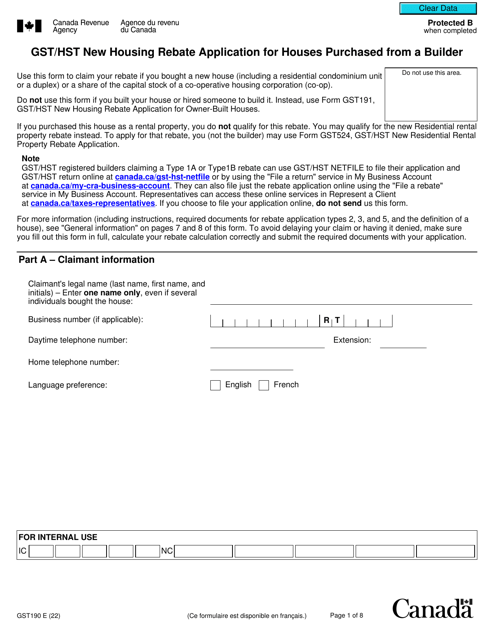

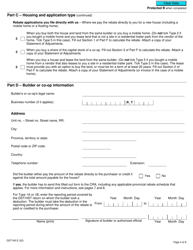

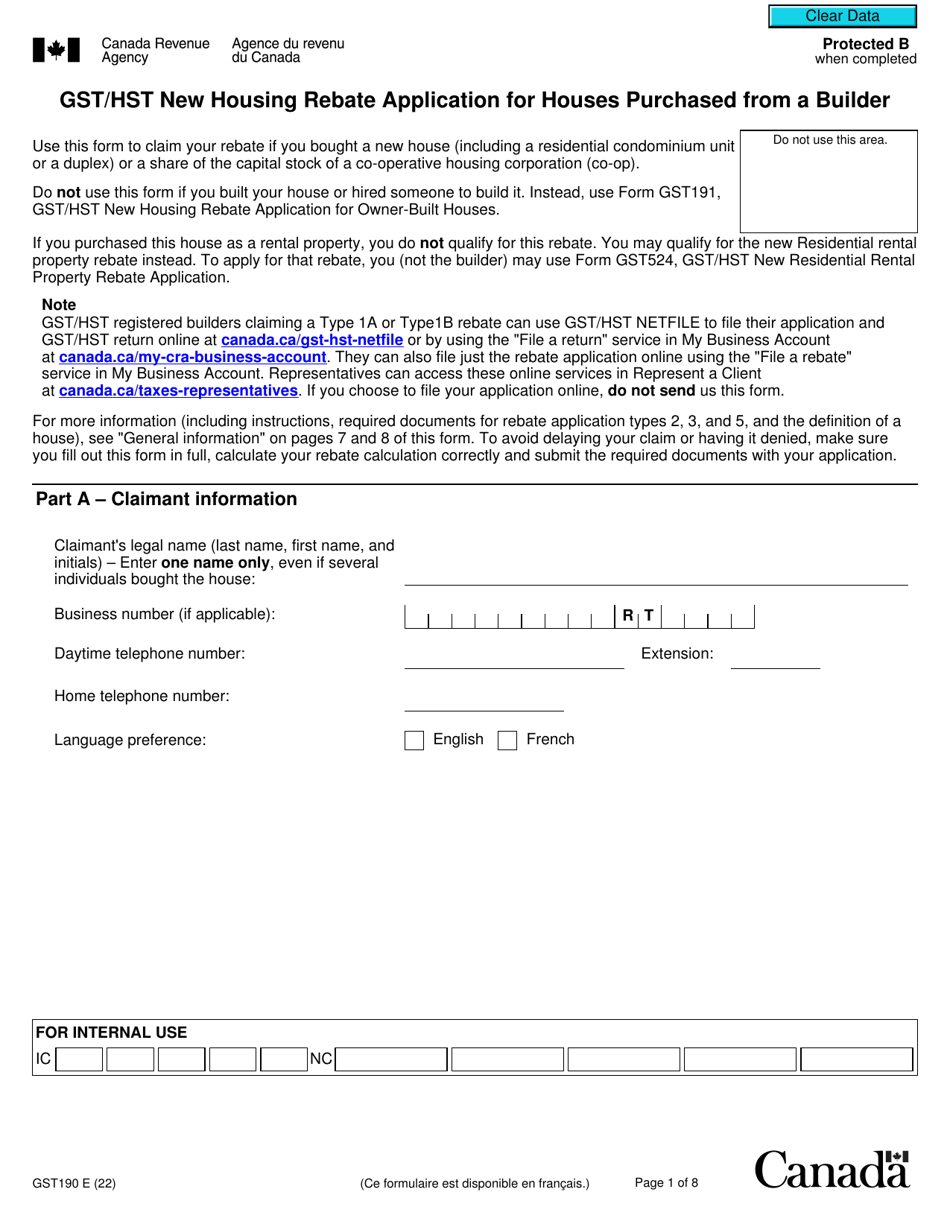

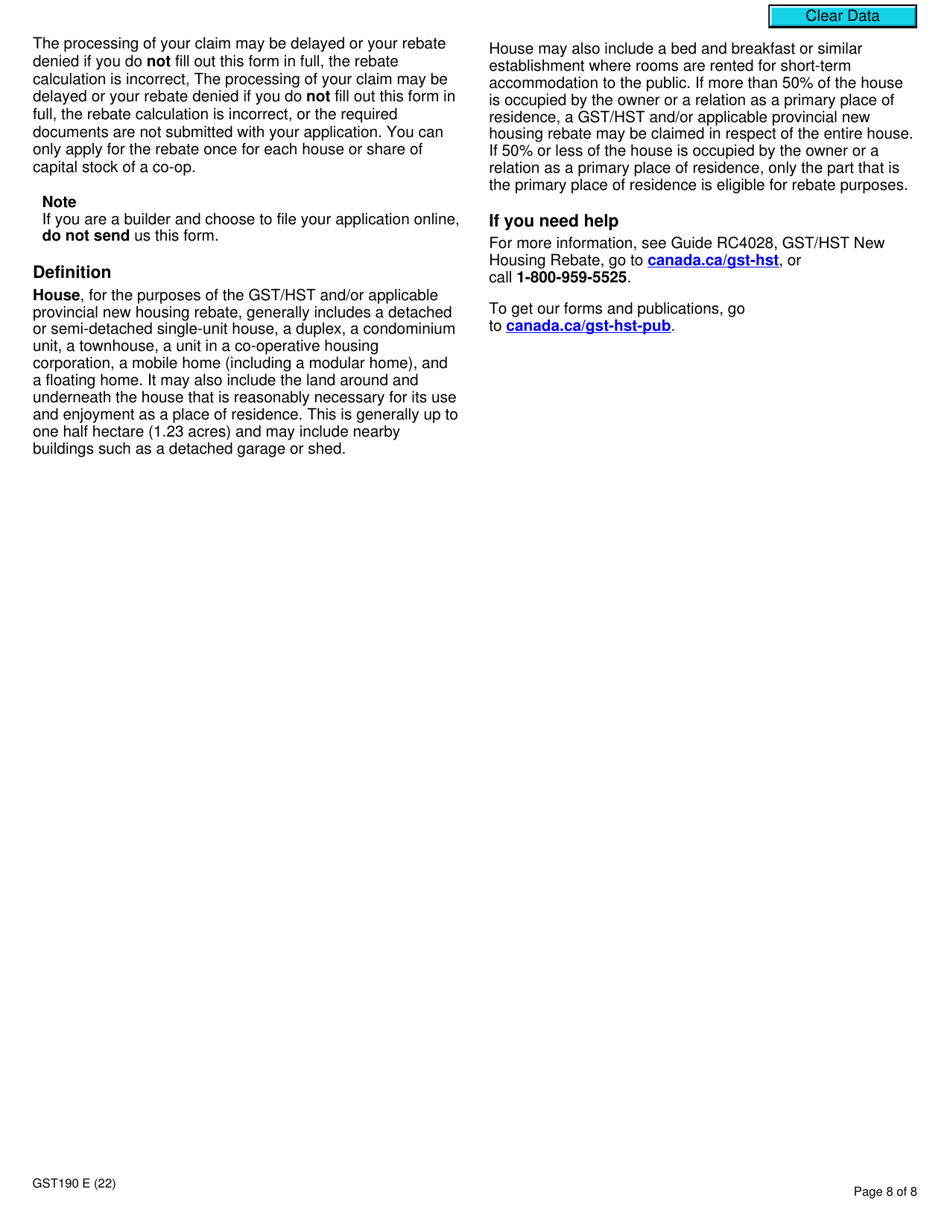

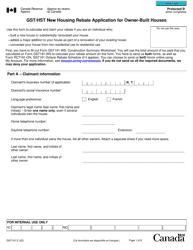

Form GST190 Gst / Hst New Housing Rebate Application for Houses Purchased From a Builder - Canada

