This version of the form is not currently in use and is provided for reference only. Download this version of

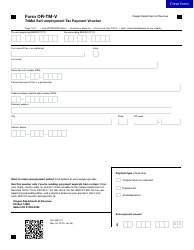

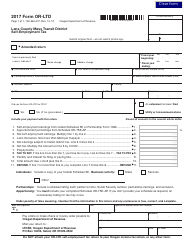

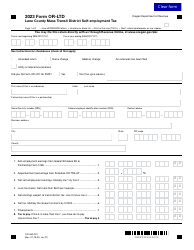

Form OR-TM (150-555-001)

for the current year.

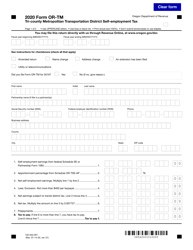

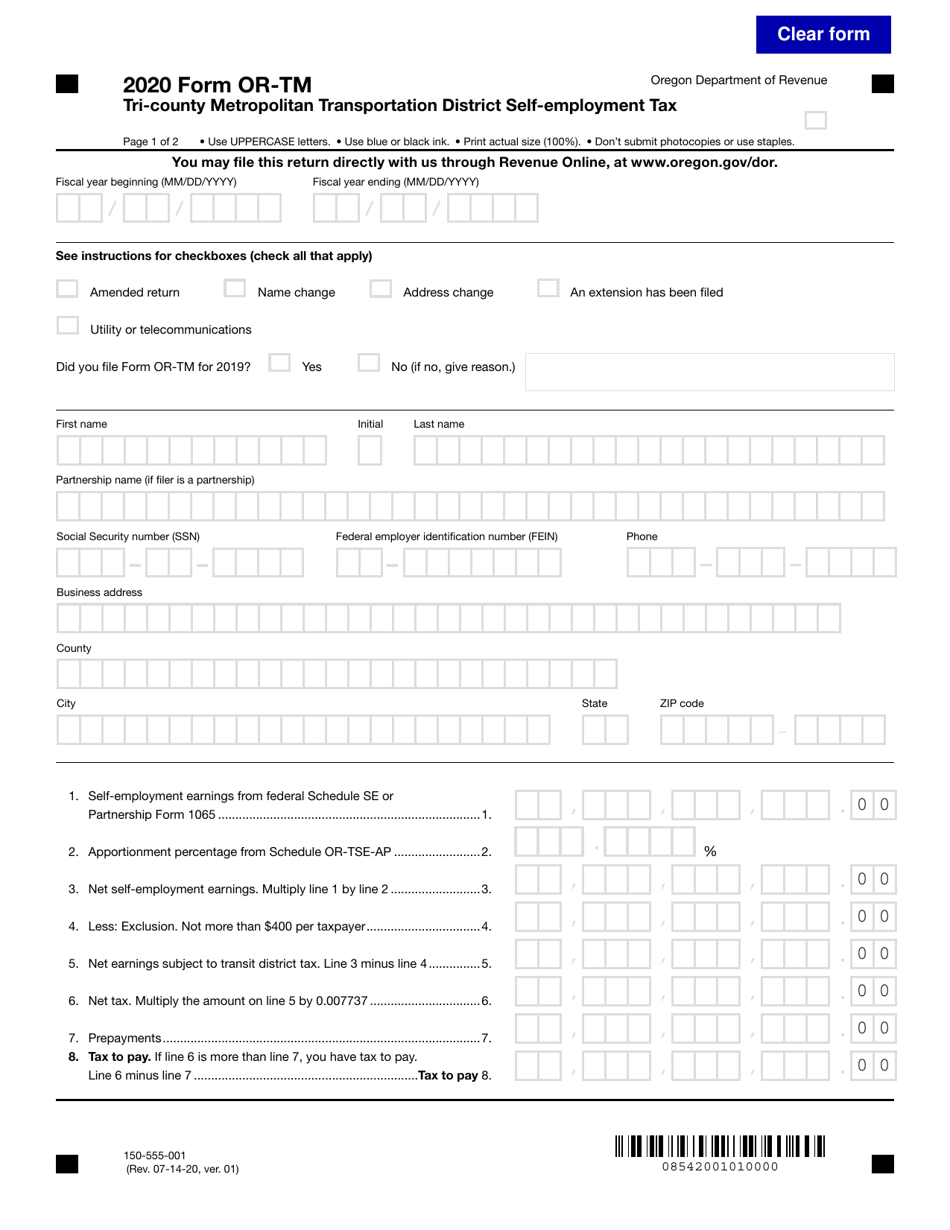

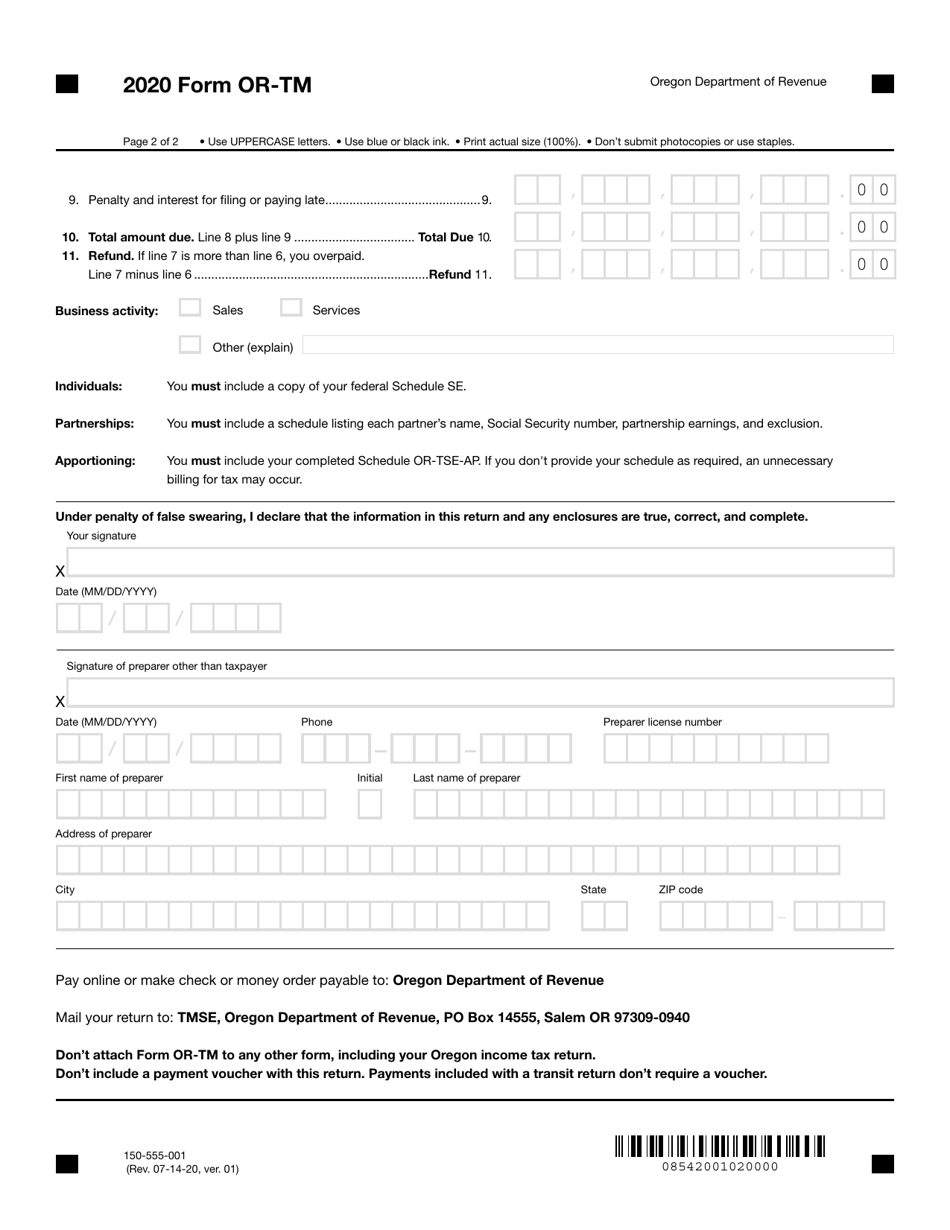

Form OR-TM (150-555-001) Tri-County Metropolitan Transportation District Self-employment Tax - Oregon

What Is Form OR-TM (150-555-001)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is OR-TM (150-555-001)?

A: OR-TM (150-555-001) refers to a tax form used for reporting self-employment earnings in the Tri-County Metropolitan Transportation District (TriMet) in Oregon.

Q: What is the Tri-County Metropolitan Transportation District?

A: The Tri-County Metropolitan Transportation District, commonly known as TriMet, is a regional transit provider in the Portland metropolitan area of Oregon.

Q: What is self-employment tax?

A: Self-employment tax is a tax imposed on individuals who work for themselves and are not classified as employees.

Q: Who needs to file OR-TM (150-555-001)?

A: Individuals who have self-employment income within the TriMet district in Oregon need to file OR-TM (150-555-001).

Q: What do I need to report on OR-TM (150-555-001)?

A: OR-TM (150-555-001) is used to report self-employment earnings within the TriMet district, including income from services performed as an independent contractor or business owner.

Q: When is the deadline for filing OR-TM (150-555-001)?

A: The deadline for filing OR-TM (150-555-001) is usually April 15th of each year, unless this date falls on a weekend or holiday. In that case, the deadline is extended to the next business day.

Q: Are there any exemptions or deductions for OR-TM (150-555-001)?

A: There may be certain exemptions and deductions available for OR-TM (150-555-001), depending on your specific circumstances. It is advisable to consult with a tax professional or refer to the instructions provided with the form.

Q: What happens if I don't file OR-TM (150-555-001)?

A: Failure to file OR-TM (150-555-001) or accurately report your self-employment earnings within the TriMet district may result in penalties and interest imposed by the Oregon Department of Revenue.

Form Details:

- Released on July 14, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-TM (150-555-001) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.