This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form OR-TM, 150-555-001

for the current year.

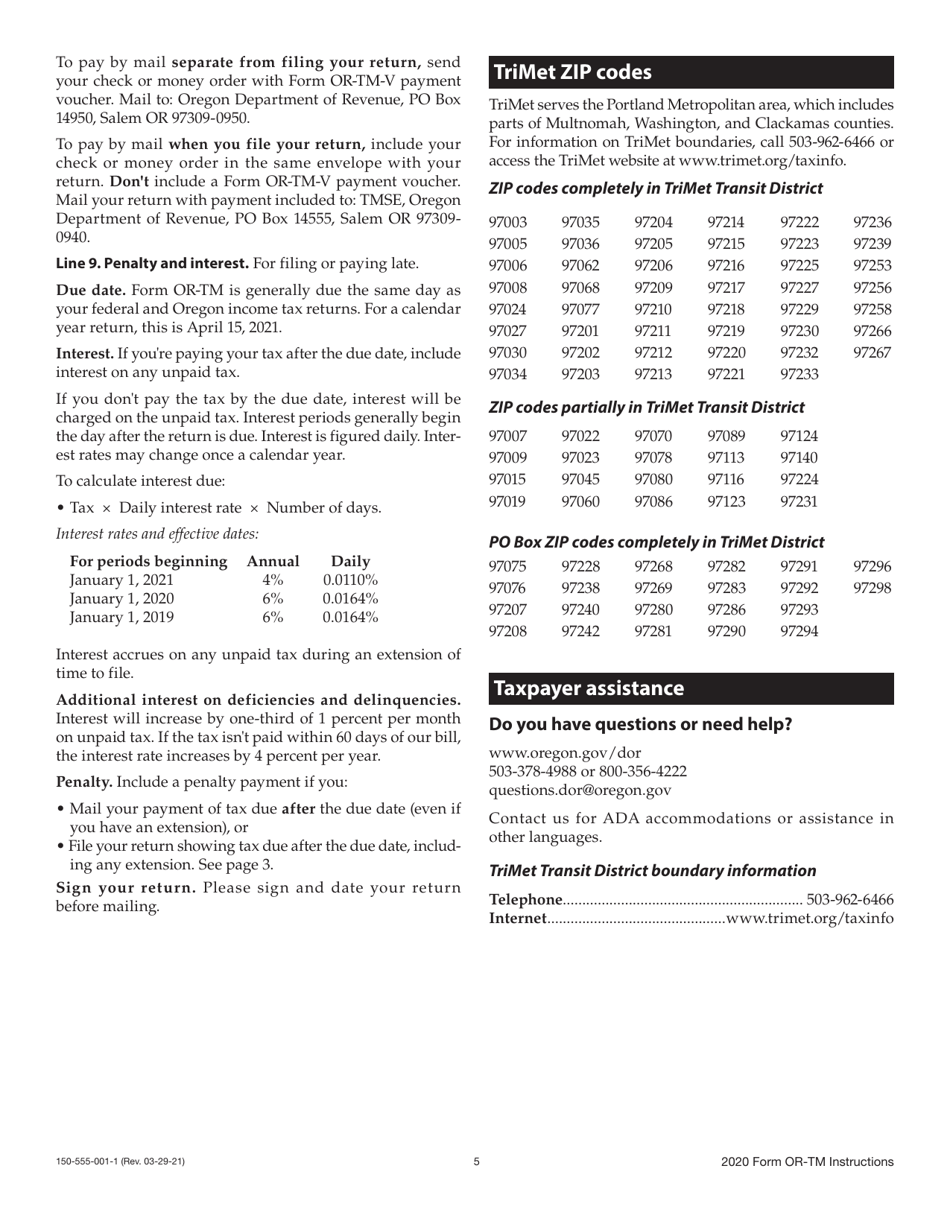

Instructions for Form OR-TM, 150-555-001 Tri-County Metropolitan Transportation District Self-employment Tax - Oregon

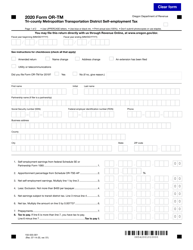

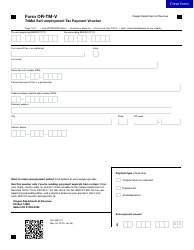

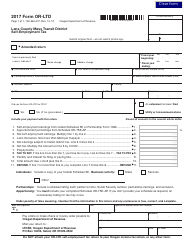

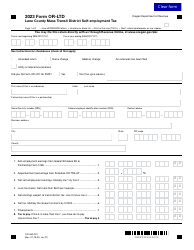

This document contains official instructions for Form OR-TM , and Form 150-555-001 . Both forms are released and collected by the Oregon Department of Revenue. An up-to-date fillable Form OR-TM (150-555-001) is available for download through this link.

FAQ

Q: What is Form OR-TM?

A: Form OR-TM is the Tri-County Metropolitan Transportation District Self-employment Tax form for Oregon.

Q: What is the purpose of Form OR-TM?

A: The purpose of Form OR-TM is to report and pay self-employment taxes for individuals who are subject to the Tri-County Metropolitan Transportation District tax in Oregon.

Q: Who needs to file Form OR-TM?

A: Individuals who have self-employment income and are subject to the Tri-County Metropolitan Transportation District tax in Oregon need to file Form OR-TM.

Q: When is Form OR-TM due?

A: Form OR-TM is due on April 15th of each year or the following business day if it falls on a weekend or holiday.

Q: Are there any penalties for late filing of Form OR-TM?

A: Yes, there may be penalties for late filing of Form OR-TM. It is important to file and pay your taxes on time to avoid penalties and interest.

Q: How do I fill out Form OR-TM?

A: Form OR-TM requires you to provide your personal information, self-employment income, and calculate your self-employment tax. You may need to refer to your income and expense records to complete the form accurately.

Q: Can I e-file Form OR-TM?

A: Yes, you can e-file Form OR-TM using approved tax software or through a tax professional.

Q: Do I need to include any supporting documents with Form OR-TM?

A: You may need to include supporting documents that verify your self-employment income and expenses. Keep a copy of your records for your own records.

Instruction Details:

- This 5-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.