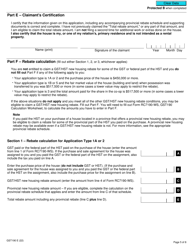

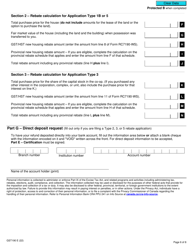

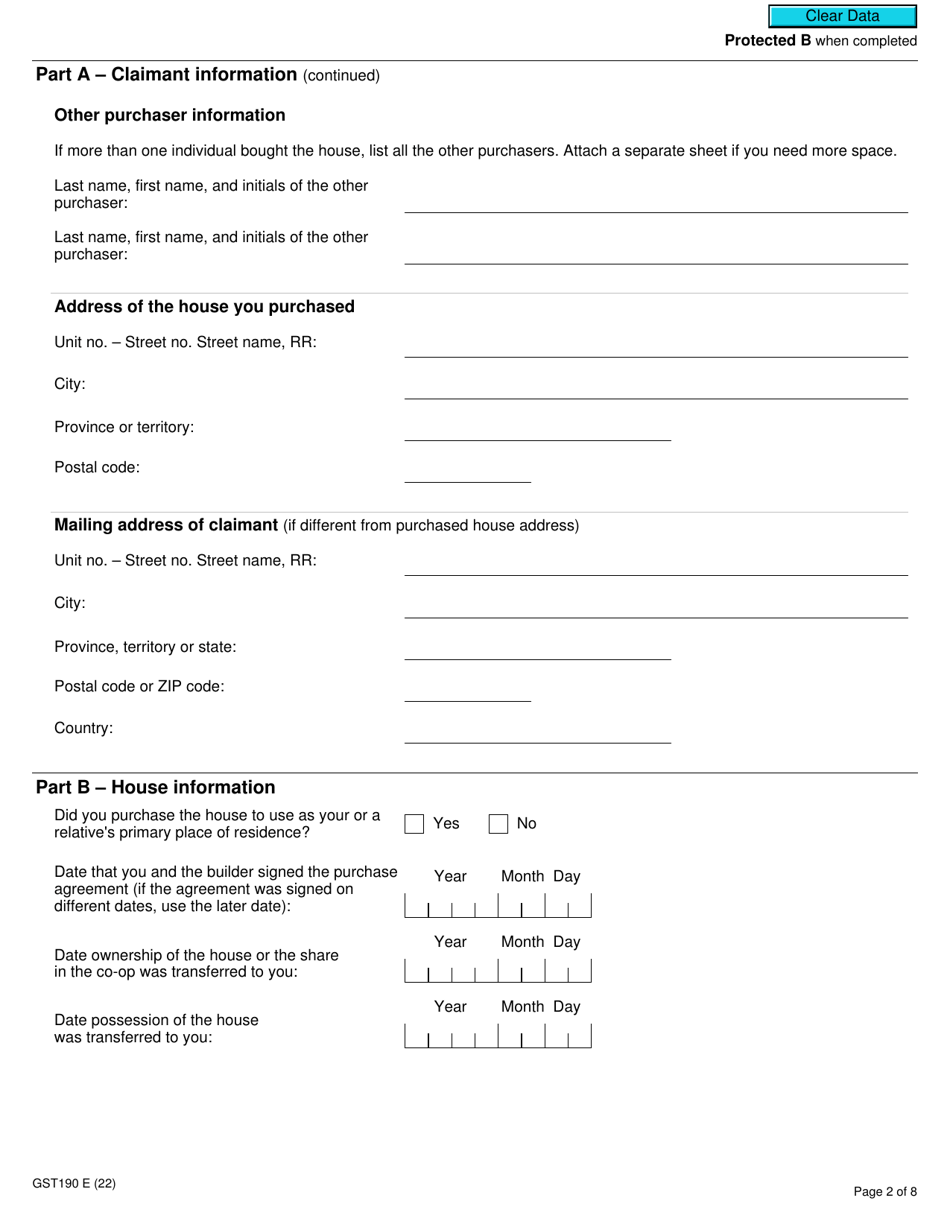

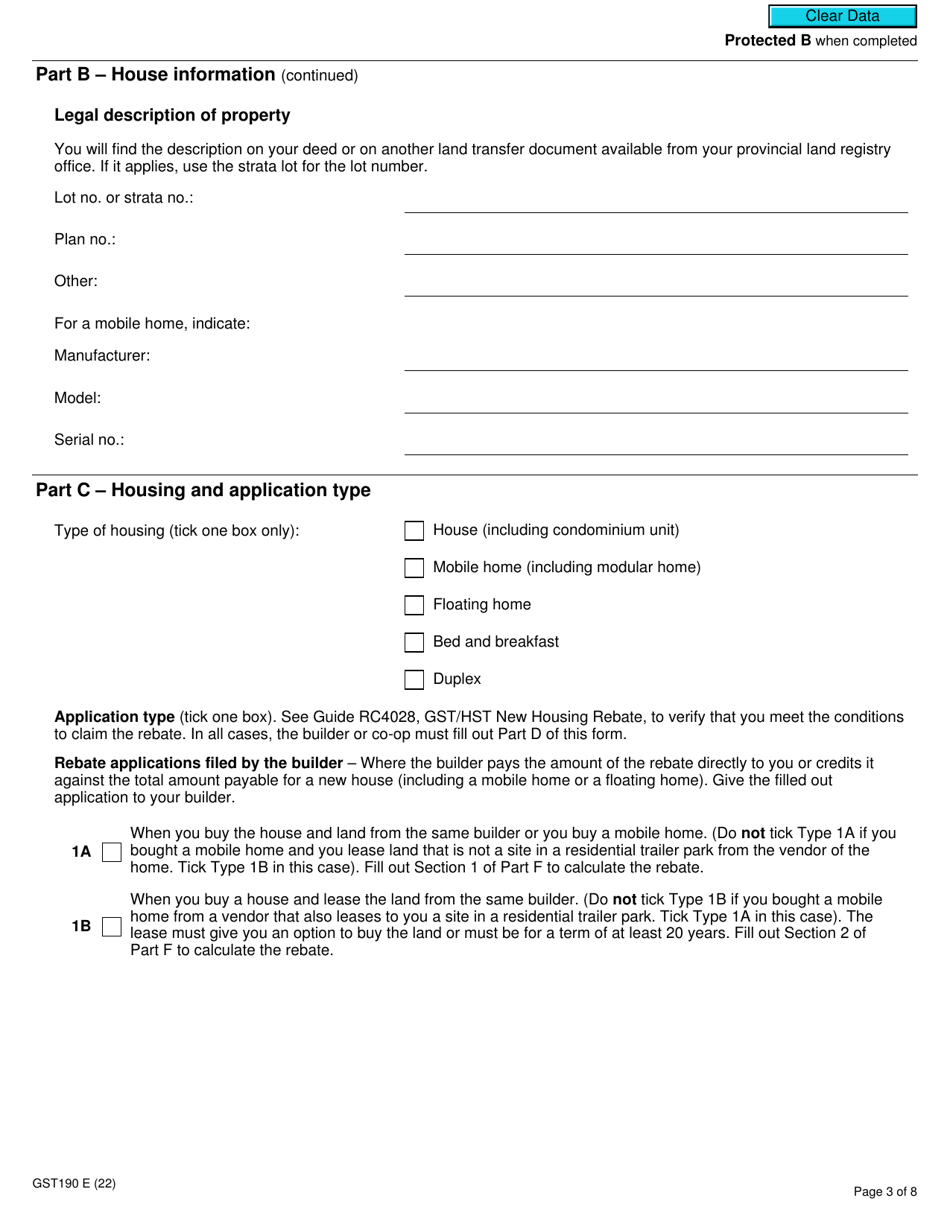

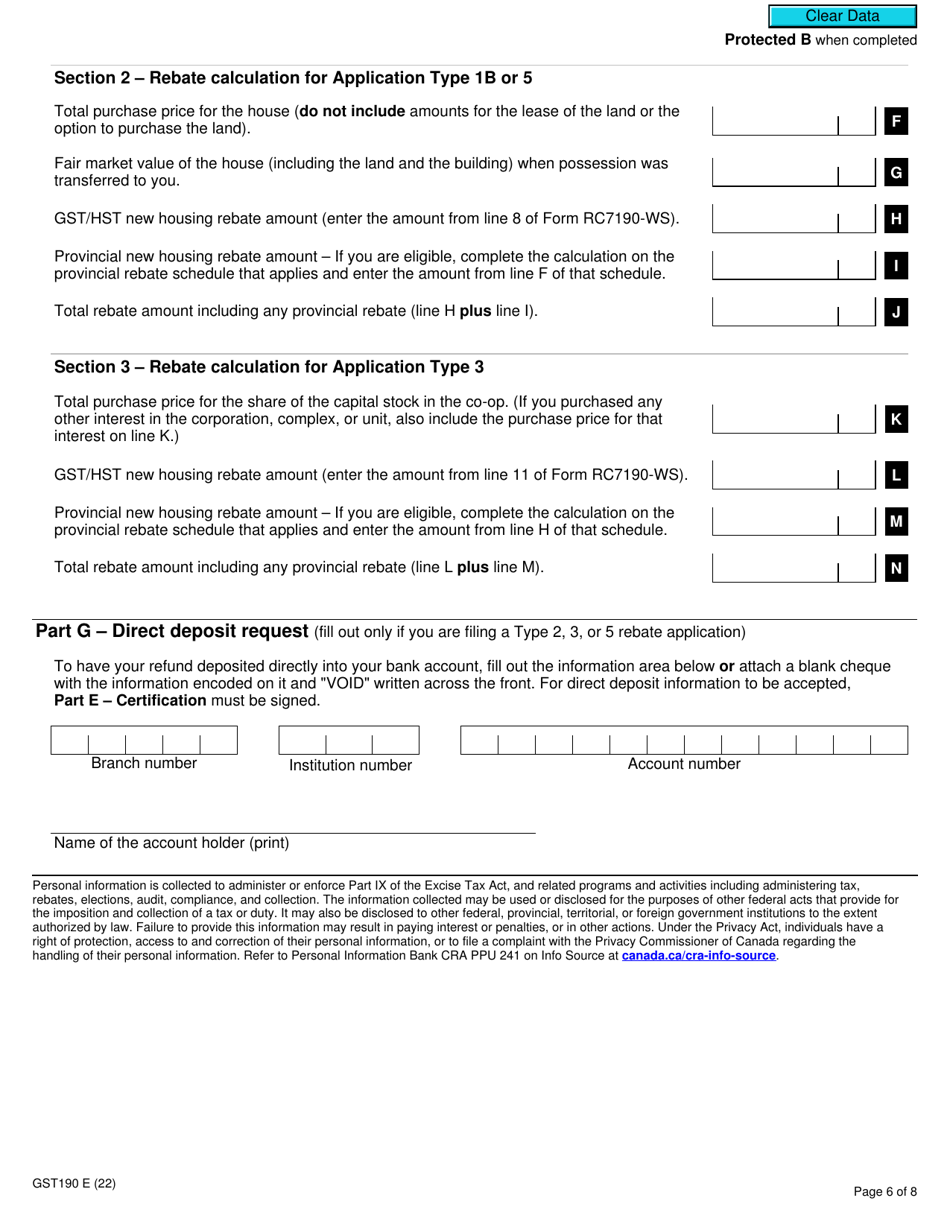

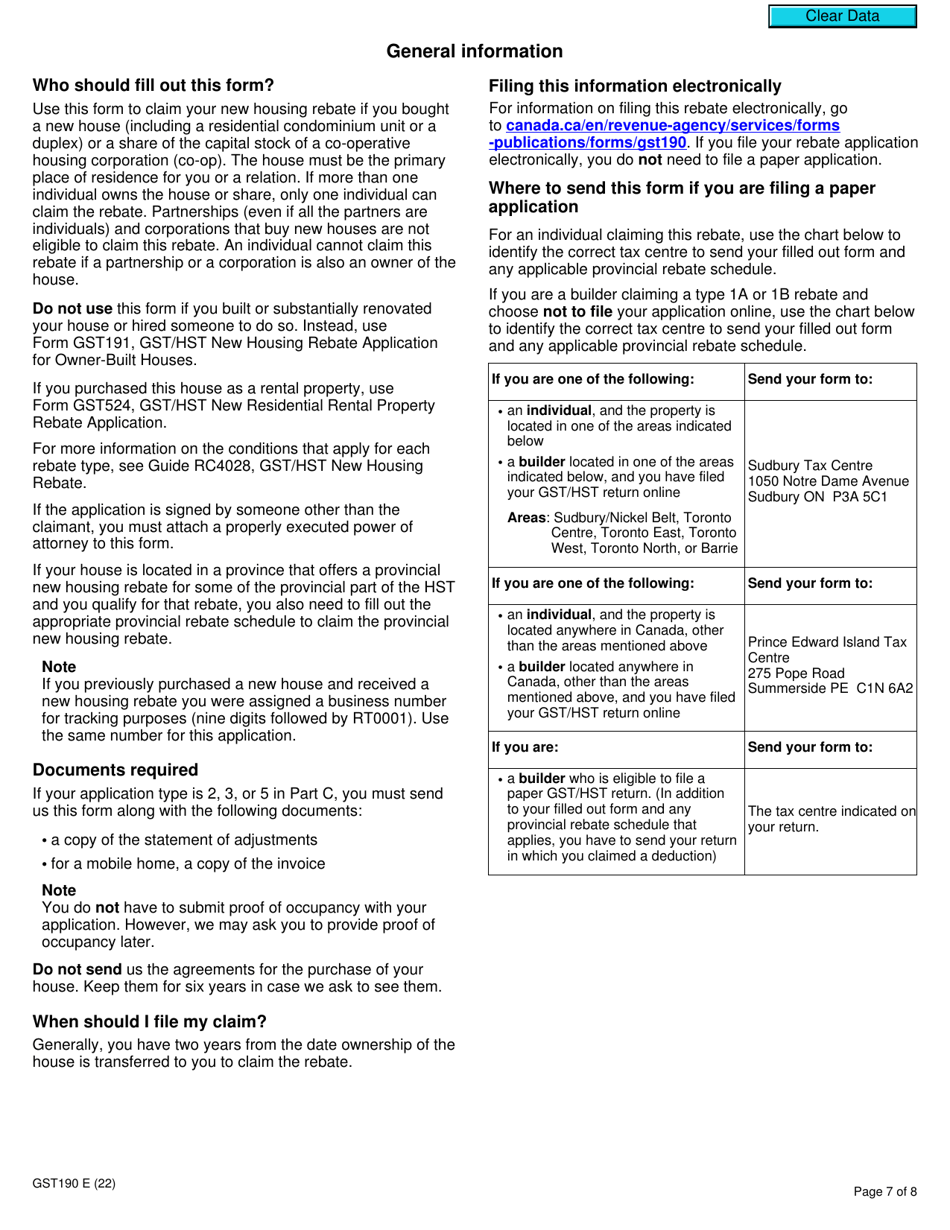

Form GST190 is the application form for the GST/HST New Housing Rebate in Canada. It is used to claim a rebate for the Goods and Services Tax (GST) or Harmonized Sales Tax (HST) paid on houses purchased from a builder.

