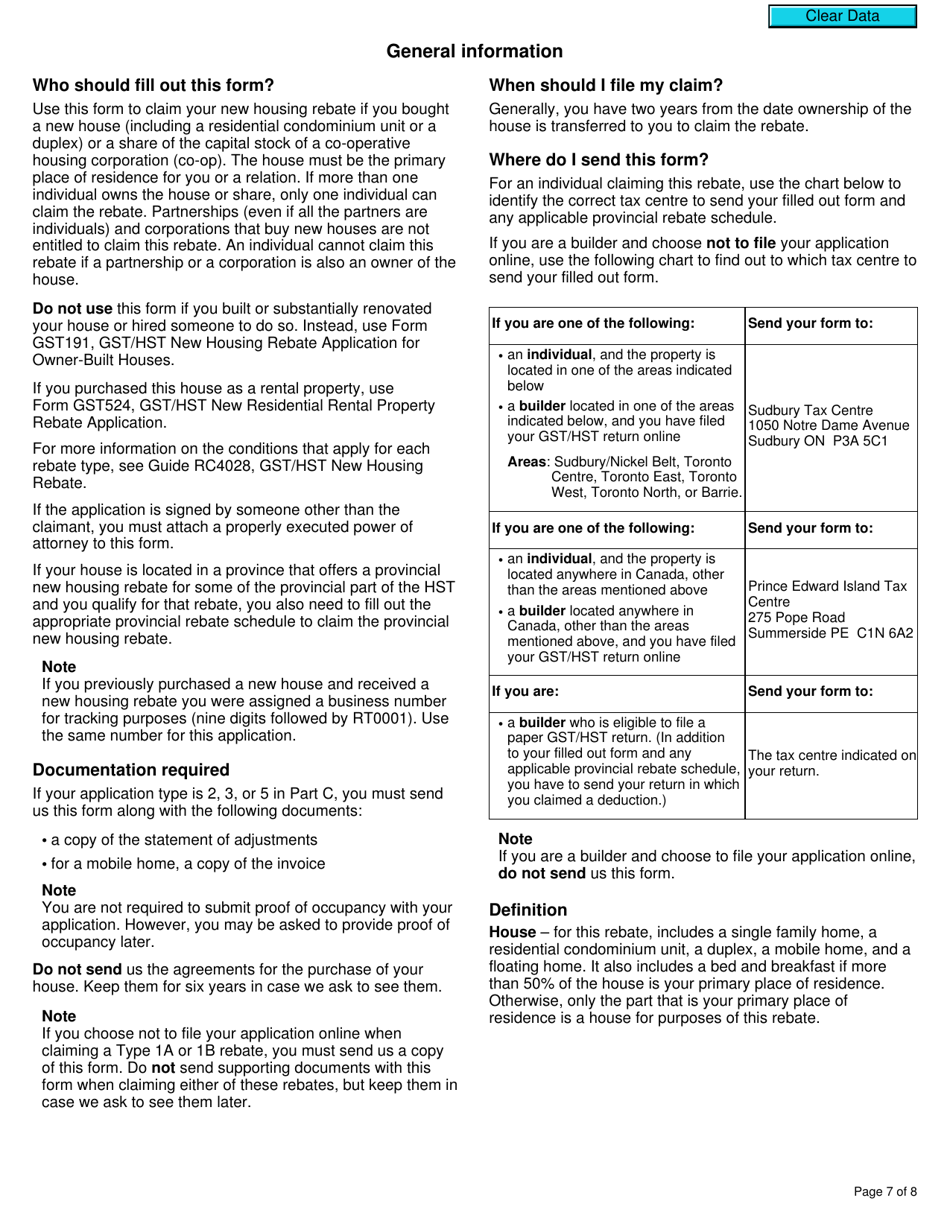

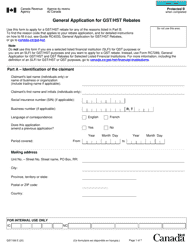

Form GST190, Gst/Hst New Housing Rebate Application for Houses Purchased From a Builder, is a form used in Canada to claim a rebate of the Goods and Services Tax (GST) or the Harmonized Sales Tax (HST) for individuals who have purchased a new or substantially renovated house from a builder. This form is specifically for houses purchased from a builder and not for other types of housing. The rebate helps to offset the taxes paid on the purchase of the new house.

The Form GST190 for the GST/HST New Housing Rebate application for houses purchased from a builder in Canada is filed by the homebuyer.

FAQ

Q: What is the Form GST190?

A: Form GST190 is the GST/HST New Housing Rebate Application for houses purchased from a builder in Canada.

Q: What is the purpose of Form GST190?

A: The purpose of Form GST190 is to apply for the GST/HST New Housing Rebate for houses purchased from a builder.

Q: Who can use Form GST190?

A: Anyone who has purchased a new house in Canada from a builder and wants to apply for the GST/HST New Housing Rebate can use Form GST190.

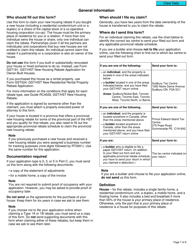

Q: When should Form GST190 be filed?

A: Form GST190 should be filed within two years from the date the builder first made the supply of the house.

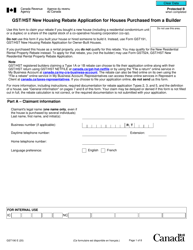

Q: What documents are required to be submitted with Form GST190?

A: The required documents include a copy of the purchase agreement, proof of payment, and any other supporting documentation related to the purchase of the house.

Q: How long does it take to process the GST/HST New Housing Rebate application?

A: The processing time can vary, but generally it takes around eight weeks for the CRA to process the application.

Q: Can I claim the GST/HST New Housing Rebate if I built the house myself?

A: No, the GST/HST New Housing Rebate is only available for houses purchased from a builder in Canada.

Q: Is the GST/HST New Housing Rebate taxable?

A: No, the GST/HST New Housing Rebate is not taxable.