The Form GST190 GST/HST New Housing Rebate Application for houses purchased from a builder in Canada is filed by the home buyer.

Form GST190 Gst/Hst New Housing Rebate Application for Houses Purchased From a Builder - Canada - Frequently Asked Questions (FAQ)

Q: What is Form GST190? A: Form GST190 is the GST/HST New Housing Rebate Application for Houses Purchased From a Builder in Canada.

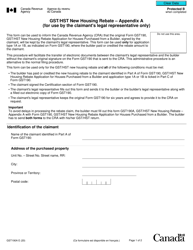

Q: Who can use Form GST190? A: Form GST190 can be used by individuals who have purchased a new house from a builder in Canada and want to claim the GST/HST New Housing Rebate.

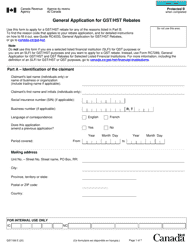

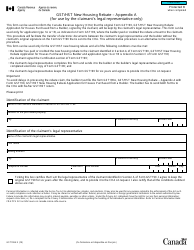

Q: What is the purpose of the GST/HST New Housing Rebate? A: The purpose of the GST/HST New Housing Rebate is to provide a partial rebate of the GST/HST paid on the purchase of a new house.

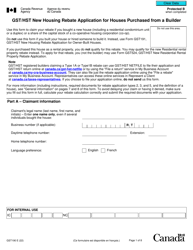

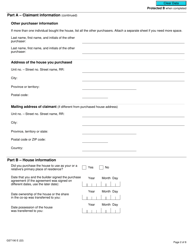

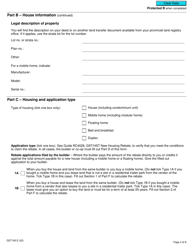

Q: What information do I need to complete Form GST190? A: To complete Form GST190, you will need information about the property, the builder, and the purchase price.

Q: Are there any deadlines for submitting Form GST190? A: Yes, you must submit Form GST190 within two years from the date the house is conveyed or possession is taken of the house, whichever is earlier.

Q: Can I claim the GST/HST New Housing Rebate for a house purchased for investment purposes? A: No, the GST/HST New Housing Rebate is only available for houses purchased as a primary place of residence.

Q: Is the GST/HST New Housing Rebate available in all provinces and territories in Canada? A: Yes, the GST/HST New Housing Rebate is available in all provinces and territories in Canada.

Q: What should I do if my application for the GST/HST New Housing Rebate is denied? A: If your application for the GST/HST New Housing Rebate is denied, you have the option to file an objection with the CRA.

Q: Can I claim the GST/HST New Housing Rebate if I purchased a pre-construction condo? A: Yes, you can claim the GST/HST New Housing Rebate if you purchased a pre-construction condo from a builder in Canada.